Solskin

It’s easy to paint diversified healthcare REITs with a broad brush, as Welltower (WELL) and Ventas (VTR) have large exposure to the troubled seniors housing segment. However, that’s not the case for Healthpeak Properties (NYSE:PEAK), which is currently attractively valued while only having a relatively small exposure to senior housing. In this article, I highlight why PEAK appears to be undervalued, giving investors the potential for strong returns.

Why PEAK?

Healthpeak Properties is one of the 3 big diversified healthcare REITs and is a member of the S&P 500 index. Unlike REITs such as Omega Healthcare (OHI) and Physicians Realty Trust (DOC) that are more pure-play REITs in their respective segments, PEAK is focused on the three private-pay healthcare assets of Life Science, MOB (Medical Office Buildings), and Senior Housing.

What’s good for PEAK investors is that it’s more highly focused on the stable and growing life science and medical office segments. Unlike seniors housing, these segments haven’t been plagued by oversupply issues. They also aren’t labor intensive, and therefore haven’t had to deal with labor shortages and wage inflation. As shown below, Life Science and Medical Office Buildings comprise a combined 90% of PEAK’s NOI, while Continuing Care Retirement Communities comprise just 10%.

PEAK Portfolio Mix (Earnings Release)

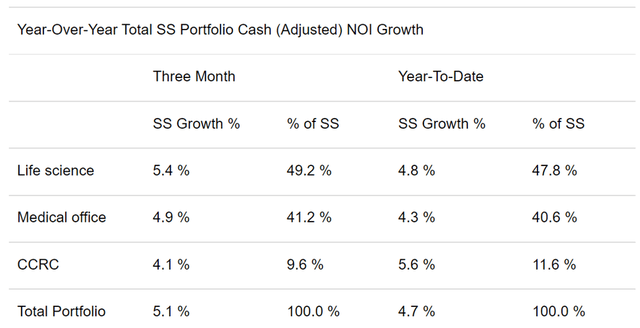

Meanwhile, PEAK is demonstrating strong results, with total same-store portfolio NOI growing by 5.1% YoY during the third quarter, with Life Science and MOB leading the way, at 5.4% and 4.9% growth, and CCRC not too far behind at 4.1% YoY growth. Management sees plenty of opportunities ahead, especially with Life Science as this segment is viewed as a public-private partnership, with major public research institutions and pharmaceutical companies collaborating in the world of biotech innovation, supported by over $200 billion per year spent on drug research and scientific development.

Moreover, PEAK has the balance sheet capacity to continue funding growth in this arena, as it carries a BBB+ rated balance sheet with a strong net debt to adjusted EBITDAre ratio of 5.3x. As a sign of bond investor appetite for PEAK’s debt, it was able to issue $500 million of unsecured term loans with a 2027 maturity at a low 3.5% fixed interest rate.

Looking forward, PEAK is set to benefit from the pending projects, including a 70/30 joint venture partnership with a sovereign wealth fund partner on a 400K square foot portfolio of seven life sciences buildings in the well-regarded health hub of South San Francisco. Moreover, its life science building development in Brisbane, California is now 100% leased to leading global pharmaceutical and biotech companies. All in all, PEAK’s $1 billion life science development pipeline is now 81% leased.

Longer term, PEAK’s MOB and CCRC communities should benefit from the long-term trend of the growing senior population. This was highlighted by Morningstar in its recent analyst report:

The top healthcare real estate stands to benefit disproportionately from the Affordable Care Act. With an increased focus on higher-quality care being performed in lower-cost settings, the best owners and operators in the industry, which can provide better outcomes while driving greater efficiencies, should see demand funneled to them from the best healthcare systems.

Additionally, the baby boomer generation is starting to enter its senior years, and the 80-plus population, an age range that spends more than 4 times on healthcare per capita than the national average, should almost double in size over the next 10 years. Long term, the best healthcare companies are well positioned to take advantage of these industry tailwinds.

Meanwhile, PEAK pays a healthy 4.6% dividend yield that’s well covered by a 70% AFFO payout ratio, based on Q3 AFFO per share of $0.43. While the dividend rate was cut by $0.07 to $0.30 in 2021, I see this as being a necessary step, as PEAK disposed of the majority of its senior housing assets in 2020 in order to transition the portfolio towards higher quality Life Science and MOB assets.

Given the portfolio transition to a higher quality asset base, I see the market currently undervaluing PEAK at the price of $26.15 with a forward P/FFO of 15.1. Given the high quality asset base, with a more assured and growing revenue stream, I would expect for PEAK to trade at least at a P/FFO of 17.5. Morningstar has a fair value estimate of $36, and analysts have a consensus Buy rating with an average price target of $30, implying potential for double-digit total returns.

Investor Takeaway

PEAK has a solid portfolio of Life Science and MOB assets, with additional projects in the pipeline. It also has a balance sheet capacity to fund further growth opportunities. With the senior population expected to grow over the next 10 years and an improved asset base, PEAK should benefit from increasing demand for its properties. Meanwhile, it pays a respectable and well-covered dividend and appears to be undervalued for potentially strong total returns down the line.

Be the first to comment