Erika Goldring/Getty Images Entertainment

I’ve got a kid who is really into flamingo-themed decor at the moment, so I try to keep my eyes out for anything with an interesting flamingo image on it. Last fall I had a meeting with some co-workers, and one had a nice quilted bag and matching wallet that I thought my daughter might like. I wasn’t surprised at all to find out my co-worker purchased it from Vera Bradley (NASDAQ:VRA), but it was available at their factory outlet stores only and couldn’t be ordered online, so my daughter never got one. It does remind me that this company, who has not found a way to create long-term value for its shareholders, nevertheless provides some products that have enough consumer appeal to keep going. For those not familiar with the company, Vera Bradley is most known for its quilted cotton bags and accessories, and in 2019 acquired Pura Vida, a company selling bracelets and trendy accessories.

I have written off and on about Vera Bradley, but have not chimed in with anything since November 2020, just a couple of weeks before the first emergency use authorization for a Covid-19 vaccines was approved. Clearly a lot has changed in the world since then – inflation, interest rates tightening, fears of recession, a military incursion in Ukraine and now saber rattling in Taiwan, just to name the headlines, even as Covid remains an unfinished story. With all those uncertainties weighing on sentiment and investor decisions, I think it is a good time to re-evaluate any investment thesis for Vera Bradley.

An Inconsistent Journey

One of my past observations about Vera Bradley as it relates to investing has been that it did not lend itself to a buy-and-hold strategy, and was perhaps more suited to shorter-term trading. When I wrote in November of 2020, the shares were valued at around $8.50. As the market rotated into value names for a while, shares climbed over the first half of 2021, up to $13.50 in early June, a nice 60% return in 7 months, but by the end of 2021 were back to the same approximate value as they started the year; so far in 2022 the shares have slid further by 50%. Anyone who bought just one lot at a single point in time around November 2020 and held since then would need about a 100% recovery to break even.

