weerapatkiatdumrong/iStock via Getty Images

The 2022 market turmoil will likely spill into 2023 as geopolitical tensions, uncertainty about central bank’s approach to interest rates going forward, and recession fears continue to influence the economy. Investing in this environment is a challenging task, so an emphasis should be put upon the ability of a certain pick to withstand and even thrive in such market climate. In order to do so and be a good investment option, a company should have the following characteristics:

- Resilient revenue growth and margins

- Strong competitive position

- Solid financial position and no need for capital raising

- Management team with a proven track record and skin in the game

- Attractive valuation with a near-term catalyst.

In this article, I’ll present arguments as to why Verde AgriTech (OTCPK:VNPKF) (TSX:NPK:CA) – an emerging fertilizer producer from Brazil – meets those criteria and may be poised for a great 2023.

Company overview

Verde AgriTech began its existence in 2005 as a gold exploration company named Amazon Mining Holding operating in Brazil. However, as the exploration didn’t yield desired results and the global financial crisis hit the world, the precious metals journey came to an end. In the meantime, the founder and CEO of the company – Cristiano Veloso – saw an opportunity in the agricultural market. Brazil is amongst the largest consumers of fertilizers, yet very little is produced inside the country. This is how Verde Potash, or currently known as Verde AgriTech, was born.

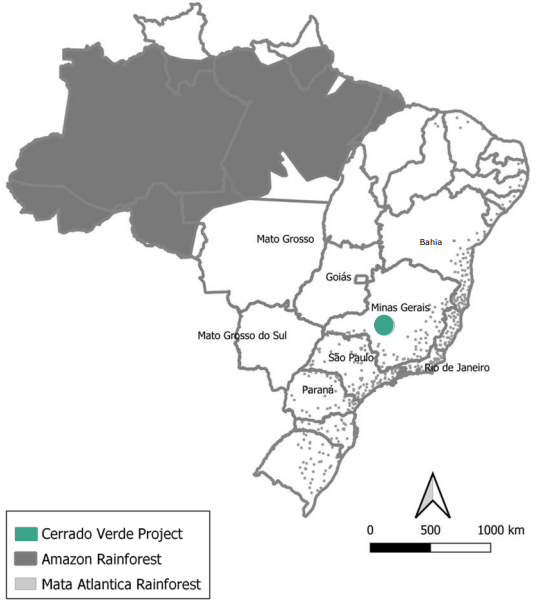

Cerrado Verde Project (Verde AgriTech)

Through its Cerrado Verde project, Verde AgriTech Ltd is positioning itself as an important part of the potash supply chain in Brazil. The property holds massive glauconitic siltstone deposits, which are used by Verde for the production of a multi-nutrient, potassium-rich product, branded as K Forte in Brazil and Super Greensand internationally.

Product highlights (Verde AgriTech)

What makes Verde a good investment?

Strong growth and margins

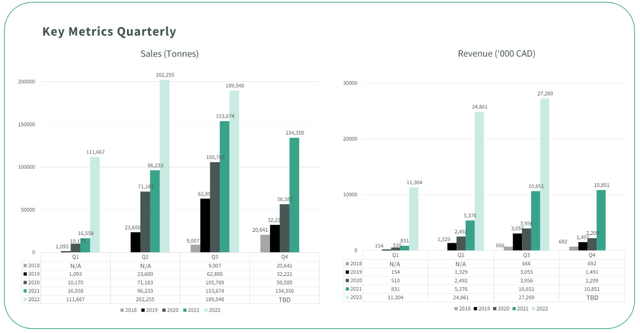

In the last few years, Verde AgriTech has been executing an ambitious expansion strategy, which aims to position it as a leading source of potash for farmers in Brazil. So far, the execution of this strategy has worked very well. While the company has benefited from increased fertilizer prices, the volumes of sold product have also been growing rapidly, which multiplies the effect on revenue. For the TTM, the company has sold over 637.8k tonnes (+97.4% YoY) of its products and is on track to meet its guidance of approximately 700k tonnes for 2022. TTM revenue reached CAD$74.3M (+289.0% YoY).

Revenue and Volumes growth (Verde AgriTech)

Going forward, while some easing of potash prices is possible, the company completed its Plant 2 in 2022 and is now ramping it up to reach a production capacity of 2.4Mtpy, which in addition to Plant 1’s 0.6Mpty will total 3Mtpy of production capacity in 2023. In light of that, the company entered into a partnership with Lavoro – the largest distributor of inputs for agriculture in Brazil. Until now, all the sales were handled by Verde’s employees, but the addition of the large distribution network of Lavoro to the business should support the rapid expansion of total volumes of product sold.

