TexPhoto/E+ via Getty Images

Investment Overview

I gave Miami, Florida based biotech Veru Inc. (NASDAQ:VERU) a bullish rating in my last post on the company back in July based on a number of factors, but the main one was the biotech’s opportunity to win Emergency Use Authorization (“EUA”) for lead asset Sabizabulin to treat hospitalized COVID patients. Given the unmet need, this could potentially translate to a blockbuster (>$1bn per annum) revenue opportunity.

Sabizabulin is “an oral agent that targets and disrupts microtubules halting transport of viruses in the cell and cytokine release”, according to a recent Veru investor presentation, and although it was initially developed for, and remains in late stage trials for breast and prostate cancers, Veru opted to test its candidate as a therapy for COVID 19, based on management’s observation that:

microtubule depolymerization agents that target alpha and beta tubulin subunits of microtubules also have strong anti-inflammatory effects including the potential to treat the cytokine release syndrome (cytokine storm) induced by the SARS-CoV-2 viral infection that seems to be associated with high COVID-19 mortality rates. (Source: company 10K submission).

In February 2021, Veru reported data from a Phase 2 clinical study in which:

Sabizabulin treatment demonstrated an 82% relative reduction of mortality in hospitalized patients with moderate to severe COVID-19 symptoms who were at high risk for developing ARDS.

Veru subsequently initiated a pivotal Phase 3 trial in 210 patients who were hospitalized with COVID-19 and at high risk for Acute Respiratory Distress Syndrome (“ARDS”) – a life-threatening condition.

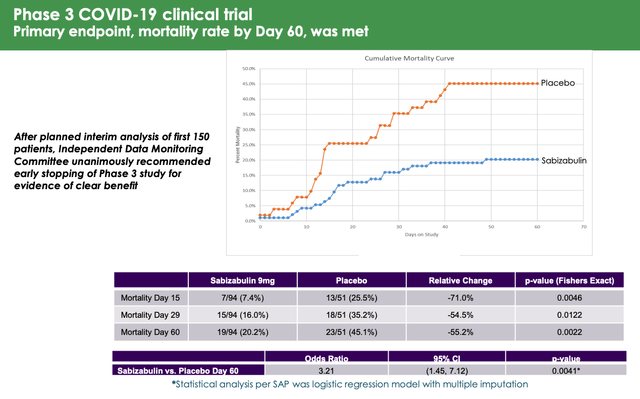

Once again, the data was positive – a planned interim analysis after 150 patients were treated either with standard of care (“SoC”), or SoC plus Sabizabulin showed that:

Sabizabulin treatment versus placebo resulted in both a clinically meaningful and statistically significant 55.2% relative reduction in deaths (p=0.0042) and no safety issues were identified. (Source: Q222 10Q submission).

These results suggest that Sabizabulin is a substantially more effective therapy for hospitalized COVID patients than current standards of care – namely the steroid Dexamethasone, Gilead Sciences (GILD) anti-viral Remdesivir, Roche’s (OTCQX:RHHBY) arthritis therapy Tocilizumab, Eli Lilly (LLY) / Incyte’s (INCY) Baricitinib, and Pfizer’s (PFE) Xeljanz – both indicated for autoimmune conditions.

When the data was published in April, Veru’s share price bounced from ~$4, to ~$15, and despite reporting an earnings miss in fiscal Q3’22 (Veru also markets and sells the FC2 Female Condom and Entadfi – an oral treatment for benign prostatic hyperplasia), management’s announcement that it expected to win an Emergency Use Authorization (“EUA”) for Sabizabulin to treat COVID briefly sent the share price >$23.

The events that have followed that announcement have likely frustrated Veru and its investors however. First of all, in September the US Food and Drug Authority (“FDA”) informed Veru that it had opted to convene an Advisory Committee (“AdComm”) to discuss the EUA application.

Veru may have hoped that its data alone would have been sufficient to garner an EUA, but now the data will face additional scrutiny from the FDA’s Pulmonary-Allergy Drugs Advisory Committee. The date was set for October 6th, but Veru announced on September 19th that the meeting had been put back to November 9th.

Veru promised shareholders a substantial rise in near-term revenues in its fiscal Q3’22 earnings press release, but now management cannot even be sure that it will secure its EUA. As such, Veru’s share price has slipped in value to $11 at the time of writing, which values the company at $870m.

There has been speculation that Veru’s data set may have been too small to persuade the FDA that an EUA should be given, although after the planned interim analysis, the Independent Data Monitoring Committee (“IDMC”) recommended the trial be halted due to “evidence of clear benefit to patients”.

Veru has also been the subject of reports from short sellers of its stock claiming that its Phase 3 study was deficient in many ways and its management ineffective. Let’s consider the evidence.

Was Veru’s Phase 3 Clinical Study Flawed?

Culper’s short report suggests that the 45% mortality rate of patients in the placebo arm of the study at Day 60 was far too high. Culper suggests that 20-25% would have been more in line with prior studies, and cites Gilead’s Remdesivir trial, in which mortality rates in the placebo arm at the highest risk level were only 20%.

The report also points out that Veru used 57 different sites for its Phase 3 study – the majority of which were outside the US. Apparently, 20 sites were in the US, 15 in Brazil, 9 in Colombia, 5 in Bulgaria, 5 in Argentina, and 3 in Mexico. The point here is that different countries have different standards of care and therefore it is difficult to evaluate performance. In Mexico, for example, Culper states that mortality rates from an initial COVID infection were ~6%, compared to just over 1% in the US.

Culper also compares the 150 patients evaluated in Veru’s study against other trials e.g., Lilly’s Bebtelovimab study – 1,634 patients, Pfizer’s Paxlovid – 2,246 patients, and Regeneron’s REGEN-COV study – >10k patients.

The short report compares Veru’s results with those released by the likes of Humanigen (HGEN) – whose Lenzilumab suggested 54% greater chance of survival in an early study, before more recently failing to achieve significance in a trial alongside Remdesivir – or Cyto-Dyn, whose study of a potential COVID therapy became subject to a clinical hold issued by the FDA and is now discredited.

Were There Mitigating Circumstances To Explain Away The Accusations?

One of the reasons that could possibly explain the difference in mortality rates between clinical trials is that Veru used a longer duration – 60 days – than other trials which were conducted over a shorter period.

Sabizabulin P3 study results (Veru Inc.)

As we can see above in a slide from Veru’s presentation at H.C Wainwright’s annual global investment conference, mortality rates were highest at Day 60 – at Day 29, in the placebo arm the mortality rate was 35%, which is more in line with other studies, although still on the high side. It would therefore be surprising if the FDA does not discuss this when releasing its briefing notes prior to the AdComm, and if it does not become a discussion point and potential barrier to approval.

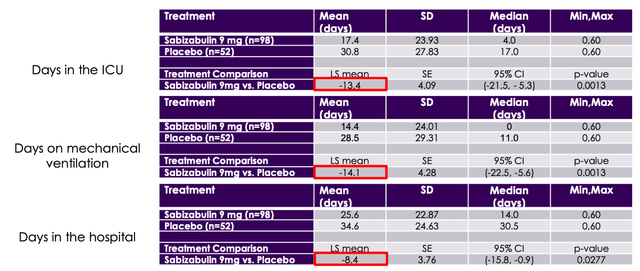

Perhaps more positive is the fact that Sabizabulin met its key secondary endpoints, of days in the intensive care unit, days on mechanical ventilation, and days in the hospital, as shown below.

secondary endpoints (Veru Inc.)

The argument has been made that Veru could have “cherry picked” healthier patients for the Sabizabulin arm, and the number of different trial locations makes it hard to standardize the data or “compare apples to apples”.

The data certainly looks compelling overall, and it shouldn’t be forgotten that an independent data committee saw fit to recommend the trial finish early based on evidence of clinical benefit. Again, however this seems likely to be a discussion point for the FDA’s AdComm.

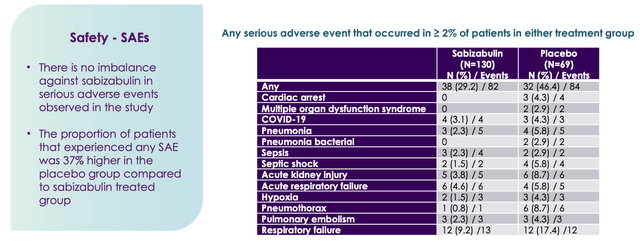

Another important consideration is the safety record, which in Sabizabulin’s case appears to be good.

Sabizabulin safety (Veru Inc.)

Sabizabulin compared favorably against placebo, so at the very least, unlike some other controversially products – Biogen’s (BIIB) Aduhelm, for example, controversially approved last year – patients using the therapy would not be risking damaging side-effects.

In summary, Sabizabulin’s trial data were so strong it was felt at the time that it would be unethical to continue to give patients placebo. Sabizabulin reduced risk of death by 55% in the key study, and met all of its secondary endpoints. But, why was the mortality rate so high in the placebo arm, and was there enough data collected from easily comparable trial sites? That is what the AdComm will need to consider.

It is also worth bearing in mind that the criteria for patients qualifying for the trial were as follows:

Key inclusion criteria: high risk for ARDS, hospitalized, WHO Ordinal Scale for Disease Progression ≥4 (requires supplemental oxygen), and oxygen saturation <94% on room air.

Would it be possible to “cherry pick” patients based on this criteria? Another question for the AdComm.

Did Veru’s Management Get Ahead of Itself?

Culper’s short report was heavily critical of Veru’s management team, accusing certain Senior Executives of being involved in “sham research” and CEO Mitchell Steiner of “pumping and dumping” style activities at his former company GTx – from whom Veru’s other lead candidate Enobosarm was licensed, apparently.

Back in May, Veru informed the media that its drug could have saved 500k lives had it been available at the start of the pandemic, whilst CEO Mitchell Steiner was quoted as saying:

Most companies get 18 months to launch a new product. We’re only going to get a few months.

This optimism was based on initially positive discussions with the FDA, it seems, but perhaps management did not consider that an AdComm would be arranged.

The FDA has also been inspecting some trial sites – 2 in the US have been investigated with no adverse findings, Veru told investors in the Q3’22 earnings call, but it may take more time to investigate the overseas locations, and the FDA is expected to look at 2 ex-US sites. Chief Scientific Officer Gary Barnette told analysts on the earnings call:

It does take a little longer for the FDA to schedule sites outside the United States for audit because of all the political things that have to go on with that. But we expect these sites to do very well in those audits… we do not believe that there’ll be any additional audit to clinical sites after these.

In answer to analyst’s questions around likely FDA inspections of manufacturing sites, Veru management was confident they would not be required.

Apparently, Sabizabulin’s API is manufactured by the same company that make Merck’s COVID anti-viral Molnupiravir – Olon Ricera – which has sites in the US and Italy. Management expects there to be no investigation here, given it was inspected as part of the Molnupiravir approval process, and no inspection either at the facility – CoreRX – that puts the drug product into capsules, which also makes Veru’s Entadfi. Finally, a packaging manufacturing facility based in the US was apparently investigated recently with no issues reported.

In terms of the market opportunity, Sabizabulin could potentially be approved in the UK and Europe, with Veru already in discussions with the European Medicines Authority (“EMA”) and the Medicines and Healthcare products Regulatory Agency in the UK, who will choose whether or not to approve the drug independently from the FDA. Korea is potentially another market, with CEO Steiner telling analysts that Sabizabulin has been discussed in the media there.

According to PharmaVoice, Steiner said in May that:

Veru has enough doses for 57,000 patients ready, will make enough for another 100,000 patients in August, and then ramp up to producing a 250,000-patient supply in September.

After that, Steiner apparently believes Veru can treat 1m patients every 4 months. The CEO has frequently compared Sabizabulin’s revenue opportunity to Remdesivir, which earned ~$5.6bn in 2021.

Veru reported $101m of cash as of Q322, net revenues of $9.6m – down from $17.7m in the prior year, and a net loss of $22m.

Conclusion – High Unmet Need And Excellent Trial Results May Be Undermined

I find it tricky to make a call on whether Veru can win an Emergency Use Authorization for Sabizabulin. In some ways the situation is comparable with e.g. Amylyx’ recent win for its Amyotrophic Lateral Sclerosis drug Relyvrio.

Amylyx was able to gather Phase 2 clinical study data suggesting that its drug improved patients cognition and mobility, but the FDA found several inconsistencies in the data, and questioned some of Amylyx’ conclusions.

Ultimately, the FDA handed Relyvrio accelerated approval, with the caveat that the drug would be withdrawn if it failed to meet endpoints in a larger Phase 3 trial.

Obviously, Veru already has Phase 3 study data, but I would not necessarily be surprised if the FDA asked or more data from a further trial in order to confirm the efficacy of the last trial.

That would make things difficult for Veru which is apparently relying on Sabizabulin COVID revenues to fund its breast cancer and prostate cancer studies of both Sabizabulin and Enobosarm (discussed in more detail in my last note on the company). Sales of the company’s female condom are falling, and although management believes that Entadfi sales can explode, there is not necessarily compelling evidence for this.

The initial optimism around a rapid EUA for Sabizabulin in hospitalized patients had been stymied by the time taken for the FDA to complete its reviews and arrange an AdComm, although we may see a decision either way on the EUA before the end of the year.

A drug that can obtain better results than the existing SoC’s is still very much required, and Veru management insist everything is in place to roll out a solution as soon as permission is obtained. The company will apparently not have to pursue reimbursement for Sabizabulin since that is the hospital’s responsibility, and management believes that hospitals will buy the drug in similar quantities to Remdesivir.

Although short reports are obviously deigned to spread fear, uncertainty and doubt (“FUD”), based on the risk/reward profile as I see it I would probably opt against buying Veru stock at this time. Others will doubtless disagree, and the upcoming AdComm will hopefully clarify matters as we get to hear expert opinions on the matters at hand – although it should be noted the FDA does not necessarily have to follow the recommendations of its AdComm.

Be the first to comment