rgbspace

The Canadian cannabis market has been a disaster since the launch of recreational cannabis back in 2018. Some of the leading LPs have seen stocks fall 99% from the highs, though off irrational peak levels due to the hype. Village Farms International (NASDAQ:VFF) remains the best way to play the Canadian cannabis sector. My investment thesis stays ultra Bullish on the stock falling while the Canadian cannabis market is improving.

Canadian Cannabis Boost

In a big surprise, the Canadian cannabis market is actually showing signs of strong growth. And for once, the top cannabis LPs are actually seeing sales growth in recreational cannabis per research firm Hifyre according to Cantor Fitzgerald.

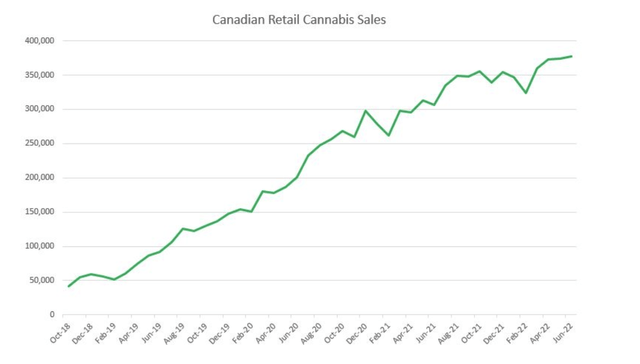

Canadian cannabis sales were up 7% sequentially in July following a 9% gain during Q2’22. All of the key players grew sales during the quarter according to research from Cantor. One key snippet is that Hifyre data isn’t 100% inclusive of the whole Canadian market.

The good news is that the top public producers appear to finally be gaining market share in a market that has grown since the launch of recreational cannabis. The problem hasn’t necessarily been the overall market opportunity, but rather the inability of top producers to gain share and keep that share with so many market participants.

June cannabis sales were C$377.5 million, up 23% from a year ago. Sales are up dramatically from levels back in 2019 when monthly retail sales first topped C$100 million, yet a lot of the top producers aren’t any better off financially.

On the flip side, MJBizDaily highlighted how licensed producers continued to destroy more and more cannabis each year. Licensed producers destroyed 435 million grams of marijuana in 2021 equal to 26% of all production. These producers only destroyed 280 million grams back in 2020 for just 19% of all cultivation.

The market has to turn around this trend dramatically in order to generate profits and reverse weak pricing trends.

Upbeat Numbers

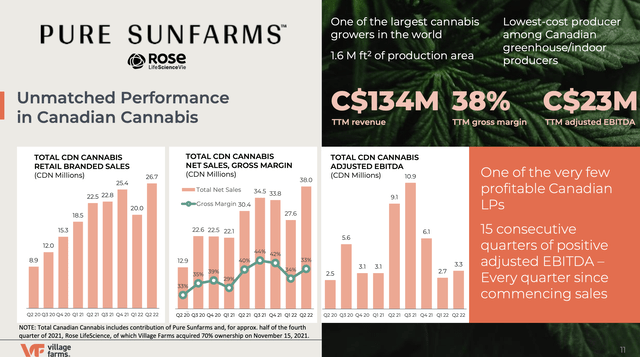

Since Village Farms shifted a greenhouse in Canada to cannabis cultivation away from vegetables, the company has far outperformed the other Canadian providers. The company has successfully matched cultivation growth with market demand unlike most other LPs that overbuilt and produced far too much inventory.

Village Farms reported Q2’22 cannabis sales grew 37% sequentially to C$38.0 million with net branded retail sales a record C$26.7 million. More importantly, the amount was up 20% YoY following the weak Q1’22 numbers.

Source: Village Farms Sept. ’22 presentation

The major issue for the cannabis sector has been the weak adjusted EBITDA. The company has reported consistent sales growth unlike the industry, but ultimately profits matter in a sector where leaders like Canopy Growth (CGC) and Aurora Cannabis (ACB) have long struggled to even produce positive EBITDA evidenced by another quarter of losses.

Village Farms reported an adjusted EBITDA of C$2.1 million for the cannabis sector, down from C$7.3 million last year. Total EBITDA was negative for the quarter to the tough environment for produce sales.

Another interesting aspect is that Village Farms recently took 85% control of Leli Holland. The operation sets the little the company with an avenue into European cannabis sales, including Germany.

For now, Leli Holland has one of the 10 cultivation licenses in the Netherlands. In addition, Village Farms continues to ship medical cannabis to Australia and is poised for approval for Germany and Israel providing the small Canadian producer with generally the same access to international markets as the LPs with massive valuations in prior years.

The stock is only worth a meager $200 million with the stock down to only $2.25 despite the positive Canadian market news. All of the top Canadian producers could start generating value in a scenario where maintaining market share in a growing market is much easier.

With the produce business, Village Farms does C$320 million in annual sales. The cannabis business alone tops C$140 million, or $103 million, now and Q3 sales should rise based on Hifyre data. The company only trades at 2x the current cannabis business alone providing all upside for the international business and additional sales growth going forward.

Takeaway

The key investor takeaway is that the Canadian cannabis market appears to finally show some stability for the producers. Village Farms remains the best way to play the sector with a management team that delivers consistent growth and has solid optionality in the U.S. and internationally.

Be the first to comment