PhilBilly/iStock via Getty Images

Viper Energy Partners (NASDAQ:VNOM) is one of two MLPs that General Partner Diamondback Energy (FANG) controls and the one that produces oil and gas (the other MLP is Rattler Midstream LP (RTLR) – a midstream infrastructure LP). The current relatively strong O&G price environment appeared to be bullish for VNOM in the short to mid term considering its ability to throw off strong distributions to unitholders. Indeed, in the Q2 report issued today (Monday, Aug. 1), VNOM announced a $0.81/unit distribution – up 21% sequentially from Q1. However, the company also significantly increased its unit repurchase plan – by a whopping half-a-billion dollars. That represents what otherwise would have been a potential $6.52/unit of potential income for unitholders. I’m not a fan of energy companies that greatly over-emphasize share buybacks during up-cycles. I would take advantage of any price strength to SELL the units.

Investment Thesis

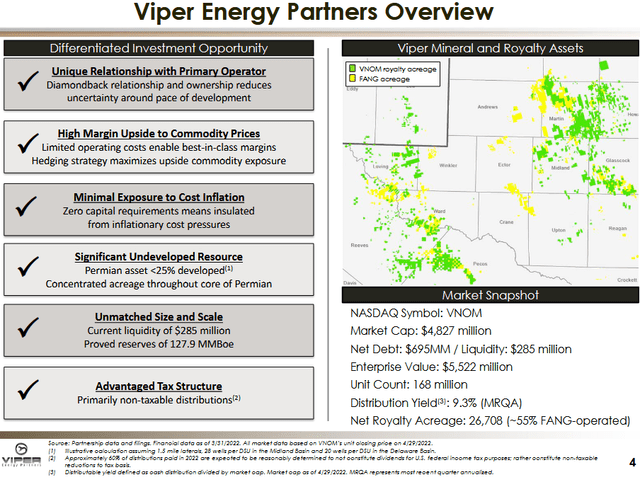

An overview of VNOM is shown below and illustrates the tight-link and adjacency of VNOM’s royalty leasehold with that of Diamondback Energy:

Viper Energy Partners

Source: May Presentation

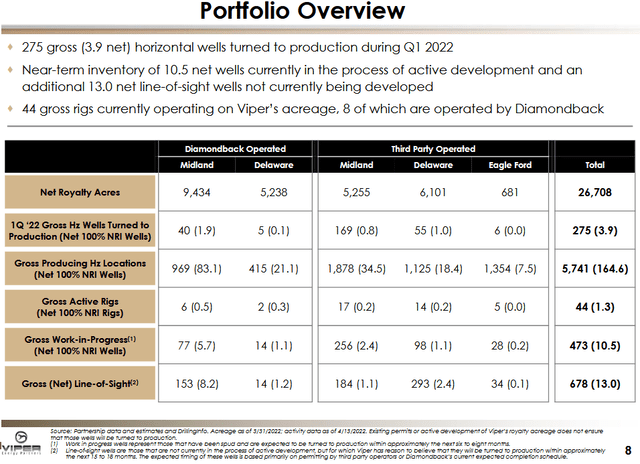

As can be seen below, Viper Energy Partners’ primary asset is its large leasehold in the Permian Basin which has proven reserves of 127.9 million boe: 54% oil and an estimated 1.67 boe/unit with ~76.7 million units outstanding:

Viper Energy Partners

Source: May Presentation

As can be seen in the above graphic, Viper owns 26,700 net royalty acres (operated and non-operated) primarily across the Midland and Delaware Basins of the Permian. That being the case, Viper Energy Partners is focused on efficiently producing O&G from its Permian leasehold (with a dash of the Eagle Ford) in order to generate robust free cash flow to reward its unitholders with excellent income.

Of its operated acreage, VNOM reports it has 3,900 gross (213 net) horizontal wells economic at $50/Bbl WTI, 190 net locations of which are economic at $40/bbl WTI. Proved reserves at YE 2021 were 127.9 million boe (69.2 million bbls oil) and represented a 29% increase over YE 2020 reserves. Net proved reserve additions of 38.8 million boe equated to a reserve replacement ratio of 378% and an organic RRR of 293%. My point being that VNOM’s asset base still has considerable upside reserve potential as the partnership exploits its resource base.

As mentioned in the bullets, and although VNOM is an MLP, since May of 2018 the partnership has been treated as a corporation for U.S. federal income tax purposes. However, VNOM units are still tax-advantaged because ~60% of the distributions paid in 2022 are expected to be “reasonably determined to not constitute dividends for U.S. federal income tax purposes; rather constitute non–taxable reductions to tax basis” (see page 4 of the above reference May Presentation).

Q2 Earnings

The Q2 FY2022 EPS report was released after the market closed today (Monday, August 1) and it was a very bullish report (at least from a financial and operational perspective). Highlights included:

- Q2 average production was 19,758 bo/d (33,560 boe/d), +9% from Q1 2022 and 20% yoy.

- Q2 consolidated net income (including non-controlling interest) was a record $171.6 million; net income attributable to VNOM was $34.0 million, or $0.44/unit.

- Adjusted net income was $167.0 million, or $2.18/unit

- The Q2 cash distribution of $0.81/unit represented ~70% of total DCF of $1.16/unit and was up 21% qoq and implies a 10.9% annualized yield based on today’s close.

The increase in production was primarily driven primarily a record 4.8 net wells being turned onto production by Diamondback. Travis Stice, CEO of Diamondback, said:

As a result of Diamondback’s consistent focus on developing Viper’s high concentration royalty acreage, primarily in the Northern Midland Basin, as well as continued strong activity levels by third party operators, Viper is increasing our guidance for oil production for the full year 2022 by 4% at the midpoint.

That increases VNOM’s guidance for full-year 2022 average daily production guidance to 19,000 to 19,750 bbls of oil per day (32,500 to 33,750 boe/d). More production obviously means more distribution potential for unitholders.

Management also adjusted its guidance on distributions’ taxation: As of end of Q2, ~55% of distributions paid in 2022 are expected to be “reasonably estimated to constitute non-taxable reductions to the tax basis, and not dividends, for U.S. federal income tax purposes.”

Share Repurchases

During Q2, VNOM repurchased 1.0 million common units for an aggregate $28.9 million (an average of $28.38/unit). The stock closed Monday at $29.61/unit.

That comes on the heels of repurchasing 1.6 million common units in Q1 2022 for an aggregate of $39.3 million (or an average of $24.56/unit) and, in the Q1 report, lifting the authorization for its common unit repurchase program by $100 million to $250 million.

Today, the repurchase authorization was further increased by $500 million to $750.0 million. Viper also reported it already expended ~21% of the increased authorized amount, leaving ~$591.6 million remaining on the increased authorization as of July 29, 2022.

Risks

Being an O&G producer (and commodity price taker), Viper Energy Partners is exposed to the typical risks and volatility associated with the commodity price cycle. Increased domestic and/or international oil production and/or reduced global demand for O&G due to a slowing global economy could negatively affect the company’s realized pricing and therefore reduce distributions to unit holders.

Viper has increased its share unit repurchase program by $600 million over just the past two quarters. All things being equal, and given the average number of VNOM fully diluted outstanding units as of the end-of-Q2 (76.729 million), that equates to an estimated $6.52/unit of income that otherwise could go to unitholders. That’s a big red flag to me because it’s going down a road that energy investors have traveled many times: massively over-emphasizing share buybacks during up-cycles. Coincidentally, note that the Q2 release also said:

The Board has approved, beginning in the third quarter, an annual base distribution of $1.00 per unit, which provides a competitive yield of 3.3% at today’s unit price,

After paying out a $0.81/unit distribution in Q2 alone, I don’t find the new over-emphasis on share buybacks – that appear to have cut the legs out from under distribution growth – to be all that attractive for unit-holders going forward. Unit-holders that bought VNOM for income probably feel as though they just got snake-bit. Further, those who have been around the energy patch long enough are probably well aware of the $10s of billions of shareholder capital that energy companies have wasted on buybacks during commodity price up-cycles.

As I reported in my recent Seeking Alpha article on FANG, its other MLP is Rattler Midstream, LP (RTLR), and FANG intends to roll-up Rattler in an all-stock transaction (see FANG: No Snake Eyes Here). I expect the roll-up of Rattler to have little to no effect on VNOM considering Rattler was a midstream infrastructure outfit while VNOM is a royalty owning oil and gas producer.

Buying an instrument like VNOM for dividend yield (i.e. income) can be risky in that investors can lose that dividend yield (or more) in a day or two of trading. For example, WTI was down almost $5/bbl today (Monday, August 1, 2022), or ~5%, and VNOM units were down $1.13/unit (~3.7%).

Summary and Conclusions

I began this article thinking I’d find VNOM to be an outstanding opportunity for investors wanting to turn exposure to the strong O&G price environment into excellent income and the potential for distribution growth. Then VNOM released its Q2 EPS report and revealed management plans to allocate over half-a-billion dollars to buybacks (~$591.6 million remained on the buyback authorization as of July 29, 2022). That equates to an estimated $6.52/unit that could otherwise have gone into unit-holders’ pockets. I’m not a fan of the plan. If I had VNOM units, I would try to take advantage of price improvement to SELL (the units are currently trading higher in the after hours market). Heck, at this point, I’d rather own FANG for income instead of VNOM (see my previously referenced Seeking Alpha article on FANG).

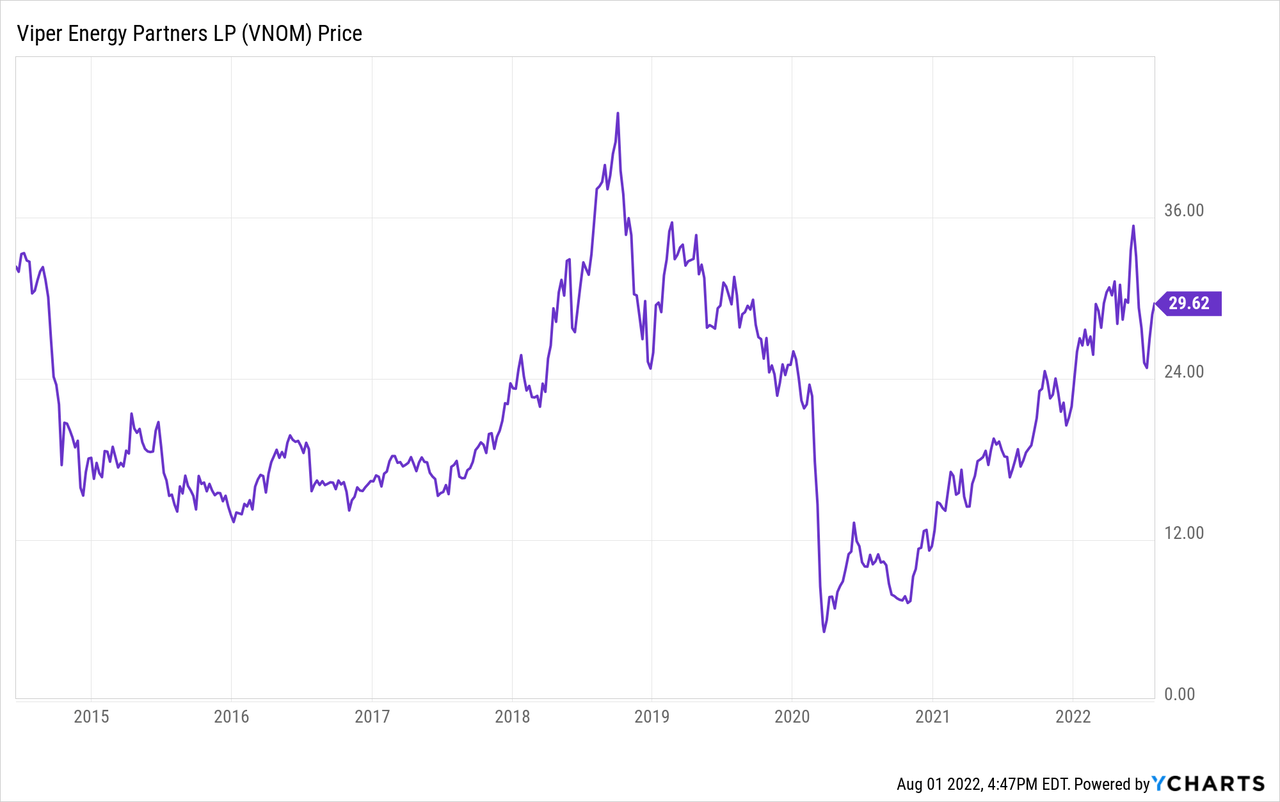

I’ll end with a long-term chart of VNOM’s units and note that management plans to buyback a ton of units (11.5% of its current market cap) during the current up-cycle:

Be the first to comment