April30/E+ via Getty Images

Introduction

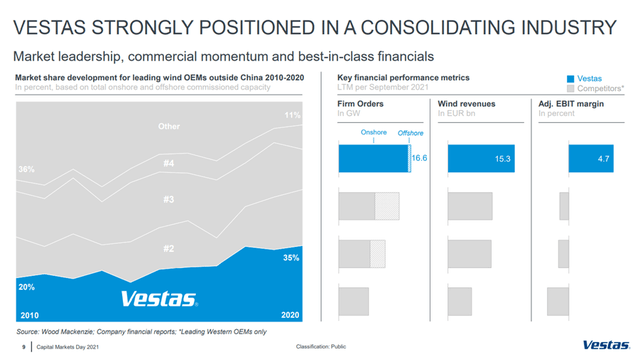

Vestas Wind Systems A/S (OTCPK:VWDRY) is a Danish manufacturer of wind turbines who also install and service the turbines. Employing more than 25.000 individuals and having held the number one spot in its industry more or less consistently in the last decade, effectively being one of the pioneers for especially onshore wind turbines. Depending on the given year, Vestas commands a market share somewhere between 15% to 20% and if the Chinese market is excluded (where local providers often win the projects) the market share can in some years reach north of 30%, at least when speaking of onshore installations. Vestas’ strong position is mostly in the realm of onshore installations, while it is trailing its competitors somewhat in the offshore segment, where Vestas originally sought a joint venture before repurchasing the full ownership back in October 2020. For the offshore segment, Vestas is also expecting a more difficult decade, but more on that later.

Industry conditions are tough, and margins are slim, to the point where many large competitors struggle to turn a profit while Vestas’ own margins have also taken a turn for the worse in the previous years, while yet to find a bottom which could calm prospective investors. The prime example would be the major competitor Siemens Gamesa Renewable Energy (OTCPK:GCTAF) who slashed its guidance more than once during 2021 and exhibits negative net income for the last two years straight and three out of the last five years.

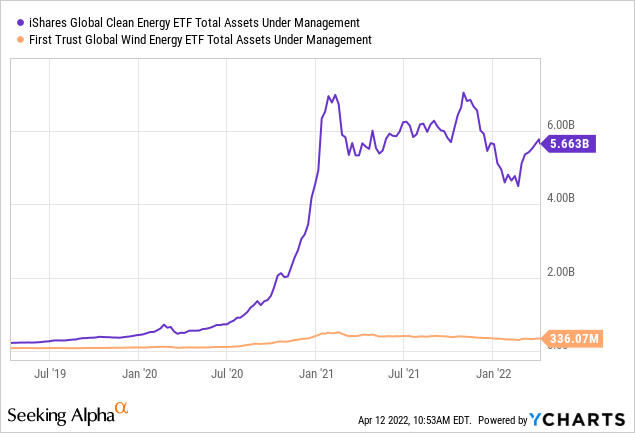

Due to Vestas’ market position and strong sustainability rankings, it’s a core holding with both the Global Clean Energy Index ETF (ICLN) and First Trust Global Wind Energy ETF (FAN), both of which I’ve covered numerous times. Holding such a position yields a helping hand to the stock as we’ve seen massive capital inflows in such ETFs in the previous years, as interest has grown concerning the renewables space, causing the ETFs to continue its purchase of Vestas stock no matter the underlying fundamentals for that given moment.

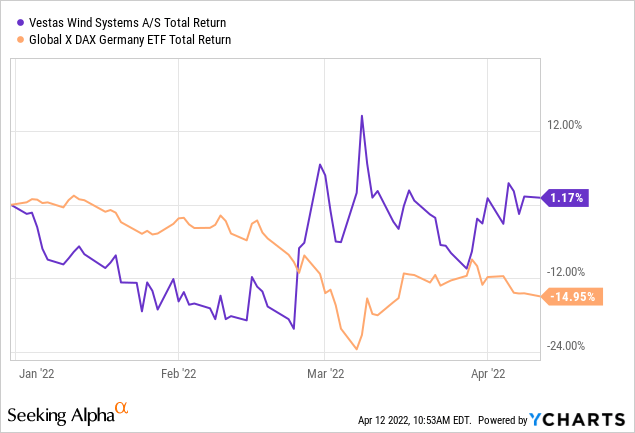

Investors must understand that while a stable old-school blue-chip company like Coca-Cola (KO) often trades with a beta lower than the market, e.g. showing less volatility than the market because it just trots along, a company like Vestas is exposed to the sun and rain of politics as much of the returns are expected in the future given the expected massive ramp-up in renewable energy sources. As such, when the Russian-Ukrainian war began, the western nations quickly communicated that they would rid themselves of Russian natural resource dependencies by for instance expanding their investment plans for renewables. As such, nations are expected to contract the window for when they expect to deploy investments, however, we are yet to see any communication underlining an actual increase in spending by the European nations. Vestas’ stock responded strongly compared to the neighboring stock index of Germany, as political indications such as this weigh heavily in favor of the company and added $8 billion to the market cap, which corresponds to somewhere between 8-15 years of historical net income depending on what year we use as a comparison while assuming the net income doesn’t stand to increase drastically – I’d say that’s quite a swing in the stock price. Point being, that the expectations surrounding Vestas are heavily influenced by the political agenda and willingness.