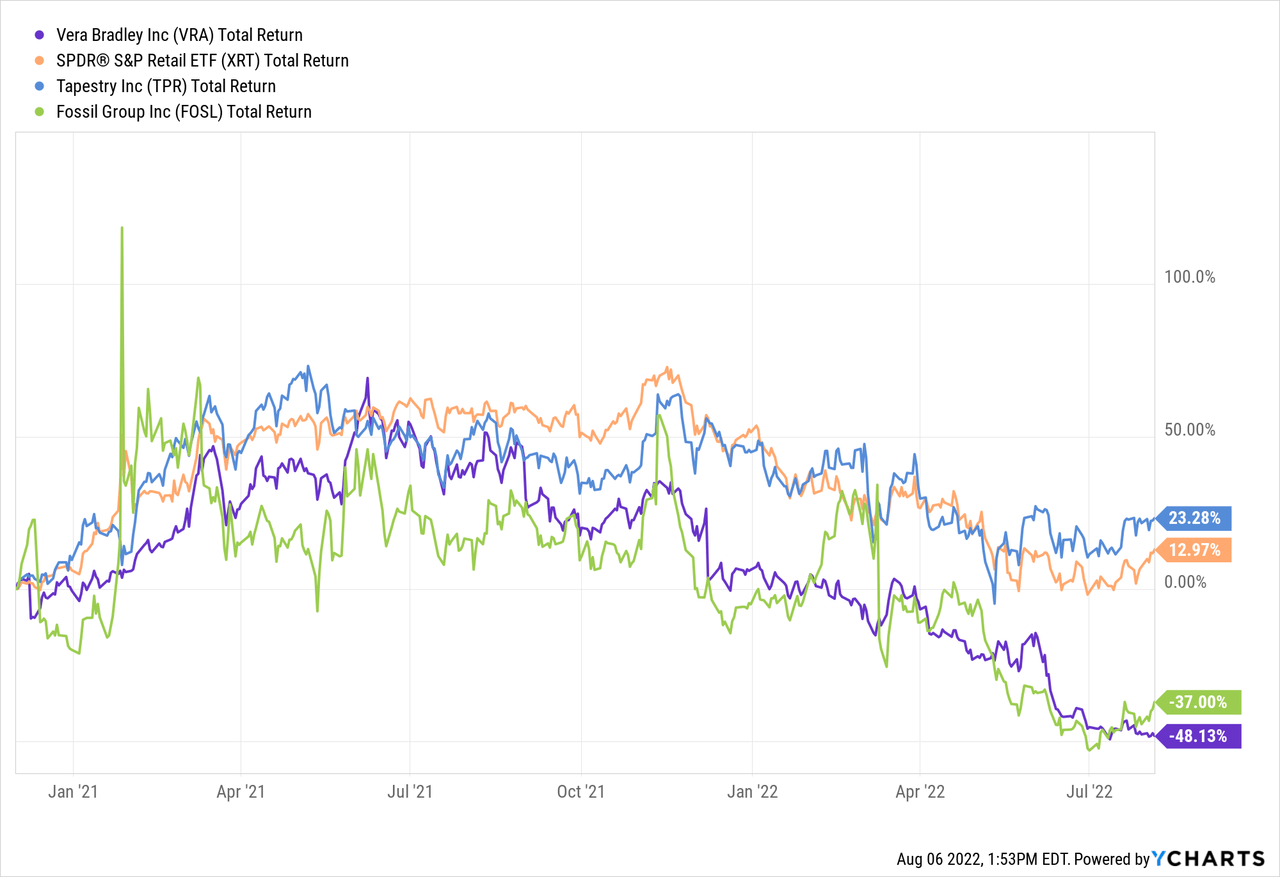

Relative to the S&P Retail ETF (XRT) and luxury brand company Tapestry (TPR) (home to upscale brands Coach, Kate Spade, and Stuart Weitzman), Vera Bradley has badly under-performed, and also lagged a mid-tier brand Fossil Group (FOSL), which is largely a seller of watches licensed for multiple brands (including Tapestry’s Kate Spade New York) but also incorporates accessories, jewelry and leather goods.

Looking into the fundamental financial results over the last year or so goes a long way towards explaining why the market value has pulled back, along with changes in investor preferences. Vera Bradley wrapped up fiscal year 2022 (twelve months ended 1/29/22) with $540 million in sales, a topline improvement over both FY 2021 (Covid year, starting February 2020 through January 2021) of $468 million and FY 2020 (pre-Covid) results of $494. The revenues translated to net income of $17.8 million, a nice of growth over pre-Covid results of $16.0 million, and EPS of $0.53 easily beat the results of $0.47 from fiscal 2020, keeping in mind that Pura Vida was not really fully contributing for a full year until fiscal 2021. So far, everything looks all to the good – growing sales, growing profitability and growing EPS.

While that is all true, the first quarter of fiscal 2023 starts to reveal a different narrative, and things took a decided turn for the worse, reflected in the market reaction in early June when results were published. In the three months ended 4/30/22, sales were $98 million, but the expectations had been in the range of another $110 million. Granted, the first quarter is seasonally the slowest, however net result was a loss per share for the quarter of ($0.21) is a tough way to begin a new year. Perhaps of most concern to note was the drastic drop-off in sales for Pura Vida. Bearing in mind Vera Bradley acquired this brand for its growth profile, the Pura Vida segment saw year-over-year sales decline of 27%, down to $20 million from $27 million last year.

The lower sales are not attributable to a single factor – supply chain disruptions, inflation and pricing increases, some softening in American consumer discretionary spending as they allocate more of the household budget to gas, energy and groceries – it is a complex mix. Guidance for the full year fiscal 2023 is for sales in the $490 – $505 million range, around a 7.5% decline. In response to the sales trend, management is implementing some efforts at cost controls, attempting to squeeze out annualized expenses of $25 million. At the same time, the company is investing in opening new stores featuring the Pura Vida products, taking a life-style brand that had been e-commerce focused and attempting to convert it into more omni-channel opportunities. A pilot bricks & mortar store for Pura Vida in San Diego has been exceeding expectations, and new locations are slotted for Myrtle Beach and Phoenix, among others.

All Dressed Up, Anywhere to Go?

