photobyphm

Thesis

In our pre-earnings article on Verizon Communications Inc. (NYSE:VZ) in early July, we presented that investors should capitalize on the rally from its May lows to cut exposure and rotate away. We posited that its recovery was unsustainable, as its valuation didn’t justify the worsening underlying metrics of its business.

We also highlighted that the market had already de-rated VZ, so investors need to be wary of buying the dips. Consequently, VZ has significantly underperformed the SPDR S&P 500 Trust ETF (SPY) since our previous article. VZ posted a return of nearly -16%, compared to the SPY’s 7% gain. Therefore, VZ failed to participate in the broad market bottom in July 2022, as it fell closer to its July 2017 lows last week.

Verizon’s Q2 release also failed to inspire confidence that its 5G strategy is working. It’s facing competitive headwinds from AT&T (T) while building out its C-Band spectrum against T-Mobile’s (TMUS) leadership. Therefore, even its recent pricing action failed to address its worsening underlying performance, as management downgraded its FY22 outlook.

Notwithstanding, we postulate that VZ’s valuations seem more well-balanced after the recent underperformance. Its price action also suggests that VZ could be closer to a multi-year bottom, even though we have not gleaned constructive price action yet. Therefore, we suggest investors who have been biding their time to add exposure be patient as we await a more constructive bottoming process.

Accordingly, we revise our rating on VZ from Sell to Hold.

VZ’s Valuations Are More Well-Balanced After The Recent Collapse

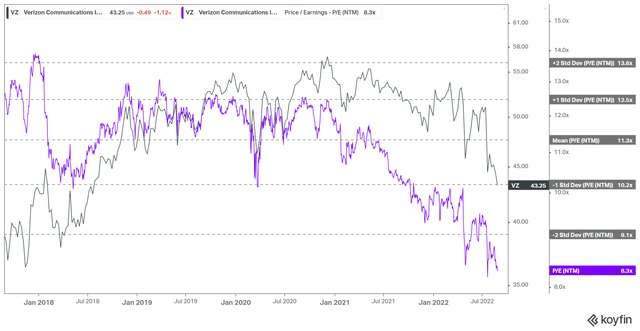

VZ NTM PE valuation trend (Koyfin)

As seen above, VZ’s recent collapse has brought its NTM PE multiples back to the two standard deviation zones below its 5Y mean. However, we urge investors to be wary of relying on the above multiples and assess that VZ is too cheap to ignore and justify a buy rating.

Investors should glean that the market had de-rated VZ from its 2020/21 highs. We gleaned that VZ has consistently found intense selling pressure at the one standard zone below its 5Y mean. Therefore, we posit that it corroborates our observation that the market adjusted its expectations of Verizon’s underlying performance, given its competitive challenges, macro headwinds, and 5G leadership complexities.

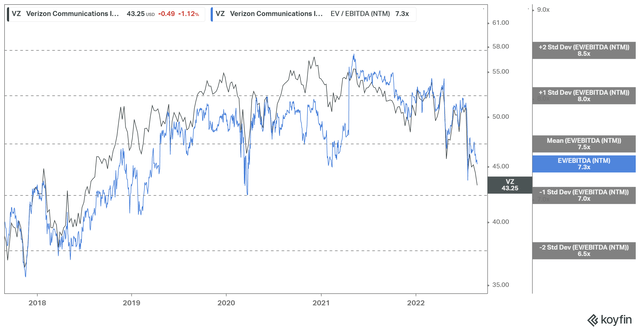

VZ EV/NTM EBITDA valuation trend (Koyfin)

Notwithstanding, VZ’s NTM EBITDA multiples suggest that it has fallen to levels that saw robust buying support in March 2020. It also found strong support in 2019, as VZ closes in on the one standard deviation zone below its 5Y mean. Therefore, we posit that VZ’s valuations seem more well-balanced now, given the recent pummeling.

