imaginima/iStock via Getty Images

(All figures in CAD $ = $)

VET – Business Model:

VET is a commodities company active in the oil and gas exploration, production, and acquisition. There are two main segments of North America (USA + Canada) and International (Europe + Australia). The company’s operations are focused on the exploitation of light oil and liquids-rich natural gas conventional resource plays in North America and the exploration and development of conventional natural gas and oil opportunities in Europe and Australia.

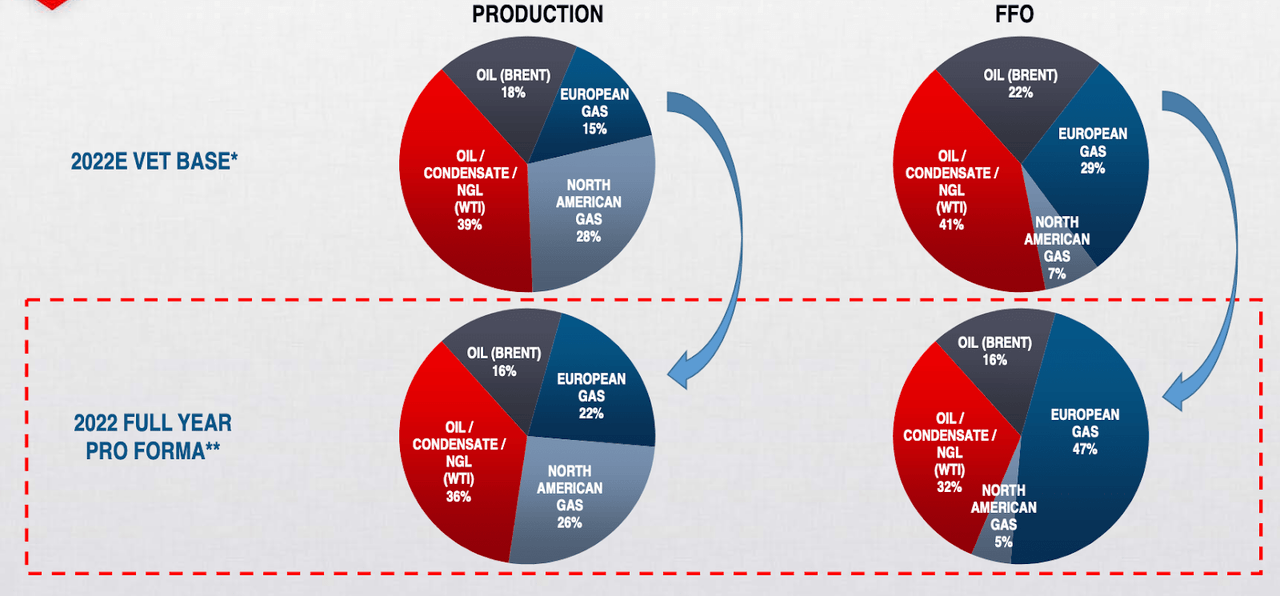

To highlight from the chart below is the high production to FFO translation of European gas. This implies VET generates the highest margin due to elevated prices and 29% of European production translates to a 47% share of FFO.

Production and segment split (VET presentation LEX acquisition )

After the most recent acquisition of Leucrotta intl. Production will still account for 36% with an FFO share of 58% and FCF of 68%.

For additional information about the business model, I would refer you to other articles written about VET.

FFO And FCF:

Guidance changes – steady increases:

With the Corrib Acquisition during Q4 2021 VET updated its initial guidance with the following:

-

FFO: FFO FY 22e of >1.45bn including Corrib & 1.1bn w/o Corrib

-

FCF: FCF FY 22e of >1bn including Corrib & FCF >1bn w/o Corrib

-

Debt reduction: FCF FY 22e will be used for debt reduction to get to ~0.9x at YE 2022

-

Production level:

This was further updated with the latest acquisition of Leucrotta Exploration (LEX) for a total net cash consideration of 477m.