The good news historically for Vera Bradley has been its overall conservative cash management, typically operating without any debt, and that remains true; the most significant liability on its balance sheet are its $98 million in operating lease liabilities. Through the end of the first quarter, the company had cash of $64 million, which is down nearly $25 million from the fiscal year end, but still overall healthy. Much of that cash drawdown is explained by $10.5 million used actively buying back shares, part of a $50 million authorization that still had $35 million available to use. I fully expect that shares are being actively repurchased on at least the same pace currently as they were during Q1, when the average price on repurchased shares was $7.35.

But the buyback price leads to its question of what Vera Bradley’s shares should be worth. To start with, there is a baseline amount of cash per share, regardless of any value the operations may or may not have. At $64 million in cash and 32.7 million shares outstanding, each share is backed by almost $2 of cash, or nearly 50% of share value with the stock trading around $4.15. That ratio could well change a fair amount by the time Q2 results come out, but it provides a sort of starting point, suggesting a bottom range of $2.00. If the operations have another $2.00 per share in value, then the equity is fairly valued, and if the value of the operations is justifiably and measurably more than $2.00, then the shares are likely undervalued.

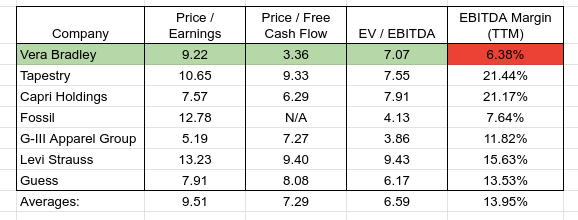

A quick note about one of the valuation metrics here. There is some healthy debate about how to treat operating leases – as operating expenses or as a financing expense, and how that flows over into factoring into calculations for enterprise value, for example. In this case, Vera Bradley’s operating lease liabilities have been factored into its enterprise value for determining its EV / EBITDA ratio.

Valuation ratios, assorted (Seeking Alpha, author’s spreadsheet)

On the whole, Vera Bradley is valued in-line with some selected peers in fashion and accessories, although what clearly sticks out is its low margins, which suggests to me that perhaps it has had to discount prices through the last quarter, combined with being only partially through the cycle of raising prices. If inventory can be well managed, then I expect to see margins jump up, although historically Vera has lagged its peers on margins.

