RudyBalasko

VICI Properties (NYSE:NYSE:VICI) has come a long way since it came public in 2018. The company has made great progress in diversifying away from its top tenant Caesars Entertainment (CZR) which, alongside greater interest in the casino real estate sector, has helped the stock outperform net REIT peers. While casino real estate carries attractive features like longer lease terms and larger annual lease escalators, VICI’s premium to more traditional and arguably higher quality peers is questionable. I explain why the premium may exist and give my estimate of fair value.

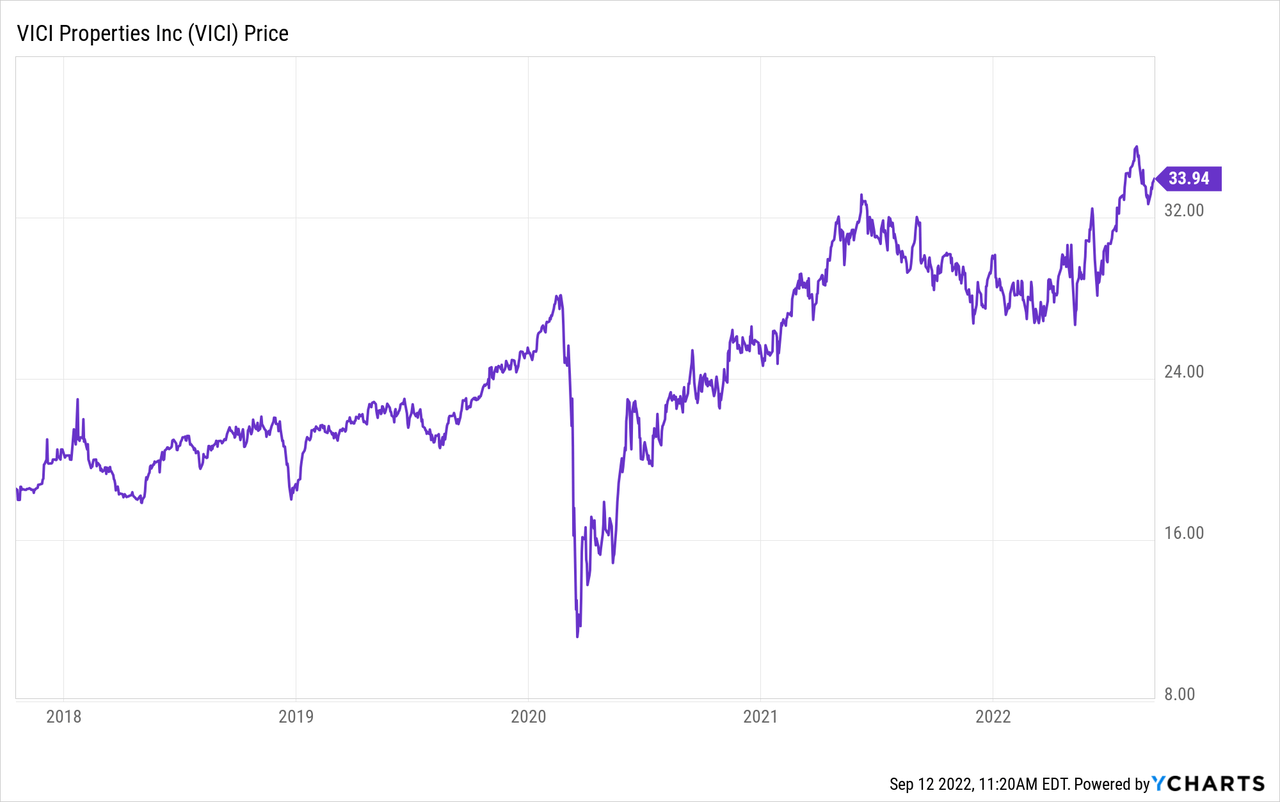

VICI Stock Price

VICI came public in early 2018 at $20 per share, crashed to as low as $12 per share during the 2020 pandemic crash, but has since traded violently higher, surpassing pre-pandemic levels.

I covered VICI during the pandemic crash and concluded that it was not worth the risks, even as I was buying REITs in general hand over fist. That assessment proved incorrect as the stock has since delivered 141% total returns. While some of that recovery is warranted, this is a case in which the bulls have gotten ahead of themselves.

