imaginima

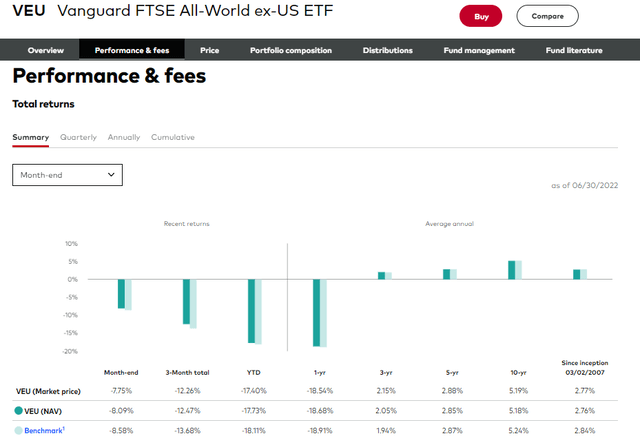

Foreign stocks have gotten clobbered recently. A surging U.S. dollar, now valued at the highest since late 2002, has sharply hurt relative performance among international equities. The Vanguard FTSE All-World ex-US ETF (NYSEARCA:VEU) is a popular low-cost index ETF to gain exposure to the world of stocks outside of the States. With an expense ratio of just seven basis points and solid intraday liquidity, many investors own VEU in both taxable and qualified accounts for long-term diversification. Unfortunately, it has been more like “de-worsification” as VEU’s 10-year annual return is a meager 5.2%, according to Vanguard Group.

VEU: Lackluster 10-Year Annual Returns

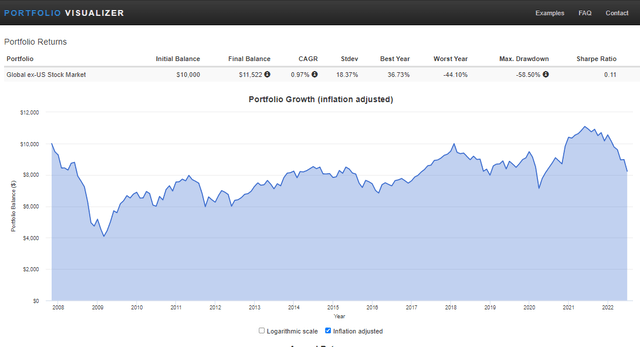

Moreover, an investor putting $10,000 to work in the international market on November 1, 2007, would have just $8,326 in real dollars, including dividends today, according to Portfolio Visualizer’s backtesting data. While U.S. stocks have surged over the past many years, it has been a dead decade-and-a-half for ex-U.S. investors.

15 Years of Dead Money

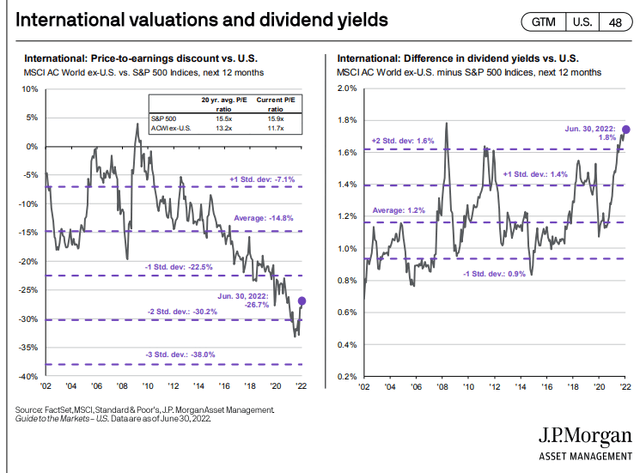

But could the times be a-changin’? Consider it’s widely assumed that foreign stocks are a better value than their domestic counterparts. According to J.P. Morgan Asset Management, the yield on something like VEU is a whopping 1.8% more than what you might earn on, say, the Vanguard Total Stock Market Index ETF (VTI).

MSCI All-Country World Index: Low P/E, High Yield

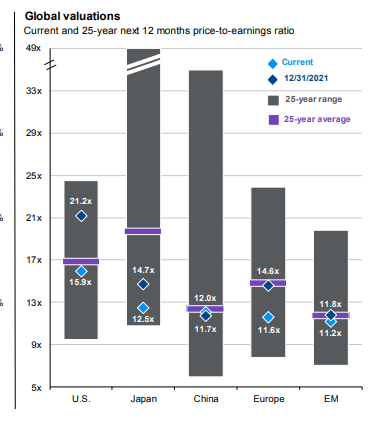

Ex-U.S. equities sport a P/E multiple of roughly 12x vs 16x for the U.S. market, per JPM.

Ex-U.S. Valuations Are Compelling

J.P. Morgan Asset Management

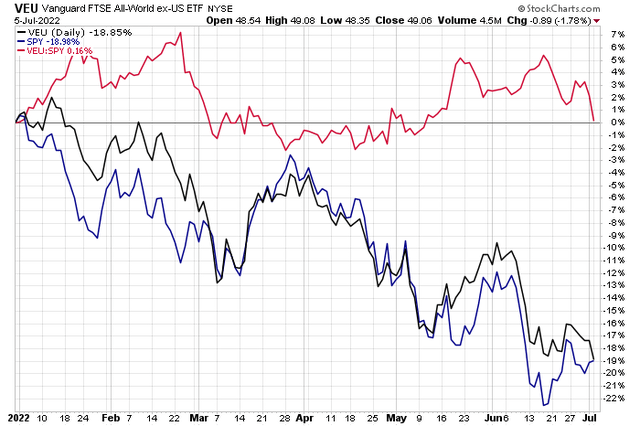

But how does VEU look right now technically? It has been an ugly 2022. The fund is down 19% on a total return basis through July 5. That’s a fresh year-to-date low while the S&P 500 has managed to rally and hold above its June low in the last few weeks. As resource stocks retreat sharply and Big Tech gains, along with a surging USD, VEU’s absolute and relative performances have suffered.

VEU & SPY Both Down 19% in 2022

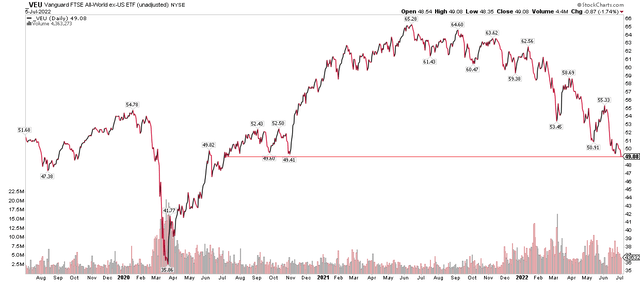

VEU now trades at its lowest level in two years. It has given back more than half of its 2020 through mid-2021 rally.

VEU: Lowest Since Mid-2020

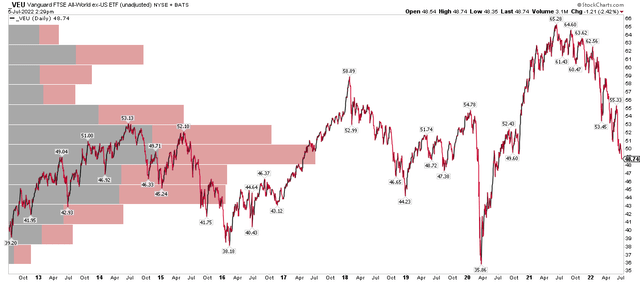

In fact, Ex-US stocks are right at their VWAP of the last 10 years.

VEU: Technically Significant Spot?

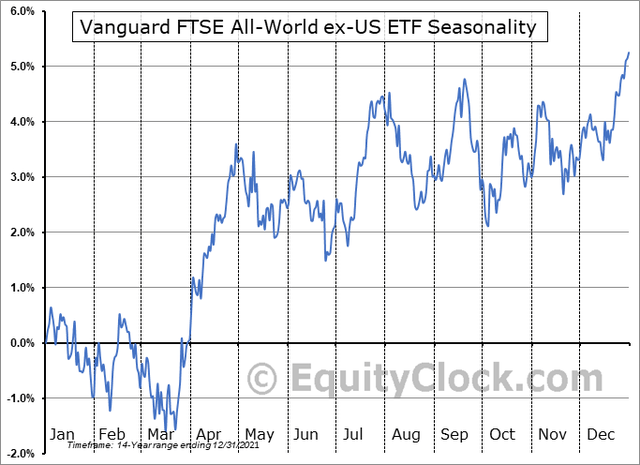

VEU actually tends to rally from early July through the end of the month before a choppy trendless action often happens until a late-year rally, according to Equity Clock.

Foreign Stocks: Often Choppy in H2

The Bottom Line

I think there’s long-term value amongst overseas stocks. With a historically low P/E and a dividend yield that is considerably higher than that of the S&P 500, it’s likely that the current nearly 30% drawdown off the high about one year ago is a great long-term buying opportunity.

I even assert that with shares trading at a technically significant area, at the highest volume-by-price range on VEU of the last decade, we could see some support here. Foreign stock market bulls want to see the greenback ease back, and a return to the value story would certainly be a relative tailwind.

Be the first to comment