Hispanolistic

Introduction

Since my last article on Village Super Market (NASDAQ:VLGEA) the company has performed quite well. The company’s profitability has significantly improved and same-store sales has been positive. However, its valuation is still depressed at .17 times sales which is one of the lowest in the sector and about the same as of my last article. Net income margin has increased since 2021 from .98% to 1.7% in 2022 and in the most recent quarter, it hit 2.2%. If the current profitability can continue the company would be trading at 8 times earnings. Given a pending recession, Village wouldn’t be a bad place to continue to park money in my view.

Highlights

This margin expansion is due to a combination of sales leverage and gross margin expansion. As you can see gross margin increased from 27.83% in 2021 to 28.73% as of Q1 2023 and Same-store sales is up 4.3% YOY in Q1 of 2023.

|

Village Supermarket Key Metrics |

||||

|

Year |

Q1 2023 |

2022 |

2021 |

2020 |

|

Gross Margin |

28.73% |

28.12% |

27.83% |

28.07% |

|

SG&A/Revenue |

24.16% |

24.63% |

24.57% |

24.65% |

|

Net Income Margin |

2.13% |

1.3% |

.98% |

1.38% |

|

FCF Margin |

2.35% |

1.75% |

1.33% |

1.61% |

|

AFCF Margin |

2.19% |

1.84% |

.88% |

2.02% |

|

Same Store Sales |

4.3% |

4.1% |

2.3% |

5.3% |

Source: Author created table. Data from company reports

Village in 2022 has also accomplished a number of objectives including the following

-

As mentioned in my previous article Village has been acquiring more of its stores outright instead of leasing. In 2022 Village purchased the Galloway shopping center putting their total owned supermarkets to 7 while the remainder is leased.

-

Village’s private label brands increased as a percentage of sales. Own Branded products or private label accounted for 12.8% of Sales in 2022 vs 9.7% in 2015 and 12.4% in 2021.

Both private label and purchasing shopping centers were two ways I mentioned in my last article Village could expand margins which were struggling pre covid. Private label is forecasted to grow to 21.6% of total grocery sales by 2026 and so Village should see further growth. Also if inflation persists this could see even faster growth in private label as a recent report by Colliers reports “some 61.3% of consumers say they would switch to private label if inflation persists”.

Management’s outlook as of their Q1 2023 10Q are as follows

-

Same stores sales increase of 1%-3% in 2023

-

Construction of 3 replacement stores that will be opened in 2024

-

2 Major remodels

-

Purchase of the Vineland shopping center which adds an 8th supermarket to the company

-

Installation of electronic shelf labels in six stores

-

Village entered into an agreement for 30% interest in the development of a retail center in Old Bridge, New Jersey, which includes a Village replacement store

Key takeaways are Village continually purchasing shopping centers per their intention to purchase the Vinland shopping center and entering into a 30% interest in a replacement store. Also, Village is investing more into automation by installing electronic shelving in six of its stores. Automation was another key point in improving margins that I mentioned in my last article. Replacing all the price labels in a grocery store is actually a very labor-intensive process that isn’t done that often. Electronic shelf labeling removes the labor involved and allows for more dynamic pricing which could potentially change daily, fluctuating with demand.

Same-store sales growth projections of 1% to 3% for next year aren’t that impressive especially if inflation persists in the 5%-7% range. However, inflation does look like it’s moderating and will definitely decline given a recession.

Valuation

Given the positive trends in the business Village’s valuation still remains depressed. As of now Village’s price-to-sales ratio is at .17 which with its current margins of 2.2% would be an 8 times PE ratio. Village’s price-to-sales ratio is one of the lowest in the sector.

