sarawuth702

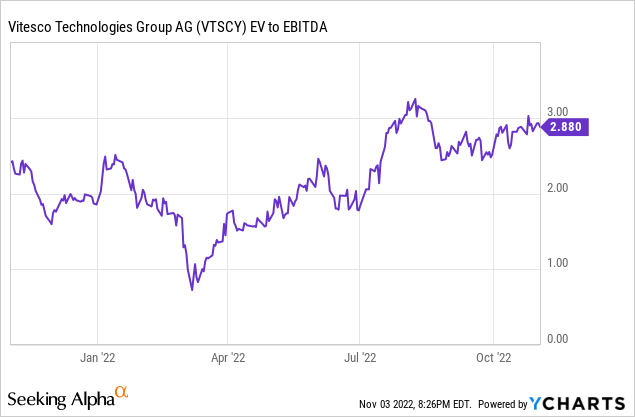

Germany-based powertrain supplier Vitesco’s (OTCPK:VTSCF) updated Capital Markets Day targets will be well-received by investors, outpacing even the bullish expectations heading into the event. Management’s confidence in an accelerated electrification transformation path also came as welcome news given the prospect of a challenging macro backdrop ahead. All in all, the Vitesco investment case looks compelling – relative to a CAGR of ~40% through FY26 for the electrified business, the current ~3x EV/EBITDA valuation seems like good value. Plus, there’s good visibility here, given a significant majority of the ~EUR5bn mid-term electrification sales target has already been booked. Potential upside catalysts include the stock’s growing thematic appeal as its share of electrification ramps up, as well as the accelerated streamlining of the legacy combustion engine portfolio.

Growing into an EV Powertrain Leader

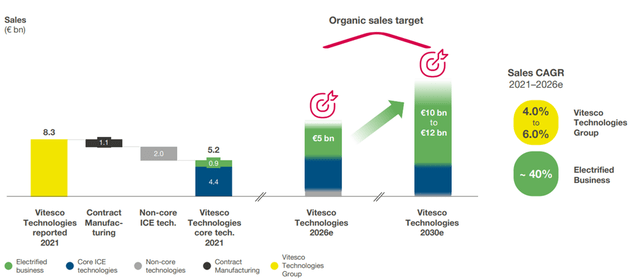

Vitesco has unveiled an upgraded electrification sales target of EUR5bn in FY26, well above the prior >EUR2.5bn target for FY25. The strong electrification sales growth is targeted to stretch well into FY30 at EUR10-12bn as well, topping even the most bullish investor expectations heading into the event. For context, achieving the FY26 target would mean EVs will become the majority revenue contributor at ~45% (up from ~11% in FY21). This could have profound valuation implications – relative to the current ~EUR2bn market cap, capitalizing the EV business at a base case revenue multiple of ~1x would imply a EUR5bn valuation on FY26 targets (or >EUR10bn on the FY30 numbers). A successful EV transition would also have the added benefit of attracting ESG-driven flows from investors, so this valuation estimate could prove very conservative.

In the meantime, visibility is key – with ~70% of the mid-term electrification sales target already booked, the likelihood of Vitesco meeting (and exceeding) these targets seems high, in my view. The breadth of orders is also worth noting, given they span the entirety of the company’s product portfolio, from e-axles to proprietary high-voltage boxes. At a time when EV powertrain components are facing in-sourcing pressures, Vitesco’s diversified product offering will be key in insulating against this risk and ensuring sustained market leadership through the cycles.

Profitability Targets Intact

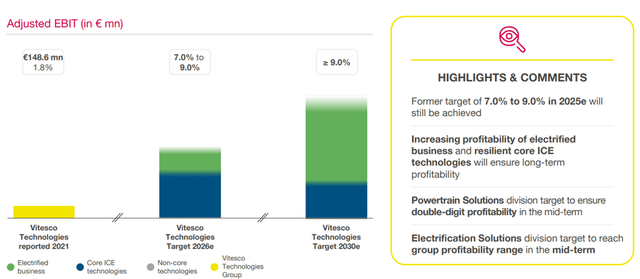

Despite the macro headwinds, Vitesco reaffirmed its adj EBIT margin target range of 7-9% by FY26 and expects margins to exceed 9% by FY30. For the electrification side, management also confirmed the current EBIT break-even targets and remains on track for the mid-single-digit % segment margin target for FY26. As long as Vitesco maintains its vertical integration and tech leadership advantage, particularly in the EV business, these targets seem well within reach.

There could be some near-term margin dilution, though, as most of the R&D spend for electrification products is not customer-specific (unlike combustion engine products) and, thus, is expensed earlier in the process. Over the mid to long term, this effect should reverse, expanding the scope for Vitesco’s EV product margins to run higher than the group over time. Even relative to the 10% margin guidance for FY30, the higher content per vehicle opportunity in EVs could enable significant upside, in my view. Additional profitability improvement drivers to keep an eye on include platform modularity and synergies between the combustion engine and EV businesses.

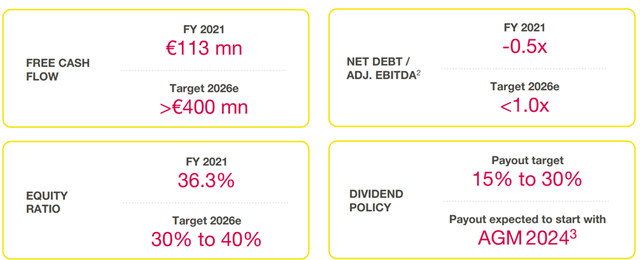

Accelerated Reorganization Progress

Having announced that the company will be splitting into two divisions, Powertrain Solutions and Electrification Solutions, Vitesco appears poised to accelerate the streamlining of its portfolio. The focus here is to emphasize the future growth driver, EVs while maintaining profitability within its legacy combustion engine business (i.e., Powertrain Solutions). As things stand, Vitesco is targeting double-digit margins here while delivering on the phasing out of 50% of non-core combustion engine sales by FY26. Perhaps more importantly, management sees cash conversion levels sustaining at an impressive >65%, paving the way for dividend payments starting FY24 (at a modest 15-30% payout ratio).

Also worth noting is Vitesco’s announced divestiture of its combustion engine catalyst business (~EUR200m of sales). While management did not disclose the transaction value at the CMD, an in-line ~0.5x EV/Sales multiple would imply a ~EUR100m valuation. While this is minor in the context of the overall group at a mid-single-digit % of Vitesco’s market cap, I view this move as a clear statement of intent to accelerate the transition away from combustion engines to electrification parts. Further reorganization progress should shed light on the growing value of Vitesco’s electrification, potentially catalyzing a re-rating of the stock.

An Inexpensive Play on Secular EV Growth

Relative to the upgraded targets established at this year’s CMD, Vitesco’s current market cap seems undemanding for an EV powertrain market leader on track for electrification sales of ~EUR5bn through FY26. With ~70% of the mid-term sales target already booked, visibility has improved as well, and the path to EV business profitability by FY24/25 looks well within reach. In addition to the raised electrification targets, the positive updates on the reorganization progress should also alleviate investor concerns about the impact of a potential global recession.

Yet, the stock still trades at a relatively undemanding ~3x EV/EBITDA vs. a CAGR of ~40%/year in the electrified business through FY26. So, while Vitesco has outperformed YTD on its growing leadership in EV powertrains, the company remains an attractive acquisition target, in my view. Additional re-rating catalysts include an accelerated transition away from the combustion-engine business, which should broaden the stock’s thematic appeal and attract more ESG-driven flows.

Be the first to comment