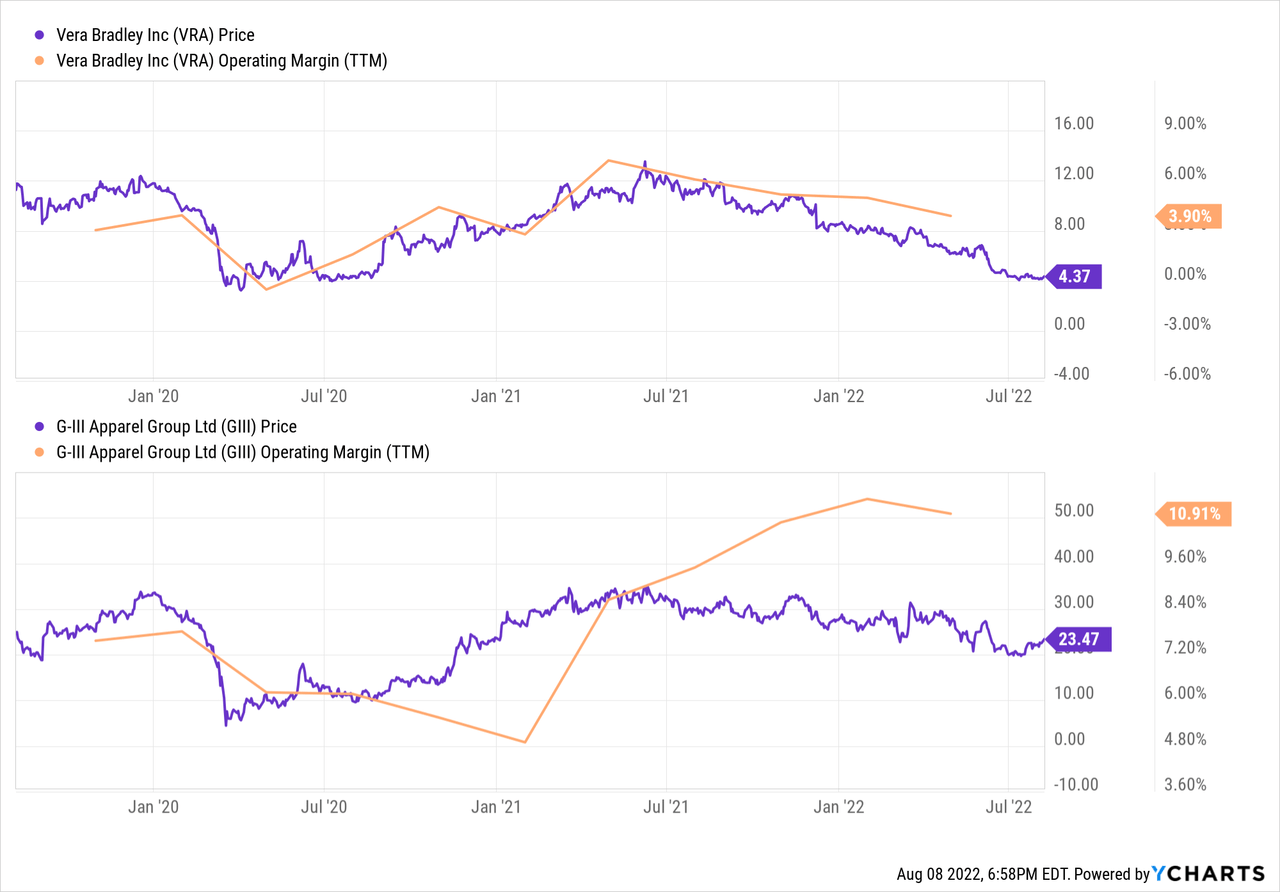

What is immediately evident from the chart looking at share price and operating margin over a three-year period is that Vera Bradley’s equity value correlates to its operating margin pretty strongly, as opposed to G-III Apparel (GIII). G-III Apparel is the owner of brands such as DKNY, as well as having brand licenses for several others well known fashion names, and its chart shows a situation in which margin and valuation diverge strongly at times. Clearly, there is no universal rule dictating that margins and valuation go hand-in-hand, even within the same sector. I even picked G-III Apparel intentionally because it also had EBITDA margin below the average of the names I used for comparisons, in order to pick one that might be considered another under-performer. Vera’s very best operating margin in the last three years, 6% or so, is merely the average or slightly below the average for G-III Apparel. In other words, Vera’s average margin over time has generally been lower.

Concluding Thoughts

If I were forced to go into predictive mode (with the standard caveat that past performance is not necessarily indicative of future results), my contention would be simple – if Vera can improve its operating margins, the valuation will improve. Management is clear that they are raising prices, as would be expected, but it will take a couple of quarters for those price changes to start being reflected. Rob Wallstrom, the company’s outgoing CEO, addressed pricing on the most recent analyst call, saying (edited for length):

At Pura Vida, that they’ve had price increases across nearly all of the product categories. And it seems to be a good level of acceptance from the consumer. At Vera Bradley, we’ve been more targeted in those price increases, really looking at it by item because of the diversity of our assortment there. And what we’re seeing though is that as we’ve increased price increases that the consumers are accepting it, but not with an unlimited acceptance. . . what we have seen, as we talked about earlier, is just more acceptance, more spending overall by the higher income customer and obviously, a pullback from the lower-income customer. But what’s been interesting is even looking at promotional activity, we found that the promotional activity is really not necessary for the high-income customer that they seem to be accepting their price increases.

The long-term question is really whether or not Vera cannot just first reach higher margin, but more importantly, can they prove durable. I am modestly comfortable in expecting to see those margins improve over the next 4 to 6 months, and expect to see the valuation follow right along. However, given the company’s prior difficulties in keeping margins robust, I continue to see Vera Bradley as an equity for trading short-term, but a harder one to invest in for the long-term. I rate it a speculative buy with a holding period less than a year, as its overall valuation on fundamentals does not point to deeply under-valued equity.

Be the first to comment