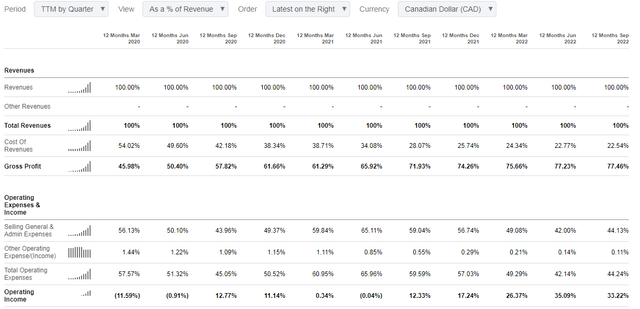

As far as marginality, it has been improving steadily, as the company reached gross profit margin of almost 77.5% on a TTM basis in Q3’22, compared to 74.2% in 2021. The EBITDA margin of Verde is also strong at more than 33% on a TTM basis.

Verde AgriTech’s margins (TTM) (Seeking Alpha)

The reasons for the improved margin are twofold. On one hand, growth in potash prices have been able to compensate the cost inflation. In addition, the production capacity of Verde has led to some economies of scale. Going forward, while the first factor may subside to an extent as potash prices may mean revert, the effects of economies of scale are going to become more significant as the company further increases its production capacity. That being said, the most important factor for sustainable and even growing marginality would be the value proposition of a business to its existing and potential customers, compared to the rest of the sector.

Strong competitive positioning

At first glance, one may think that the fertilizer industry is very similar to other commodity-based businesses – the main area of competitive advantage would be the cost structure of the business, while the end product is identical in terms of characteristics. However, this is not the case with Verde and its product.

Superior product

The most used source of potash in agriculture is Potassium Chloride (KCl). At the same time, scientific research shows that the chloride is having negative impacts on the soil’s biodiversity. Besides the positive effects of plants, the soil’s biodiversity has a positive effects on carbon capture.

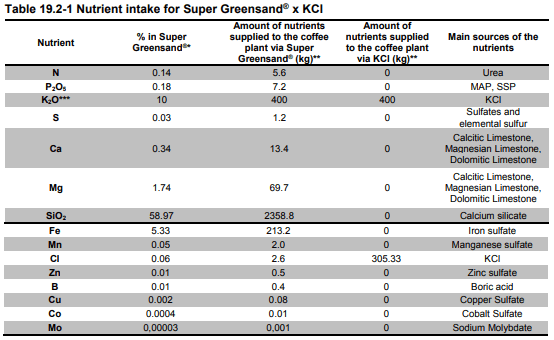

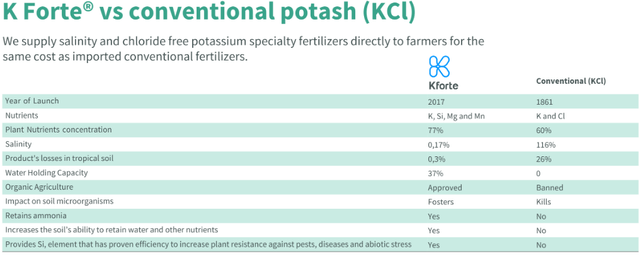

Super Greensand vs. KCl (Verde AgriTech) The merits of K Forte (Verde AgriTech)

Verde’s product approaches the satisfaction of crops’ potash needs from a different angle. The products of the company are derived from glauconitic siltstone, which has about 10% potash content, compared to 60% in KCl based fertilizers. While this requires 6 times the tonnage to reach the same K2O content, K Forte (Super Greensand) has more than 100 times less Cl than KCl and is rich in other nutrients, which help support soil’s biodiversity. Scientific research indicates that glauconitic based fertilizers have long-term positive effects on soil’s fertility.

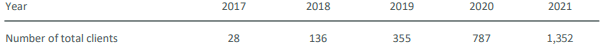

Verde’s customers dynamics (Verde AgriTech)

Customers appear to be quite satisfied with Verde’s product as the number of clients have been climbing exponentially. While the main focus of the company is Brazil, it’s tasting the waters of international markets as Super Greensand is available on Amazon. The reception has been very good, judging by the 4.7/5 rating and the sold-out stocks at the moment.

