jetcityimage/iStock Editorial via Getty Images

Written by Nick Ackerman. This article was originally published to members of Cash Builder Opportunities on June 11th, 2022.

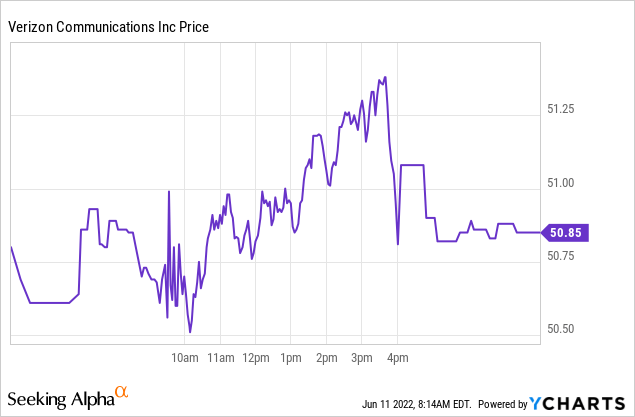

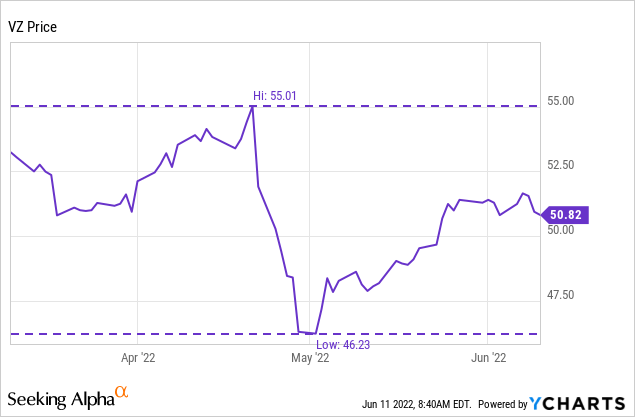

Heading into the end of the trading day on Friday, June 10th, 2022, we saw shares of Verizon (NYSE:VZ) slip from over $51 per share. This was significant because that’s where we had sold covered calls from our previously assigned shares. The whole market slipped deep into the red due to higher than anticipated inflation. VZ held up relatively well and throughout the trading day, actually trended higher right until the end.

Ycharts

Since VZ has moved higher from our original trade, this certainly isn’t bad as we simply get another opportunity to write more calls and at potentially higher strike prices.

At the same time, we are holding onto a dividend growth stock, and while growth has been quite slow, it has been growing over the years anyway. With the next ex-dividend date coming up in early July, we will certainly be paying attention to that when considering which expiration date to use for our next trade.

Typically, the telecom giants VZ and AT&T (T) don’t have so much volatility. They run businesses that are almost utility-like. That’s what can make them good candidates for more conservative option writing if you don’t want wild swings. It often means reduced premiums relative to names with higher implied volatility.

With the market being so volatile across the board, that is helping to present better opportunities out there from these sorts of usually boring names. We recently were discussing AT&T, as we successfully sold puts and had those expire worthless recently.

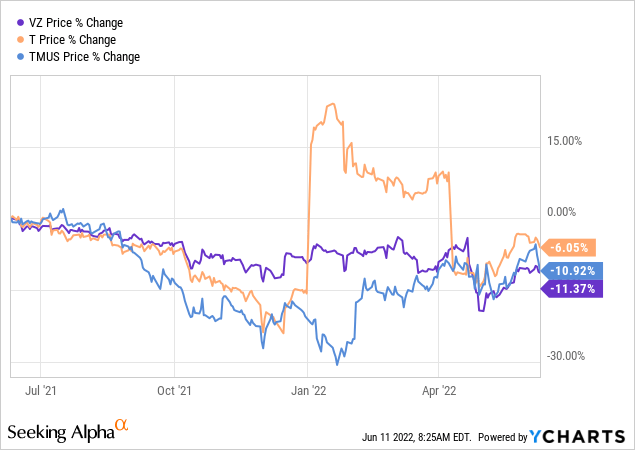

All this being said, the main stocks in this space have been grinding lower over the last year or so now. Even T-Mobile (TMUS), which is the growthier name out of the group with no dividend, hasn’t been immune to the declines in stock prices over the last year.

Ycharts

These sorts of moves help highlight why I’d prefer selling puts on dividend payers. Sometimes you can end up sitting on a stock for a while if it slides against you and there aren’t any appealing covered calls to be generating option premium. I’d rather sit on a stock for years as long as it is still providing some sort of income stream than waiting on something like TMUS to hopefully reach new highs someday.

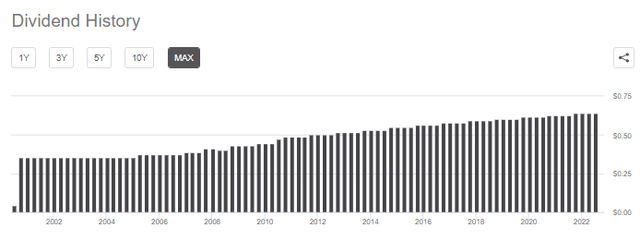

That’s, of course, going to be a personal choice of every investor. Growth investors certainly can make strong cases for why they are right, and I’m wrong. VZ has been growing its dividend for the last 18 years. That shows a strong commitment, in my opinion.

VZ Dividend History (Seeking Alpha)

However, that doesn’t tell us the whole story. The dividend history goes back even further since it was Bell Atlantic before that. During this period, they might not have grown the dividend every consecutive year, but they haven’t cut since 1984, according to the investor relations website.

