wilpunt/E+ via Getty Images

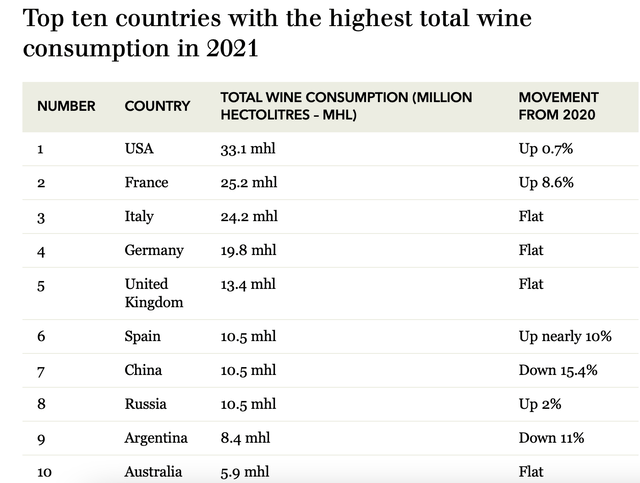

While European countries like Portugal, France and Italy drink more wine per person, the US might not be far behind. It leads total wine consumption in the world, leaving the likes of France and Italy behind already. Moreover, wine sales are growing fast in the country. In 2021, they’re estimated to have risen by almost 17%, a far cry from earlier warnings that consumption might in fact have declined during the year. Some of this could be the post-pandemic effect as the hospitality business took off after the lockdowns were eased. Still, it’s worth noting that even in 2020, the year that saw the worst of the pandemic, sales of wine to the US were flat. To put this in context, they weren’t down like the 3% decline seen in global consumption.

Yet, the share price of the US-based wine producer Vintage Wine Estates (NASDAQ:VWE) has fallen to 30% of its price when it went public in 2021. And while the S&P 500 (SP500) is up 6% over the past month, and many stocks I’ve covered recently have seen much bigger gains, VWE hasn’t quite joined the party. It’s up by 3.5% only. Year-to-date, it’s still down by a massive 75%. This of course raises the obvious question – is it a potential high-growth stock that just happens to be trading at a discount? Or is there more to the story that’s keeping investors at bay?

Source: https://www.therealreview.com/2022/08/04/top-ten-wine-consumers/

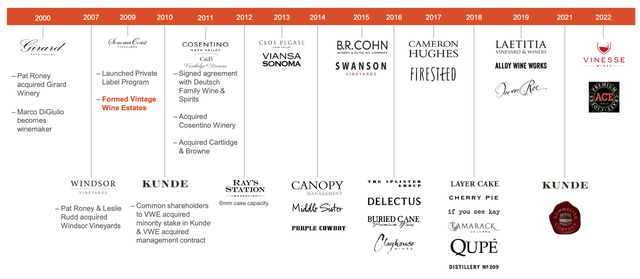

Growth through acquisitions

There’s no denying that Vintage Wine Estates is growing fast. In FY22 (ending June 30, 2022) its revenues grew by 33% and they have grown at an even faster clip in Q1 FY23 (July-September, 2022) by 40%. This was largely driven by acquisitions, though. For FY22, its growth without acquisitions would have been a relatively smaller 19% and for Q1 FY 23, its organic revenue rise was to the tune of 13%.

Inorganic growth has long been the company’s favoured strategy. It has acquired numerous wineries over the years, including Close Pegase in Napa Valley in California, Kunde in Sonoma County and Laetitia in central California. It now offers 60 wines and spirits with prices that suit all budgets, ranging from $10 to $150 a bottle. This route to growth seems to be working for the company, which has reported double-digit revenue growth in three of the last five years.

Acquisitions by Vintage Wine Estates (Source: Vintage Wine Estates)

Its CAGR of ~9% over the past five years isn’t too bad either, though it’s worth noting that in FY19 its revenues shrank and grew by just 3.35% in FY20. There aren’t details available for what exactly when down in FY19, since its result statements are available only from 2021 onwards. FY20 was probably impacted by the pandemic, though considering that its year ends in June, that would have been just one-quarter of the lockdown impact.

Earnings impacted by inflation

Its profits, however, leave much to be desired. The company focuses on adjusted EBITDA, which to be fair grew by a strong 21.4% in FY22. However, for both the final quarter of its last financial year and the first quarter of the current one, the number has shrunk by 34% and 52% year-on-year respectively.

VWE attributes this to rising inflation and supply chain challenges, which is understandable considering that prices have risen at rates not seen in decades recently. It does, however, also mean that it might not be able to grow its adjusted EBITDA for at least the numbers for the next couple of quarters considering that inflation is still pretty high, even though it has started cooling off slightly in the US now. The company’s EBIT and net earnings have been inconsistent over the years too.

Outlook doesn’t inspire confidence

Looking forward, VWE is optimistic about its adjusted EBITDA, though. Its outlook puts projections at between $50-60 million for FY23. This is a rise from the $46.8 million for FY22, but I’d take it with a pinch of salt. Up to the third quarter of FY22, the company had expected the number to come in between $62-64 million, which means that the actual was an almost 26% miss.

It was able to predict its revenue better, which came in at $293.8 million, which was within the target range. But here’s the rub. For FY23, it expects the revenue figure to be at $300-310 million. Considering the average of $305 million, this is only a 3.8% growth for the year. In other words, it expects growth to slow down significantly compared to where it’s been in the first quarter. In sum then, there’s reason to be cautious about VWE’s foreseeable future.

Market multiples show limited upside

Coming to its multiples, since the company’s loss-making on a net basis at present and is essentially growth focused, so the market multiple I focus on here is price-to-sales (P/S). VWE is favorably priced with a P/S of 0.6x, which is half of the average for the consumer staples sector. Its forward P/S is even lower by comparison at around 0.5x compared to the sector average of 2.6x.

However, compared to other wine companies, its valuation sits somewhere in the middle. It looks undervalued compared with other wine producers like the Napa-based Crimson Wine Group (OTCQB:CWGL) and Canadian Corby Spirit and Wine (OTCPK:CBYDF) at 1.9x and 3x respectively. However, companies like the US-based Winc (WBEV) and Eastside Distilling (EAST) have a lower P/S than VWE at 0.06x and 0.3x, respectively.

It’s difficult to argue a case for an upside on VWE’s price considering that at least one of the companies, Corby Spirit and Wine, has more stable financial metrics. When seen in conjunction with its muted revenue guidance and last year’s adjusted EBITDA miss, it’s even harder.

What next?

VWE’s high recent growth rates are undeniably attractive. It has a history of acquisitions, which are clearly going more in its favor than not. However, high inflation has taken a toll on its earnings. Its adjusted EBITDA has shrunk for the past two quarters compared to the same quarter the year before. As prices continue to remain elevated there could be more disappointment in store.

The company’s revenue outlook isn’t encouraging either. It clearly expects growth to slow down significantly over the remainder of the year. Considering that its P/S already sits somewhere in the middle compared to peers, there’s already little upside indicated. I’d wait and watch how the situation evolves over the course of the year before uncorking the bubbly on this one just yet.

Be the first to comment