-

FFO: FFO FY 22e of >2.4bn including Corrib & Leucrotta

-

FCF: FCF FY 22e of >1.9bn including Corrib & Leucrotta

-

Debt reduction: remaining FCF FY 22e will be used for debt reduction to get to net debt/ FFO ~0.4x at YE 2022 and a total net debt level of .9bn

-

Production level:

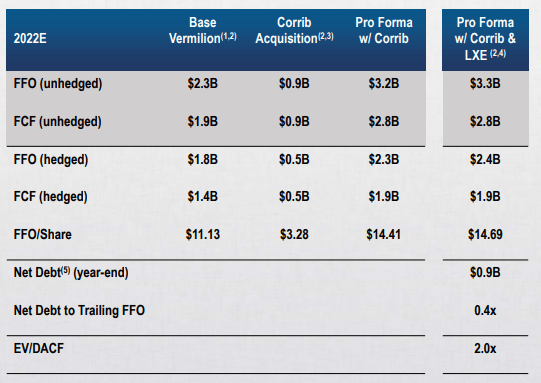

Furthermore, VET discloses unhedged FFO figures FY 22e of 3.3bn and FCF FY 22e 2.8bn – however, hedged FFO FY 22e is at 2.4bn and FCF FY 23e of 1.9bn – as shown in the latest presentation:

Guidance hedged and unhedged (VET presentation LEX acquisition)

(Presentation of March 28th, 2022, following Leucrotta acquisition)

Implied valuation FFO and FCF:

At current equity valuation of 25.5 per share and total market cap of 4.2bn this would yield ~45% FCF yield and ~ 57% FFO yield. This is the hedged scenario for FY 22e. However, unhedged this could increase to 2.8bn in FCF, implying a 78% FCF yield at current valuation. At an EV of 5.9bn, VET could buy back the entire company in less than 2 years – hypothetically.

But VET only hedges a small amount of their production – for FY 23e there are around 10% hedged. If growth slows – esp. In China – this would impact commodity prices and therefore will lead to lower revenue generation for VET.

However, assuming conservative estimates and including some margin of safety, VET should show FCF yields of 20% FY 22e, 36% FY 23e and 27% FY 24e – still enough for attractive shareholder returns.

My personal estimates include some dilution (roughly 2% pa), WTI oil prices of 70 FY 22e, 65 FY 23e, 60 FY 24e as well as declining VET base production that is peaking in FY 23e with just below 100k boe (barrel of oil equivalents) of daily production. The production assumption is very conservative as the company is strongly increasing output with the Leucrotta acquisition. Also, FY 22e capex reaches 1.5bn with Corrib and LXE as well as core capex for VET in the amount of 500m. For the following years, I also assume $ 535m in Capex versus $325m on average since FY 2015.

I believe the low debt, potentially negative net debt in FY 23e, as well as conservative assumptions going forward should provide an attractive investment for shareholders.

Capital Return

Return of capital based on sustainable debt levels:

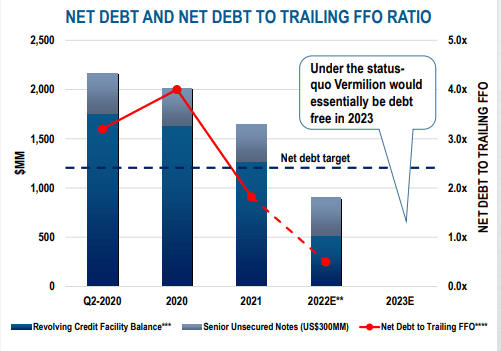

Mgmt. wanted to reduce debt levels within their VET strategic 2030 plan. They have already achieved their goal – three years before the target.

Additionally, management said the following:

“Return of capital framework will be a staged approach that will increase over time as further debt targets are achieved while retaining the flexibility to adjust when necessary. Intention is to augment return of capital through one or a combination of fixed dividend increases, special dividends and/or share buybacks. Next leverage target is 1.5x net debt to trailing FFO at mid-cycle pricing** which implies absolute net debt of ~$1.2B”

VET’s goal of 1.5x net debt to trailing FFO as well as absolute net debt of 1.2bn is already achieved and there should be no need to reduce debt levels further in FY 23e.

