Justin Sullivan

Visa Inc. (NYSE:V) is one of the companies taking a top spot on my watchlist as it has a great business model and although we are talking about a mature business – Visa was founded in 1958 – the company can still grow with a high pace. In my last article about Visa, I already argued that the stock is getting closer to its intrinsic value and at the time of writing, the stock is trading about 9% lower than when my last article was published.

In the following article, we will look at the recent quarterly results, look at the impact a potential recession might have and provide an updated intrinsic value calculation.

Quarterly Results

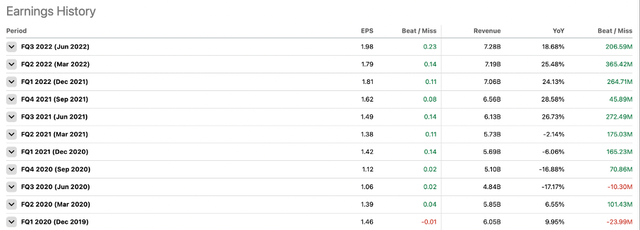

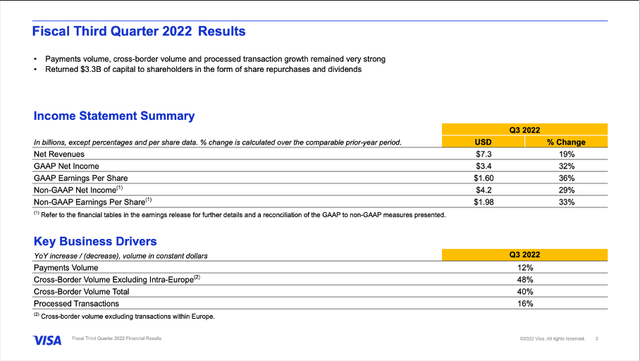

Last week, Visa reported third quarter results and the company beat revenue as well as earnings per share expectations. For Visa it was the eight quarter in a row that the company beat analysts’ estimates for revenue and EPS.

Visa Earnings Estimates Last Few Quarters (Seeking Alpha)

Net revenue increased from $6,130 million in the same quarter last year to $7,275 million this quarter resulting in 18.7% year-over-year growth. And especially “International Transaction Revenues” which increased 51% YoY contributed to top line growth. While operating income increased only slightly from $4,064 million in Q3/21 to $4,148 million in Q3/22 (2.1% YoY growth), diluted earnings per share increased from $1.18 to $1.60 – resulting in 35.6% year-over-year growth. And non-GAAP diluted earnings per share increased 32.9% year-over-year from $1.49 in the same quarter last year to $1.98 this quarter.

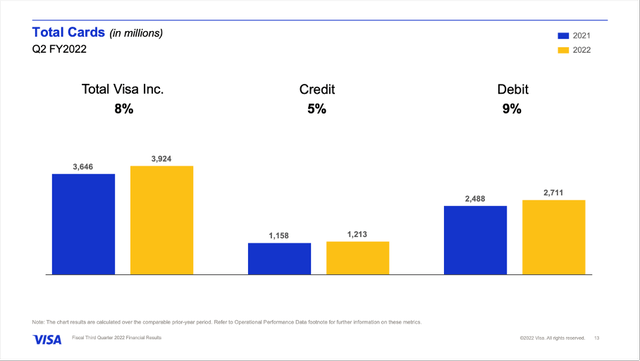

But Visa not only improved the top and bottom line on its income statement, but the number of total cards also increased 7.6% from 3,646 million in the same quarter last year to 3,924 million this quarter. With 7,869 million people living on this planet more than half of the population of the earth have a Visa card (in theory). The total payments volume was $2,939 billion in the last quarter compared to $2,775 billion in the second quarter.

And we should also point out that Visa is clearly above pre-pandemic levels with the U.S. payment volume being 46% above the 2019 level and total payment volume being 136% when indexed to 2019.

Recession

Without any doubt, Visa is performing great and there is hardly a sign of slowdown right now. Nevertheless, the risk of a looming recession was one of the topics discussed during the earnings call and the CEO made the following reassuring statement:

On the first, we’re not economic forecasters, so I’m not going to predict the future or a potential likelihood of a recession. Instead, let’s focus on the facts. From the numbers I just reviewed relative to 2019 levels, growth has been stable or improving in overall domestic payment volume, credit, debit, card present and card backwards and volume.

And this indicates the most of 2022 with no indication of any slowdown including in more recent weeks.

And during the earnings call, when Tien-Tsin Huang from JPMorgan Chase (JPM) pressed on the topic, Al Kelly elaborated a bit more:

Well, thanks, Tien-Tsin. I think we’re a very different company from any past recession, I guess, going back to 2008-2009 time frame. First of all, we’re strong — much stronger in debit, which tends to be the vehicle, the card of choice for people in a slowdown period. We’re stronger in everyday spend categories. We’re stronger in e-commerce. We benefited from this acceleration in cash utilization that happened during the pandemic. Since the last recession, we’ve added Europe, which is a very important part of the company today and contributes to our growth.

And then as you alluded to, we’ve added an emphasis on value-added services and new flows. Some of those value-added services are tied to volume. So the degree that some volumes might go down, those might go down as well. But on the other hand, for volumes that we will have today that we — that will have the opportunity to sell more value-added services than we would have in the prior recession.

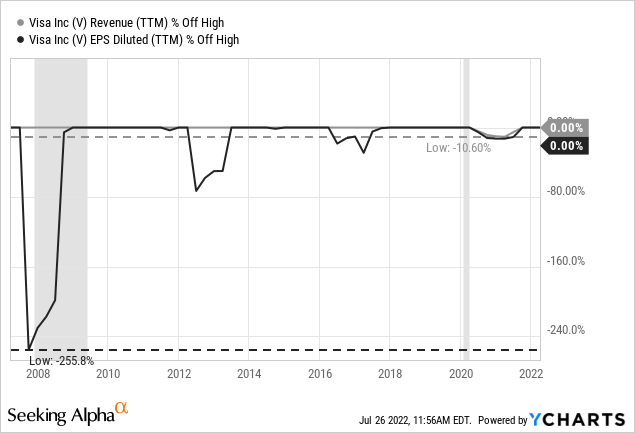

When looking at available results, we have data for two recessions – the last recession in 2020 which was the result of COVID-19 as well as the Great Financial Crisis. And in case of both recessions, we can argue that Visa was impacted by the recession. While revenue did not decline during the Great Financial Crisis, it declined about 10% during the COVID-19 recession. However, we can argue that without lockdowns and travel restrictions the results might have been different. When looking at earnings per share, we also saw a decline around 10% during the last recession, but earnings per share declined extremely steep during the Great Financial Crisis.

I would not go so far to call Visa a recession-proof business, but I would paint a similar picture as the CEO. Visa might be quite resilient in case of a recession, and we should not expect the business to grow in case of an economic slowdown, but we also must not fear steep declines for revenue or earnings per share. Of course, in case of a recession, disposable income will be lower for most people and the payments volume will decline which will lead to a lower revenue for Visa and Mastercard (MA). But if the biggest part of payments volume is stemming from everyday products, the drawdown might be limited.

And while we should not be blind to the risks and acknowledge that a looming recession might not necessarily be visible in quarterly results beforehand, we should also not ignore the positive trends Visa is still seeing in the United States:

We’re seeing positive trends in terms of additional spend and transaction lift in the US. In 2021, the average contactless active debit cardholder had two more transactions and $65 in additional spend each month. We expect this trend to continue, driving incremental payment volumes and transactions for contactless card issuers through faster, simpler POS experiences.

Continuing Growth

While the recession is certainly a risk we must keep in mind, it should not distort the picture of Visa as a company reporting high growth rates. In the last ten years, Visa increased its revenue with a CAGR of 10.13% and earnings per share with a CAGR of 15.88%. And during the last earnings call, management also commented on its initiatives to grow its international business. And especially in Brazil and India, Visa is growing with a high pace:

On the acceptance side, we’ve doubled acceptance points since 2020, reaching more than 10 million merchant locations in Brazil. The results of our efforts over the past 8 to 10 quarters is evident in Brazil’s payment volume, which in the third quarter was more than 200% of 2019, with e-commerce nearing 300%.

In India, our efforts over the last few years are paying off and Q3 payments volume was 184% of 2019, with e-commerce above 300%. Building on that momentum, we had co-brand wins with two of the largest multibillion-dollar revenue Indian conglomerates that collectively represent millions of potential credentials.

And aside from expanding to more and more countries, Visa also renewed contracts (which is important for the business). In China, Visa renewed the partnership with the Industrial and Commercial Bank of China – the largest bank in the world – and in Japan the partnership with Credit Saison was renewed. In the United States, Visa renewed the relationships with Green Dot – one of the top 20 issuer in debt and top 10 issuer in prepaid.

