Maxiphoto

Viatris (NASDAQ:VTRS) started trading publicly via a spinoff-merger. Ever since, the stock has been underperforming due to selling pressure. While the herd is running away, opportunities arise for value investors. In addition, the stock is tremendously undervalued compared to peers. Investors that invest with a margin of safety should consider Viatris as it offers an attractive dividend yield of 4.8%. More so, the firm is considering a buyback program after the biosimilars asset sale. Free cash flow remains strong to support shareholder returns and reinvestments.

Spinoff – Merger

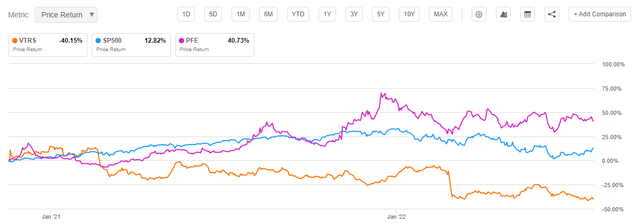

In November 2020, Viatris was formed through a merger of Mylan and Upjohn (a division of Pfizer (PFE)). Although Pfizer shareholders received shares of Viatris, a lot of them sold their shares as soon as they got them. As an example, institutional investors of large cap funds sold shares of Viatris, as they were obligated to sell their shares since Viatris is a mid cap stock. Consequently, the selling pressure started hammering down the stock once Viatris started trading on the Nasdaq. The stock is now down 40% from November 2020 as investors are still clueless about what to do.

Viatris stock performance (Seeking Alpha)

Value investors love to do the opposite of the herd. Therefore, Viatris might be a great example as there are many things to like. Chris Davis, a known value investor, has been growing his Viatris position towards a 3-3.5% weighting in the Davis New York Venture Fund. The fund has been slightly outperforming the S&P 500 in the last 40 years with a 12.16% annual return.

Strong free cash flow permits high dividend yield

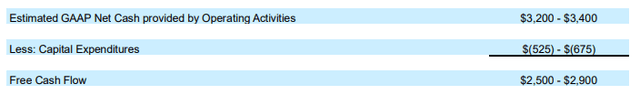

In Q1 2022, Viatris reported $1.07 billion of free cash flow. This was primarily driven by strong operating activities and the timing of capital expenditures. For the full year 2022, the company expects free cash flow to be between $2.5-$2.9 billion. On the other hand, the dividend payment is estimated to be around $580.4 million for the year (excluding a possible dividend increase).

This results into a 23% payout ratio of free cash flow for the bear case, giving the firm plenty of room to payback debt and reinvest into the business. Accordingly, the 4.8% dividend yield is relatively safe and already gives investors a great return on their investment.

FCF estimates 2022 (Earnings Report Q1)

