Ethan Miller

Vivint Smart Home’s (NYSE:NYSE:VVNT) stock price has bounced back over the last few months after the company reported robust double digit growth on top and bottom lines in Q2.

VVNT’s stock price is now at the same point it was in late January, buckling the trend of underperformance seen in the broader markets, particularly in the growth stock arena. This has been for good reason too, VVNT’s underlying business has proven its resilience against a difficult consumer backdrop and grew at a fast clip even when lapping tough Y/Y comps. Debt still weighs heavy though, and investors need to monitor the impact of rate hike increases on interest expense closely.

Financial performance YTD

Over the last two quarters, the firm has reported back-to-back operating profits, marking a significant improvement in comparison to 2021 which saw four straight quarters of operating losses. This was driven by strong (15%) revenue growth in Q2.

The adjusted EBITDA performance was even more impressive, which came in just shy of $190M in Q2, a $30M increase compared to the prior year. Since listing in early 2020, the Adjusted EBITDA margin of ~45% has held up nicely while the absolute figure expands due to top-line growth.

Free Cash Flow was $50M in Q2. This combined with the sale of the Canadian business put VVNT on a cash balance at the end of June of $248M. The company noted that the $104M generated from the sale was significantly more than they expected to gain from the subscribers over the next ten years. This appears a shrewd move and it bolsters the cash balance in a time of economic uncertainty. It will also allow VVNT to reinvest for growth (particularly on the customer acquisition side).

Strong performance on KPI’s

This financial performance has been underpinned by the company delivering on its Key Performance Indicators, namely subscriber growth:

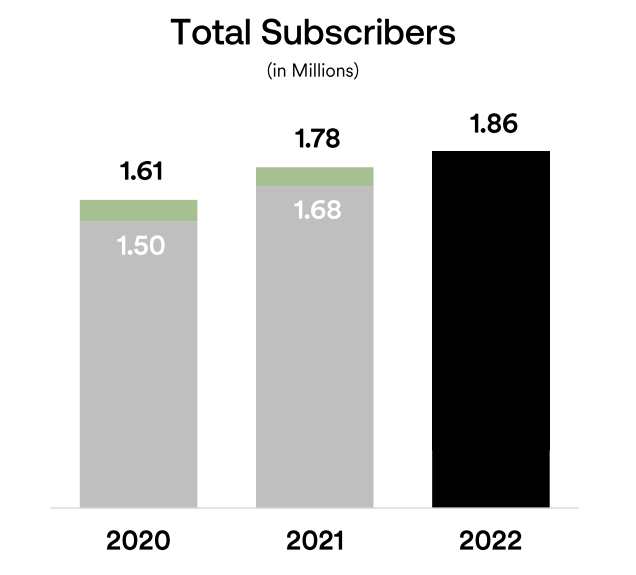

Q2 Presentation

As can be seen above, total subscribers hit 1.86M at the end of last quarter. The green sections of the chart represent the impact of the Canadian division. VVNT’s subscriber count is now growing faster without the Canadian business. Growth in 2022 was 4.7% with the Canadian business and 10.8% without. Canada was growing slower than the core business. This effect on growth is also seen in Total Monthly Recurring Revenue.

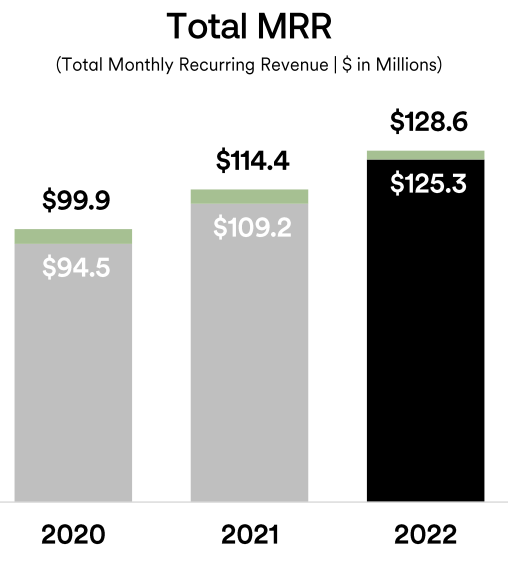

Q2 presentation

Growth ex-Canada was 14.8% compared to 12.4% with Canada. All things considered, the disposal of the Canadian segment does look attractive.

Customers of VVNT are buying more products and services and are staying with the company for longer. The attrition rate (churn) over the three months to June was the lowest in the last 14 quarters at 10.9%.

Future prospects: Looks Great… but the debt

VVNT reaffirmed its FY guidance, adjusted in some aspects for the Canadian disposal. Both Revenue and Adjusted EBITDA have been reaffirmed even after the removal of the Canadian operations. Whilst subscriber count and free-cash flow have both been adjusted for it. Therefore, Adjusted EBITDA is expected to be $745M with revenue at $1.63B, inferring a margin of ~45.7%.

VVNT has now streamlined the business to focus on its core growth markets (particularly US). The primary concern for the company and risk to the bullish thesis is the debt pile. Total long-term debt is $2.2B with a large variable component to it. Management quantified this in the call:

a lot of our debt has a variable component to it. And so we’re impacted by rising interest rates associated with the change there. And then the customer financing options that we provide also have a variable component to them. So both of those things can impact us pretty significantly. If you quantify that, and let me just give you a little bit of benchmark here, if we rise by about 1%, 1% increase in interest rate creates about a $26 million increase in interest expense for the company at the current run rates with the current structure

Considering FCF for the FY is now expected to be $60m, a $26M increase in interest expense is significant. CPI has just come in hotter than expected on Tuesday morning, which has once again provoked fears that the Fed may looks to hike by 100BP instead of 75, that alone would create a $6.5M additional headwind. The razor thin cash flow margins are understandable as VVNT funds growth (which it is achieving) but the large debt pile should make investors cautious, particularly with the feds current hawkish stance.

Bottom Line

On the whole VVNT’s performance in consideration of the backdrop is very impressive. Management has boasted the resilient nature of its business and those words have been proven by the underlying results. VVNT’s unit economics are improving as the company feels the benefits of its fully integrated system and sees operating profitability for the first two quarters in the year. However investors should remain cautious regarding interest expense and the impact of rate hikes on FCF. Even with a forward EV/EBITDA ratio of just ~4.5x, I am maintaining a hold rating in consideration of the CPI print on Tuesday.

Be the first to comment