Ian Hromada/iStock via Getty Images

We’ve seen a violent bear market for the Gold Juniors Index (GDXJ), with the ETF sliding more than 50% from its Q3 2020 highs and several names down as much as 60%. While Victoria Gold (OTCPK:VITFF) was a temporary outperformer after ramping up to commercial production in late 2020, the stock has come under considerable pressure this year, sliding at a similar magnitude to its benchmark, the GDXJ. However, with considerable growth on deck and Victoria being one of the few Tier-1 jurisdiction single-asset producers with ~250,000-ounce per annum potential, I would view any further weakness as a buying opportunity.

Eagle Mine Operations (Company Website)

Just over three months ago, I wrote on Victoria Gold, noting that the stock could underperform its peers in 2022, but pullbacks below US$10.50 would provide low-risk buying opportunities. While the stock saw two pullbacks below this level which led to immediate 11% plus rallies, the stock has since been crushed, finding itself down 55% from its all-time highs. While some of this decline is justified due to guiding far too aggressively and missing in FY2021, this sell-off is looking overdone, even after factoring in lower gold prices. Let’s take a closer look below:

Q2 Production

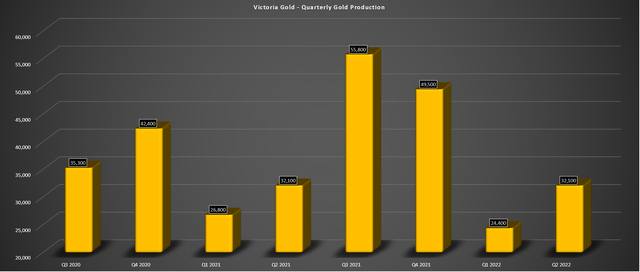

Victoria Gold released its preliminary Q2 results last week, reporting quarterly production of ~32,100 ounces, a 32% increase on a sequential basis and flat from the year-ago period. This has pushed year-to-date production to ~56,400 ounces, which is ~4% behind FY2021 levels for the same period. The lower production can be attributed to slightly lower grades and fewer tonnes of ore stacked on the pads, impacted by extremely cold weather in Q1 2022. The mediocre H1 performance has set the company up for what looks to be another consecutive annual miss vs. its guidance mid-point, though a less significant miss than its massive production miss in FY2021 (~164,000 ounces vs. guidance of 180,000 to 200,000 ounces).

Victoria – Quarterly Production (Company Filings, Author’s Chart)

The good news is that Victoria has a strong second half ahead in its best seasonal period, and assuming it can deliver 109,000 ounces, the company will be able to deliver into this year’s guidance of 165,000 to 195,000 ounces. This would require a 4% beat vs. H2 2021 levels (~105,000 ounces), which looks doable with the company now in its second full year of production at Eagle. In addition, while costs came in at very elevated levels in Q1 (all-in sustaining costs: $1,504/oz), they can be ignored given that costs are always the highest in H1, given that stacking of ore is paused during the coldest period of the year.

Costs & Margins

Based on Victoria’s guidance for costs of $1,225/oz to $1,425/oz and the fact that production should come in at the low end of guidance, I would expect to see all-in sustaining costs (AISC) come in at $1,330/oz or higher. If we assume an average realized gold price of $1,835/oz (benefiting from 15,000 ounces of forward gold sales at $2,003/oz), this will translate to AISC margins of $505/oz. These would represent weaker margins than the industry average. It doesn’t help that Victoria is sensitive to energy prices, given that it’s a high-volume, low-grade gold producer, using considerably more diesel per ounce produced than mid-grade operations or high-grade underground operations.

Fortunately, while the outlook is for declining margins in FY2022 (~$505/oz vs. $597/oz), Victoria has plans to beef up production to 250,000 ounces per annum under its Project 250. The company hopes to achieve this goal in 2023, with the two major initiatives to boost production being the scalping of fine ore from the crushing circuit and an adjustment to a longer period of seasonal stacking vs. current levels. Given Victoria’s habit of guiding aggressively and missing, I think this is a very ambitious goal for 2023. However, even if Victoria manages to produce just 230,000 ounces, this figure would represent ~40% production from FY2020 levels.

Eagle Mine Operations (Company Video)

Meanwhile, if the 250K mark is reached in 2024, this would translate to a compound annual growth rate of ~15%, giving Victoria one of the more attractive growth profiles sector-wide. Of course, this is coming off relatively easy comps given the large miss on guidance in 2021, but it’s still impressive. The bigger news, though, is that while Victoria might be a slightly above-average cost producer in FY2021, it would be a much lower cost producer at this higher production rate.

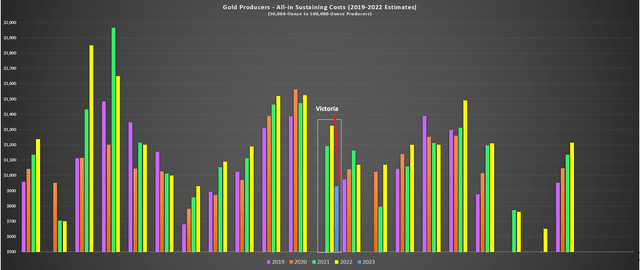

Gold Producer AISC (2019-2022 Estimates) vs. Victoria 2021-2023 Estimates (Company Filings, Author’s Chart & Estimates)

Assuming Victoria can meet its Project 250 goals, we should see all-in sustaining costs dip below $930/oz, which would take Victoria’s costs from $100/oz above the industry average to more than $250/oz below the estimated FY2023 industry average. This should allow the stock to enjoy a higher multiple vs. what’s been mediocre production to date since it went into commercial production (at least relative to the guidance it’s been providing to the market). As we can see above, this would allow Victoria to buck the sector-wide trend post-2022, with costs dropping substantially vs. its peer group (junior/mid-tier producers). In a sector where holding the line on margins is tough due to inflationary pressures, this would be yet another differentiator.

Valuation

Based on an estimated ~68 million fully diluted shares (year-end) and a share price of US$6.90, Victoria Gold trades at a market cap of ~$470 million and an enterprise value of ~$600 million. This makes Victoria one of the cheapest producers sector-wide, and the stock actually trades at a discount to some juniors that have yet to reach the Feasibility Study level. The current undervaluation not only offers a low-risk entry point for investors at less than 0.50x estimated net asset value (~$1.04 billion), but it makes Victoria a potential takeover target for a company looking to increase its gold production in Tier-1 jurisdictions. (The Yukon Territories are ranked in the top 15% of all mining jurisdictions).

From a cash flow standpoint, Victoria is just as attractively valued, trading at less than 3x FY2023 estimated cash flow per share ($2.40). Notably, this cash flow estimate assumes a lower gold price assumption of $1,730/oz and assumes Victoria does not meet its 250,000-ounce per annum goal in 2023. So, even baking in more conservative assumptions of a flat gold price from current levels and 230,000 to 240,000 ounces in annual production, Victoria looks very attractively valued at current levels. Let’s take a look at the technical picture:

Technical Picture

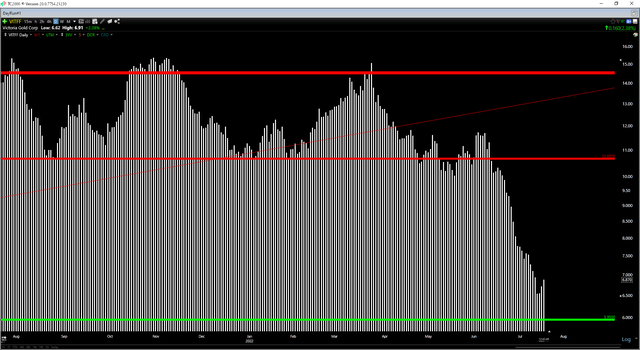

Despite Victoria’s valuation remaining attractive, the stock has taken a beating thus far this past year, declining more than 55% from its all-time highs near $15.00 per share. The major technical breakdown in the stock has left multiple resistance levels overhead, which are likely to provide a ceiling for the stock if sentiment does return to the sector. However, given that the next major resistance level does not come in until US$10.65, the stock could have further legs to this rally, though this is contingent on the gold price holding the $1,700/oz level.

VITFF Daily Chart (TC2000.com)

Based on a required 6.0 reward/risk ratio to justify entering new positions in small-cap names, Victoria’s low-risk technical buy zone comes in at US$6.65 or lower. So, if the stock does retreat and come down to re-test its recent lows, I would expect this area to hold. However, if it doesn’t, investors can take comfort in the fact that Victoria will be among the top-5 takeover targets sector-wide at these levels. This is because there’s a dearth of Tier-1 assets out there with 250,000-ounce per annum potential that also boasts a 12+ year mine life. Hence, from a valuation and technical standpoint, Victoria looks the most attractively priced it’s been since March 2020.

Summary

Victoria had a mediocre start to the year, but it has a strong second half ahead and should be able to deliver into the lower end of its guidance (165,000 to 195,000) ounces if it can put up a slightly better H2 2022 than H2 2021 levels. While this would represent flat production year-over-year, it’s 2023 that investors should be paying attention to, with the potential for gold production of 230,000+ ounces if the company can make solid progress on Project 250. This should translate to considerably lower costs, with the potential for AISC below $925/oz. Given this more attractive margin profile, Victoria should be able to gain more respect, making this pullback an attractive entry point ahead of meaningful growth.

Be the first to comment