Nastassia Samal/iStock via Getty Images

Macro vs. micro

It’s been almost a year since Russia attacked Ukraine, but every time I sit down to the keyboard, I have trouble writing about relatively mundane things when I know that people are dying not far from here. It is impossible to get used to war. Sometimes I feel almost guilty when I realise that while Ukrainian cities are being bombed, we here are living a quiet and normal life. In the light of this, meanwhile, the turbulence on the stock markets seems quite irrelevant.

We experienced a few market shocks together last year. In fact, this is the first time since 2008 that stock markets have been in a prolonged decline. Global stock markets, as measured by the MSCI World index, fell by more than 17% last year, and the US S&P 500 index, which investors often track, fell by more than 19%. Our portfolio performed significantly better. The most likely explanation is that rising interest rates have put less pressure on our stock valuations than on the market as a whole.

This is due to the fact that we have companies in our portfolio whose valuations do not rely on often inflated expectations of future profitability growth but instead are primarily based on already existing current high profitability. Moreover, these are companies that are significantly cheaper than the overall market and much stronger financially. Higher interest costs thus have only limited impact on them.

Last year was also very negative for bond markets, which recorded the biggest drop in many years. The real estate market was not spared either. So where do we find ourselves now, after a year of declining stock markets?

Macro or micro?

Those who want to take a negative view of the markets and their outlook today need not go far to find reasons. A whole range of macro data rings negative. High inflation, rapidly rising interest rates, more restrictive central bank policies, record national debts and budget deficits, high commodity prices and their potential shortages, COVID in China, a disrupted global logistics chain, war, larger currency movements, and a year of falling stock prices. It’s a mix that leaves one almost no choice but to be pessimistic when taking a macro view of the market.

(At the same time, it must be said that today’s economic environment is nowhere near the one we had here in 2008. Indeed, back then, the entire financial system was on the verge of collapse, and markets were falling and fluctuating to a much greater extent than last year. Compared to that, nothing so horrific is happening now.)

However, there are several larger problems with taking a macro approach to stock markets. Macro forecasts have such enormous dispersion (and these days especially) that they are practically worthless. They tend to induce short-term thinking and, above all, they say nothing about where stock markets will go in the near term. In fact, markets usually react to events in advance, whereas most macro data look backwards and, moreover, with a certain lag.

A macro approach usually ignores second-level thinking. First-level thinking looks like this: “The macro outlook is negative; stocks will go down.” Second-level thinking is better and goes like this: “Macro outlook is negative; do current stock prices reflect this adequately, too little or too much?” Even when macro prospects are negative, it is possible to have attractive stock prices just as it is possible to have stock prices that are too high when macro prospects are positive.