The Vestas Conundrum

Having tracked Vestas for years, I find there are strong arguments both for and against the investment case, and I’ll touch upon some of them here, while the rest have previously been covered in my other articles concerning either the company itself or the aforementioned ETFs.

- Heavily expanding marketplace suggesting CAGR of 7.2% between 2019-2050 for onshore installations and CAGR of 11.5% during the same time period for offshore installations, as indicated by The International Renewable Energy Agency. It’s important to understand the magnitude of something growing at such percentages for a period covering thirty years. Winners in the industry truly can become massive and should also be expected to capitalize greatly, even if profitability is challenged during these years.

- With a steep decline in its EBIT margin from above 12% in 2017 to 5.1% for FY2020 and 3.0% for FY2021 it indicates the company has a hard time making ends meet when matching its supply chain against its end selling price. The company consistently managed to grow its top line, but profits keep dwindling and while it is indeed hard times for any industry, that can’t be the sole reason for the continuous slip throughout those years, which also goes across the industry as a whole with Vestas being of the few who manage to turn a profit. Raising the question, what should investors expect when looking ahead, which ultimately impact the profitability expectations.

- The political climate changing ever in favor of accelerating the transition to renewables with a focus on solar and wind power. The Intergovernmental Panel on Climate Change, part of the United Nations, just released its most recent report indicating that the climate situation is worse than expected and calling for global action. On top, we have the annual climate conference, most recently hosted back in Q4 2021 where politicians are slowly but surely dipping their toes into the political lingo suggesting a need to ramp-up. However, we’ve also seen some of these annual conferences be deemed a flunk as it’s sometimes more talk than action as politicians inevitably must walk the fine line between committing and impacting citizens lives in domains where they know it may draw consequences at a coming election which is rarely more than a few years down the road. As such, there is an incentive for the individual politician pulling in more than one direction.

- Interestingly, the rush towards the green energy transformation also propels risk willing capital into other industries which may impact the long-term CAGR for wind power as indicated above. One example being the company Seaborg Technologies, a private Danish start-up focusing on developing the technology known as “small molten salt reactors” posing a nuclear alternative both much safer and much more sustainable than traditional nuclear reactors. Interestingly, it’s a novel technology back from the 60’s, which was pushed aside as it couldn’t provide weapons grade plutonium meaning the more well-known technology of graphite moderated reactors took center stage as the ability to stock up on nuclear weapons also mattered. The technology currently undergoing development poses a much safer use of nuclear technology while also holding the potential advantage of utilizing the existing nuclear waste being stored around the globe. How is that? Well it is related to the fact that traditional reactors don’t burn through much of the uranium in the rods before they have to be replaced due to the heavy particle bombardment during fusion processes, while this new technology holds the potential to consume almost the entire thing leaving close to no waste behind. Well, we can’t invest in that particular company at this point in time, but it underlines the fact, that other technologies could be on the rise impacting the marketplace of a company like Vestas, suggesting that it could be dangerous to buy the company at any given price. Here is a link to Seaborg’s webpage for those interested in understanding the idea and concept, with the company currently aiming for regulatory approval by 2026 with deployment by 2027. I’ve also inserted a link to a report written by the International Atomic Energy Associated where Seaborg is mentioned amongst others working on the same technology, but I should note that the report is rather old as it’s from 2016 meaning that some of the information concerning Seaborg is outdated.