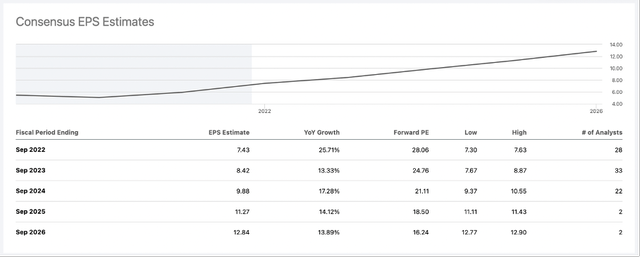

Visa EPS Estimates (Seeking Alpha)

And it is not surprising that analysts are expecting double-digit growth rates in the years to come.

Intrinsic Value Calculation

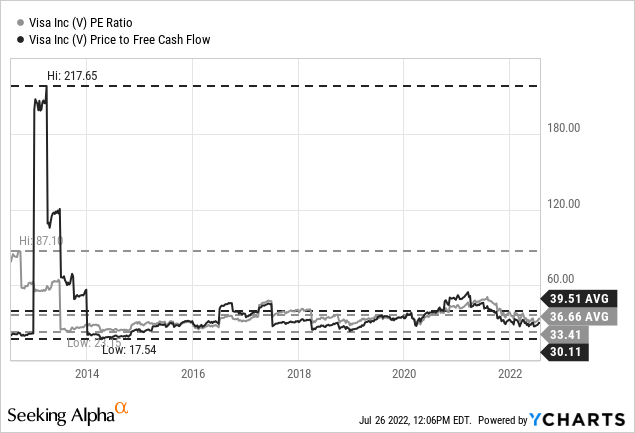

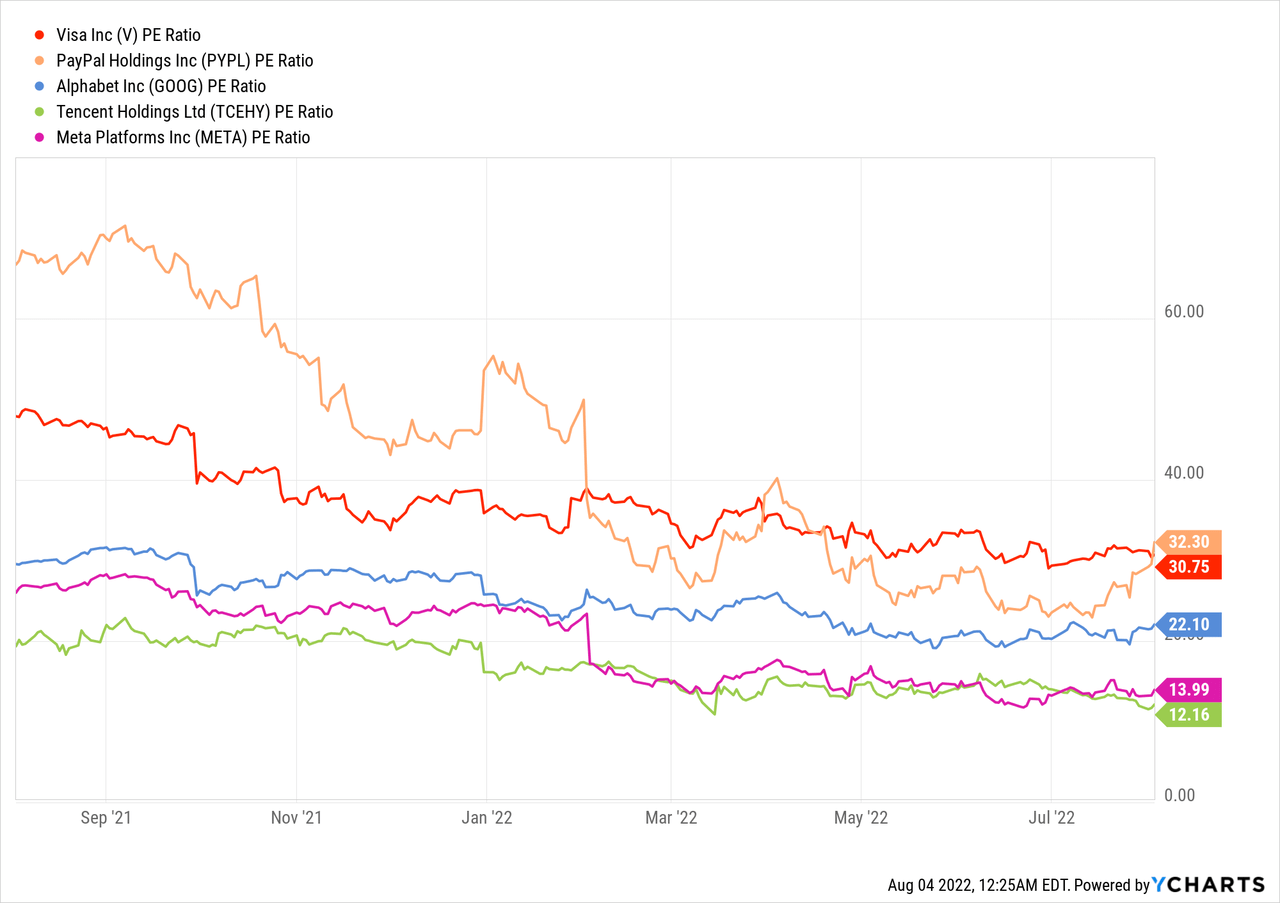

I often wrote in past articles that Visa is a stock that has always been expensive and there were only a few brief periods when Visa was trading for a valuation multiple below 30. Right now, Visa is trading for 33 times earnings as well as 30 times free cash flow. And this is below the 10-year average P/E ratio (which is 36.66) and clearly below the 10-year price-free-cash-flow ratio (which is 39.51). I also have mentioned countless times that I consider a valuation multiple above 30 as rather expensive and I also won’t call Visa cheap, but the stock is definitely trading for one of the more reasonable valuation multiples in the last few years.

In my last article I calculated an intrinsic value of $206 for Visa by using a discount cash flow calculation and argued that Visa is getting close to its intrinsic value. In this article, I would argue that Visa might trade below its intrinsic value and can be bought, but in our intrinsic value calculation we should include negative effects from a recession.

As basis for our calculation, we use the free cash flow of the last four quarters, which was $16,061 million. To be fairly valued right now (using 2,129 million outstanding shares and a 10% discount rate), Visa must grow its free cash flow 8% annually for the next 10 years followed by 6% growth till perpetuity (my usual growth rate for wide moat companies). Using more realistic growth rates, I would assume 10% decline in fiscal 2023 (due to a potential recession) followed by 20% growth in fiscal 2024 (after a recession growth rates are usually high). For the following years I would assume 11% growth again (until the end of the next decade) followed by 6% growth till perpetuity. This leads to an intrinsic value of $235.85 for Visa and makes the stock undervalued.

Multiple Contraction

Visa seems to be undervalued right now. However, we should be a little cautious as we don’t know what the recession will bring and what will happen in the coming quarters. And although we can argue for Visa being slightly undervalued, we must acknowledge that the stock is still trading for a high valuation multiple.

One risk I am seeing is Visa going a similar path as several other high growth companies in the last few quarters. And of course, we saw a slowdown of growth rates for companies like Meta Platforms (META) or Tencent Holdings (OTCPK:TCEHY) and therefore the comparison between Visa and Meta Platforms is not perfect. But at the first signs of growth slowing down for Visa a multiple contraction might seem likely and Visa can easily trade for a much lower stock price than right now.

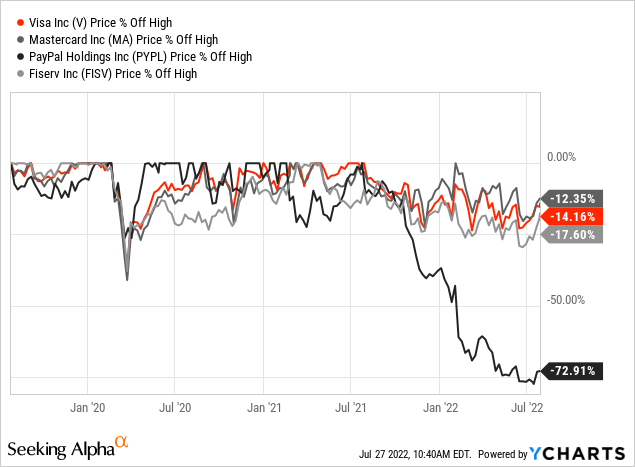

And so far, many payment stocks are keeping up quite well during this challenging market. Not only Visa, but also Mastercard and Fiserv (FISV) are performing quite well. And exception would be PayPal (PYPL), which declined extremely steep, but PayPal was also trading for an extremely high valuation multiple before.

Conclusion

I am still a bit cautious about Visa as the stock is still trading for a rather high valuation multiple and the company must continue growing with a high pace to justify the current valuation multiple. But when forced to make a call about Visa, I would be cautiously bullish at this point and Visa could be a great long-term investment when buying at current prices. On the other hand, I still expect lower prices for the stock in the coming quarters (or years) and the ability to purchase Visa cheaper (but that is only speculation).

Be the first to comment