Pgiam/iStock Unreleased via Getty Images

It seems counterintuitive that in the era of high inflation and record low unemployment that REITs have gotten cheap, but that’s the irrational market that we currently find ourselves in. While a recession is indeed risky for REITs with low quality assets, as what we have seen with such names as Washington Prime Group, those that hold prime real estate such as VICI Properties (NYSE:VICI) are built to not only survive but thrive. This article explores why the recent dip in VICI presents an excellent buying opportunity for this REIT and its world-renowned assets.

Why VICI?

VICI Properties is a REIT with a portfolio of premium gaming, entertainment, and hospitality assets. This includes renowned properties such as Caesars Palace, Bally’s Las Vegas, and The LINQ. VICI’s properties are known for their high-quality experiences and are located on prime real estate, making them “destination” attractions for their customers. It enjoys a 100% occupancy rate and 80% of its rent roll comes from S&P 500 (SPY) companies, which tend to have more access to debt and equity financing than smaller and private companies.

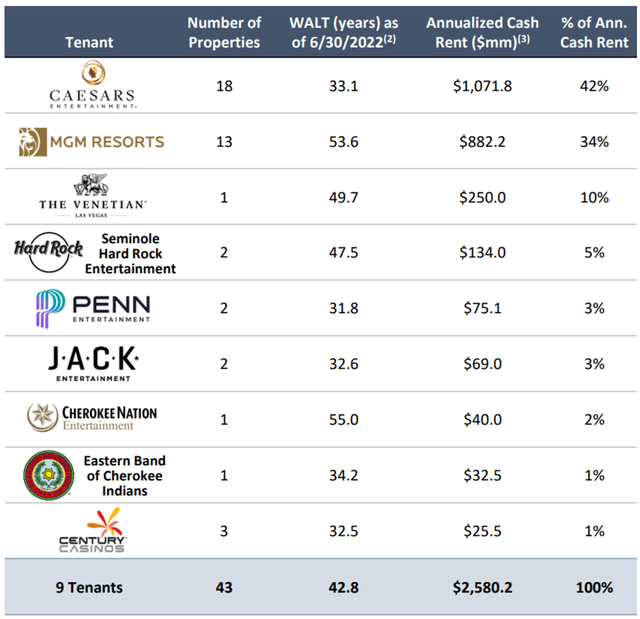

VICI recently completed a transformational quarter, in which it closed on its much anticipated acquisition of MGM Growth Properties, while receiving BBB- investment-grade ratings from both S&P and Fitch. As shown below, VICI has now reduced its reliance on Caesars Entertainment (CZR), from which it was originally spun off, to 42% of annual base rent, with MGM and Venetian rounding out the top 3 with an additional 44% of ABR.

VICI Tenant Mix (Investor Presentation)

True to form, 100% of VICI’s leases remain triple net after the acquisition. This results in higher margins and profitability, as this lease structure enables it to pass on property taxes, insurance, and maintenance to its tenants. Moreover, 90% of VICI’s leases come with Parent guarantees, and 79% of its rent roll has master lease protection. This means that a tenant with multiple properties can’t just let one property go into rent default, lest they risk all properties go into default.

Furthermore, VICI’s properties are irreplaceable in many ways, as they occupy prime real estate in locations with high barriers to entry. VICI also has ultra-long lease terms, which has a weighted average of 43 years, comparing favorably to the standard net lease REIT, which carries an average remaining lease term of around 10 years.

Importantly, VICI has demonstrated its ability to grow in an accretive manner, generating AFFO per share of $0.48 in the second quarter, beating the $0.45 consensus estimate, and rising by 9% from the first quarter and by 4% on a YoY basis.

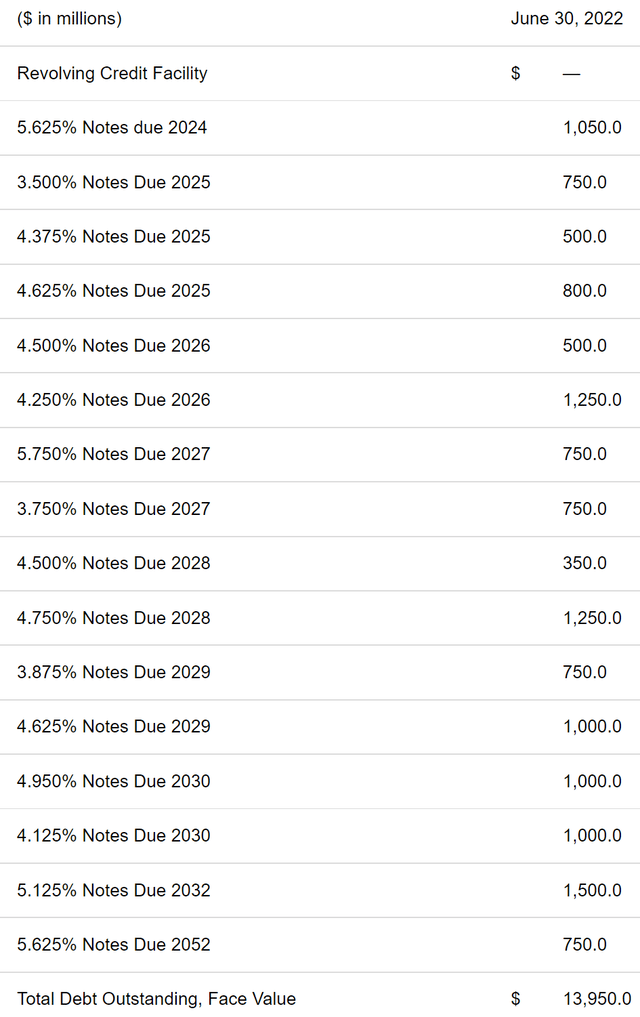

Risks to VICI include rising interest rates, which would raise its cost of debt. However, VICI’s balance sheet isn’t stretched by any means, with a debt to annualized EBITDA ratio of 5.8x, sitting below the 6.0x level that’s generally regarded as being safe for REITs. VICI also has plenty of available liquidity amounting to $4.5 billion as a buffer and for opportunistic investments. As shown below, VICI’s debt maturities are also well-laddered, meaning that it would take many years for VICI to fully realize the impact of higher interest rates, and by that time, rates could even go lower from where they are today.

VICI Debt Maturities (Earnings Release)

Looking forward, VICI has plenty of greenfield to continue expanding its asset base. This is reflected by its recent announcement last month of an agreement to provide a mezzanine loan for up to $127 million to indoor water parks operator Great Wolf Resorts for the development of a project in Texas. Also encouraging, management highlighted the overall resiliency of the gaming segment in face of a recession, as noted during the recent conference call:

Point number one, gaming consumer resiliency. As we have discussed in the past, the gaming customer has proven to be more resilient through both garden variety recessions, and full blown crises than just about any other discretionary consumer out there, that was proven through both the great financial crisis and throughout the COVID19 pandemic.

Point number two. Gaming operator resiliency. A couple of you on the sell side have produced well reasoned analysis that show the gaming operators generally, and many of our partners specifically will be in very solid shapes in terms of both free cash flow and balance sheet strength, even under fairly draconian recession scenarios in the year or so ahead. Our operators are responsive and agile in dealing with changing conditions. Both gaming consumer and gaming operator resiliency give VICI confidence in our belief that a possible recession will not harm the credit quality of our operators.

Meanwhile, VICI recently raised its dividend by 8%, and currently yields an attractive 5.1%. The dividend is also well protected by an 81% payout ratio (based on Q2 AFFO per share of $0.48). I also find VICI to be reasonably cheap after its recent drop from $35.53 in August to $30.72 at present with a forward P/AFFO ratio of 16.0x (based on $0.48 in Q2 annualized).

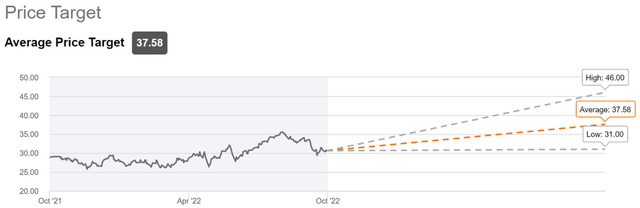

Given the asset quality of VICI, I would expect for the REIT to trade closer to P/AFFO closer to 20x. Sell side analysts have a consensus Strong Buy rating on VICI with an average price target of $37.58, implying a potential one-year total return of 27%.

VICI Price Targets (Seeking Alpha)

Investor Takeaway

The REIT has a high quality portfolio of gaming assets with long lease terms and is supported by a reasonably strong balance sheet. Importantly, VICI has demonstrated its ability to grow in an accretive manner, and has plenty of greenfield opportunities ahead. In conclusion, I believe VICI stock is an attractive pick for income investors after the recent drop, as it’s trading at a discount to what I believe as fair value.

Be the first to comment