Super Greensand’s presence of Amazon (Amazon.com)

Despite the what appears to be a superior product, Verde is not currently charging more for it and aligns the pricing with the K2O differential alone, meaning that a tonne of K Forte costs farmers approximately 6 times less than a tonne of KCl. The company is sticking with that policy as it’s still an emerging player, the product is relatively new and it takes time for the farmer community to test and appreciate the merits of K Forte. Later on, when the product’s merits become well-known by a wider client community, I think there could be a case for Verde to place some premium on it compared to KCl.

Glauconite based competition?

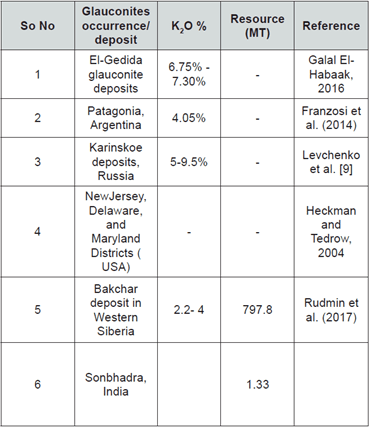

If glauconite based fertilizers are superior way to supply the soil with potash and other nutrients the potential treat of other products based on the same material should be observed. Scientific research indicates, that glauconite is mostly found on sea floors in depths from 50-300m. Also, typically K2O content, which is the key for making it an alternative to KCl is usually in the 2-8% range.

Glauconite deposits around the world (Satya Prakash and Jay Prakash Verma; Recent Advances in Petrochemical Science)

For comparison, the potash ore-grade at the Cerrado Verde project are about 10%, making the deposit very high grade. This is very significant comparative advantage of Verde’s deposit, because it would require far less ore volumes in order to reach levels of total K2O concentration, similar to KCl.

Leaner cost structure

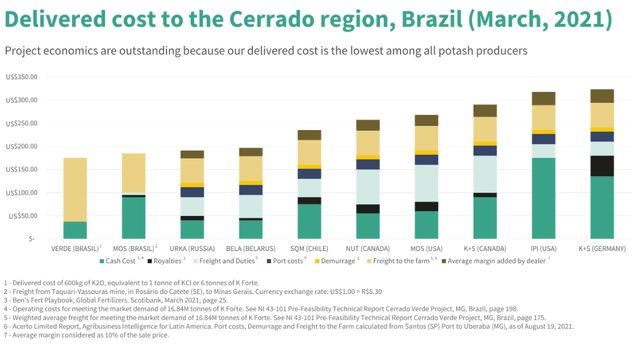

On the surface, the fact that Verde’s product is needed in 6 times greater quantity in order to reach the potash content in KCl may push some investors into thinking that the cost structure of K Forte is inferior to the alternatives. While transportation costs are indeed higher, the overall cost structure of the product is superior to the competition.

Verde’s product cost structure vs alternatives (Verde AgriTech)

Mineralization at the Cerrado Verde mine starts from surface and the ore doesn’t need capital intensive processing, which puts the cash costs of K Forte the lowest amongst the peer group. Additionally, the company doesn’t have to pay port and demurrage costs. Since Verde is already located in Brazil, import duties are also not part of the equation.

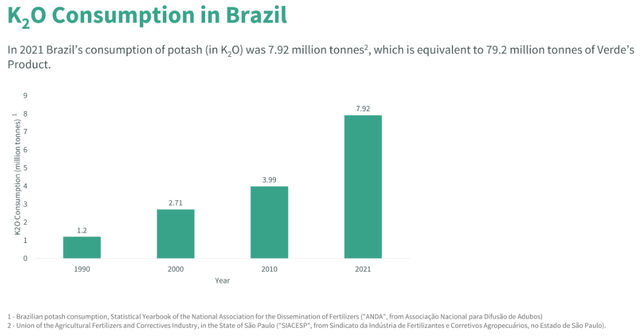

Potash consumption in Brazil (Verde AgriTech)

It has to be noted, that the six times larger quantities for the same result could be a burden if Verde decides to aim at international expansion, since it will face additional costs like duties and larger distance will impact transportation costs further. This could shrink or even eliminate the cost advantages compared to alternatives. But the main area of focus – the Brazilian market is huge and growing, so Verde probably doesn’t even need to rely on exports for K Forte.

Solid financial position and non-dilutive expansion path

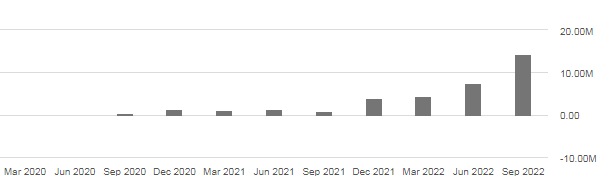

Verde’s net debt (Seeking Alpha)

As of the end of Q3’22, Verde has net debt of CAD$14.3M. The figure has been increasing in 2022, due to the company’s significant cash outflows, related to the construction of Plant 2 during the year. There were additional expenses, related to the repair of the road to the plant, which were not previously anticipated. Receivables also grew to CAD$29M, which could be normal, given that some farmers buy the product on credit and will pay later on as they sell their commodities.

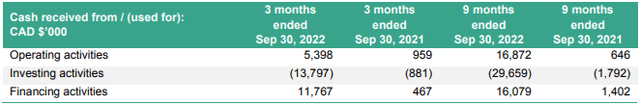

Verde’s cash flows dynamics (Verde AgriTech)

The favorable market environment as well as production growth has resulted in Verde generating almost CAD$17M of cash flow from operating activities in 9M 2022, compared to just CAD$646k a year ago. I expect that the company will be able to generate more than CAD$21M of operating cash flow in 2022, of the production guidance of 0.7Mtpy is met. For 2023, the cash flow generation potential of the company will be much larger, as with Plant 2 online, the total capacity will jump to 3Mtpy.

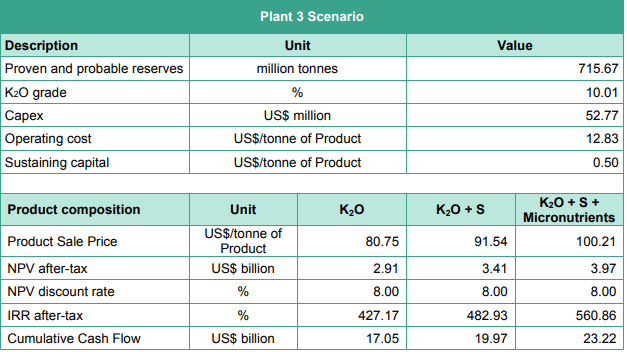

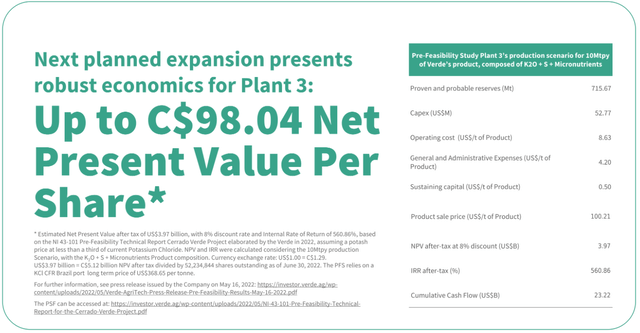

Plant 3 economic highlights (Verde AgriTech)

The next step of Verde’s expansion strategy is the construction of Plant 3 with capacity of 10Mtpy, which according to the company will require initial capital investment of US$52.8M. The project has impressive economics with IRR well into the three-digit territory and the relatively low initial investment could be financed with internally generated funds, given the considerably higher cash flow generating potential of Verde in 2023. Based on that, I don’t think that there’s much risk of a dilutive share offering. The plant is expected to begin construction in the middle of 2023 and be operational in 2024. When realized, it will put the company’s total production capacity at 13Mtpy, which would be 16.4% of total potash demand in Brazil.

Management team with a proven track record and skin in the game

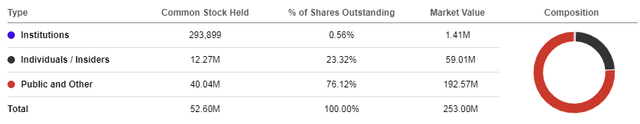

Management has a key role for the development of a company, especially a one that is in a rapid growth phase. Verde AgriTech is a founder-led business as the CEO – Cristiano Veloso has been in that role since day one. He’s also the largest shareholder of the company with a stake of over 19%. Other senior executives also own shares of the company as total insider ownership equals 23.3%. I interpret such insider ownership percentage as very positive, since it aligns the interests of management with that of shareholders.

Verde’s ownership structure (Seeking Alpha)

It has to be noted, that in July 2022, Verde established a scheme, under which the CEO will be able to sell up to 3M shares, which would represent 5.7% of the float and approx. 30% of his personal holdings. However, the mechanism sets a minimum sale price of CAD$9.00/share, which is a lot higher than current market prices. I don’t see this mechanism as a negative, since even after the sale Cristiano Veloso will maintain significant ownership percentage and some portfolio diversification on his side probably makes sense from a purely personal wealth management perspective.

Management has also been very transparent and proactive in the communication with shareholders. The company publisher Investor Newsletter every month where it gives information about important events during the month. For example, in those releases there were regular updates with pictures of the construction process at Plant 2. Furthermore, Verde maintains a YouTube channel where it provides reviews of its products by farmers and more importantly uploads its earnings calls and the Q&A session afterwards.

Regarding the track record of management, the execution of the expansion strategy has been done as guided, while temporary setbacks, like the road problems at Plant 2 have been dealt with in a timely manner.

Share price and Valuation

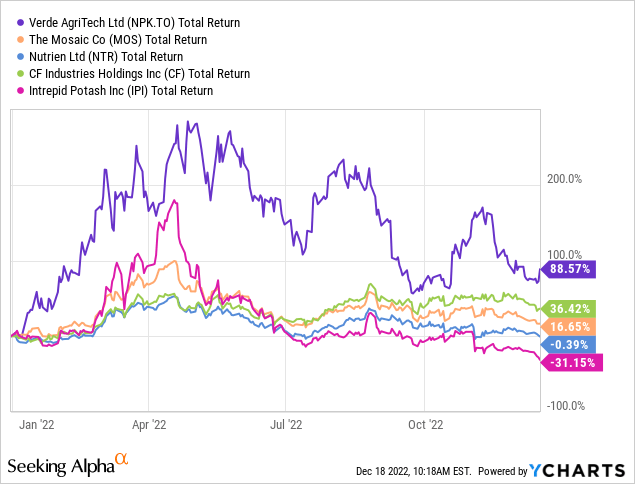

Looking at YtD performance, Verde outperformed considerably some notable fertilizer producers like Mosaic (MOS), CF Industries Holdings (CF), Nutrien (NTR) and Intrepid Potash (IPI). While Verde gained more than 88.5% since the beginning of 2022, it has retreated significantly from its peak of more than CAD$10/share. So is there still upside going forward?

Verde’s Plant 3 economics (Verde AgriTech)

Looking at the results from Verde’s prefeasibility study – the next phase of its expansion plan – Plant 3 has and estimated NPV/share of CAD$98.04, which is more than 18x the current share price of CAD$5.28. The IRR of the expansion is projected at 560%, which is extremely high and leaves a lot of margin of error. In order to stay conservative, I decided to value the company at the production capacity that is already build and permitted – 3Mtpy.

DCF model

Since the DCF model will be under the assumption of a capped production rate of 3Mtpy, projecting too many periods ahead doesn’t make sense. Instead, I assumed that the company will sell 2Mt of product in 2023, and full capacity of 3Mtpy will be reached from 2024. The remaining assumptions are presented in the following table:

| 31.12.2022 | 31.12.2023 | 31.12.2024 | |

| Tonnes K Forte sold (M) | 0.70 | 2.00 | 3.00 |

| Average price/tonne | 124 | 105 | 108 |

| K Forte price change YoY | 78% | (15%) | 2.5% |

| COGS (% of Revenue) | 22% | 23% | 23% |

| Sales & Freight (% of Revenue) | 38% | 35% | 33% |

| G&A (% of Revenue) | 7% | 6% | 5% |

| Effective tax rate (% of EBT) | 15% | 34% | 34% |

| Change in NWC (% of Revenue) | 5% | 5% | 4% |

| Depreciation (% PPE) | 3% | 4% | 4% |

| CAPEX (%PPE) | 1317% | 5% | 5% |

* Author’s own assumptions

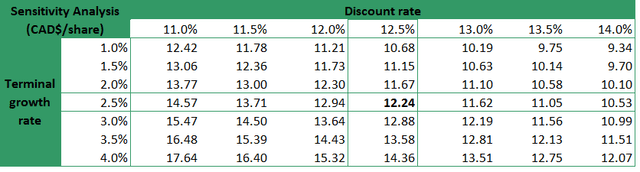

Using a discount rate of 15% and a terminal growth of 2.5% I get fair value/share of CAD$12.24, which indicated more than 130% upside from the current level. To make the DCF results more robust, I did a sensitivity analysis of the fair value to changes in the discount rate and the terminal growth rate.