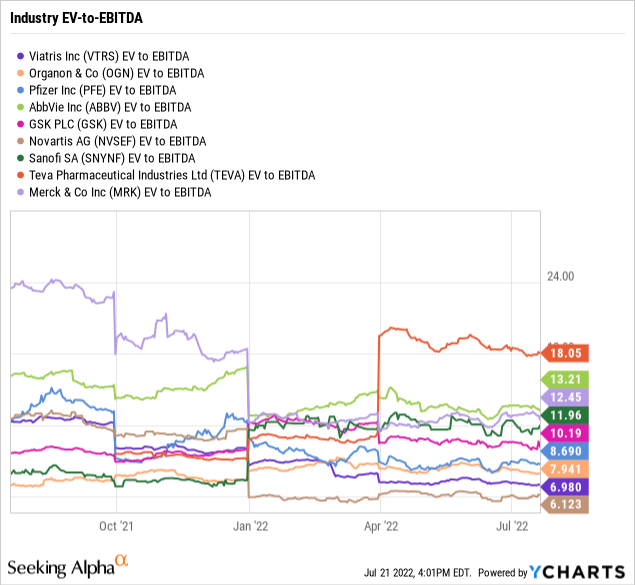

Attractive valuation compared to peers

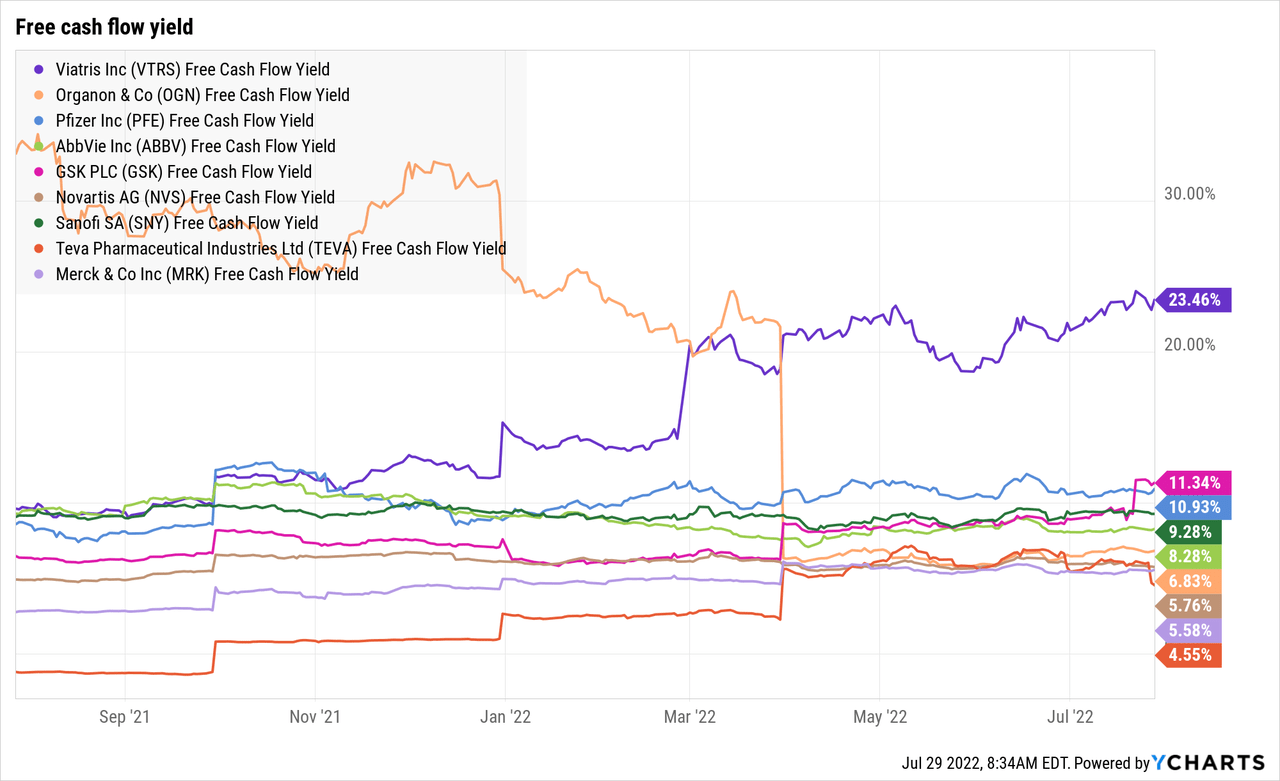

In the graphs below, I have compared competitors and peers of Viatris in terms of EV to EBITDA and free cash flow yield. EV to EBITDA gives us a general insight of how healthy a stock is. The companies that stand out the most are Viatris and Novartis (NVS), as both trade well below the industry average.

Since EV to EBITDA does not include capital expenditures it is important to bring free cash flow to the table. Capital expenditures can bite in the total free cash flow of a company and can decrease the potential funds for R&D or acquisitions. Viatris has by far the most attractive free cash flow yield and it is not even close. In consequence, the firm has much more room to reinvest in the business, pay down debt, pay out dividends and do share buybacks.

Restructuring opens up enormous buyback potential

In the beginning of 2022, Viatris announced a sale of their biosimilars portfolio to Biocon Biologics. The sale grants Viatris $2 billion in upfront cash, $1 billion of convertible preferred equity representing a stake of at least 12.9% in Biocon Biologics and up to $335 million of additional payments. Although the assets were sold at 16,5 times EBITDA, investors took the news extremely negative as this could potentially destroy the growth for the company.

But let’s not forget this company had a recent merger. Therefore, the most important factor must be synergy between the two companies, which can only be created when there is a convergent focus. Additionally, it frees up R&D, capital for reinvestments and share repurchases.

There are four criteria’s Viatris is currently focusing on, as the CEO Rajiv Malik mentioned at the Goldman Sachs 43rd annual global healthcare conference:

Can we unlock a trap value? Can we free up the capital? Can we simplify the Company? And do we have assets which are perhaps better in the hands of another focus player than one of the assets in our hand?

To offset the decrease in growth by the biosimilar sale, the firm is also looking towards a gradual and diligent increase in R&D investments.

Further, buybacks are very likely as the CFO Sanjeev Narula mentioned at the conference:

The proceeds that we will get $4 billion net of tax and net of that pay down from these divested assets will provide us enough fire power for share buyback, additional BD — develop BD and investing organically in the Company.

A $1 billion share buyback plan would create 8.5% shareholder value. Combine this with the dividend yield of almost 5% and the risk reward balance looks very favorable in these uncertain times.

Risks

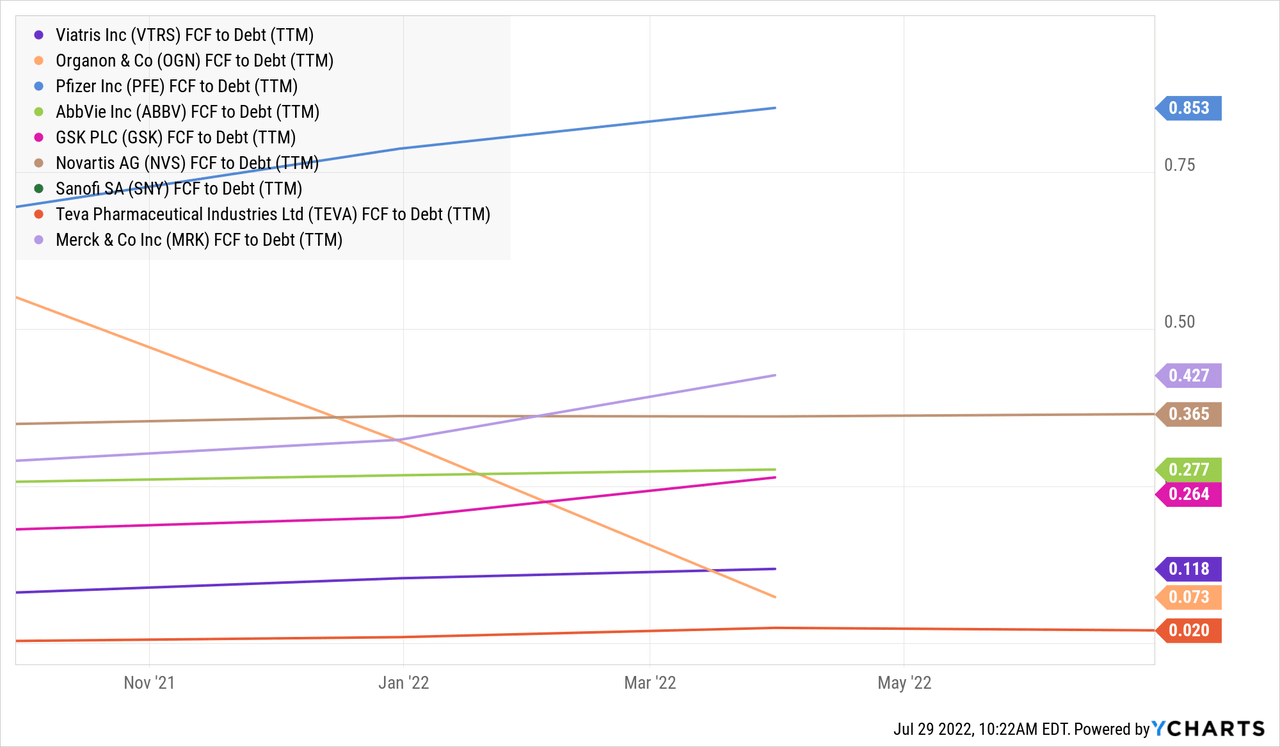

The two risks that are important to keep an eye on are the high level of debt and a possible decrease in free cash flow.

Being leveraged can amplify returns on investments and increase buying power, but too much leverage can create risky environments. Currently, Viatris is highly leveraged compared to their free cash flow, nonetheless the firm is proactively decreasing debt. For 2022, Viatris is on track to pay down $2 billion of debt.

A decrease in free cash flow could sink Viatris’s stock deeper down. Even so, one time costs from the merger are coming down, SG&A expense are decreasing and synergies between the two companies could perhaps increase free cash flow. The expected spending increase on R&D should also be favorable for the company as the CEO mentioned at the conference:

If you have tracked us for the last four or five years or six years, that’s what we have been spending, $600 million, $700 million in R&D and we have been getting $600 million, $700 million in annual launches. So, it’s a pretty good 1:1 payback if you spend over there.

Takeaway

I rate Viatris a Strong Buy below $10 per share. The risk reward balance is favorable for long-term investors. The dividend yield and the undervaluation are too attractive to ignore. Looking at the high free cash flow yield and EV to EBTIDA ratio, few peers are even close to Viatris. Additionally, The management team is aware of the risks and is proactively keeping them at bay. Finally, a buyback program can boost the stock price into a positive momentum environment.

Be the first to comment