jiefeng jiang

Company Description

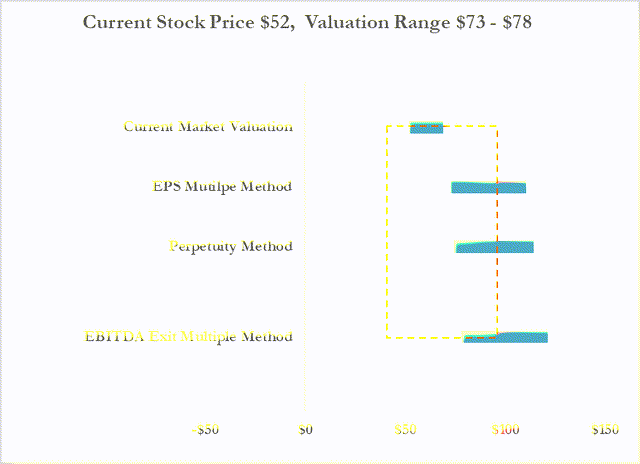

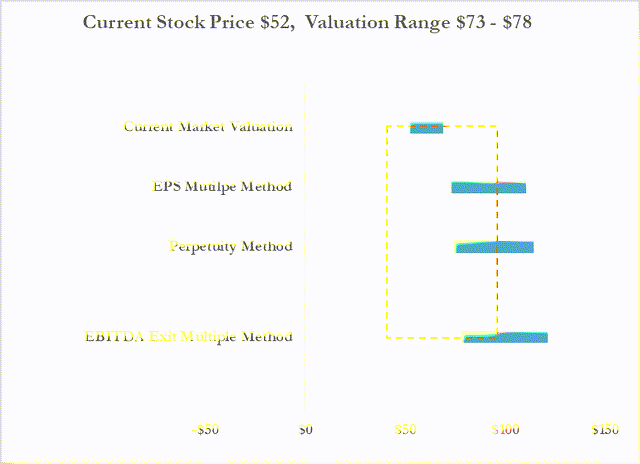

Vicor Price Target (Samuel Eneh Research)

Founded in 1981, headquartered in Andover, MA, Vicor Corporation (NASDAQ:VICR) designs, develops, and manufactures power modules for electrical power conversion. Most electric-powered devices often are plugged into a wall outlet; the current coming from the outlet is known as alternating current voltage (AC). Vicor’s products convert the AC voltage into a direct current voltage (DC) utilized by the device or a subsystem/application within the device. Vicor’s products may further convert the DC voltage into a higher or lower form of DC voltage required by a subsystem/application within the device.

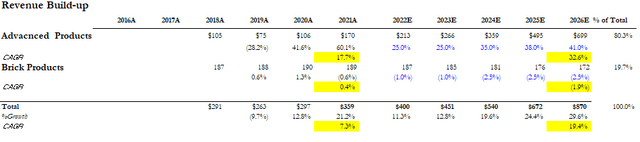

Vicor has two business segments: Advanced Products (47.4% of FY21 Rev); and Brick Products (legacy business, 52.6% of FY21 rev). Vicor’s products come in the form of a chipset (set of chips). Some of the Advanced Products are Pre-regulator Module (PRM), Modular Current Multiplier Driver (MCD), and Voltage Transformation Module (VTM).

Advanced Products utilized Vicor’s unique Factorized Power Architecture for a range of 48V applications in the data center, AI, HPC, and automobile space. Whereas Brick Products are standard and customizable chipsets, i.e., AC-DC Converter, DC-DC Converter, Intermediate Bus Converter (IBC) with applications in aerospace, defense electronics, and industrial automation.

Thesis

Vicor management, during the recent annual shareholders meeting in June 2022, made a statement worth capturing here:

“In summary, the market opportunity in HPC is very large and growing, we have clear technology advantage that we’ll expand, we also now have the manufacturing footprint and vertical integration required to succeed, so no excuses.”

Vicor, in my view, is a company on the edge, on the edge of accelerating its technological advantage and embarking on unprecedented growth. Thus, the thesis here is one of technological innovation coming to the marketplace, the questions become: how good is the technology relative to the status quo; is the end-user comfortable with the product; and how fast can the product penetrate the market. Almost a decade ago, Vicor introduced an innovative Factorized Power Architecture (FPA) 48 V chipset that has no true competition yet in the marketplace.

How good is this product? Using High Performance Computing as an example here (“HPC”; AI, data center, cloud computing, enterprise computing, and Hyperscalers can be grouped under HPC), most data centers in the marketplace run on conventional 12V except the Google data center. The incumbent 12V or intermediate conversion option, as you would expect, is inefficient relative to 48V. 48V increases the voltage in systems by a factor of 4x, decreases current by a factor of 4x, and reduces dissipative power losses by a factor of 16x. The FPA technology in 48V, according to Vicor, improves power efficiency by 10% which translates to greater compute density, thereby saving electricity and enabling higher performance.

Is the end-user comfortable with the product, and what is the adoption rate? Google Data Center’s adoption of 48V demonstrates that the product works, however, the product faces 12V incumbency challenges, thus, the marketplace has been slow in adopting 48V. That said, Vicor has established a relationship with the two largest CPUs, three largest GPUs, the largest FGPA, and more than a dozen AI accelerator vendors. Therefore, we expect Vicor’s topline to accelerate as the next-generation CPU, GPU, FPGA, and AI accelerators ramp up.

Business Model & Revenue Buildup

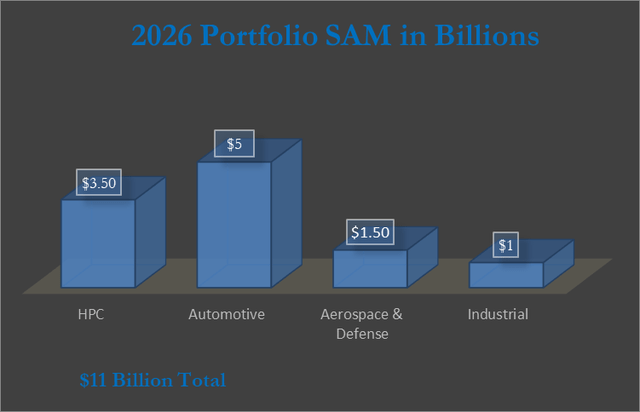

Vicor’s Serviceable Available Market (SAM) (Company Reports & Samuel Eneh Research)

Vicor customers have traditionally been aerospace, defense electronics, transportation, industrial equipment, and industrial automation players. For these players, Vicor design, develop, manufacture, and distribute standard and customizable power modules, i.e., 12V AC-DC converter (Brick Products). With the introduction of 48V (Advanced Products), Vicor is targeting 100 customers in high-growth markets. The markets include HPC with SAM worth $3.5 billion, Automotive with $5 billion SAM, Aerospace & Defense with $1 billion SAM, and Industrial with $1.5 billion SAM. Cumulatively, $11 billion SAM by 2026.

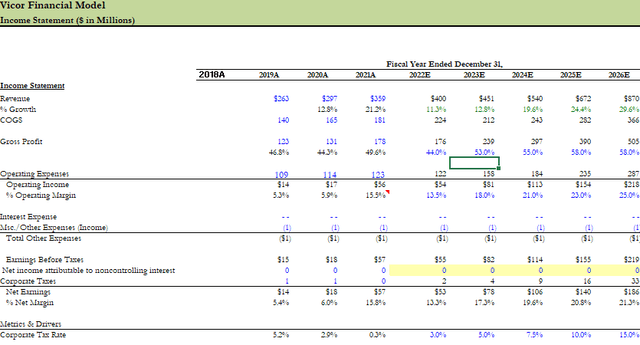

Vicor is projected to grow at a double-digit CAGR over the next five years, driven by revenue from Advanced Products as Brick Products’ revenue steadily declines over time. Vicor intends to convert Brick Products customers into Advanced Products customers.

As of YE21, Advanced Products represent 47% of Vicor topline while Brick Products hold 53%. By YE26, Vicor expects Advanced Products to be 80% of the total revenue. Vicor anticipates that Advanced Products revenue will overtake Brick Products revenue in dollar value by YE22. Vicor’s total FY21 revenue is $359 million, 7.3% CAGR in the last four years. Advanced Products in the same span has grown approximately 18% CAGR whereas Brick Products is less than a half percent CAGR in the same period.

Vicor management targets $1 billion in revenue by FYE26, driven by Advanced Products – I believe Vicor would grow double digits CAGR over the next five years. For conservative calculation purposes, I modeled Vicor to hit $850-$870 million by YE26.

Growth Strategy

Vicor strategy is to hit $1 billion in revenue by FYE26. This hinges on five key focus areas: 1. The high-growth markets highlighted previously; 2. Applications with tough power delivery challenges; 3. Vertically integrate the new manufacturing facility; 4. Achieve operating excellence; and 5. Focus on specific top 100 accounts.

Valuation

Vicor Price Target (Samuel Eneh Research)

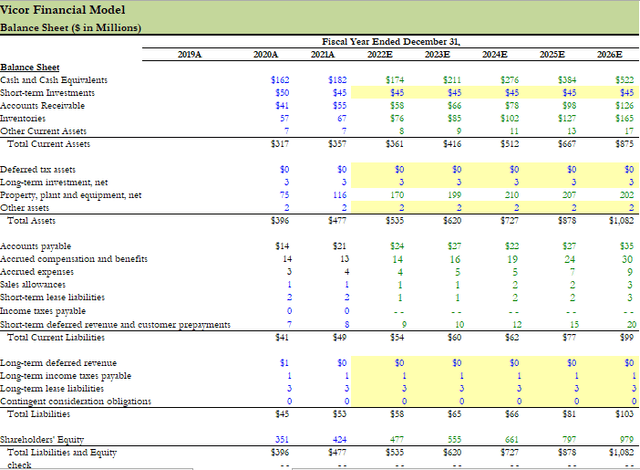

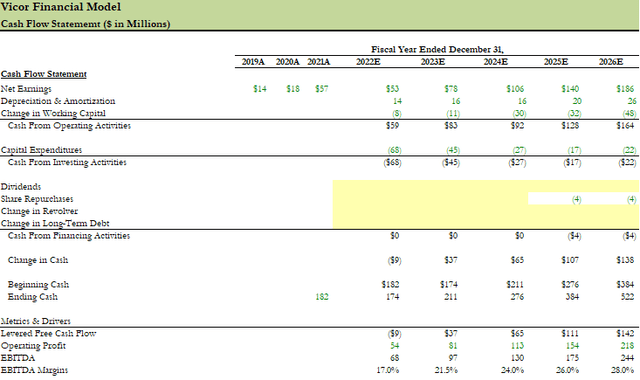

EBITDA Multiple: I obtained a $78 price target using a 17x multiple on 2026 EBITDA of $244 million discounted at 6%.

EPS: The model assumes the EPS to grow at 23.7% CAGR over the next five years discounted at 6%. For comparison purposes, the EPS grew at 76.2% CAGR between 2018 and 2021. Price target $73.

Perpetuity Method: The model assumes the topline to grow at 19% CAGR over the next five years, driven by an acceleration in Advanced Products revenue. Gross and operating margins improved to 58% and 25%, respectively by FYE26, and a discount rate of 6%. Price target $75.

Catalyst

- Successfully execute the vertical integration program expected to start in 2H22, additionally, show some traction in reaching 65% Gross Margin and 35% Operating Margin target.

- Acceleration of adoption of AI servers in a data center within HPC, with design wins for Vicor.

- An increase in design wins in automobile space as the electrification of automobiles accelerate.

- Licensing revenue could accelerate market adoption of 48 V, specifically for customers reluctant to rely on Vicor as a single supplier.

Risks

- Political/trade tension. In FY21, FY20, and FY19, Vicor generated 67.0%, 64.4%, and 53.7% of its total revenue, respectively, outside of the U.S. Furthermore, the net revenues from customers in China and Hong Kong, Vicor’s largest international market, accounted for approximately 27.5% in FY21, 31.4% in FY20, and 22.1% in FY19, respectively, of total net revenues. Therefore, trade tension or conflict would adversely impact Vicor topline.

- As of February 16, 2022, CEO and founder Dr. Patrizio Vinciarelli owns 80% of the voting stock, thus, limited space for shareholder advocacy.

- Slower adoption of 48V, continued decline in Brick Products revenue.

- Global economic uncertainty/recession.

- Limited customer base.

- Interruption in Andover facility operation.

- Extended global supply chain disruption

Conclusion

Based on the analysis in this report, I’m issuing a buy recommendation on Vicor with a price target range of $73-$78. The completion of the Andover facility and implementation of vertical integration allows Vicor to increase backlog (~$424 million, up 22.6% in Q1FY22) burn rate and reduce customer wait-time (~eight months for Advanced Products and Five for Bricks products). The vertical integration program is scheduled to start 2H22, therefore, Q3FY22 and Q4FY22 results should provide some evidence that Vicor is gaining traction to accelerate revenue, and improve margins.

Lastly, further design wins in HPC and automotive space and acceleration of topline beyond the model projections would warrant a positive re-rating of the stock.

Next Earnings Call

Vicor Q2FY22 earnings conference call: July 21st, 2022. 5 PM EST.

Model

Vicor Projected Income Statement (Samuel Eneh Research)

Revenue Buildup (Samuel Eneh Research)

Be the first to comment