Evgenii Mitroshin/iStock via Getty Images

Due to the increased oil and natural gas prices, energy companies benefited from the market condition in the last year. Because of significantly higher funds from operations in the European Union, Vermilion Energy Inc. (NYSE:VET), an international oil and gas producer based in Canada, reported one of the highest FCF yields (35%) compared to peers in the first quarter of 2022.

The war in Ukraine is still going on, and Gazprom (OTCPK:OGZPY) (OGZPF) (OTC:GZPMF) announced it would cut its natural gas flow to Europe. Thus, I expect VET’s average realize prices to increase in the following quarters. Vermilion Energy’s well-performed cash and capital conditions indicate the company’s ability to increase its yield and bring returns to shareholders. I estimate that the stock is undervalued and has an upside potential of 80% to reach about $40.

1Q 2022 highlights

In its 1Q 2022 financial results, VET reported funds from operations (FFO) of $390 million, or $2.40 per diluted share, compared with 1Q 2022 FFO of $162 million, or $1.02 per diluted share. The company’s petroleum and natural gas sales increased from $368 million in 1Q 2021 to $810 million in 1Q 2022, up 120%. VET reported 1Q 2022 net earnings of $450 million, or $3.15 per diluted share, compared with 1Q 2021 net earnings of $284 million, or $1.75 per diluted share. Vermilion’s free cash flow increased from $79 million in the first quarter of 2021 to $305 million in the first quarter of 2022.

Also, VET’s net debt decreased from $1938 million in 1Q 2021 to $1365 million in 1Q 2022. From the operational perspective, VET’s total production did not change from 1Q 2021 to 1Q 2022. However, in the first quarter of 2022, VET’s average realized price for crude oil and condensate (bbl), NGLs (bbl), and natural gas (mcf) increased by 69% (YoY), 60% (YoY), and 216% (YoY) to $120.23, $46.94, and $17.41, respectively.

The market outlook

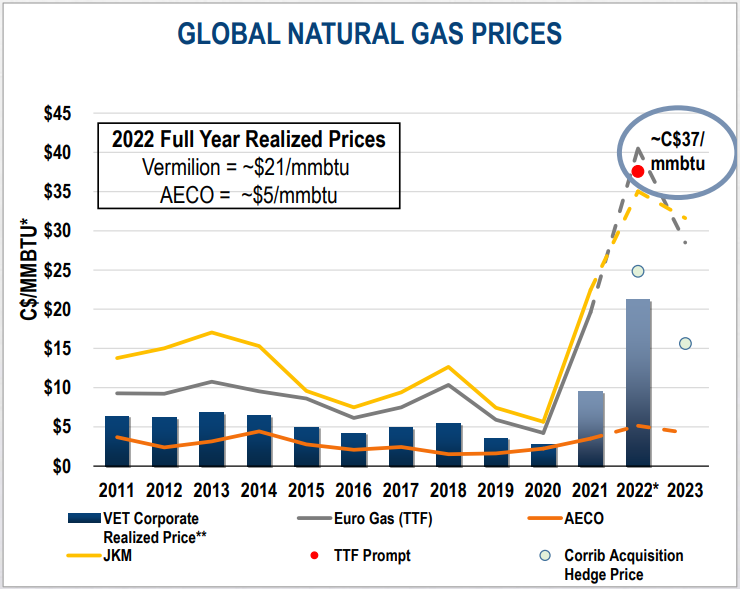

European Union natural gas import price increased from $1.575 per MMBtu on 31 May 2020 to $6.127 per MMBtu on 31 May 2021, and to $29.85 per MMBtu on 31 May 2022. In 2021, Russian natural gas accounted for 40% of EU gas demand. However, due to the Russia-Ukraine war, Russia has decreased its natural gas exports to the European Union.

Also, Gazprom, the Russian company, announced that natural gas flows through the Nord Stream pipeline to Germany will decrease again. As a result, European gas prices jumped more than 50% over the past week. Because of geopolitical tension in Europe, low domestic storage capacity in the region, declining European domestic production, global competition for LNG, and increasing European carbon pricing, VET sold its products at a significant premium to the North American benchmarks (see Figure 1).

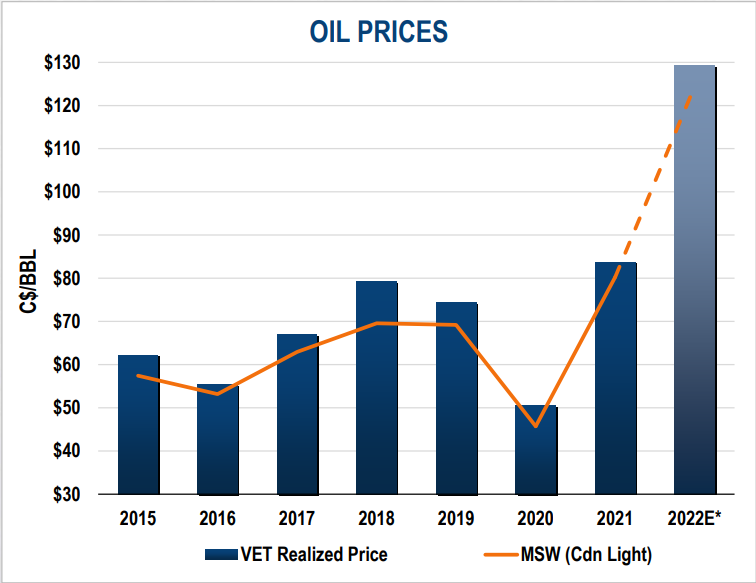

Also, WTI crude oil price increased from $71 per barrel on 17 June 2021 to $116 on 16 June 2022. Figure 2 shows that Vermilion expects its oil realized price to rise more than 50% in 2022. Also, it shows that over the past seven years, VET has sold its crude oil at a premium to the Canadian light oil benchmark (MSW). The company expects to sell its crude oil at about a $7/bbl premium to MSW in 2022. As EU leaders agreed to ban Russian oil imports by 90%, Vermilion can even sell its crude oil at a higher premium to MSW in 2022. Moreover, as west sanctions against Iran are continuing, I don’t expect natural gas and oil prices to fall.

Thus, the market condition is in favor of Vermilion. VET’s total FFO increased from $21.66 per barrel in 1Q 2021 to $50.79 per barrel in 1Q 2022. In Canada and United States, VET’s FFO increased by 73% and 28%, respectively. On the other hand, VET’s FFO in France, Netherlands, Germany, Ireland, and Australia increased by 99%, 339%, 907%, 384%, and 44%, respectively. As the war in Ukraine and sanctions against Iran are still going on, I expect VET’s FFO to increase. I don’t see tensions between the United States and Iran calming down. However, make sure you keep an eye on the tensions in Europe. For the full year of 2022, VET expects production of 86000 – 88000 boe/d and E&D capital expenditures of $500 million. VET’s total production was 86213 beo/d and 86276 Boe/d in 1Q 2022 and 1Q 2021, respectively. Thus, in terms of production, VET will not increase its production significantly. However, its FFO will increase in the following quarters due to the higher average realized prices.

Figure 1 – Natural gas prices

VET’s 1Q 2022 presentation

Figure 2 – Oil prices

Vet’s 1Q 2022 presentation

VET stock performance

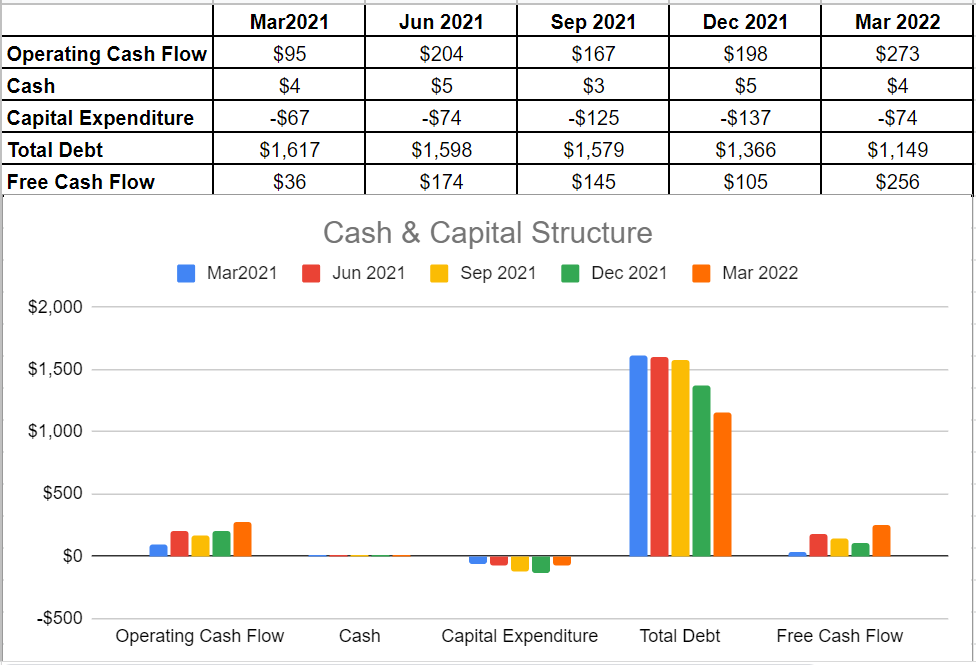

As can be seen from VET’s cash flow performance, the company’s operating cash flow of $273 million during the first quarter of 2022 is about triple year-on-year compared with its level of $95 million during the first quarter of 2021. Also, the company’s free cash flow grew by 37% compared with the amount of $198 million at the end of 2021. Coinciding with strong oil and gas prices during the last quarter of 2021, Vermilion Energy could achieve a full recovery after the COVID-19 pandemic: VET’s free cash flow boosted impressively to $256 million compared with its level of only $36 million at the same time in 2021. Therefore, the company can put some of its money to work by paying down more debt and bringing more returns for shareholders.