VICI Stock Key Metrics

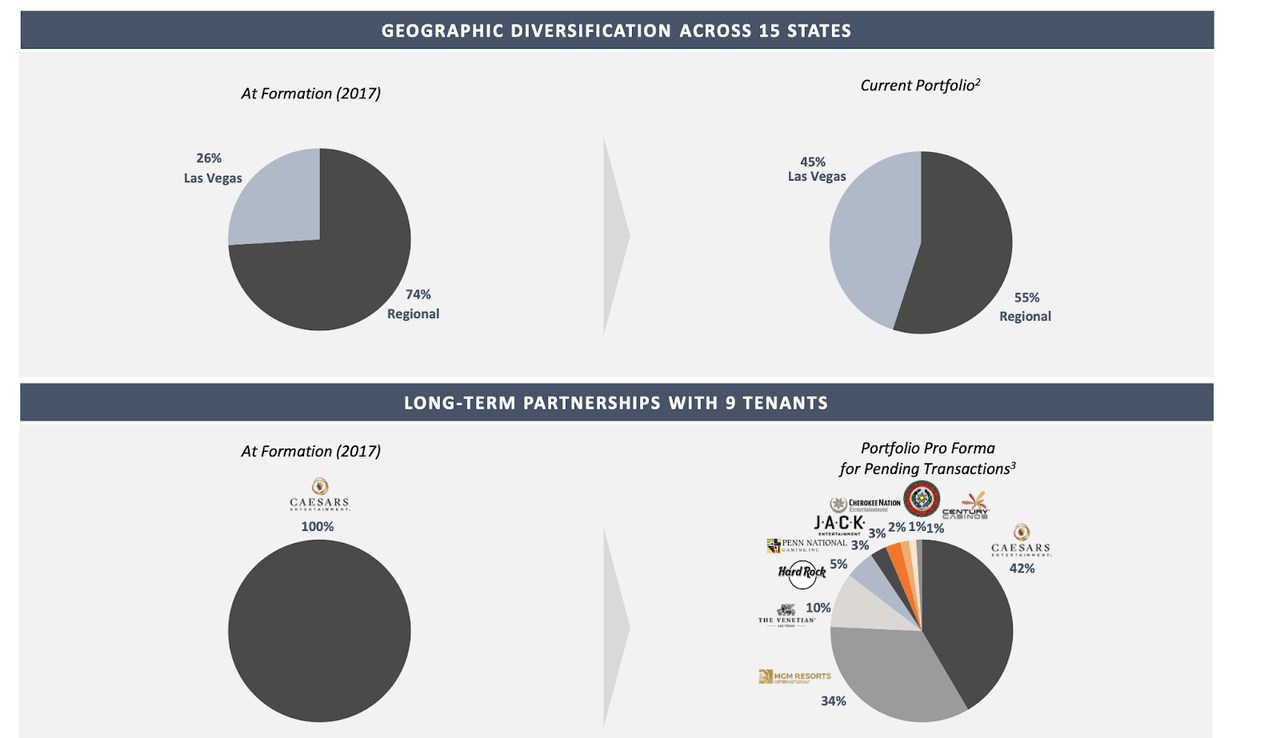

When VICI first came public, the company’s sole tenant was CZR. After an aggressive acquisition pipeline, VICI has reduced that exposure to 42% and added eight other tenants.

2022 Q2 Supplemental

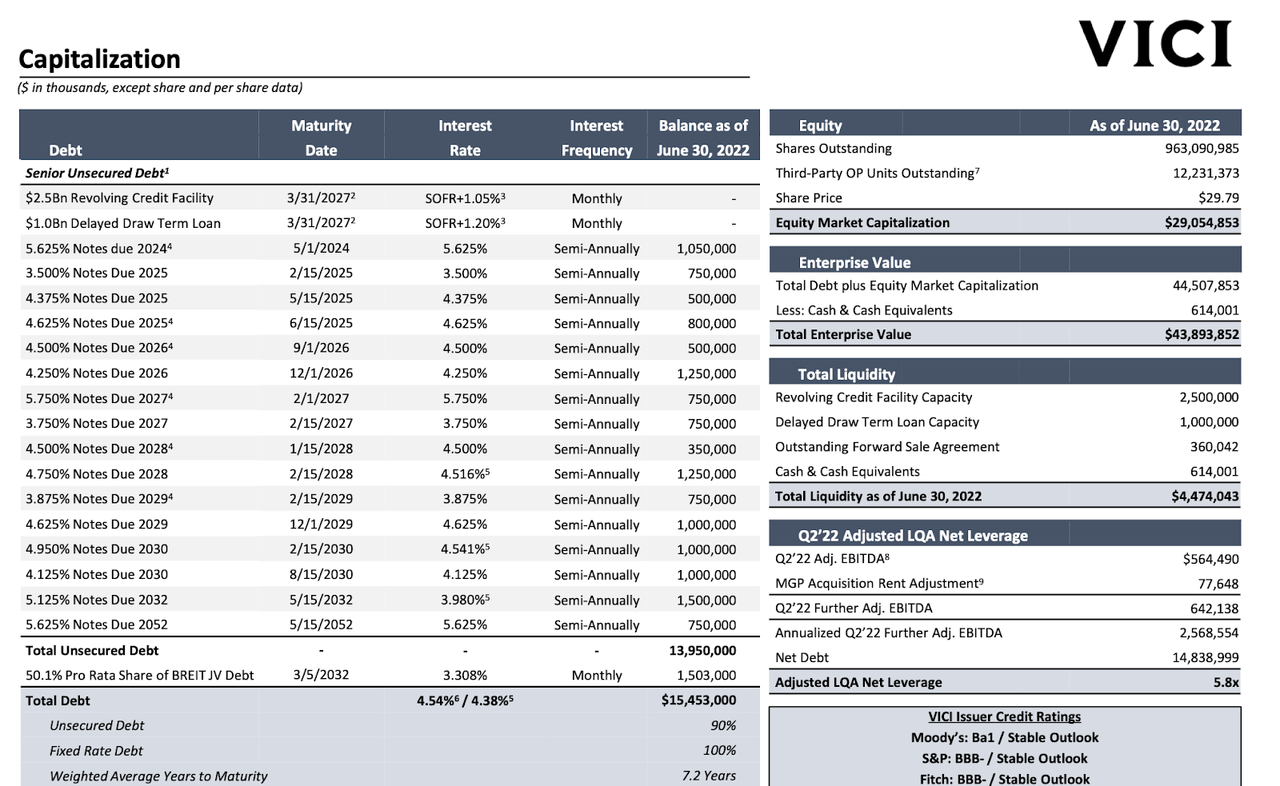

The company ended the latest quarter with a leverage ratio of 5.8x debt to EBITDA – a higher ratio, but understandable considering the sheer amount of acquisitions in recent times.

2022 Q2 Supplemental

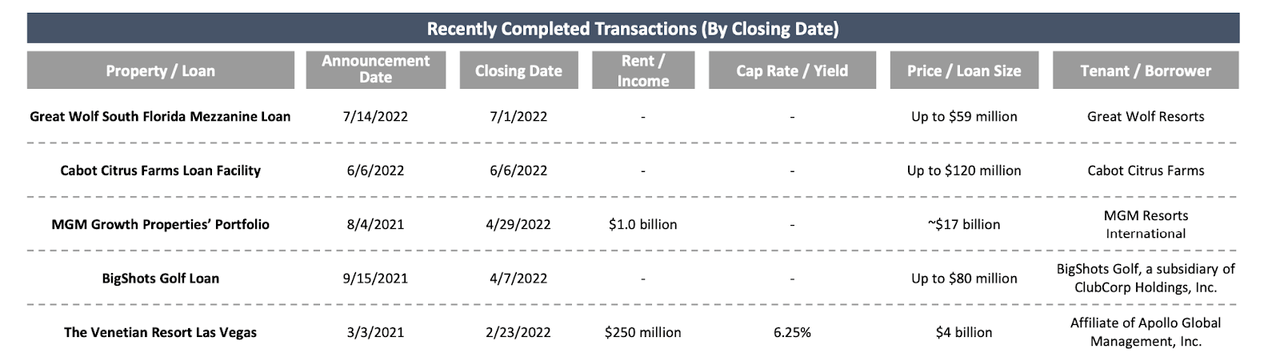

We can see a snapshot of those acquisitions, the largest being the roughly $17 billion purchase of MGM Growth Properties and the $4 billion acquisition of the Venetian Resort at a 6.25% cap rate.

2022 Q2 Supplemental

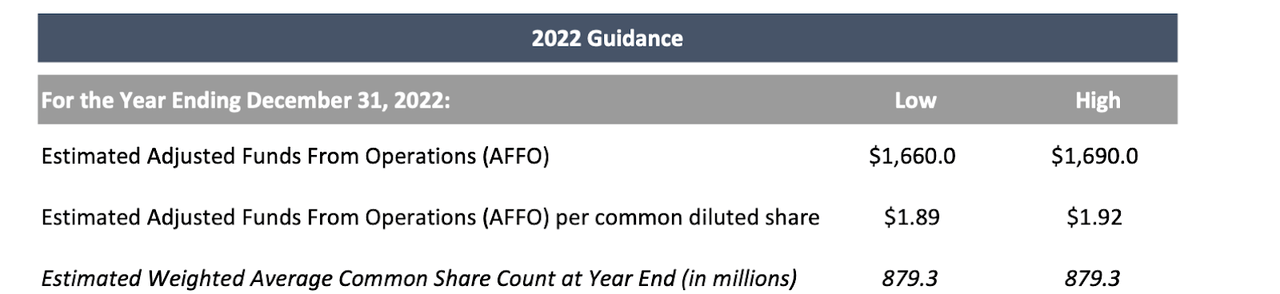

VICI has guided for this year to see up to $1.92 in adjusted funds from operations (‘AFFO’) per share. That represents 5.5% growth over 2021 AFFO of $1.82 per share. The main difference between funds from operations and GAAP net income is that it adds back depreciation and amortization. While that can oftentimes be a suspect add-back for REITs, I find it acceptable for net lease REITs due to the landlord having minimal maintenance capital expenditure requirements as by design, the tenant is responsible for real estate taxes, insurance, and maintenance costs.