Verizon’s Underlying Metrics Should Improve Through FY23

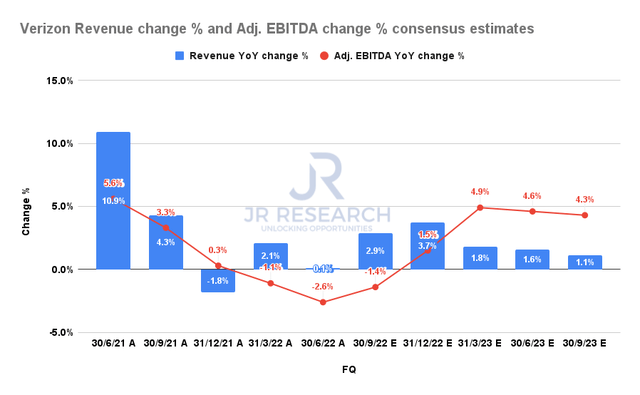

Verizon revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Furthermore, the consensus estimates (neutral) indicate that Verizon’s operating performance should recover through H2’22 into FY23. Therefore, investors should not expect its subpar Q2 performance to be repeated.

Management also highlighted that it’s optimistic about delivering a better performance moving ahead, as it articulated:

Our runway for mobility growth is predicated on driving our customer base into higher-value data plans, and we continue to make good progress in the second quarter. We [also] expect to see significant benefit in the second half of the year from the [pricing] actions we’ve taken. That’s probably about $1 billion of incremental revenue sequentially in the second half versus the first half.[We] certainly feel like the actions that we are taking and have taken and will continue to put us on a path to EBITDA growth as we go forward here. (Verizon FQ2’22 earnings call)

We posit that the macroeconomic challenges have worsened the competitive headwinds impacting Verizon’s growth drivers. Therefore, we posit that until Verizon can regain 5G leadership against TMUS, it could continue to face growth and profitability headwinds. CFRA Research also highlighted in a recent commentary:

We believe VZ is currently between a rock and a hard place. On the one side, you have AT&T, who is being extremely aggressive with promotions, and on the other, you have T-Mobile, who has a vastly superior 5G network currently. (Barron’s)

Notwithstanding, Verizon is certainly not out of the game yet, far from it. CEO Hans Vestberg was sanguine that Verizon is building up its competitive advantage to address its 5G growth drivers, as he articulated:

We ended the quarter with 135 million POPs covered by C-Band and remain on track to reach at least 175 million POPs by the end of the year. We’re seeing the phenomenal performance we expected. Network usage is growing quickly, with C-Band users up 233% since the end of the first quarter and millimeter wave traffic up 49% year-to-date. Where C-Band is deployed, it accounts for more than 1/3 of our wireless traffic on average. Currently, 47% of our consumer base has a 5G phone, and we expect that number to reach nearly 60% by year-end. (Verizon earnings)

In a recent commentary by Barron’s, it also highlighted that T-Mobile’s advantage is “by no means insurmountable.” It accentuated that “by the end of next year, it will have deployed this new [midband] spectrum and likely closed the coverage gap with T-Mobile.”

Therefore, we are confident that the company is proactively addressing its competitive challenges and remain well-positioned to close the gap.

Is VZ Stock A Buy, Sell, Or Hold?

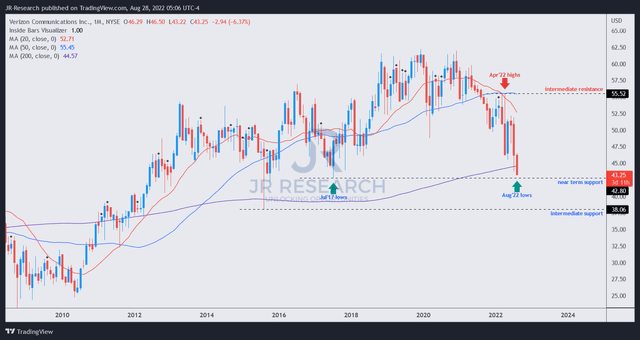

VZ price chart (monthly) (TradingView)

As seen above, VZ is closing in on its near-term support ($43). In addition, it has found robust support previously in Jan 2016 and July 2017, as VZ bottomed out.

Therefore, we posit that if VZ sees strong buying upside at its near-term support, it could stage a multi-year bottom moving forward. Otherwise, a further collapse toward its intermediate support cannot be ruled out, which could set up a capitulation move before an eventual bottom.

Therefore, we posit that the price action looks increasingly constructive if we see a bottoming process. Coupled with a more well-balanced valuation and improving operating metrics moving ahead, we are ready to re-rate VZ.

Accordingly, we revise our rating on VZ from Sell to Hold for now, as we await its bottoming process.

Be the first to comment