The management commented that they have planned to direct free cash flow to debt reduction. The company’s total debt was $1.14 billion at the end of 1Q2022. The oil and gas industries are very volatile due to the volatility of their global prices, and in volatile industries, investors look for a higher dividend. In a word, Vermilion Energy’s well-performed cash and capital conditions indicate the company’s ability to increase its yield and bring returns to shareholders (see Figure 3).

Figure 3 – VET’s cash and capital structure (in millions)

Author

Despite being volatile due to the fluctuations of commodity prices, Vermilion Energy could provide guidance for 2022. In the company’s guidance, the management forecasted that they would generate immense free cash flow of C$1.9 in 2022 based on their current hedges. This forecast is based on oil prices averaging about $100 per barrel. Analyzing the free cash flow yield based on the market capitalization of C$4.26 billion indicates that VET’s free cash flow yield is about 44%. This yield ensures the company’s ability to provide returns for shareholders in 2022.

VET stock valuation

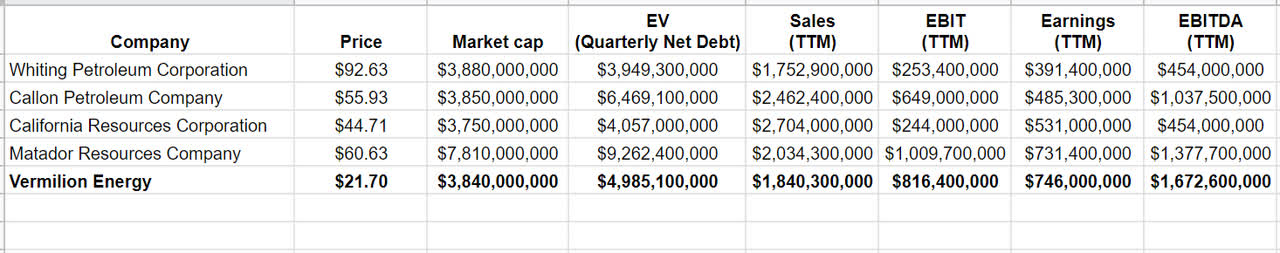

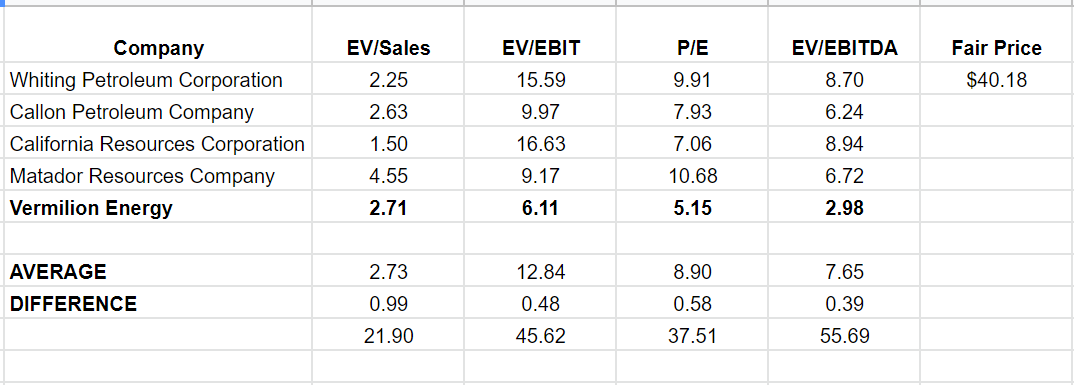

I used Competitive Companies Analysis (CCA) to evaluate VET stock. Comparing Vermilion Energy with other peer competitors and using the CCA method, I estimate that the stock is undervalued and has an upside potential of 80% to reach about $40. Based on market cap and financial operations, I selected its peers and used common key ratios in a CCA method to illustrate the value of similar companies. Data was gathered from the most recent quarterly and TTM data (see Table 1).

Table 1 – VET financial data vs. peers

Author (based on Seeking Alpha data)

Comparing VET’s ratios with other peer companies, I observe that the stock is undervalued – VET’s EV/Sales ratio is 2.71x, which is in line with the group’s average of 2.73x. Also, the company’s EV/EBIT ratio is 6.11x, which is about half of the peers’ average of 12.84x. Moreover, VET’s P/E ratio equals 5.15x, which is 42% below the average of 8.9x. These ratios indicate that the company is attractive as a potential investment (see Table 2).

Table 2 – VET stock valuation

Author

Summary

In terms of the market outlook, VET still can benefit from the high oil and natural gas prices as it did in the last few quarters. In terms of capital structure, Vermilion Energy’s well-performed cash and capital conditions indicate the company’s ability to increase its yield and bring returns to shareholders. Finally, in terms of valuation, the stock is undervalued and has an upside potential of about 80%. VET is a strong buy.

Be the first to comment