Net debt to trailing FFO (VET presentation Q1 22 LEX acquisition)

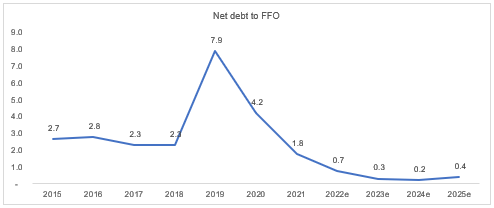

Looking at debt levels in combination with the assumptions previously mentioned, the net debt to FFO level could reach .7x at the end of FY 22e.

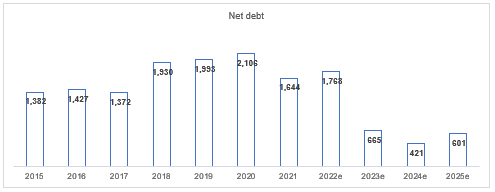

Net debt to FFO (Company statements and own calculation) Historic net debt and assumed future debt (company statements and own calculation)

Acquisitions instead of capital return:

VET continues to expand production by organic growth as well as inorganic growth. There are two major acquisitions lately: Corrib in Ireland and LXE in Canada. I understand the attractiveness of the Corrib transaction and it is aligned with VET stakeholders’ interest. LXE seems to be a more complex acquisition and I hope it is the last acquisition and management focuses on return of capital to shareholders or lowering CO2 emission footprint. In case there are more acquisitions with high premia, management is taken ill by the empire building complex, and for me, it would be time to sell the shares.

Dividends and share buy-backs:

This year VET started again to pay a dividend after overpaying in FY 2019 and the previous years that led to a stop of payments in early FY 2020. However, management’s plan now is the following:

“Plan to reinstate a $0.06 per share quarterly dividend commencing in Q1 2022. Equates to an annual cash outlay of approximately $40 million. Less than 3% of 2022 full-year pro forma FFO and approximately 5% based on mid-cycle commodity prices. Dividend sustainable through various commodity cycles. Provides significant excess FCF to facilitate further debt reduction and additional return of capital beyond the current base dividend.”

This is a good sign, as mid-cycle commodity prices are the underlying indicator of a sustainable dividend. However, they should pay a special dividend in the meantime or buy back shares excessively beforehand. So I believe there is upside to the dividend payments, and hopefully, shareholders will get some guidance prior to H2 22e, which should help shares to rerate.

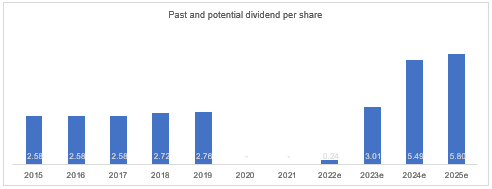

Taking the above into consideration, VET would be able to pay a dividend of $3 per share and even higher in FY 24e, and FY 25e. Again, this would not stretch the balance sheet capacity and the narrative around such dividend payments could be one-time special dividend payments. A mix of share buy-backs and dividends would be even more favorable.

Past and assumed dividend (Company statements and own calculation)

All in all, I recommend purchasing VET’s equity and at the same time suggest adding a stop-loss level given higher uncertainty regarding world economy and increasing volatility of energy prices.

Some Thoughts On Valuation:

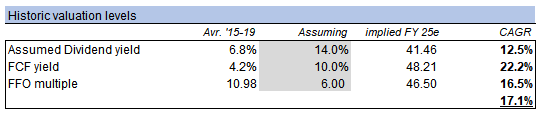

FCF, FFO & dividend yield on historic basis

Valuation assumptions (Own calculation and historic values)

Assuming historical implied valuation and taking conservative assumptions – or increased risk premia on all valuation metrics – the CAGR until FY 25e is attractive with ~17%.

VET is my second largest position and I keep on to the shares. For constructive feedback – please use the comment section. Thanks for reading.

Be the first to comment