2022 Q2 Supplemental

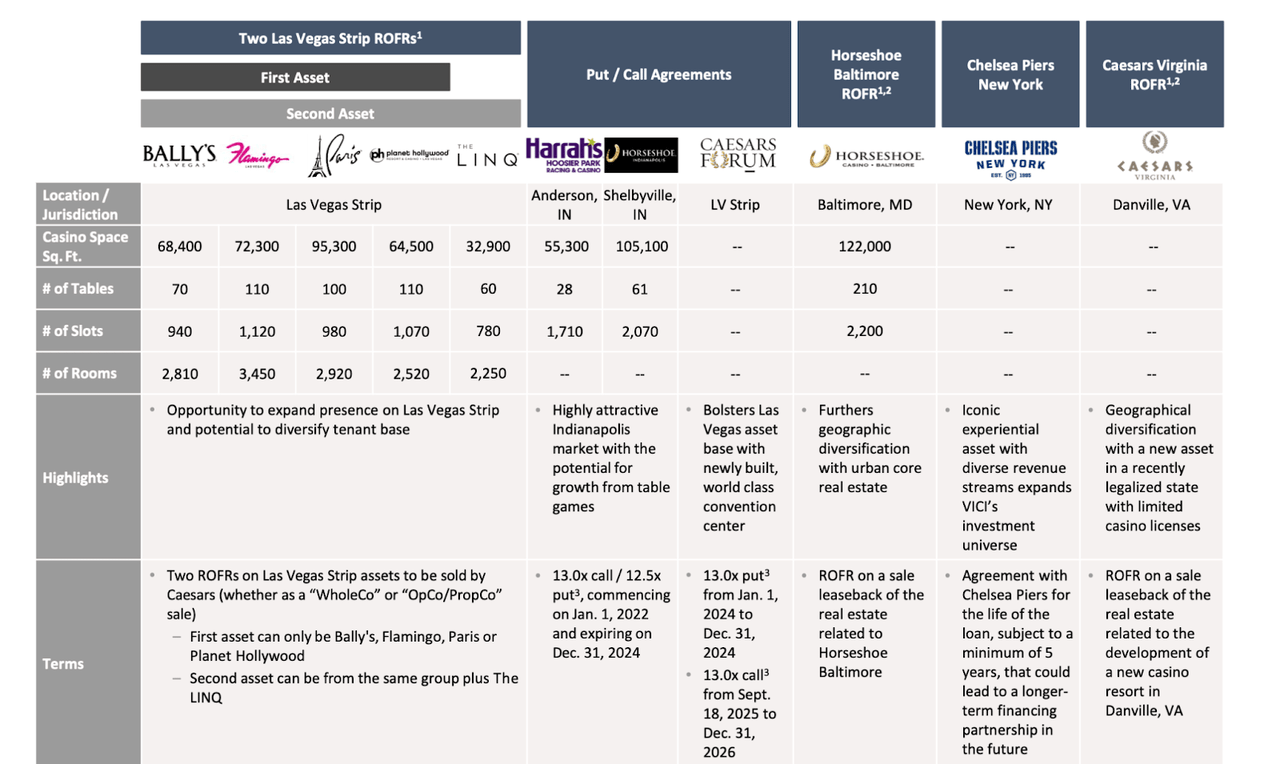

Over the next few years, there is some visibility into the acquisition pipeline. This includes some potentially lucrative deals like being able to purchase a Harrah’s and Caesar’s Forum property at a 7.7% implied cap rate.

2022 Q2 Supplemental

Is VICI Stock A Buy, Sell, or Hold?

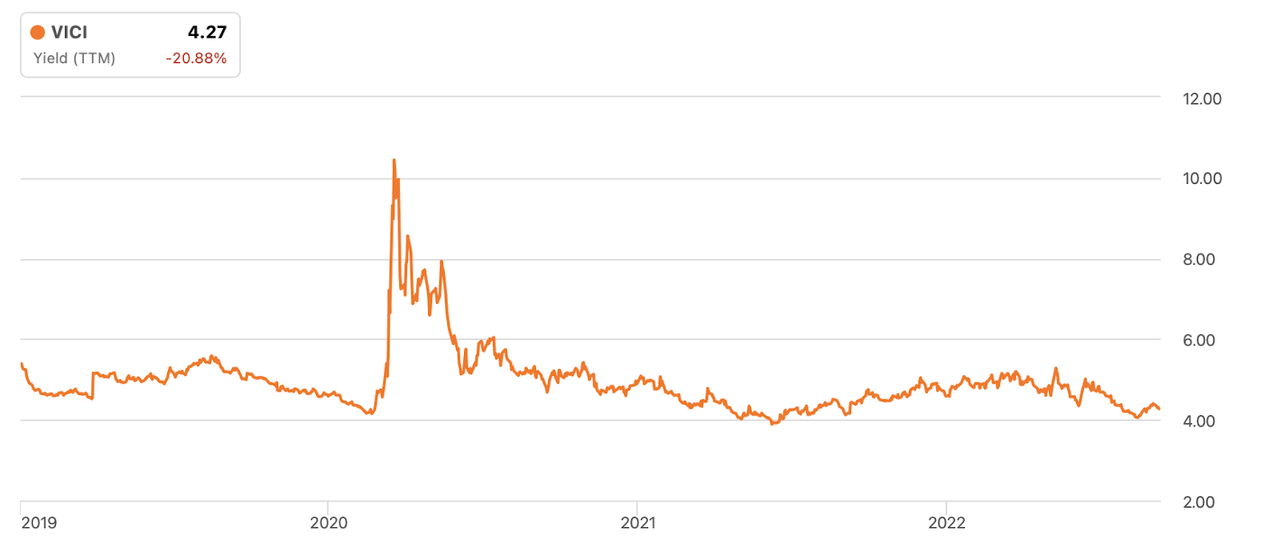

VICI stock has traded markedly higher but its yield is not that far off from where it has traded previously.

Seeking Alpha

Some might interpret this to mean that the valuation is not unreasonable. I caution against such an assessment because VICI traded with unusually low leverage ratios previously – a trait that has since been addressed.

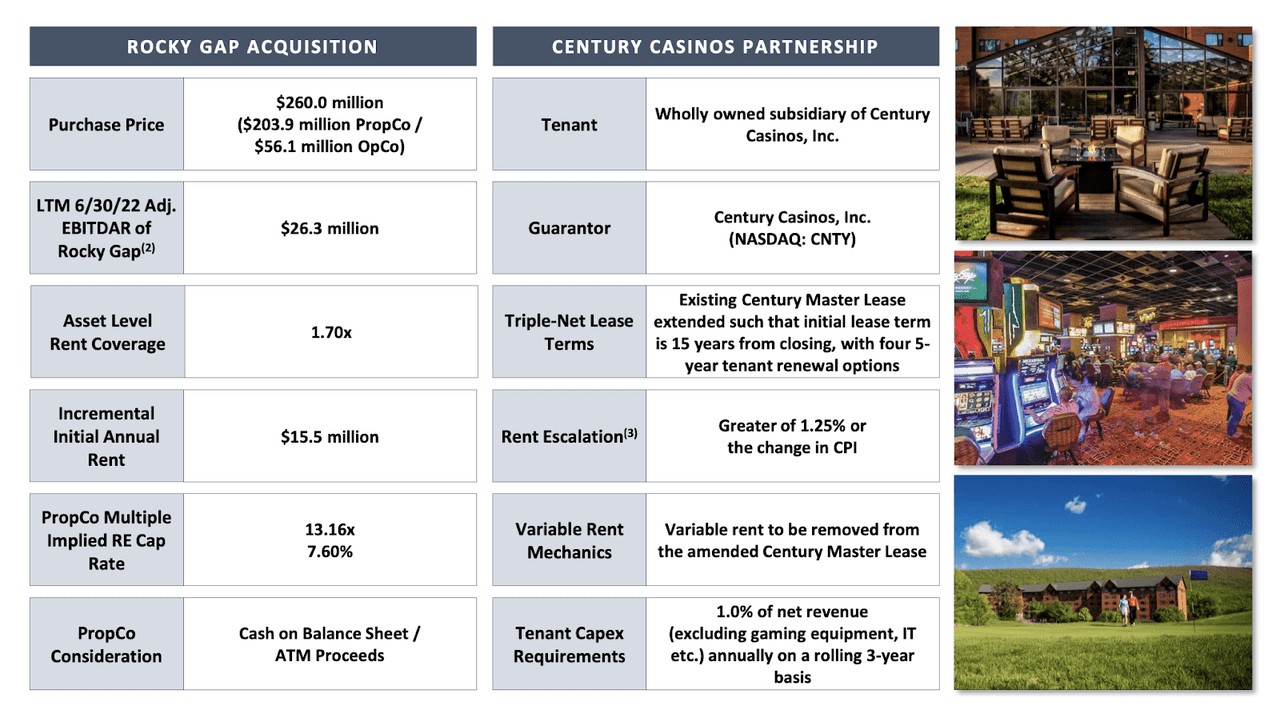

Bulls might point to the attractive lease terms in the casino real estate sector. VICI’s latest acquisition of Rocky Gap illustrates this, with rent escalations of 1.25% or change in CPI, a 7.6% cap rate, and 15-year lease term.

Rocky Gap Acquisition

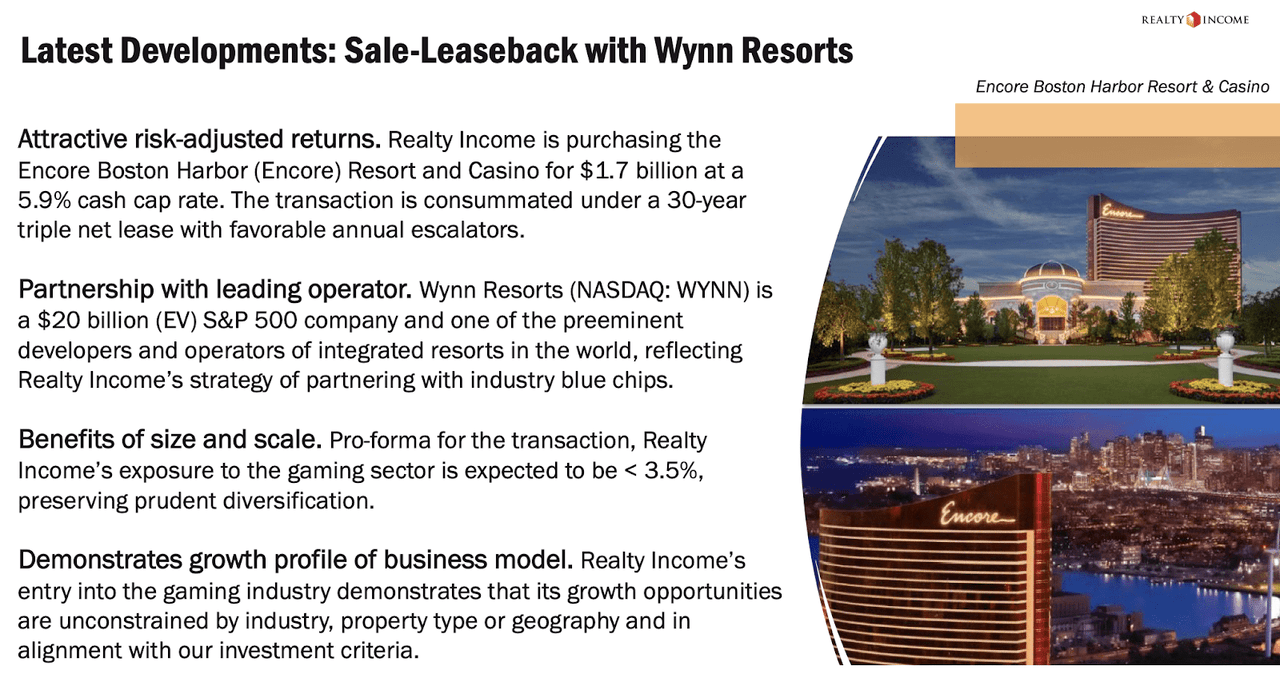

Those compare favorably with the 6% to 6.5% cap rates and 1% annual escalators reported by traditional NNN REIT peers. Furthermore, industry giant Realty Income (O) made a big splash into the sector with its $1.7 billion acquisition of Encore Boston Harbor Resort and Casino from Wynn Resorts (WYNN) at a 5.9% cap rate.

Realty Income 2022 Q1 Presentation

I wonder if some investors have been comparing that cap rate with VICI’s valuation and assuming some likelihood of an acquisition of VICI’s portfolio by traditional peers. VICI is trading at a 5.5% cap rate. That is surprisingly close to the 5.2% cap rate that O trades at. That is questionable considering that casinos remain highly leveraged tenants – the whole reason why they have begun engaging in sale and leaseback transactions was to help address their leverage positions. Furthermore, I view land-based casinos as facing secular headwinds from the rise of online gambling – not too dissimilar with the e-commerce risk facing mall assets.

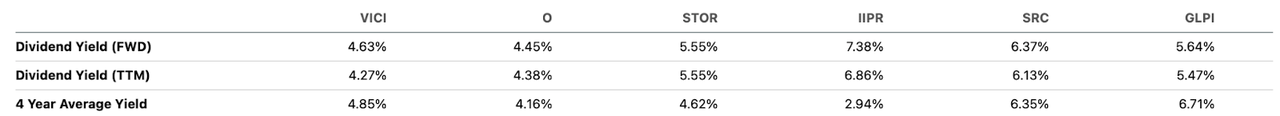

VICI’s dividend yield of 4.6% is also very close to O’s 4.5% yield and is lower than other NNN REIT peers like STORE Capital (STOR), Spirit Realty (SRC), Innovative Industrial Properties (IIPR), and Gaming and Leisure Properties (GLPI).

Seeking Alpha

It appears that VICI has earned a loyal if not enthusiastic investor base. I find its valuation to be overly optimistic, even inclusive of the attractive annual lease escalators. The acquisition cap rates are likely to come down moving forward, especially if O continues to enter the sector and also if other traditional peers eventually enter as well. I find it unlikely for O or any other company to acquire VICI at these valuations, as it would not be accretive enough relative to purchasing assets one by one on the open market. Forward growth rates are likely to hover around 5% or lower. I view a more appropriate risk premium to be at least a 1.5% yield to O, implying a dividend yield of 6% and stock price of $26 per share. I also note that if one likes VICI for the attractive lease terms, then IIPR – the cannabis landlord – looks like a better deal with far more attractive terms and a deeply distressed valuation. I rate VICI a hold.

Be the first to comment