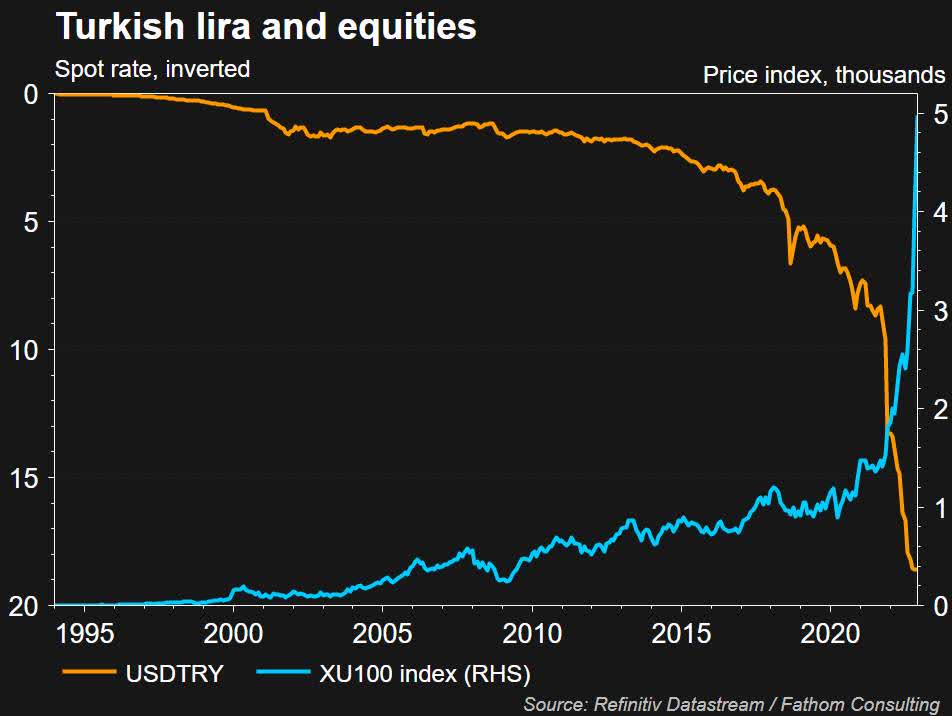

So, what do we do about it? We try to concentrate the whole macroeconomic environment into one question: “How fast will the price of money fall in the long term and how can we best protect our investments against this impact?” If I had to summarise these considerations in one picture, it would be the following:

It concerns the Turkish market. The orange curve shows the exchange rate of the Turkish lira against the dollar and the blue curve shows the Turkish stock market index. While the Turkish currency is steadily losing value, and at an accelerating pace, the stock market is rising at an also accelerating pace. There is a fairly logical connection. If we measure the value of assets in units that are themselves declining in value, then the measured assets must be rising in value as expressed in nominal terms.

Turkey is an extreme case, of course, but it does illustrate what essentially is going on (albeit much more slowly) around the world. Money is losing its value at an accelerating rate and this is the biggest long-term problem for investors.

Some protection against this phenomenon can be provided by property (or equity) assets over the long term, and this is our fundamental long-term macro consideration. Inasmuch as Vltava Fund is an equity fund, we do not deal with the issue of asset class selection but focus on finding suitable investments directly in the stock market. That means we are much more interested in the micro situation of individual companies than in the macro situation.

Micro often doesn’t look bad at all

It is said that every cloud has a silver lining, and that is precisely how we try to look at individual stocks. Let’s start with interest rates. Rising interest rates are pushing down profits for many companies, and for some they can pose even an existential risk. But for other firms, higher rates are bringing higher profits. When US interest rates were still close to zero, JPMorgan (JPM) reported net interest income of $12.7 billion in the second quarter of 2021.

In the third quarter of 2022, with rates much higher, it reported net interest income of $17.5 billion. On an annualised basis, that would come to nearly $20 billion in additional revenue annually. The insurance companies in our portfolio (Markel-MKL, Quálitas Controladora-QUCOF, Berkshire Hathaway -BRK.A,BRK.B) are also benefiting from higher rates. They have big investment portfolios largely invested in bonds. Higher interest rates mean much higher returns on bond holdings. The bond portfolio of Mexico’s Quálitas Controladora, for example, is currently yielding around 10% p.a., which is almost twice as much as a year ago.

High commodity prices (and occasional shortages) push up inflation and make life more expensive for people and businesses generally. However, the companies that extract these commodities are enjoying solid profits. This is the case with our Cenovus Energy (CVE), a Canadian oil and gas company that is currently achieving record profits.

The war in Ukraine has reminded many NATO countries as to the importance of a strong and functioning military. In some countries, this immediately brought specific plans for a significant rise in defence spending. Our Lockheed Martin (LMT) will be a direct beneficiary in the coming years, and its revenues and profits will be positively affected. War brings immeasurable suffering to people and hardship to entire economies, but even here there are cases of companies whose products and services will be in greater demand than before.

We could go on with these examples. We could mention the disrupted logistics (which benefits BMW, for example), an improved acquisition environment (which benefits Berkshire), and so on. Broadly speaking, the existing macro environment highlights differences between companies at the micro level more than at any time in the last decade. Risks are being better priced again, with the cost of money, returns on capital, the financial strength of companies, and stock valuations coming to the fore.

Recession, which we may be in or into which we may be heading, is a healing environment from which financially strong and high-quality companies always emerge in even stronger positions. We have always made sure that the companies we buy are not only highly profitable, but also financially strong and have little or no debt. When interest rates were at zero, this may have seemed like an overly cautious approach, but now we are benefiting from it.

A large proportion of our companies have no debt or have net cash. This includes Berkshire, Markel, Quálitas, BMW, Williams Sonoma (WSM), NVR, Alphabet (GOOG, GOOGL), and Crest Nicholson (OTC:CRNHY). Lower stock prices are also beneficial to companies that return excess cash to shareholders through buying back their own stock (e.g. Williams Sonoma, Cenovus Energy, NVR, Alimentation Couche-Tard-OTCPK:ANCUF, LabCorp, and Magna-MGA). When stock prices are undervalued, share buybacks are often the best use of capital and impact very positively on shareholder value. For several companies in our portfolio, the sum of annual dividend payments and share buybacks is around 10% of market capitalization. This is an unprecedentedly high figure.

New additions to the portfolio

We bought two new positions: Arrow Electronics (ARW) and Alphabet.

Arrow Electronics is a high-quality company with an attractive return on capital and strong growth in earnings per share that is often overlooked by investors because it is a seemingly boring company in the technology sector. ARW is usually thought of as a simple semiconductor distribution company, but it also provides an interesting offer of value-added services that creates deep ties with its customers. In essence, ARW provides economies of scale by acting as an intermediary between a highly diversified supplier base and a fragmented customer base of more than 220,000 customers.

The company has 288 offices in more than 100 countries and has long-standing relationships both with its suppliers and its customers. Such distribution businesses may be found in multiple industries. In addition to electronics and semiconductors, for example, they occur in the automotive and chemical industries. They can be very attractive if well and efficiently managed. In looking at its long-term results, ARW appears to us to be just such a company. What’s more, we bought its shares at a historically very low valuation.

Alphabet (formerly Google-GOOG,GOOGL) probably needs no special introduction. It dominates the global online search market and has a number of other valuable businesses (YouTube, Maps, Gmail, Chrome, Google Play, Android OS, Google Cloud, Waymo, etc.) Why GOOG and why right now? The technology sector had been dominating the US market for several years up until the close of 2020. Since then, the sector has been under greater selling pressure. (The Nasdaq index, with its large representation of technology stocks, fell by 33% last year.)

We are following it very closely, waiting to see if anything emerges that is attractive to buy. Most stocks, however, seem either uninteresting or still expensive to us. The only stock that has slipped through our screen so far is Alphabet. It’s a quality business, no question about it. When the price fell to $90, we cautiously started buying. It’s not yet a price that makes a buyer jump for joy, but it’s a reasonable price for a solid company. We see a lot of future potential (perhaps somewhat paradoxically) in trimming the corporate fat that the company has packed on over the past few years.

When revenues were growing rapidly, this could have been hidden, but now it’s proving to be a problem. Costs are rising too fast, the company apparently has too many employees and too many overpaid employees, and it has some other segments, like the so-called “other bets”, that have swallowed up tens of billions of dollars and still produce virtually no sales. Management seems to be realising this and if they start running the company with much greater emphasis on efficiency, then maybe we will add some more to this position.

In addition to these two new positions, it is worth noting that we have increased investments in Cenovus Energy, Celanese (CE), S&U, Williams Sonoma, and the Nikkei 225 stocks while reducing positions in CVS, Magna, and Lockheed Martin.

What to say about the outlook for coming years? Some things remain the same, some seem to have changed. What remains the same? I don’t think anything has changed in that we will continue to live in an environment of above-average inflation and negative real rates. Governments will also not give up their habit of running large budget deficits, which will over and over again require the monetization of debt (aka printing money).

What has changed? Over the past decade, a huge amount of money has been invested in the technology sector. Often well, but often also quite senselessly. Large sums of money have been wasted in this way. In my opinion, that era is over. The last year has shown, in no uncertain terms, that the world is not suffering from a lack of mobile apps, games consoles or gender-neutral toilets. It is suffering from inadequate infrastructure for future necessary development. That is where the main sums of money are likely to be directed in coming years.

The world is likely to see an investment super-cycle focused primarily on infrastructure investment. This should go hand in hand with the commodity super-cycle, of which we seem to be in the early stages. The era of underinvestment in the real economy is hopefully over. In the short term, it is possible that economies will go through a recession. But this should bring, among other things, a drop in inflation and a halt to the rise in interest rates. Where stock markets will go amidst all this remains to be seen.

According to an analysis by JP Morgan Private Banking, global stock markets are at their lowest valuations in more than a decade. Periods of very low consumer confidence, like the one we are in now, tend to be historically good buying signals. It’s a time for second-level thinking.

Daniel Gladiš

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment