Introduction

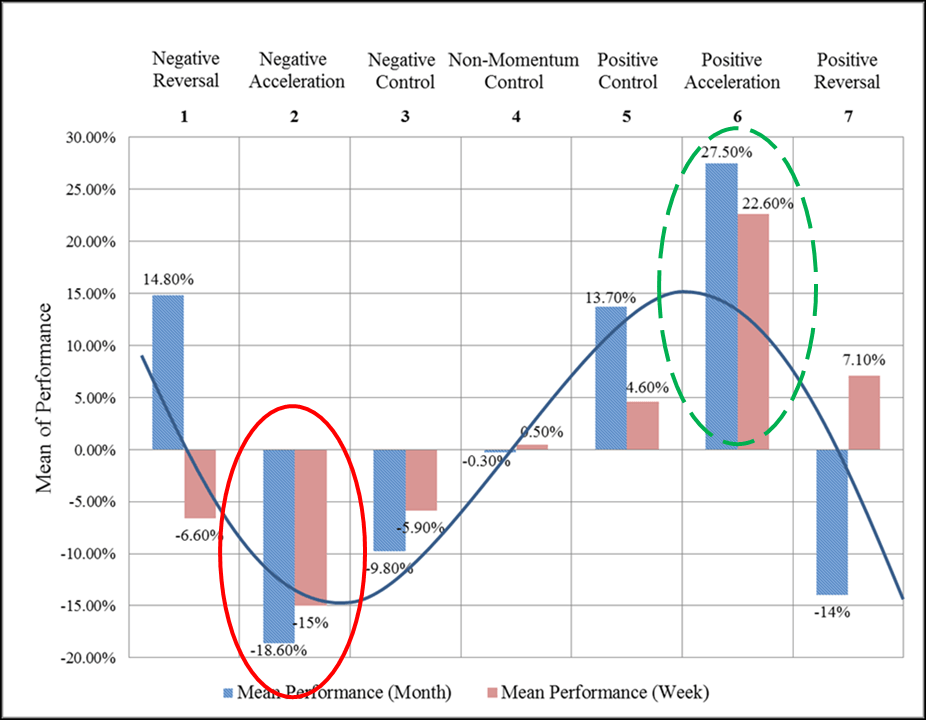

The Top Dividend Growth stock model expands on my doctoral research analysis on multiple discriminant analysis (MDA) adding new complexities with these top picks. Research shows that the highest frequency of large price breakout moves is found among small-cap stocks with low trading volumes offering no dividends and delivering higher-than-average risk levels. The challenge with the Top Dividend Growth model is to deliver a combination toward optimal total return with characteristics that typically reduce the frequency and size of price breakouts, but deliver more reliable growth factors for higher profitability longer term.

These 2 stocks are above a minimum $10 billion market cap, $2/share price, 500k average daily volume and at least a 2% dividend yield. The population of this unique segment is approximately 330 stocks out of over 7,800 stocks across the US stock exchanges. While these stocks represent less than 5% of available stocks, their market cap exceeds $19 trillion out of the approximately $33 trillion (57.6%) of the US stock exchanges. Efforts are made to optimize total returns on the key MDA price growth factors (fundamental, technical, sentiment) for the best results under these large-cap constraints, with high priorities for dividend growth and dividend yield.

Top Growth And Dividend Stocks For March 2020

Score Overview of the Growth & Dividend Stocks for March

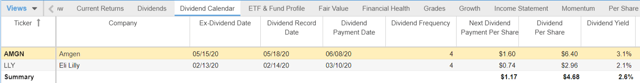

(StockRover)

Dividend Calendar

(StockRover)

The factors shown are not necessarily the selection variables used in the MDA analysis and dividend considerations for growth and strong total returns. These are additional financial perspectives to enhance your investment decisions.

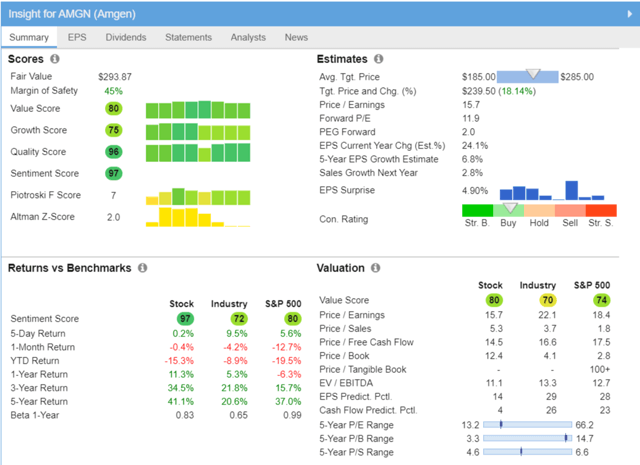

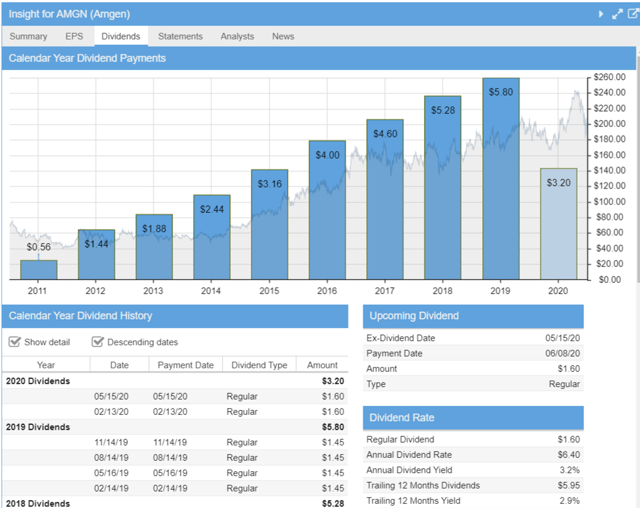

Amgen Inc. (AMGN)

(StockRover)

(FinViz)

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide. It focuses on inflammation, oncology/hematology, bone health, cardiovascular disease, nephrology and neuroscience areas. The company’s products include Enbrel to treat plaque psoriasis, rheumatoid arthritis, and psoriatic arthritis; Neulasta, a pegylated protein to treat cancer patients; Prolia to treat postmenopausal women with osteoporosis; Xgeva for skeletal-related events prevention; Aranesp to treat a lower-than-normal number of red blood cells and anemia; KYPROLIS to treat patients with relapsed or refractory multiple myeloma; Sensipar/Mimpara to treat secondary hyperparathyroidism; and EPOGEN to treat anemia caused by chronic kidney disease. It also markets other products in various markets, including Nplate, Vectibix, Repatha, Parsabiv, BLINCYTO, Aimovig, NEUPOGEN, Otezla, AMGEVITA, KANJINTI, EVENITY, IMLYGIC, MVASI, and Corlanor.

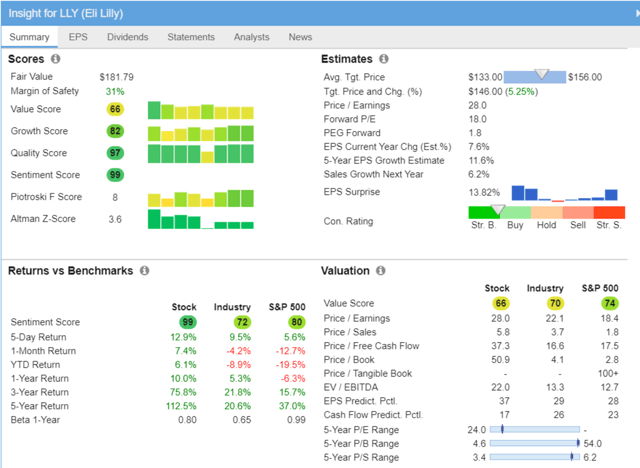

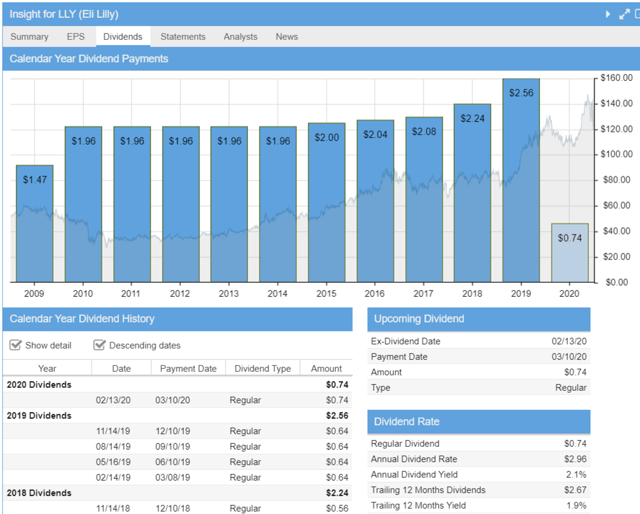

Eli Lilly (LLY)

(StockRover)

(FinViz)

Eli Lilly and Company discovers, develops, manufactures, and markets pharmaceutical products worldwide. It offers endocrinology products for diabetes; osteoporosis in postmenopausal women and men; and human growth hormone deficiency and paediatric growth conditions. The company also provides neuroscience products for treating depressive disorder, diabetic peripheral neuropathic pain, anxiety disorder, fibromyalgia, and chronic musculoskeletal pain; migraine and episodic cluster headache; attention-deficit hyperactivity disorder; and schizophrenia.

Methodology

These Growth & Dividend stocks leverage the same MDA breakout characteristics used in the Momentum Gauge models and Weekly MDA breakout picks. These stocks fit the acceleration Segment 6 of my research with strong dividends and statistical values consistent with breakout conditions in small-cap rapid accelerators. Revisiting The Signals That Forecasted Every Recent Decline, In Search Of Early Recovery Indicators

Revisiting The Signals That Forecasted Every Recent Decline, In Search Of Early Recovery Indicators

Investing in the current adverse Momentum Gauge conditions works against the model, but there may be longer term advantages to these stocks when market conditions improve in the coming weeks and months.

Conclusion

These stocks continue a live forward-testing of the breakout selection algorithms from my doctoral research applied to large-cap, strong dividend-growth stocks. These monthly Top Growth & Dividend stocks are intended to deliver excellent total return strategies leveraging key factors in the MDA breakout models in the small-cap weekly breakout selections.

These selections are being tracked on the V&M Dashboard Spreadsheet for members and enhancements will continue to optimize dividend, growth, and higher breakout frequency variables throughout the year.

All the very best to you and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

If you are looking for a great community to apply proven financial models with picks ranging from short-term breakouts to long-term value and forensic selections, please consider joining our 500+ outstanding members at Value & Momentum Breakouts.

If you are looking for a great community to apply proven financial models with picks ranging from short-term breakouts to long-term value and forensic selections, please consider joining our 500+ outstanding members at Value & Momentum Breakouts.

Disclosure: I am/we are long FAZ, TZA, DRV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment