Justin Sullivan/Getty Images News

Thesis

Dominant companies melted up with the long bull market, sparking bubble-like valuations. Since then, the risks materialized for tech stocks like PayPal and Netflix, and shares plummeted. Technology is a constantly changing world, and the risks often lurk in the shadows. But when the market takes notice, high multiple businesses can get crushed. Warren Buffett once described this phenomena as:

“You don’t find out who’s been swimming naked until the tide goes out.”

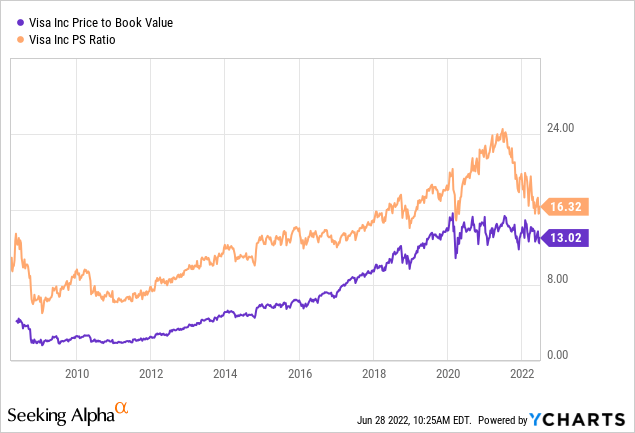

Enter Visa (NYSE:V) with a P/E of 31 and a P/B of 13. Visa’s been buying back shares and decreasing its book value over the years. A large part of the stock’s outperformance has come from bull market multiple expansion:

We believe that if Visa’s growth slows, the stock is still in bubble territory. With the risks waiting in the shadows, we believe now is the time to take profits.

The Business

Visa is a simple business when broken down. The company facilitates transactions, acting as the intermediary between banks, consumers, and merchants. Visa doesn’t take on any of the debts or interest payments itself. Instead this credit is handled by the banks, who take on credit risk and profit from the interest payments. Visa simply collects fees for its services.

Visa’s competitive advantage is its massive network effect, connecting banks and merchants on a global basis. The company’s fees are supported by the brand, which is globally recognized and trusted. The flywheel is reinforcing because banks profit, consumers receive rewards, and Visa collects high-margin fees.

On the darker side, one of Visa’s primary stakeholders is suffering: the merchant. The merchant is paying increasingly higher fees to Visa, which squeezes already thin margins. Visa sits on 50% profit margins. Meanwhile, struggling retailers typically have profit margins of just 1% to 4%, and the point of payment eats their profits away. So why would merchants agree to such a deal? The answer is they essentially have no choice. By choosing not to carry these credit card networks, merchants could see a huge drop in sales.

In the near-term, there are opportunities and threats for Visa. A rebound in consumer travel could see Visa boost its fees from cross-border transactions. But, Visa also profits from overall card usage. A recession could hit Visa’s revenues.

What Lurks In The Shadows

The world of payments is constantly changing. When Apple Pay was introduced in 2014, the world was introduced to touch-less smartphone payments. Of course, Visa participates in this world, but the smartphone has opened the playing field for disruptive innovation. With 50% profit margins and a market cap over $400 billion, Visa has a huge target on its back. Apple is now rolling out its pay-later service. Google and Meta are entering the space as well, leveraging billions of users. Could Apple Pay, Google Pay, or WhatsApp Pay displace Visa in the future? With time, anything is possible. This just compounds on the wave of FinTech start-ups that raised capital in 2020 and 2021. Along with old competitors PayPal (PYPL) and Block Inc (SQ).

Visa bulls reference the trend of emerging markets (EM) moving to non-cash payments, but this trend may not live up to expectations for Visa. In China, Alipay and WeChat Pay dominate non-cash payments. The Chinese government is also implementing the use of a new digital form of cash, that can be easily exchanged. At the same time, Paytm has established a dominant position India. Many EM consumers favor local FinTech apps over Visa and Mastercard (MA). The merchants dislike credit cards even more. We’ve personally witnessed retailers in Asia and South America offering discounts to customers who pay with cash, rather than credit.

Layered in are regulatory and geopolitical risks. Visa and Mastercard face large lawsuits from time to time. Governments can also take their toll on Visa with antitrust efforts. Geopolitically, Visa pulled its business from Russia, which is expected to hit revenue to the tune of $1.2 billion.

Consensus Versus Reality

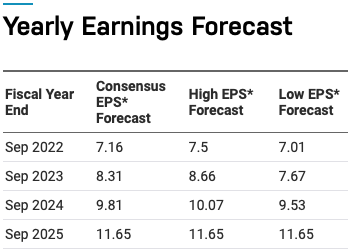

Expert consensus appears to be betting on a rebound in Visa’s cross border transactions as travel resumes. The problem is, international transactions make up only a 3rd of Visa’s net revenue. If international transactions returned to 2019 levels, it would increase Visa’s overall revenue by just 5.3%. Meanwhile, analysts expect Visa to grow EPS at 17.6% per annum over the next three years:

Visa EPS Estimates (Nasdaq)

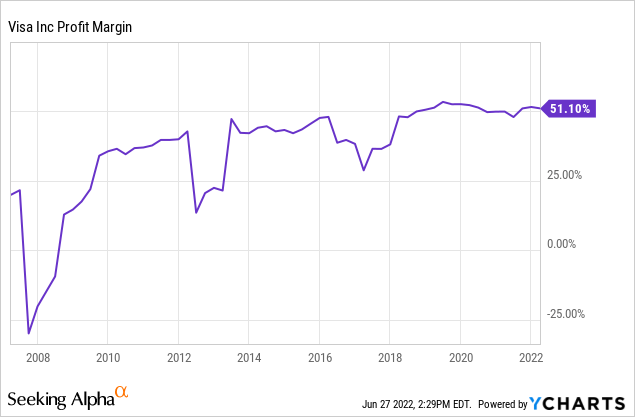

Despite a booming economy in 2021, Visa has grown earnings per share at just 8.2% per annum over the past three years. Revenue grew even slower, at 5.4%. Why is this happening? We believe Visa’s business is beginning to peak. It seems profit margins have topped out at 50%:

The company is losing market share globally:

Market Share By Transaction Volume (Statista)

Growth in credit card payments also seems to be slowing; the global market is forecast to grow at just 7.8% per annum over the next five years.

If we combine margins, market share, and market growth, we get a pretty bleak picture for Visa’s earnings going forward. Mix in the external threats the company faces, and there’s a lot of risk.

On the plus side, Visa’s network effect remains in tact. Visa can leverage its network to develop new revenue streams. The business can also leverage its free cash flow to buyback shares and make acquisitions.

The Valuation

Visa pays a forward dividend of just 0.79%, and the company has been propping up its stock by repurchasing shares above 40x earnings. Paying such a high multiple for repurchases is an ineffective policy because its effect on shares outstanding is minimal. This has drained Visa of its working capital, which should have been used to strengthen the company’s competitive position in a rapidly changing world.

Our 2032 price target for Visa is $252 per share, implying a return of just 3% per annum.

- We estimate Visa can grow earnings at 8.5% per annum, resulting in 2032 earnings of $14.38 per share. We’ve applied a terminal multiple of 17.5x earnings for a business that appears to be at the peak of its power. The company’s growth runway shrinks with each passing year. It is hard to imagine Visa not maintaining its favorable economics and network effects. But, we worry the company will not keep pace with a quickly changing world. The loyalty of Visa’s stakeholders could prove thinner than expected. If disruptive innovation enters, consumers, governments, and merchants may not hesitate to make Visa a product of the past.

Conclusion

Visa has a strong global network, but its growth is slowing, and new entrants are beginning to flood in. With disruptive innovators lurking in the shadows, now may be the time to sell. Unhappy merchants could be another Achilles’ heel for Visa, and its stakeholders may not be as loyal as perceived. With emerging market consumers already moving to FinTech, Alipay and WeChat Pay have laid a blueprint for future disruption. We project a return of just 3% per annum over the decade ahead. This estimate signals a dangerous risk/reward. We have a “sell” rating on the shares.

An Alternative For Investors

We believe traditional financials (Insurance and Banks) will benefit from higher interest rates, and see their multiples expand rather than contract. Our return estimates hover around 11% per annum for this category.

For more on this, check out my articles:

Be the first to comment