claffra/iStock via Getty Images

Introduction

Denver-based Vista Gold (NYSE:VGZ) is a gold exploration and development company. The company’s flagship asset is the Mt Todd gold project, located in Northern Territory, Australia. Australia is considered a Tier 1 mining jurisdiction.

Note: This article is an update of the article published on August 19, 2021. I have been following Vista Gold on Seeking Alpha since August 2020.

The company published a new presentation in July 2022 and announced its first quarter of 2022 results on May 2, 2022.

1.1 – A quick snapshot below.

One essential item in this new presentation is the recent feasibility study that extended the mine LOM’s life and significantly increased the mineral reserve published in February 2022.

Also, on March 17, 2022, Vista Gold appointed CIBC Capital Markets as its strategic advisor to assist the company in evaluating a broad range of alternatives for Mt Todd.

However, despite a bullish report, the stock continued to drop to a record low level, and I will try to figure out why the market failed to show any interest.

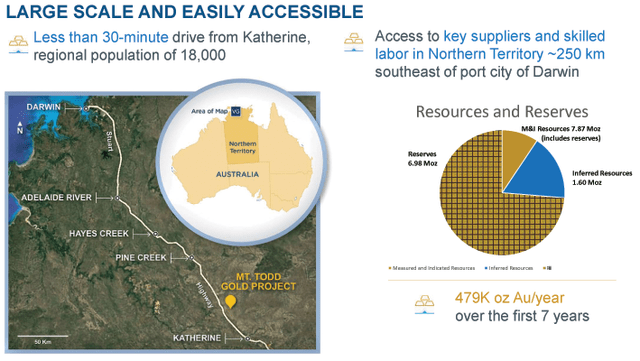

VGZ Map Presentation July 2022 (Vista Gold)

All major permits have been received. The Mt Todd project is expected to produce an estimated 6.979 million ounces of gold at 0.35 gAu/t cut-offs from proven and probable reserves over 17-year mine life. The gold grade is 0.84 G/T.

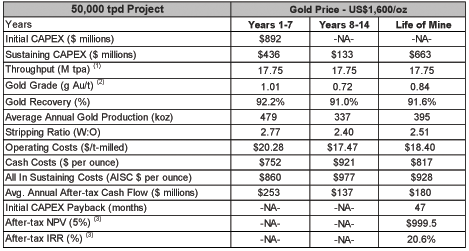

VGZ Data Table presentation (Vista Gold)

In the NI 43-101 Technical Report issued in February 2022, the initial CapEx is estimated at $892 million with a pay-back of 3.9 years (after Tax) with a cash cost of $817 per ounce.

LoM capital cost requirements are estimated at US$1,555 million as summarized in Table 1-8. Initial capital of US$892 million is required to commence operations. At the end of operations, the Project will receive an estimated US$37 million credit for asset sales and salvage.

Average annual production of 479K Au ounces during years 1 to 7 of commercial operations, with an AISC of $860 per ounce. Yearly average production of 395 k Au ounce per year over the mine life.

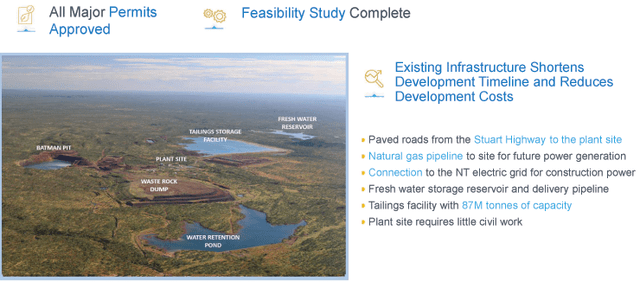

1.2 – A Brownfield project with good quality infrastructure.

One good characteristic is that the project is considered a brownfield project with a good quality infrastructure already in place ( Paved roads, connection to the NT electric grid, fresh water storage reservoir, tailing capacity, etc.)

VGZ Infrastructure Presentation (Vista Gold)

Frederick H. Earnest, President and Chief Executive Officer of Vista Gold, said:

As previously announced, the FS was completed in early February 2022, delivering a 7 million ounce gold reserve with high operating margins over a 16-year mine life. The FS affirms the strength of Mt Todd’s gold production capacity and ability to deliver robust economics with significant cashflows and resilience to inflation.

Our ongoing exploration program continues to identify targets for efficient future mineral resource expansion.

1.3 – Stock Performance

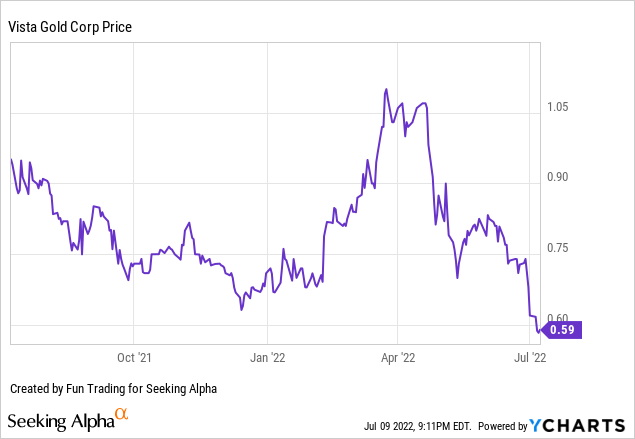

VGZ rallied quickly after the feasibility release and the news that management appointed CIBC Capital Markets as its strategic advisor.

The upside reached a high of $1.08 but did not last long. However, the stock collapsed by over 45% in less than three months when the market realized that inflation was a significant threat to the global economy.

1.4 – Vista Gold 1Q22 Financials. The raw numbers

Note: The company is not generating revenue.

| Vista Gold | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Net Income in $ Million | -3.10 | -0.75 | -3.07 | -8.32 | -0.32 |

| EBITDA $ Million | -3.07 | -2.92 | -3.09 | -2.82 | -3.19 |

| EPS diluted in $/share | -0.03 | -0.01 | -0.02 | -0.08 | 0.00 |

| Operating Cash Flow in $ Million | -2.53 | -2.26 | -2.65 | -3.18 | -2.45 |

| Total Cash $ Million | 7.42 | 6.60 | 16.35 | 13.14 | 12.86 |

| Long-term Debt in $ Million | 0 | 0 | 0 | 0 | 0 |

| Shares outstanding (diluted) in Million | 103.51 | 104.57 | 115.59 | 117.27 | 117.44/129.6* |

Source: Vista Gold 10-Q

* The company indicated the outstanding shares as of March 31, 2022. Fully diluted 129.6 million.

The balance sheet is not essential for a company like Vista Gold. However, I believe it provides specific data that could help your investment strategy.

However, VGZ has total cash of $12.86 million as of March 31, 2022, and has no debt.

1.5 – A few issues

1.5.1 – Mt Todd is a low-grade project

The Mt Todd project is expected to produce an estimated 6.979 million ounces of gold at 0.35 gAu/t cut-offs from proven and probable reserves. The grade is relatively low and not very attractive.

Thus, Vista Gold will have difficulty finding a potential suitor willing to invest nearly $1 billion in this project. On the other side, Mt Todd is a brownfield project that will take only about three years after the final investment decision FID is announced.

1.5.2 – The company uses its stock to dilute shareholders

In my preceding article, I indicated that the company decided to use its stock as currency to finance the project a year ago, and I was not happy with the move.

On July 7, 2021, Vista Gold announced an increase in the size of the previous public offering and purchased 12,272,730 shares at $1.10 per share (exercised underwriters’ over-allotment was 920,454 shares) for gross proceeds of ~$13.5 million. The final total shares sold was 13,193,184 shares.

Each share consists of one common share and one-half of one common share purchase warrant. The warrants will be exercisable for 36 months at $1.25 per share. The money was used for the definitive study of Mt Todd.

This move is quite concerning for VGZ shareholders looking at further potential dilution. The shares outstanding diluted has jumped about 25% on a one-year basis.

1.5.3 – Inflationary pressure will increase initial CapEx and its feasibility

The initial CapEx is estimated at $892 million with a pay-back of 3.9 years (after Tax). However, inflationary pressure is relatively high, and the project could end up with a CapEx of about 20%-25% higher, eroding the feasibility significantly.

We could compare the Mt Todd project to a similar project called Côté Gold, owned by Iamgold Corporation (IAG). The initial CapEx was $875 million to $925 million and increased recently to $1,125 million to $1,175 million.

I recommend reading my recent article on IAG published on March 28, 2022, by clicking here.

Technical Analysis and commentary

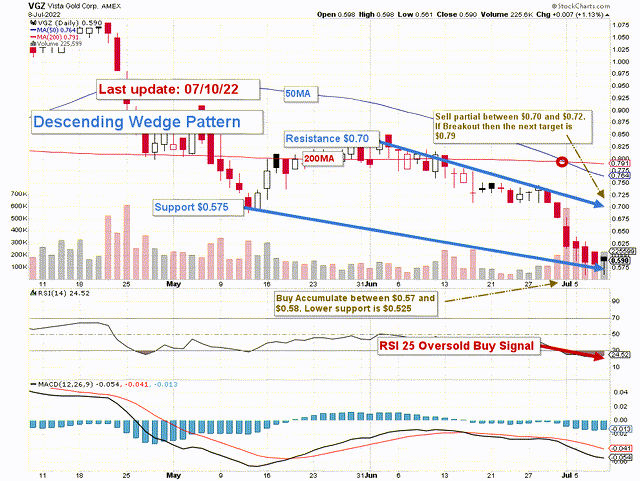

VGZ TA Chart short-term (Fun Trading)

VGZ forms a descending wedge pattern with resistance at $0.70 and support at $0.575. The RSI is now 25, which indicates an oversold situation hinting at a buy signal.

The trading strategy is to accumulate between $0.57 and $0.58 with an accumulation to the potential lower support at around $0.525. The stock is now weakening due to a bearish gold environment due to the FED’s action, and I see it as an opportunity.

Also, It is important to take profits between $0.70 and $0.72 with a potentially much higher stock price if the company can find a partner to develop the project. I would not be surprised if VGZ can reach $1.25-$1.35 in this case.

The strategy is to trade LIFO about 70%-80% of your position and keep a core long-term for a more outstanding payday.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States to generally accepted accounting principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stocks, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks.

Be the first to comment