lcva2

Here at the Lab, we recently initiated to cover Vodafone Group plc (NASDAQ:VOD). On the core business, we anticipated that the company’s new sales policy linked to the inflation rate could be a supportive catalyst to going back to earnings growth. In addition, our analysis emphasized how the European telecommunications sector was relatively immune to the higher energy prices and we forecasted a lower-than-expected EBITDA decline. On the valuation, we were more pessimistic and more cautious about the EBITDA outlook set at the lower end of Vodafone’s range. Following the half-year results, we were right, indeed, the company announced a lower EBITDA guidance. Despite that, we initiated with an outperforming rating supported by an interesting FCF yield (higher than comps) and the positive evolution of what we called the company’s “top priority” i.e. the tower deal.

Vantage Towers

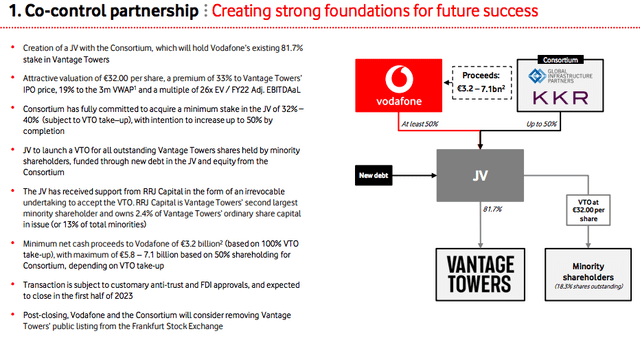

Let’s start to analyze the tower operation. After many rumors, on the 9th of November, Vodafone announced a reorganization of the Tower business, an operation which is not a total sales but a co-control, with KKR and Global Infrastructure Partners (GIP). Speaking of numbers, the deal value Vantage Towers at €16.2 billion, and technically KKR and GIP will buy between 32% and 40% of the joint venture at a price of €32 per share (+19% compared to the average price of the last 3 months and +33% compared to IPO initial price). Later on, the joint venture will in turn launch a voluntary takeover bid on the residual capital of Vantage Towers held by minority shareholders. The takeover bid is conditional on a number of objectives, including the green light from the authorities for the partnership between Vodafone and the consortium. The conditions of the voluntary takeover bid will be the subject of a prospectus which will have to be approved by the German authority BaFin. The JV has already had the backing of Vantage Towers’ second minority shareholder, RRJ Capital, which owns 2.4% of the capital and who has committed itself to irrevocably accept the offer.

Vantage Towers deal in a snap (Vantage Towers presentation)

The deal could generate net cash for Vodafone of between €3.2 and €7.1 billion and will lead to the delisting of Vantage Towers. For Vodafone, this operation will lead to the consolidation of its tower activities and further decrease its important debt obligation. This deal was also a response to a few activist fund investors pushing Vodafone’s CEO to rationalize the company’s activity.

Vodafone and 3 (in the UK)

Again very important for activist investors is the recent Vodafone announcement that confirms a potential interest in ‘Three UK’. This talk could be a potential mega-merger that would create Britain’s largest mobile company.

Unlike in Italy, in Great Britain, the company has never managed to grow Three UK, launched more than two decades ago. Last February, Nick Read, confirmed that he had started talks with some competitors, arguing that the European telecommunications industry must consolidate to reduce the enormous costs that are now needed to ensure thriving competition and to spend the new 5G network. The same English authority Ofcom had established that some companies in the United Kingdom, including Vodafone UK and Three UK did not have the necessary scale to increase their CAPEX expenditure. By combining the businesses, Vodafone and 3 will have the tonnage needed to be able to accelerate the rollout of 5G and stay on the market.

The change of approach contrasts with what is happening in the European Union, where the totem of competition at any cost forces the market to include an excessive number of operators. For instance, years ago, when Wind and 3 joined forces in Italy, the EU forced the entry of a new competitor, Iliad.

Half-year results, valuation and conclusion

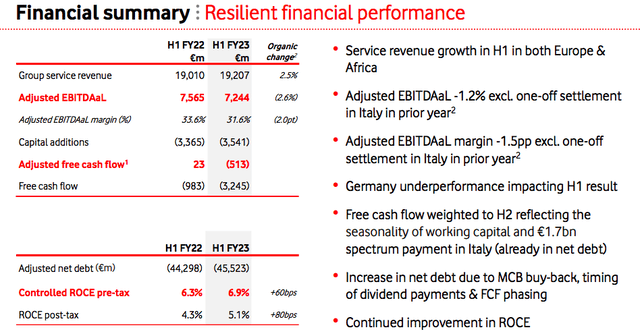

Recently, Vodafone closed its half-year account with revenue up by 2% and an adjusted EBITDAaL of €7.2 billion, signing a minus 2.6% on a yearly basis. CEO Nick Read sets a cost reduction target of over €1 billion and confirms the company’s interim dividend of 4.5 cents. Despite the higher top-line sales, core profit contracted to the German underperformance, the group’s core market, and a one-off legal agreement signed in Italy. For the above reason, the company cut its fiscal year EBITDA 2023 outlook by 1% and its FCF by €200 million to €5.1 billion from €5.3 billion. Cross-checking consensus expectation, this lower outlook was in line with analyst estimates. However, the poor performance recorded in its most important market led to the company to decline of more than 7% at the stock price level on the reporting day.

Vodafone results in a snap (Vodafone half-year results presentation)

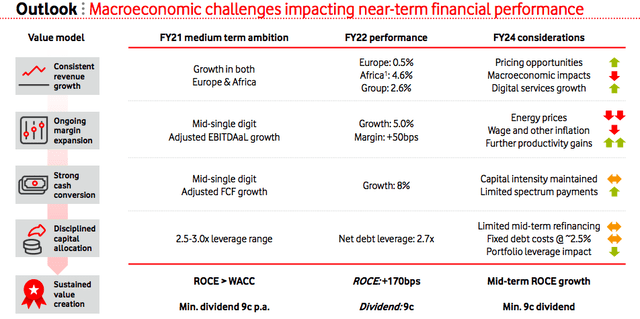

The lower outlook leaves a few question marks on Vodafone’s medium-term expectations, including its outlook on mid-single-digit growth at EBITDAaL level. In the last slide, the company presented a series of arrows up and down, and we should note that there are more down arrows. We believe this suggests that risks are mostly skewed on the downside. Regarding the valuation, we decide to leave unchanged our target price based on a 2024 FCF yield higher than 9% compared to peers at an average of 8.3%. The company’s results are disappointing; however, Vodafone is managing to extrapolate value with a potentially interesting merger and de-risked its debt thanks to the Vantage Towers business deconsolidation (sold at a very high multiple). Key risks include higher competition in the core market (German, in particular, followed by Italy), pressure on pricing, cost-cutting execution, and macroeconomic slowdown.

Be the first to comment