Sensitivity analysis (Author’s own work)

Potential catalysts

Even though a stock appears to be undervalued, the actual market price may persist to trade at discount, especially if there are no major news around the stock. However, if there are upcoming events that have favorable impact on the business and/or on the perception of shareholders for the stock, closing the valuation gap is more likely. In the case of Verde, I identified the following upcoming catalysts:

U.S. listing

Currently, the stock is listed on the TSX and trading is possible in the U.S. OTC markets under the ticker VNPKF, which is very illiquid. However, a proper listing on an U.S. exchange may put the stock on the radar of a wider investor audience. According to the last earning call, management is working on it and it’s expected to happen rather soon.

Shareholder returns program

Since Verde is expanding exponentially, keeping the generated cash flows and reinvesting them back into the business makes sense. However, now that Plant 2 is built and significant cash generation is expected, the company is expected to initiate its P4G (Paid for growth) strategy in 2023, which should bring some returns back to shareholders in forms of dividends/buybacks.

Institutional presence

So far, probably due to the stock being rather small, the lack of listing on US exchange and the absence of distributions back to shareholders, institutions have stayed away from owning equity in the company. If this changes, it could be interpreted as further affirmation of the stock’s potential and could lead to upside pressure as well.

Executing the expansion strategy

The developments, related to the actual business also offer upside triggers. Any news for mining permit that would allow further expansion should have positive effects on the price. Also, surpassing guidance in terms of quantity of product sold could reaffirm the strong demand for Verde’s product and justify faster further expansion.

Risks

Recession risk

In case of a recession, some companies suffer from sharp reduction in demand for their products, which hurts their bottom line. However, demand for potash is rather inelastic, since farming is not a cyclical business. So even if recession hits, I don’t expect Verde to suffer from demand destruction.

Political risk

Brazil is not the most politically stable place. The recent election of Lula as president have sent some notable Brazilian stocks like the oil kingpin Petrobras (PBR) sharply lower. While more intervention from the new government in the economy is possible, I don’t think Verde’s business will be likely impacted. After all, Brazil is a huge importer of fertilizers and domestic production is miniscule, so any sort of price control measures are not likely.

Currency risk

The company operates in Brazilian real, which is not the most stable of currencies. The good thing is that the product that the company sells – potash is priced relative to international prices. In this case, the weaker real may have some benefits since operating expenses are paid in reals, but the sale price is following international prices. On the other hand, the liquidity position of Verde is mostly held in reals, and their value will deteriorate if the currency weakens.

Interest rates risk

Although the company has relatively low debt, it uses bank loans, which have a variable element in them, therefore is sensitive to changes in interest rates. On of that, interest rates in Brazil are considerably higher than those in the U.S. or Canada. So if Verde has to increase its debt level, interest expense may become somewhat of a drag on performance. Fortunately, Verde has serious cash flow generation potential and I don’t expect much increase in the loan financing

Permitting risk

Verde’s expansion is dependent on various permits. So far, the company has been able to obtain them in the expected timeframe. Recently, the company received permit to access lands that will allow it to realize its 23Mtpy production scenario. While theoretically permitting could slow down or even prevent Verde from further expansion, I think that this risk is rather low.

Key person risk

The CEO of Verde – Cristiano Veloso has been the driving force behind the transformation of the company from a failed gold explorer to a factor on the Brazilian fertilizer market. Being the largest shareholder, he has been very involved with the business and with communication with shareholders as well. So if for some reason he’s no longer involved with the company, this could be a major risk.

Conclusion

Verde AgriTech is transforming the Brazilian fertilizer market by offering a superior potash-based product. The company is led by a motivated management team with significant skin in the game, which has been executing its expansion strategy flawlessly. The strong balance sheet and cash flow generation capabilities of the business pave the way for a non-dilutive further expansion. The stock currently trades to only a tiny fraction of the estimated NPV of its future Plant3, but it offers 130% upside to my estimate of fair value even to the current production capacity. Surrounded by multiple potential upside catalysts, Verde may be the right fertilizer for one’s portfolio in 2023.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment