Luis Alvarez/DigitalVision via Getty Images

Village Super Market (NASDAQ:VLGEA) is a small-cap grocery store located in New Jersey, New York, Pennsylvania, and Maryland. Village operates 37 grocery stores under three different brands including Shoprite, Fairway, and Gourmet Garage. Village is a member of Wakefern which is the largest food cooperative in the United States. Wakefern is Village’s largest supplier and Village is one of Wakeferns largest shareholders. Village Super Market is trading at one of the lowest price to sales ratios or P/S Ratio in the grocery sector and the lowest P/S ratio Village has traded for in the past decade. This low valuation is most likely caused by the trend in Village’s profitability. For Village, I see a number of catalysts that could reverse this trend and lead to a far higher stock price more comparable to their peers.

Low Valuation

Village Super Market trades at the lowest price to sales ratio in the grocery store sector. The main reason for Village’s undervaluation was profitability. Village’s Free cash flow margin or FCF margin was .84% in 2021. This compares unfavorably to peers. The average FCF margin for peers was 2.9%.

|

Price to Sales Ratio Compared to Current Free Cash Flow Margin |

||

|

Company |

Price to Sales Ratio |

FCF Margin |

|

Albertsons (ACI) |

.23 |

3.26% |

|

Ahold Delhaize (OTCQX:ADRNY) |

.42 |

2.94% |

|

Ingles Market (IMKTA) |

.36 |

3.32% |

|

Kroger (KR) |

.27 |

2.98% |

|

Natural Grocers (NGVC) |

.39 |

2.42% |

|

Sprouts (SFM) |

.54 |

4.95% |

|

Village Super Market |

.16 |

0.84% |

|

Weis Supermarkets (WMK) |

.40 |

3.57% |

|

Walmart (WMT) |

.68 |

4.62% |

|

BJ’s Wholesale Club (BJ) |

.57 |

4.05% |

|

Grocery Outlet (GO) |

.83 |

1.80% |

|

Average |

.50 |

3.16% |

Source: Table created by the author with data collected from company 10-K’s

This decreasing price to sales ratio on a historical basis is directly correlated to Village’s operating income margin slowly falling from close to 4% in 2012 to 1.43% in 2021. A number of factors were to blame however these factors should be viewed as transitory. Net Income margin for Village first quarter of fiscal 2022 was 1.48% which is a large jump from the previous year’s Q1 which was .69%. This jump was mainly due to lower operating and administrative expenses as a percent of sales.

|

Village Super Market Historical Valuation |

||||||||||

|

Year |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

2013 |

2012 |

|

P/S |

.16 |

.17 |

.21 |

.21 |

.21 |

.23 |

.22 |

.21 |

.29 |

.27 |

|

OPM |

1.43 |

1.68 |

2.16 |

2.07 |

2.54 |

2.71 |

2.75 |

1.96 |

2.99 |

3.91 |

Source: Table created by the author with data collected from company 10-K’s

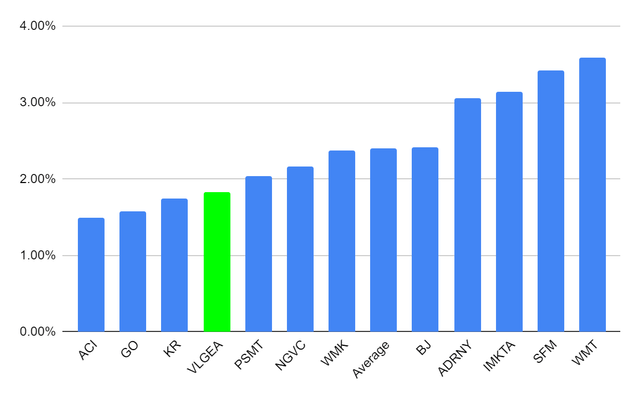

Village’s profit margin improved from 2021 but Village’s margin is still low compared to the industry. Looking at the three-year average FCF margin, Village clocked in at 1.8%. This is far higher than 2021 which further shows the abnormal nature of 2021. Nevertheless, this is still lower than the industry. Peers three-year average FCF margin was 2.4%. Grocery stores operate on razor-thin margins so each tenth of a percent means a lot. Village doesn’t have to be stuck with such low margins as there are a number of levers they can pull such as increasing private label sales, merely growing the company, reducing labor, and buying real estate.

3 YR average FCF Margin (Author Created. Data from 10-K’s)

Increasing Profitability

The main levers I see Village being able to pull to increase their below-average profitability are private label sales, merely growing the company, reducing labor, and buying real estate.

Private Label

Private label brands have higher margins for the grocery store than selling other products. These products also tend to be cheaper for the consumer so it’s a win-win for both parties. Village store-branded products were 12.4% of sales. This is quite low compared to peers. In 2019 Shoprite launched two new private label brands called Bowl & Basket and Paper Bird. Shoprite expects to add 3500 new products to store shelves.

|

Private Label Sales as a Percent of Total Sales |

|

|

Village |

12.4% |

|

Ahold Delhaize |

30.1% |

|

Sprouts |

16% |

|

Albertsons |

20% |

Source: Table created by the author with data collected from company 10-K’s

Growing

Another path to increasing profitability is store expansion. This increases profitability because Village will be able to spread admin costs to more stores. Village has one of the worst admin costs to sales ratios at 24.57% of sales. This is probably Village’s single biggest contributor to decreasing margins over the past decade as mentioned above. This is mostly due to having only 37 stores. The closest peers such as Weis Supermarkets and Ingles Supermarkets have admin costs to sales ratios of 20.6% and 19.3%. Both Weis and Ingles can achieve this because they have close to 200 stores. This represents close to a 4% spread. Since 2010 Village has been increasing store count by a 3.8% CAGR. However, this growth has been lumpy as it’s been mostly through acquisition. In 2019 Village acquired Gourmet Garage and in 2022 they’ll be adding a Gourmet Garage organically. Over time growth in store, count should lead to decreasing admin costs to sales ratio.

Reducing Labor

Most grocery chains have been experimenting with fully autonomous stores such as Ahold, Casino Group, and Aeon Group. These experiments make sense as reducing that frontend labor could lift gross margins which should trickle down to either higher profit margins or more competitive pricing for consumers. Gourmet Garage seems to be Village’s attempt to go into the future. Recently Village eliminated cashiers from their Gourmet Garage stores and now only have self-checkout machines. As Village only has three stores under the banner this seems like an ideal testing ground.

As mentioned above, Village plans to open a fourth Gourmet Garage in 2022 so the experiment seems to be going well. Wakefern which is the food cooperative that Village is a part of also has its own stores and is testing out Trigo’s AI-based frictionless checkout technology. This would give them fully autonomous stores. Village as a member of Wakefern may be able to learn from Wakefern and piggyback off this technology.

Real Estate

The final way I see Village increasing their profit margin is by acquiring the remainder of their stores. Village owns 6 of its 37 grocery stores. The remainder are on long-term lease contracts. Those lease contracts in 2021 ate up 1.8% of revenue or 2 times Village’s profit margin in 2021. Management is already on top of it as in their 2021 annual report they announced their intent to purchase the Galloway store shopping center. This would mark their second property purchase in the last decade. Village not only will eliminate the lease payments when purchasing their properties but may also be able to sublease the properties to generate additional income thus increasing margins.

Risks

Every investment has their risks and Village is no exception. The three largest areas are competition, value trap, and sustainability of current sales due to COVID.

Competition

Between the years 2017-2019, same-store sales growth was anemic for Village due to competition opening up stores in close proximity to Village. If competition continues to build more stores next to Village this would obviously be a negative. Another area of worry is the threat of online and autonomous stores. Village as well as most other grocery stores employ a number of workers covered under union contracts. This may hamper them in adopting fully autonomous stores as quickly as a new entrant – and more specifically, Amazon (NASDAQ:AMZN). That could allow Amazon to gain such a large lead to where there’s no way to compete.

I’m comforted by the fact that Village has already instituted all self-checkout in their Gourmet Garage store. For the competition, the last worry is online grocery shopping as competitors may develop better services. Village doesn’t disclose online grocery sales as a percent of total sales. However, online grocery store sales increased 68% in fiscal 2021 compared to fiscal 2020 and 219% on a two-year stacked basis. So that’s somewhat comforting.

Value Trap

The stock price for Village has gone nowhere for a decade. This has followed Village’s loss in operating income margin which peaked in 2011. This loss in operating income was caused by a rise in admin expenses which has remained elevated since 2014. For whatever reason management has not been able to correct the issue. Even though I see a number of ways margin could expand there is a chance that none of what I discuss gets implemented and Village continues going nowhere. This is however reflected in the stock price which is basically pricing in no improvement in profitability.

Current Sales Sustainability

COVID benefited the grocery store sector greatly as most grocery stores saw large increases in same-store sales due to their primary competitor i.e. restaurants being shut down for a whole year. This raises the question of whether or not their sales have risen to unsustainable levels. For Village, I think this is unlikely so far. In fiscal year 2021 they have seen same-store sales growth of 2.8%. and in the most recent quarter ending October 31 2021, they saw store-sales growth of 2.3%.

Not to mention that Village was actually hurt by COVID as a number of their stores based in Manhattan were negatively impacted by the mass exodus of people. The people who fled have slowly started to come back, starting in July 2021. Omicron most likely would have reversed that trend, but the main point is that post-COVID Village will actually benefit with people returning to New York City compared to competitors who will likely see large declines in same-store sales. Given that tailwind and the increasing growth over last year, I’m confident that current sales per store are more sustainable than other grocery stores.

Expected Return

|

10 Yr Expected Return |

|||||

|

Worst Case |

Base Case |

Best Case |

|||

|

Current Sales per Share |

$139 |

Current Sales per Share |

$139 |

Current Sales per Share |

$139 |

|

Same Store Sales 10 YR CAGR |

-2% |

Same Store Sales 10 YR CAGR |

2% |

Same Store Sales 10 YR CAGR |

2% |

|

Store Growth |

0% |

Store Growth |

2% |

Store Growth |

4% |

|

Sales Per Share 10YR Projection |

$113 |

Sales Per Share 10YR Projection |

$205 |

Sales Per Share 10YR Projection |

$248 |

|

FCF Margin |

1% |

FCF Margin |

2% |

FCF Margin |

2.5% |

|

P/S |

.08 |

P/S |

.28 |

P/S |

.35 |

|

10 Yr Price Target |

$9.04 |

10 Yr Price Target |

$57.4 |

10 Yr Price Target |

$86.8 |

|

Dividend Yield |

4.5% |

Dividend Yield |

4.5% |

Dividend Yield |

4.5% |

|

Expected Return CAGR |

-4% |

Expected Return CAGR |

14% |

Expected Return CAGR |

19% |

|

Market Cap |

130M |

Market Cap |

828M |

Market Cap |

1.25B |

Worst Case

In the worst-case scenario, I assumed competition continually opening new stores by Village’s current store base slowly bleeding Village’s revenue. On top of that, I assume Village does not open a single new store, which goes against history, as Village grew store count by 11 stores in the previous decade. Next, margins for Village stay at their current level with no improvement. If these things were to happen naturally a declining valuation would ensue, which I place as a .08 P/S ratio. This scenario could be too bearish as none of the grocery stores in the peer set experienced more than a couple of years with negative same-store sales in the past decade.

Base Case

In the base case scenario, I assume Village can continue a similar same-store growth that they achieved in the prior decade which was 2.07%. In the prior decade, Village went from 26 stores to 37 which represents a 4% annual store growth. In the base case, I assumed a more conservative store growth of 2%. Next, I assume margins of 2% which is still on the lower end of most grocery stores. Improving margins and sales growth deserve a higher multiple so I came up with a .28 times sales ratio or a 14 times price-earnings ratio.

Best Case

For the best-case scenario, I assumed Village to expand store count roughly at the same pace as the last decade. Next, I have margins coming in at around the average for most of their peers. Margins could easily exceed this which would lead to an even bigger return. The rest of the assumptions are about the same as the base case.

Management

Village is a family owned company with many family members serving at key positions on the board and management. It will ultimately be up to management to right the ship when it comes to profitability. The most important thing I believe in evaluating management is to look at incentives. Considering that this is their livelihood and that management has over 60% insider ownership, management should be quite incentivized to increase the stock price.

Conclusion

Village Super Market has a number of paths to higher profitability for the future. Management has started a number of the paths already and should continue to do so as a large portion of their net worth is tied up in the stock. If management can execute, I expect a 14% CAGR over the next decade from the current stock price.

Be the first to comment