undefined undefined/iStock via Getty Images

VirTra, Inc. (NASDAQ:VTSI) is an American manufacturer of training simulation systems for global law enforcement agencies and military forces. The company has a history of slow but steady growth that could soon accelerate. Valuation is fair, and the risk of dilution is low. VirTra is a buy at the current $46M enterprise value as there is a realistic pathway for shares to double by the end of 2023.

Business Background

VirTra engages in four main categories of business. They are the sale of simulators and accessories, installation/training, warranty sales, and custom scenario/software development. The initial transaction is the simulator sale which ranges from a cheaper one screen simulator to the flagship five screen 300-degree surround simulator. The simulator price ranges from $150K to $300K. The simulator allows the trainee to run through a variety of intense use of force scenarios that require split second judgment and can branch to different outcomes based on the trainee’s actions. Here is a scenario example from VirTra’s website:

You’re on foot patrol with your partner when you see a subject that you’ve had interactions with before. The two of you decide to speak to the subject, and proceed to walk down the alley to see what he is up to.

As you approach him, he decides to be uncooperative. He doesn’t want to talk to you, he starts to flail his arms and become more aggressive. As your partner attempts to arrest the subject, a white pickup truck suddenly pulls up on the street behind you. The driver immediately gets out and starts shooting, striking the subject and your partner. Your only option is to get off the ‘X’ and return fire in an attempt to stop this subject.

You fire your handgun, and immediately stop the threat. The simulator screens around you tell you to make your weapons safe and to prepare for a debrief. Congratulations, you just completed the “Nightmare Alley” scenario in the VirTra simulator.

In addition to the simulator VirTra sells drop in recoil kits that convert the trainees live firearm into a simulation-ready weapon that has realistic recoil. This enhances realism and makes it so the trainee can go through scenarios with their service firearm. Furthermore, VirTra sells an accessory called Threat-Fire that the instructor can use to shock the trainee with electrical impulses to emulate real world physical consequences. The company’s robust product offering and patented technology have established it as the leader in law enforcement use of force simulation training.

Historical Financial Results and Future Modeling

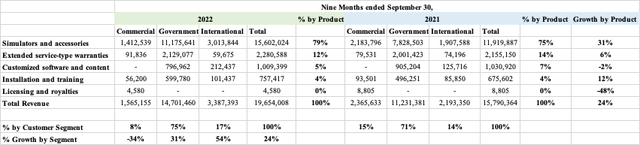

The company reports results across three segments, government (police), commercial (military), and international (non-US). Here are the results and trends over the first 9 months of 2022 and 2021.

Virtra Revenue (Company Reports)

The primary ingredient that drives a growth stock to outperform the market is accelerating revenue growth. VirTra grew revenue at 3.5% in 2019, 2.0% in 2020, 28.0% in 2021 and 24.5% so far in 2022. There are several easy-to-understand reasons why the recent 20%+ growth rate can continue. Let’s start by making an educated guess at 2023 revenue.

VirTra has seen and will continue to see significant growth in ratable revenues, which are recurring by nature with margins greater than 90%. The company’s “STEP” program allows customers to lease simulators instead of purchasing the product upfront. For example, on a $250K simulator sale the company would recognize revenue on a straight-line basis, say $50K/year over five years, instead of all $250K upfront. At the end of five years the client would either renew the lease or return the simulator. CO-CEO Bob Ferris said in a recent interview with StoryTrading that retention rates on these subscriptions are at 95%+. During the first nine months of 2022 VirTra reported $2.1M of STEP revenue and $2.3M of extended Warranty revenue (warranty sales beyond the 1 year manufacturer’s warranty included in the initial sale). As such, it is conservative to estimate that VirTra will enter 2023 with $5M of ratable revenue already accounted for.

Another 2023 revenue tailwind is that VirTra ended Q3 2022 with record backlog of $28.3M. Backlog includes bookings that are signed but can’t be recognized until delivery as well as the total value of extended warranties and STEP agreements. If we estimate that backlog declines to about $25.0M ($8.3M in Q4 revenue and $5.0M in Q4 bookings) by the end of the year, then take out an estimate of $8.0M of warranty and STEP agreements this yields a yet to be delivered backlog of $17M entering 2023. This is a conservative estimate in terms of high Q4 revenue, low Q4 bookings, and multi-year STEP/warranty assumptions. The company has not highlighted any supply chain issues or customer behavior that would push delivery or shipment of this equipment out more than a year. Additionally, it’s safe to assume $2.4M in revenue from services and custom content/software. This is the midpoint of 2020 and 2021 results, so there is no growth assumption even though the number of customers and units in the field keeps growing every year. Adding it up, $5M of ratable revenue, plus $17M of already signed product revenue, plus $2.4M of software and services revenue means the company is entering 2023 with visibility to $24.4M of revenue without signing a single deal. If you assume that VirTra can only convert one third of 2023 bookings to revenue (2021 bookings were $32.9M and 2022 bookings will be $31.6M if they book $5M in Q4, so $30M+ in 2023 bookings seems reasonable) then 2023 revenue can easily be $35M.

Let’s review why this revenue target is conservative. The $5M of STEP/warranty revenue is already guaranteed. The $17M of product backlog available to be converted to revenue is largely already booked. The $2.4M from services and software assumes no meaningful growth. Remaining revenue is less than 1/3 of likely FY 2023 bookings despite Co-CEO John Givens saying on the most recent conference call that the time required to assemble a customer order is down to 45 days. Even with conservative assumptions revenue growth should be 25%+ in 2023.

A secondary ingredient that helps premier growth stocks outperform the market is improving profitability. VirTra should show meaningful profitability improvement in 2023. In the StoryTrading interview referenced above Co-CEO Bob Ferris mentioned that analysts should view the VirTra gross margin profile as 50% – 60%. Assuming 2023 gross margins of 55% that yields 2023 gross profit of $19.25M, based on $35M in revenue. Estimating operating expense is tricky. Operating expense in Q3 2022 was $3.6M and for the nine months ended 9/30 2022 operating expense was $10.3M. It’s important to understand that this period included moving into a bigger building in Arizona, the opening of a 9,000 square foot facility in Orlando, the creation of a one-of-a-kind volumetric design studio, and a poorly handled ERP implementation. Also, in the Q2 2022 conference call management shared that on August 16th the company reduced headcount by 10%. Due to the headcount reduction and since many of these items won’t be repeating in 2023, it’s reasonable to estimate operating expense at $16.0M for the year. If the company can deliver ~3.25M of profit on 10.9M diluted shares outstanding, earnings per share could be in the $0.30/share range.

It’s wise to sanity check this profitability expectation. The first sanity check is that 2021 net income was $2.5M, so the company has achieved solid profitability with much less revenue in the past. Additionally, VirTra recently awarded share grants to Co-CEO John Givens and the vesting schedule provides a window into the company’s view on profitability. Schedule 1 in Mr. Given’s RSU agreement shows that over 12-month periods ending in June of 2022, 2023, and 2024 zero shares vest if the company does not show a net profit of $2.5M, $3.0M, and $3.5M. For each additional $500K of net profit up to $7M, $9M and $11M an additional ~7,000 shares vest. Basic P&L forecasting, historical company performance, and executive compensation plans all suggest that $3.25M of GAAP net income in 2023 is realistically achievable.

Valuation

What is a 25% top-line growth microcap, with 55% gross margins, that’s delivering $0.30/share in EPS worth in this market environment? At the time of this writing P/E multiples range from 19.65 for the S&P 500 to 85.96 for the Russell 2000. As such, it’s conservative to ballpark a 2023 EPS multiple of 20 – 30 which would yield a price of $6.00 – $9.00 dollars per share, almost double the current price at the high end of the range.

Background to be Aware of

VirTra is serious about entering the military market, which could prove transformative for the company. In May of 2022 VirTra appointed John Givens Co-CEO. Mr. Givens is a known commodity in the military simulation market where he founded a company called Bohemia Interactive Simulations that he sold to BAE Systems for $200M in 2022. The hire is showing signs of paying off. In 2021 VirTra reported $3.2M of commercial revenue, 145% growth over 2020, due to a strategic contract win. Margins on the contract were poor as management referred to it as “paid R&D” that would demonstrate capabilities and build a track record with military customers. Management confirmed that margins on military contracts going forward will be more in line with the value VirTra provides. There has been little progress made on the military front in 2022 as the company focused on building out a 9,000 square foot physical presence in Orlando, the epicenter of military simulation. The facility opened in October with an open house that was well attended by military members, acquisition leadership, government program managers, law enforcement, prime contractors, and government officials. On the most recent conference call management specified 2024 as the year the expect concrete traction in the military market. Speculation is rampant that VirTra is involved with the Microsoft (MSFT) led IVAS and/or the SIVT soldier training initiatives. Any confirmation of this speculation, or of a significant military win in 2023 could send the shares skyrocketing overnight.

VirTra recently announced the creation of a volumetric video studio it calls “V-3”. The studio combines the advantages of high-definition video and 3D characters coupled with the ability to affordably build a comprehensive library of training content suitable for screen-based or headset-based platforms. Management confirmed in the press release that 90% of the related spending was complete as of the end of Q2 2022. The studio is fully operational and has the potential to supercharge high margin software revenue as the company creates new scenarios and sells them to existing customers.

VirTra recently botched an implementation of the ERP system Epicor resulting in filing delays of 10-Qs and a 10-K. The Chief Accounting Officer promptly left the company, and the business hired a new CFO who did not last 60 days. Since then, the company has hired a new CFO who started recently. Co-CEO John Givens stated on a recent conference call that all filings will be on time going forward. At no point were there any restatements of prior period financial statements or metrics.

Summary

At the current price of $4.60/share VirTra is a low-risk high-reward equity that could double over the course of 2023. Investors have high visibility to strong revenue growth and profitability potential and valuation is fair. Microcap stocks are inherently risky, but this one is worth a gamble.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment