IGOR KUTNII/iStock via Getty Images

Investment Thesis

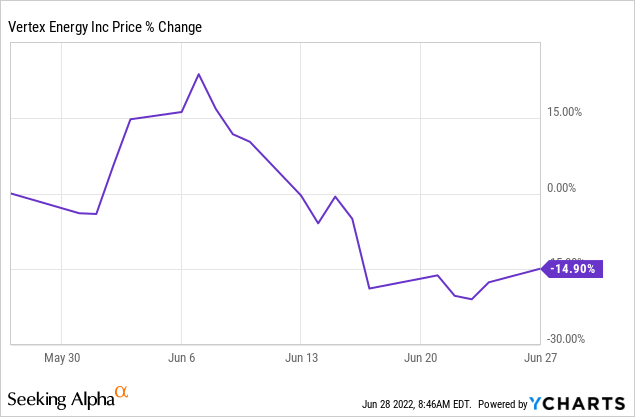

Vertex Energy (NASDAQ:VTNR) has been a very volatile stock, with its share price tumbling more than 30% from recent highs.

Meanwhile, the underlying business is not only ticking away, but it’s actually very nicely positioned for a strong refining pricing environment.

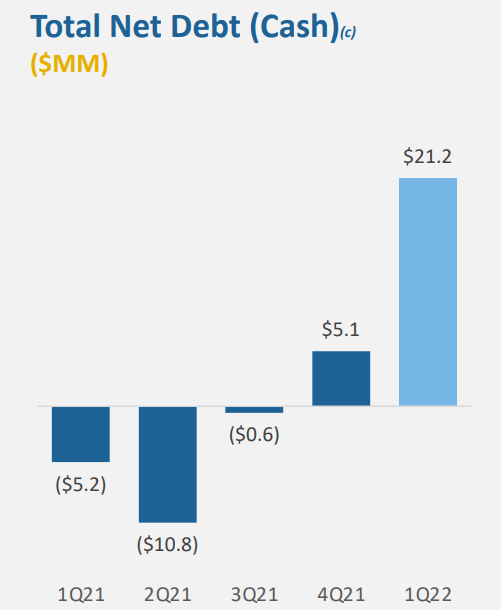

Vertex Energy carries a net neutral balance sheet, where its cash and debt roughly equal each other.

Altogether, at approximately 3x next year’s free cash flow, I believe the stock is very cheaply valued.

Hence, I rate this stock a buy.

Vertex Energy’s Near-Term Prospects

Vertex Energy is an energy company focused on the production of refining fuels.

Vertex is 50% hedged through its recently acquired Mobile refinery business. This substantially hedged book plays both ways. It provides the business with significant visibility, something that is often lacking amongst oil companies.

But at the same time, when refining prices are widely reported to be so high, given tight global distillate markets together with low domestic inventories, its hedged book gets in the way of maximum exposure to the strong pricing environment.

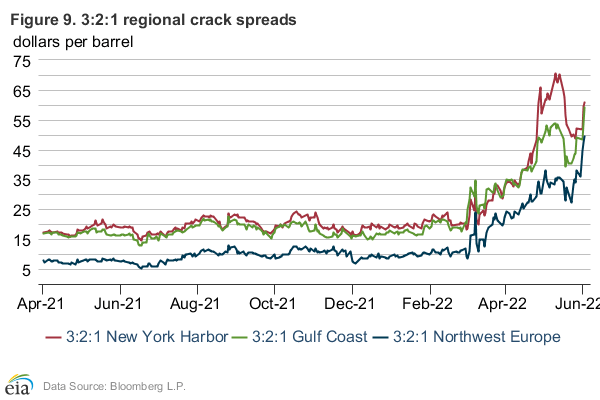

EIA

As you can see above, for June the 3:2:1 Gulf Coast crack spread appears to have reached $60 per barrel.

Meanwhile, investors have become increasingly fretful over demand destruction. Investors appear to have become so concerned about this potential, that as soon as the Wall Street article announced that the Fed was going to raise interest rates by 75 basis points, on the 13th of June, it correlated with Vertex’s share price selling-off.

Indeed, the discussion of demand destruction has been going on for a while now. And on it goes. However, presently refining prices only appear to be moving higher.

At some point, prices will come down. But for refining prices to come down, there needs to be an increased amount of supply to at least match demand. And that appears to be nowhere to be seen.

Capital Allocation Strategy?

Vertex has a net neutral balance sheet. This means that its cash and debt largely equal each other. This puts the company in a very attractive position to return meaningful amounts of capital to shareholders.

Vertex Q1 2022 presentation

That being said, during the earnings call, Vertex made no allusion to any near-term capital returns program.

On the other hand, keep in mind that when Vertex made its acquisition of Mobile Refinery, the plan had been to deploy capital back into the business to grow its hydrocracker conversion project.

It was an unforeseen set of events that led Vertex’s conventional fuels business to end up taking the limelight on the bull case.

Consequently, Vertex contends that its plan continues to be to adequately capitalize on its Mobile Refinery operation and solidify its renewable diesel production opportunity.

VTNR Stock Valuation — Priced at 3x 2023 Free Cash Flows

As alluded to already, Vertex has a 50% hedged book that provides its business with a significant amount of visibility.

Accordingly, Vertex feels sufficiently comfortable with its operations to guide for $280 million of free cash flow at the high end of its 2023 estimates.

This puts the stock priced at 3x next year’s free cash flows. This is clearly a very cheap multiple, particularly when we consider that its balance sheet is strong.

This is meaningfully cheaper than many of its peers, such as Phillips 66 (PSX) and Valero (VLO).

The Bottom Line

Was it Vertex’s vision or was it luck that led to Vertex acquiring its Mobile Refinery business? Realistically, it doesn’t even matter now. Vertex doesn’t need to repeat the success of this acquisition for its shareholders to be very well rewarded.

Vertex is priced at approximately 3x next year’s free cash flows. This is unquestionably a cheap multiple, particularly when you keep in mind that 50% of its operations are hedged already.

Arguably the one aspect holding back this stock is the lack of capital returns. But at 3x next free cash flows, at a lot can be forgiven.

Be the first to comment