cifotart/iStock Editorial via Getty Images

Published on the Value Lab 25/3/2022

We’ve all more or less seen Vimeo Inc. (NASDAQ:VMEO) before, perhaps thinking it’s some alternative to YouTube. That’s definitely not Vimeo’s plan, and the change in their strategy from providing video hosting and a storage based model to a seat based model, much more in line with what larger customers would expect, is the beginning step in arriving at a much larger addressable market. Transitioning to offering video library services for the video media needs of larger companies, offering something better than shared drives and a less organized platform for keeping track of video content files, and moving away from a small-fish model could really change Vimeo’s growth profile. They are very early in this transition, so with the multiple at 5x as it is, the company comes across as interesting. With a negative and transitory outlook having put Vimeo into the ‘forget bin’, investors should look into this opportunity.

A Word on Vimeo’s FY 2021 and Outlook

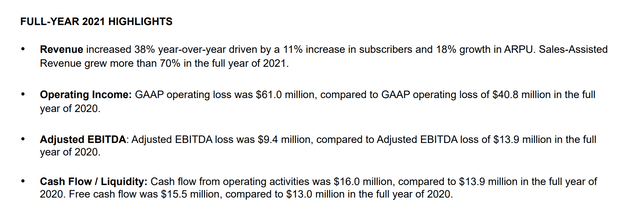

Vimeo is still achieving growth, benefiting both from an increase in subscribers, but also early work to grow ARPUs by focusing more on enterprise and more on larger accounts with sales-assisted revenue growth.

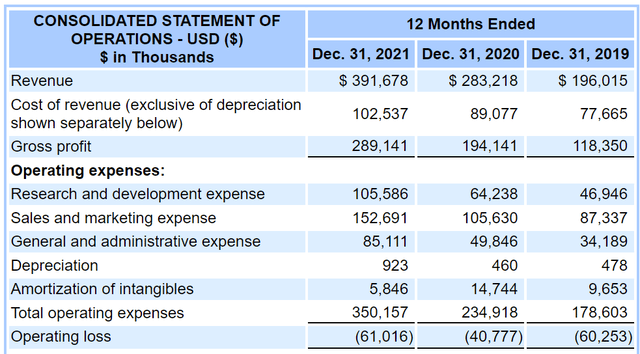

In terms of operating losses, the margin has narrowed from 2019, with sales substantially higher and loss levels the same.

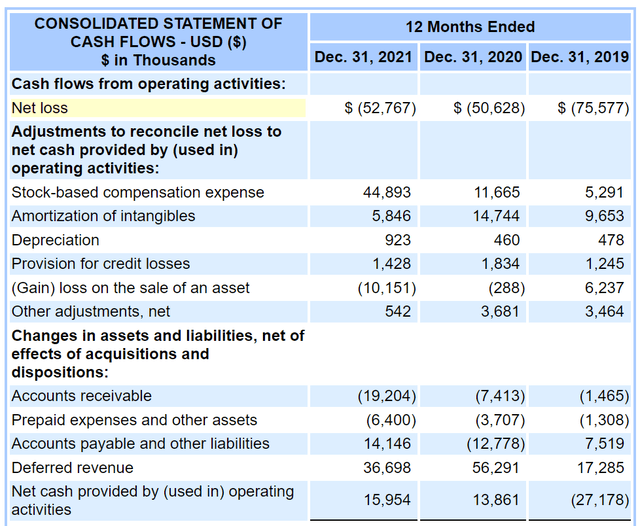

Excluding the effects of stock-based compensation, the company is at a stage where it is not burning cash. Stock-based compensation is of course a relevant factor, but it is quite normal and is not connected to a weaker fundamental performance, as the typical venture cash burn would indicate.

The outlook isn’t great however. With 38% being the FY revenue growth, thanks to both increased subscriber numbers and work to increase ARPUs with customers, headwinds in the SMB segment, which dominates the Vimeo business mix and small-market appeal for now, is going to be a problem for subscriber numbers. Gross margin outlooks are the same at around 75% due to hosting costs being more or less the same, but the revenue is forecast to grow a littler short of the 20% mark. This growth is going to come from growing tickets on larger customers and growing sales assisted revenue in the mix offsetting declines in the revenue coming from previously typical, small-time, ~$100 a month Vimeo subscribers.

The ARPU Opportunity

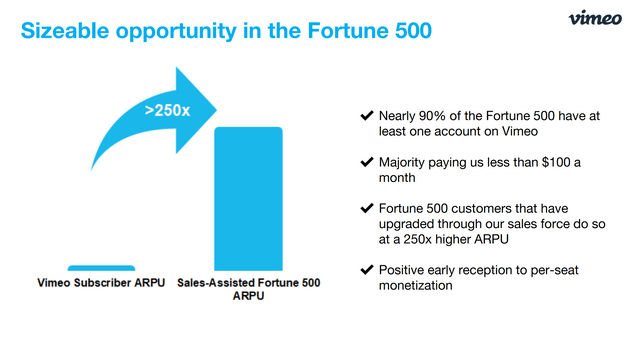

The scoop that the management is focusing on is the fact that there are massive companies out there that are using a simpler suite of Vimeo services, tailored for small businesses, and therefore only paying a retail priced subscription per month for the services. There are multi-million dollar companies paying a hundred bucks a month for Vimeo.

Upselling Opportunity (Q4 2021 Supplements)

The idea is that these clients can be upsold at a rate of 250x into an enterprise product that better deals with enterprise video needs, and can be charged on a per-seat basis rather than a hosting burden basis. This is the way customers of large sizes are typically paying for these kinds of services, and this also means that the economics of larger customers becomes really great for Vimeo. They are having some success in selling Fortune 500 companies.

We’re seeing examples where you have a Fortune 1000 company that wants to have several thousand employees contributing content to a Video Library. Well, in our old model, that would have been a $35,000 deal. But now with the sort of approach of here’s all the things that you can do very easily and then we’ll charge per seat with those thousands of employees, that becomes a 6-figure deal.

These economics will keep becoming realized as the sales assisted revenue, which is revenue coming from large customers that had to be walked through the set up process in a more concierge way, grows in the mix.

We are especially pleased to note that the sales assisted now represents more than 30% of the revenue in the quarter, up from mid-20s a year ago

Narayan Menon, CFO of Vimeo

This should eventually become the vast majority of the focus for Vimeo’s business.

Thoughts on Vimeo’s Outlook

Vimeo currently trades at a $2 billion market cap, with annual sales around $400 million for FY 2021. Major hits to smaller customers, who were still growing in numbers in 2021, is going to be a negative vector in the traditional business, including the explicit deprecation of the Magisto consumer facing business. But growth in sales assisted is what will keep the overall revenue growth around the 18% level. Moreover, growth of previous years’ levels cannot be sustained by further severity of remote events and interaction with digital media in the corporate sphere.

Fate and fitness verticals. We also talked about live streaming as a use case where we saw a big spike up in demand. It’s coming down.

Anjali Sud, CEO

The growth in sales assisted revenues in the last couple of quarters has done a lot for gross margins. They went for 68% in 2020 to 75% in 2021. With a further increase of sales assisted revenue in the mix to be expected for 2022, we would also expect gross margin improvement, but the outlook guided to flat gross margins for the following reasons, which we can believe due to hosting costs being a relevant portion of the COGS.

On gross margins, we will continue our infrastructure optimization efforts to drive cost savings, but we also plan to reinvest those savings strategically in areas that drive future differentiation in video quality and video insights at scale. So we don’t expect gross margins to grow materially in 2022.

Narayan Menon, CFO

Risk Factors from 10-K (SEC.gov)

Conclusion

As the development of the enterprise suite continues, a downward vector on margins due to development costs and HD streaming affecting gross margins, together with an increase in sales assisted revenue, a positive vector on margins due to higher ticket sales from upselling efforts, we expect spring-loading of margin expansion as the business matures into this enterprise transition. The outlook checks out as we opined above, and gives a view into the sort of economics Vimeo will be subject to as that shift is being made, with better price and recovered volume driven sales growth coming later as well as gross margin expansion and operating leverage due to the upselling.

As far as valuation goes, if it can keep up even the guided-for growth levels and offer the possibility of turning the Vimeo suite into an enterprise solution, a 5x multiple on sales, which is quite low for a pre-profit and high growth VC style exposure, seems pretty reasonable given the possible ARPU growth and consequent improvements in economics. The multiple being too low might not be too good to be true, especially with the story being a bit confounding and the relatively recent May 2021 listing justifying the lack of price discovery. Continuous focus on future initiatives and transformations tends to wear on investors, hence the longstanding decline in stock prices, so as a ‘forget bin’ pick with spring-loading for a ~2024 delivery of profits and better growth as the ARPU opportunity becomes better realized, we are pretty interested in Vimeo.

Be the first to comment