AndreyPopov/iStock via Getty Images

By Rob Isbitts

Summary

ProShares VIX Mid-Term Futures (BATS:VIXM) gets a Buy rating from us, primarily because of its ability to play a role in portfolio hedging in bear markets. VIXM tries to profit from rising volatility in the S&P 500. This often is the same thing as saying it profits from declines in the S&P 500, but that’s not the case 100% of the time. Thus, any investor who is considering using this or other volatility-based ETFs needs to do their homework. So, let’s try to start the process here.

Strategy

The S&P 500 VIX Index (VIX) is the stock market’s primary benchmark for “volatility” – specifically, how much the market is expected to hop up and down during the next 30 days. As opposed to some other VIX-based ETFs that seek to capitalize only on very short-term spikes in volatility, VIXM typically looks out over the next 5 months, which offers a smoothing effect on the VIX investing concept.

Proprietary ETF Grades

-

Offense/Defense: Defense

-

Segment: Hedged Equity

-

Sub-Segment: Volatility

-

Correlation (vs. S&P 500): High (negative)

-

Expected Volatility (vs. S&P 500): Very High

Holding Analysis

VIXM owns futures contracts that expire over each of the next four or five months. For example, as of this writing (start of November 2022), the ETF owned four different maturities: February, March, April, and May. Thus, the ETF’s name “Mid-Term” futures. The March and April contracts are each about one-third of the total assets, with the rest split between the shortest (February) and longest (May) contracts.

Strengths

When the stock market panics, volatility goes up. When that happens, VIXM aims to be one of the few green items on an otherwise red screen. And, while shorter-term VIX-based ETFs act more like trading vehicles or surrogates for owning S&P 500 options, VIXM’s “laddered” approach over several months offers a piece of the action, but without the immediate sharp drawdown every time the S&P 500’s price spikes higher, and VIX spikes lower. VIXM’s ETF wrapper also provides a transparent, convenient way to get access to VIX futures, which many investors will likely find too cumbersome to devote a lot of time and effort to doing.

Weaknesses

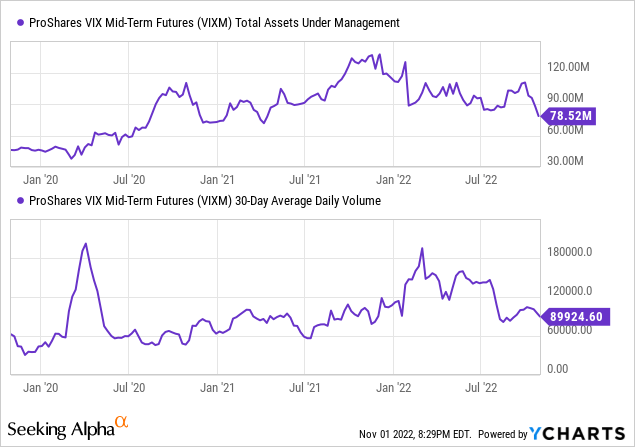

VIXM’s daily average dollar trading volume of about $3mm is on the small side. However, as the chart below shows, when the market gets shaky, volume can spike, which makes this ETF more liquid. The drawback is that VIXM can get popular quickly, then see that popularity fade just as fast.

Another potential weakness here is that in a sudden market decline such as what we saw in early 2020, VIXM’s laddered futures approach might not kick in as a big winner as rapidly and as forcefully as a shorter-term “long VIX” ETF.

Opportunities

The obvious opportunity with VIXM is the fact that the stock market is currently a mess. And, as we do not see signs that it will get significantly better soon (new all-time highs are more than 20% up from here), there should be ample room left in the bear market to deploy VIX ETFs for those who identify with and understand their pros and cons.

But there’s a more interesting opportunity that may be more timely when it comes to VIXM. Specifically, since it seeks to respond to rising volatility over the medium-term and other VIX ETFs exist that cover the shorter term, there may be situations in which those can be paired together in a portfolio to get the full “volatility ladder” effect.

Threats

And, just that quickly, it makes sense to talk about the threats of using VIXM or any other ETF tied to VIX. Contrary to what it seems, many investors now believe, the stock market is best not used like a casino. VIX is a fickle beast, and ETFs that seek to profit from rising market volatility, falling volatility or both are to be handled with “kid gloves” at all times. These vehicles are best used as garnishes in your portfolio, not the main dish. Because the biggest threat of using VIXM and its peers is not the ETF itself, but operator error: investors trying to overplay their hand and use them as outright speculative tools.

Proprietary Technical Ratings

-

Short-Term Rating (next 3 months): Buy

-

Long-Term Rating (next 12 months): Sell

Conclusions

ETF Quality Opinion

Speaking as someone who has been investing professionally for three decades, but has never traded futures or shorted a stock, bear market-oriented ETFs like VIXM have been a very good tool to have at my disposal over the years. The liquidity issue might be a thorn on the side of professional investors. However, with any ETF, there are risks to account for when determining if, when and how to use one within a portfolio.

ETF Investment Opinion

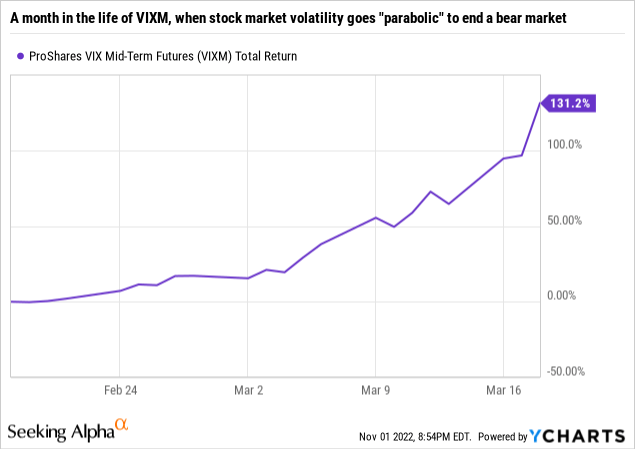

We rate VIXM a Buy for the reasons noted above. However, our proprietary technical ratings on VIXM, shown above, are perhaps a better way to summarize our opinion on this quirky, overlooked, but potentially powerful ETF. Bear markets typically don’t end until volatility spikes much higher than we have seen in that cycle. This chart shows the 2020 version of that.

For that reason alone, VIXM is on our radar as long as a bear market is in place. But the VIX does not stay elevated forever, and we suspect that at some time in the next 12 months, the storm will have passed, at least for a while. That makes VIXM a more opportunistic tool than something we’d expect to be pounding the table on year after year.

Be the first to comment