I believe the dividend is very safe with VZ based on their historical commitment to the dividend. Based on the outlook for $5.40 in earnings, the current dividend works out to a payout ratio of 46.83%. It definitely leaves plenty of room with the coming recession in case things slow down even further. Since that is the outlook for next year, or that we could even currently be in a technical recession, this is good news.

I believe the worst thing that could happen is for the company to freeze the dividend at the current level. Similar to what they did between 2001 and 2005. They didn’t grow the dividend, but they held it steady.

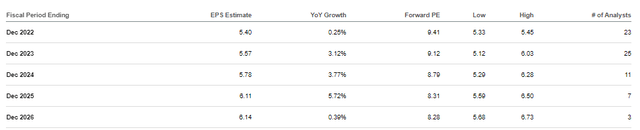

Analysts anticipate that VZ can grow earnings by an average of 2.65% over the next five years. As a mature business in a very competitive field right now, I think some growth is better than none at all. This potential growth is just added cushion to their dividend. However, it also highlights why the dividend growth remains stuck in the 2 to 3% range.

VZ EPS Estimates (Seeking Alpha)

For fiscal 2022, they are anticipating themselves to have adjusted EPS of $5.40 to $5.55 and coming in at the lower end of their guidance. With the estimate right at the low end, I think they have a good chance of beating such guidance. They’ve beaten EPS estimates for 9 straight quarters now and only missed once in the last 16 quarters.

Considering the stock is currently yielding around 5%, it’s one of the cases where we are getting a higher yield now instead of more growth to come. As an income investor, I don’t mind having a mixture of slower growers but higher yielders and faster growers but lower yielders.

The main argument here is that AT&T wouldn’t have been expected to cut their dividend, but they did. However, the counterargument is that AT&T was going through a much bigger transition too. They spun out a meaningful portion of their business through Warner Bros. Discovery (WBD), so it almost necessitated an adjustment.

To sum up, the reasonable payout ratio and expected slow but steady growth should keep VZ’s dividend safe. They aren’t going through a meaningful transition that competitor AT&T had to lead to a reduced dividend, in my opinion.

The Trades

To recap quickly, we originally took the assignment of shares at $50 on the April 29th, 2022, options expiration. In that trade, we originally collected $0.42 in premium. That knocked our breakeven down to $49.58. Originally, it worked out to a potential annualized return of 12.26% if we could make a similar trade throughout the year. In my opinion, an attractive percentage based on the dividend yield of the stock itself, sitting at 5.04% currently – which itself is quite attractive.

What pushed the stock lower during that original trade was the earnings they announced. It wasn’t necessarily all bad news, but it was the guidance that seemed to spook investors. Shares eventually touched a low in the last three months at $46.23 per share.

Ycharts

We didn’t have to wait too long to write some calls though, even when shares were lower. That’s where this latest trade comes in.

We sold calls on May 4th, 2022, collecting $0.30. Instead of sticking with the $50 strike price, we bumped it up to $51. I believe the shares are still cheap at the current level, but higher strikes didn’t have the sort of premium that I was looking for.

Given the 37 days until the expiration, this resulted in a potential annualized return of 5.80% based on the $51 strike. Since we originally were assigned shares at $50, it would have worked out to 5.92%. That was for the premium only, not counting any of the upside of the additional $1 in capital gains we could have locked in.

When writing calls, my arbitrary target is that the potential annualized return works out to something higher than the then dividend yield. That’s what made the $51 strike price stick out and why the higher strikes weren’t too appealing. At the same time, $50 could have yielded better results in terms of potential annualized returns, but again, the stock just seemed way too cheap to give up at that level.

We’ve now collected $0.30 from writing the covered calls and $0.42 from the original puts we sold for a total of $0.72 per share or $72 per contract. The original put trade was opened on April 4th, 2022. That gives us a total of 67 days so far for this series of trades where we’ve collected more than the current quarterly dividend of $0.64. We also did it in less time than the ~90 days one would wait between every quarterly dividend.

What’s Next?

I’m pretty excited about where the trade shook out. Now that shares have moved meaningfully higher from where they were when we wrote the last calls, we can probably bump up the strike price (pending where we open up trading next). Given the sharply lower close we saw on the overall market on Friday, if we could get a bit of a bounce, we could be set up in a really nice position. Even if we open next week a bit lower on Monday, I think we could still see some nice opportunities.

With the ex-div date coming up on July 7th, I’ll only be looking at expiration dates beyond this point so we can collect that $0.64. The premium in the calls will be reflecting this dividend coming up, as it means the share price will be adjusted lower on the ex-date. Still, I think several trades are looking quite appealing now. Keep in mind that the bid prices we will be using are from Friday’s close.

- July 8th, 2022, expiration at the $52 strike looks like we could collect $0.51 (last bid), working out to a potential annualized return of 13.26%.

- Even the $53 strike price on that same expiration could collect $0.24, not an absolutely large amount but annualized would work out to 6.24%.

- Going out a bit further on the July 15th, 2022 expiration, we could use the $52.50 strike. The volume will be significantly higher since this is a regular monthly options expiration date. At that strike, we can collect $0.42, working out to a potential annualized return of 8.59%.

All of these trades I shared that are potential trades we can do at this point are only using the strike price selected to annualize the returns. In our case, our assignment price is $50, and our breakeven is $49.28. So that gives us the opportunity to collect additional capital gains if we enter into any of these positions and have the shares called away.

The whole wheel hasn’t been completed while using the options wheel strategy approach yet. However, it does highlight how returns can be made beyond just the option premium. If a trade starts going in your favor, you can boost up the strike prices on the covered call side. That should eventually result in even more gains for investors as a sort of bonus.

Be the first to comment