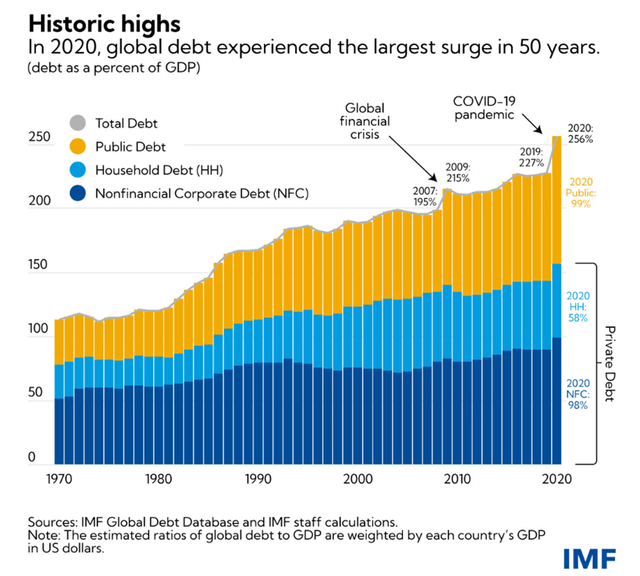

- The interest rate is always of interest in a marketplace such as the one being discussed here where growth expectations are high in combination with many of the decisions relying on a political commitment. A rising interest rate inevitably dampens investments as it causes a strain on financial balances of any given nation with debt. During the onset of the Covid-19 pandemic, many western governments in particular took on more debt with the 2020 global debt increase being the largest since the second world war. With financial conditions set to tighten due to the rising inflation, this could cause an adverse impact on the market development that Vestas is catering to which could decelerate the CAGR outlook. In the recent days, news outlets have had the chance to digest the recent FED minutes, showing that we may experience a more aggressive tightening of the monetary conditions than what was previously expecting as we see inflation at its highest in 40 years suggesting we will see a 0.5 percentage point increase sooner rather than later, which would be the first time since 2000 during the growing internet bubble.

Financial Performance

Vestas had a very difficult FY2021 with a slightly growing top line and a decimated bottom line.

Revenue grew 5.2% to €15.6 billion while net profit was reduced by 77% from €771 million to €176 million. Management spent especially the second half of the year talking into the growing supply chain and inflationary concerns as well as delays and larger than expected warranty provisions. This resulted in a combined EBIT margin of 3.0% down from 5.1% the year prior. If we look towards Q4-2021, the EBIT margin came in at 2.3% suggesting the pressure increased throughout the year and that 2022 could prove to be difficult. This also explains why management is guiding for a top line between €15.0-16.5 billion with an EBIT margin between 0-4%. The slashed income levels and guidance is also why Vestas is trading at a forward P/E of above 40. An additional 13.8 GW was added to the backlog of orders which is a reduction compared to the total for FY2020 which was 17.2 GW, however, I’m not too concerned about that part of the equation as it’s a little bit more unstable and that Vestas still has plenty of orders to fill, corresponding to more than a full years’ worth of production. While the manufacturing order book didn’t experience the same inflow as could have been hoped for, the services backlog grew 22% compared YoY.

Going all the way back to 2019, management has listed raw material price increases, logistic challenges, bottlenecks, rising warranty provisions, delays and general supply chain issues as headaches impacting profitability in an ever downwards moving spiral while consistently having guided too high on its forward EBIT margin levels. It has gotten to the point where it’s reasonable to question whether management is safeguarding operations sufficiently from all these external factors where it should be possible to mitigate somehow through contractual obligations, price hedging, quality improvements or otherwise.

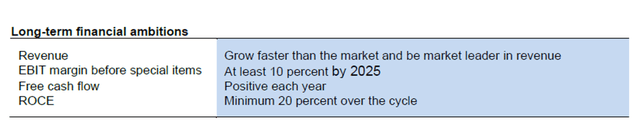

However, if we look towards the recent capital markets day in December 2021, it’s evident that Vestas is doing better than its peers and has been for some time. Being the largest and most well known in its industry bodes well for the possibilities for Vestas to regain its former income levels as once again suggested by management with its long-term ambitions. Consistently growing one’s market share while being the market leader clearly showcases value proposition and quality within products and services suggesting that Vestas will make it through the current hardship.

Vestas FY2021 Company Announcement

What The Future Could Hold

With Vestas delivering decreased profitability in recent years, it’s of interest to have a look at what the business could look like some years down the road, although it includes more uncertainty than certainty.

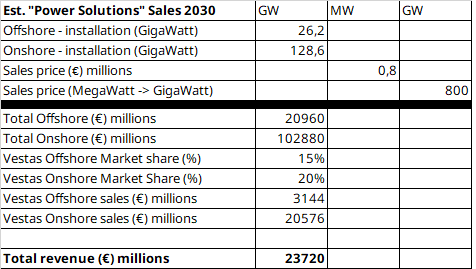

To obtain an understanding of potential future growth, we can make use of the estimates provided by The International Renewable Energy Agency suggesting that an additional 26.2 GW of offshore wind will be installed during 2030 combined with an additional 128.6 GW onshore wind in the same year. Utilizing Vestas’ average selling price in million euros per MW of 0.8 during FY2021 it would suggest a total market potential of €21 billion for offshore and €103 billion for offshore during 2030. Assuming a market share of 15% for offshore and 15% for onshore, Vestas would secure itself €18.5 billion in revenue during 2030 and if the onshore market share is adjusted to 20% it would result in €23.7 billion in revenue during 2030.

Authors own creation with numbers from Vestas Investor Presentation FY2021

This should be compared to FY2021 revenue from the power solutions (wind turbine manufacturing) business division of €13.1 billion. This would suggest a total revenue increase over the coming eight years between roughly 40% to 80%.

On top would be the service business which provided €2.4 billion in revenue FY2021 but also comes with a significantly higher EBIT margin at 24.1%, slightly down from the previous years. Currently, Vestas is servicing 129GW of installed capacity with 122GW being from onshore, something I’d expect to grow significantly.

As evident, Vestas has been struggling with profitability for its power solutions business division seeing the EBIT margin contract significantly landing at 1.5% for FY2021. It’s close to impossible to provide any reasonable estimate looking so many years ahead but assuming management can succeed in expanding the EBIT margin again to 5-8%, Vestas should be able to secure itself an annual EBIT between €1.1-1.8 billion with the service business on top. As the installed capacity expands, it works cumulative in terms of the service business as the sale of a wind turbine is a one-off while services can run between 10-30 years. As such, it’s not unreasonable to assume revenue could expand at least threefold during the coming eight years as global GW installed continues expanding. This would result in an annual revenue related to services of €7.5 billion with an EBIT margin of roughly 20-25% securing an EBIT between €1.5-1.8 for a total EBIT of €2.5 to almost €4.0 billion.

Vestas guides for a long-term EBIT margin of no less than 10% across both segments which would narrow the band towards roughly €3 billion across both segments, while also recognizing that there is a lot of variables to account for including market share, averages sales prices per GW as well as future margins.

In recent years, the tax rate for Vestas has been just above 20% and using that as a benchmark, the company could end with net earnings of somewhere between €1.5-2.0 billion also considering potential interest payments for a heavy industry company where working capital- and investment requirements are high. My back-of-the-napkin math here could be both too positive as well as conservative, maybe especially for the services segment where revenue could increase even more, however, a net income of roughly €2.5-3.0 billion would still result in a P/E relative to today’s market cap of 14-16.

There are so many variables it’s difficult to really get a grasp on how it may look at such an extended horizon, however, as the market grows, so should competition and scale economies suggesting that Vestas and its competitors can go lower on the revenue per sold GW of energy in order to win bids and tenders despite the fact the level has been stable in recent years. The prime motor for earnings appears to be within the service segment where it’s highly needed to run a tight ship in order for that division to fund future growth. Further, one shouldn’t exclude the potential for new business divisions to emerge as value drivers, something management is also highlighting as a path forward while the existing core will provide the financial muscle to ensure the possibility of introducing new growth drivers.

Vestas Capital Markets Day Presentation

Capital Markets Day, 2021

While Vestas is very strong in its onshore business, it expects to undergo heavy development and investment in its offshore business where it needs to improve both its supply chain, organization and technology resulting in fair activity in the coming years before activity is expected to decline towards 2025 before the investments should kick in and propel its offshore business towards being a market leader by the end of the decade – just in time to grasp the superior CAGR. As such, I see most uncertainty in estimating the offshore market share as the company faces strong competition in the fastest growing bit of the market which could attract more risk willing capital to challenge the incumbent market participants. Management expects the offshore business to contribute with €3 billion by 2025 which would suggest my 2030 assumption is much too low. While it is managements job to provide strong ambitions, it’s my job as an investor to remain skeptical within reason to try and gauge whether those ambitions are also reasonable, and it can’t escape my mind that management has been guiding to the wrong side of things in recent years.

However, given my estimates could very well be conservative, at least according to management itself, the year 2030 wouldn’t look too shabby for Vestas if the business can undergo positive development, and given Vestas’ current position as the market leader, there is little reason to expect this isn’t the safe bet in the industry.

Conclusion

My take-away from looking at Vestas, its performance and outlook, is that the case is attractive for the long-term but that there is limited upside in the short-to-mid-term by the simple fact that profitability is in shambles and that we need more information to understand how the offshore wind segment is expected to develop. Vestas experiences both strong tailwinds and headwinds from multiple angels related to politics, global debt, potential emergent technologies, and interest rates – all pulling in different directions. However, one variable appears stable, and that is the fact that Vestas is an industry winner poised to stay at the top of its food chain.

I’ve tracked Vestas for many years, but I’ve never felt the right moment was there, and for my sake, it isn’t here right now either. However, I wouldn’t mind owning shares via an ETF such as the ICLN or FAN, but in my personal situation I’m exposed via another ETF covering the Danish C25 Index with a current 5% allocation to Vestas, like that of the two previously mentioned ETF’s. However, should the right opportunity present itself, then I’d be interested in picking up this industry winner, but that would require at least a 25-30% haircut as I believe the uncertainties are simply too high right now even though the industry is booming.

Vestas remains a conundrum for a conservative investor such as me.

Be the first to comment