|

Ticker |

P/S Ratio |

FCF Margin |

P/FCF Ratio |

|

Albertsons (ACI) |

0.14 |

2.65% |

5.35 |

|

Village Super Market |

0.17 |

2.26% |

7.37 |

|

Natural Grocers (NGVC) |

0.21 |

0.76% |

27.83 |

|

Kroger (KR) |

0.24 |

2.59% |

9.24 |

|

Ingles Markets (IMKTA) |

0.34 |

3.87% |

8.65 |

|

Ahold (OTCQX:ADRNY) |

0.36 |

2.03% |

17.80 |

|

PriceSmart (PSMT) |

0.53 |

0.03% |

N/A |

|

Weis Supermarkets (WMK) |

0.55 |

1.94% |

28.47 |

|

BJ’s Wholesale Club (BJ) |

0.57 |

3.16% |

18.16 |

|

Sprouts (SFM) |

0.61 |

4.30% |

14.21 |

|

Walmart (WMT) |

0.71 |

1.93% |

36.68 |

|

Grocery Outlet (GO) |

0.96 |

1.05% |

90.74 |

|

Average |

0.45 |

2.21% |

24.04 |

Source: Author created table. Data from company reports and price data from Google finance

Recession

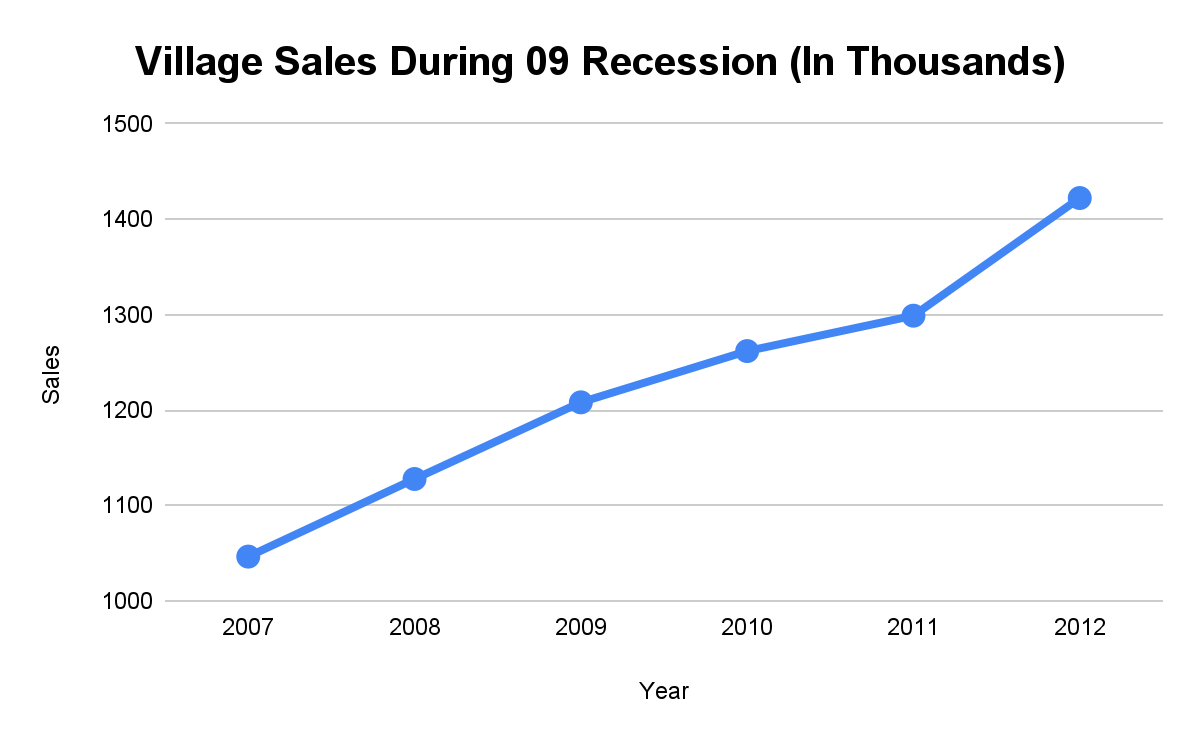

In a recession, grocery stores tend to do well because people who would have gone out to eat instead decide they should eat at home to save money. For example, Kroger claims it’s 3x to 4x cheaper to eat from home than out. Looking at Village sales in the 09 recession, sales didn’t skip a beat increasing throughout.

Source: Author created chart. Data from company reports

Conclusion

Village Supermarkets is continuing on its path to increasing profitability by pulling the three levers of expanding private label sales, purchasing real estate, and automation. I continue to hold Village and think the current price is still attractive.

Be the first to comment