cagkansayin

Bonds did not perform well so far this year. TLT, an ETF tracking long-term (20 Years+) treasury bonds, plummeted over 30% YTD. While LQD, an investment-grade bond ETF, also dropped around 20% YTD. Despite their underperformance this year, I believe investment-grade corporate bonds will be a better investment than common stock in 2023.

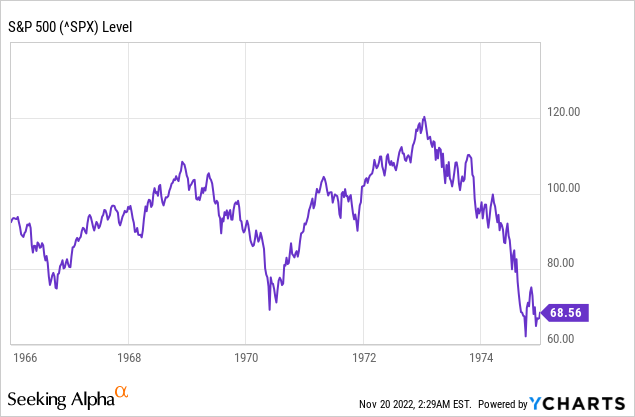

The market had a wild bullish run after the Great Recession, once up about 600% from its bottom in 2009. Many deemed such a bullish run must continue. However, if we look back into history, after the bullish run between 1949 and 1966, where the Dow Jones Industrial Average advanced over sixfold, the market experienced an 8-year stagnant period. The lowest point in 1974 was even lower than the bottom in 1966. We cannot eliminate the possibility that we are entering a similar scenario.

As Benjamin Graham said in his book, The Intelligent Investor:

Even high-quality stocks cannot be a better purchase than bonds under all conditions – i.e., regardless of how high the stock market may be and how low the current dividend return compared with the rates available on bonds.

So, investing in bonds is essential in current turbulent times and definitely worth studying.

Investment in Common Stock is Unattractive

BlackRock (BLK) recently published a commentary on the overtightening policy from central banks around the globe. Apart from rapid rate hikes, the Fed also runs off the balance sheet of US$95 billion monthly, leading to a massive drop in monetary aggregates to levels not seen since the Great Depression. These led to investment-grade corporate bonds’ disappointing performance this year. However, the investment firm overweighs it as default risk has been contained, and income potential is attractive.

The underlying reason is straightforward. The return on bonds will be more attractive than common stocks in 2023. With the expectation that the Fed will continue to raise interest rates, we may see corporate bond yield further escalate, making an investment in corporate bonds more lucrative in the short term. Below tabled the yields of investment-grade bonds referencing from the ICE BofA US Corporate Index Effective Yield. Bond yields surged to the highest level since 2008.

| Credit Rating | Yield |

| AAA | 4.64% |

| AA | 4.89% |

| A | 5.33% |

| BBB | 5.87% |

With a high probability of a recession in 2023 (The Conference Board estimated a 96% chance), investment-grade bonds will be much safer to invest in. Amid turbulent times like this, it is paramount to protect our capital. Investment-grade bonds refer to bonds having BBB grade or higher credit rating. The highest one-year default rate for BBB grade bonds is 1.02%, while the default rate for BB and B grade bonds are 4.22% and 13.84%, respectively.

On the contrary, the return in common stocks may be underwhelming due to valuation and recession risk. The current PE ratio of the S&P 500 (20.78) is slightly higher than the median (20.14), which means that prices of the broader market generally returned to their fair value. This looks like a great opportunity to invest in common stocks. But when we take into account the yield on high-grade bonds, their returns may outpace stock returns as most analysts lowered forecasts for earnings next year.

A drop in earnings forecast may push the S&P 500 further downward. Goldman Sachs (GS) estimated the earnings would stay flat, while UBS (UBS) predicted it to fall 11%. The latter also targeted the S&P 500 at 3900 at the end of 2023, implying a 2% drop from the current level.

So, regardless of the bond price, purchasing investment-grade corporate bonds will be a more rewarding investment strategy next year. Furthermore, as Blackrock mentioned, default risk has already been reflected. Corporate bond prices are unlikely to plummet further when a recession hits.

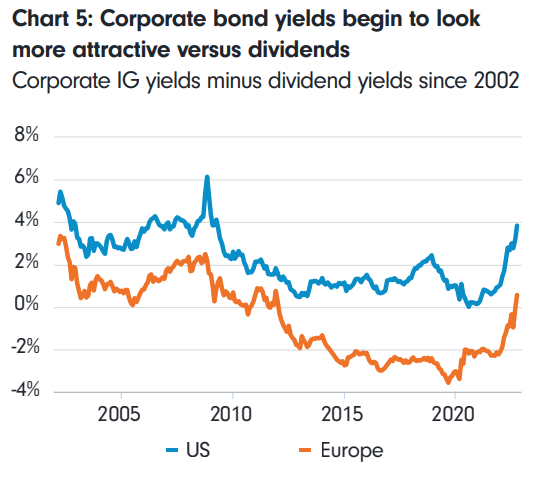

The surge in bond yield to dividend yield ratio to the highest since 2008 further confirmed us that corporate bonds are a more favourable option than common stocks. The below graph shows the spread between corporate investment-grade bond yield and dividend yield since 2002.

Fidelity

Investment Grade Corporate Bond ETF

In general, investing in a bond ETF enjoys a lower investment threshold, a monthly distribution of dividend and a higher level of risk diversification. The investment threshold of bond ETFs is only approximately $50-$100. On the contrary, the minimum investment quantity of a bond is US$1,000 or US$2,000 in most cases. And some may require ten-thousands of dollars.

Thus, I shortlisted three investment-grade corporate bond ETFs with the highest asset value for comparison:

- Vanguard Short-term Corporate Bond ETF (NASDAQ:VCSH)

- Vanguard Intermediate-term Corporate Bond ETF (VCIT)

- iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD)

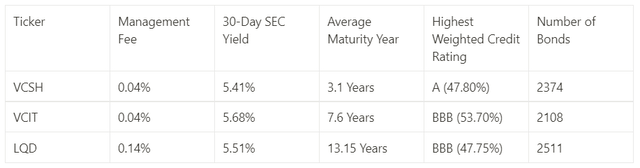

All ETFs have exposure to a wide range of investment-grade corporate bonds. Below tabled some pivotal data of the above three ETFs (as at 17 Nov 2022).

As a relatively defensive investor, my choice of ETF will be VCSH. VCSH tracks Bloomberg U.S. 1-5 Year Corporate Bond Index to invest in corporate high-quality bonds. First, it provides a relatively attractive yield with the lowest management fee. Generally, bonds with longer maturity will have higher yield. However, the yield curve is quite flat now. For instance, the yield of LQD is only ten basis-point higher than VCSH, making investment in long-term bond ETF unattractive.

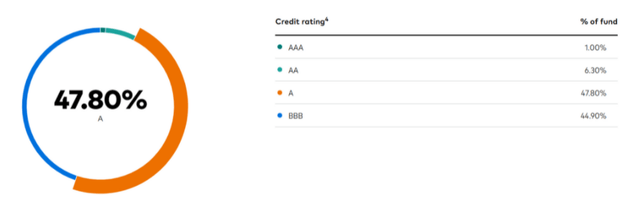

Second, VCSH is the safest investment among the four. It has 55.1% of the fund invested in A grade or higher bond, which is 9.4% and 4.2% higher than VCIT and LQD respectively. VCSH also has a great diversity on its holdings. Its top ten holdings include bonds from renowned companies like Boeing (BA), Bank of America (BAC), AbbVie (ABBV), Apple (AAPL), etc.

Thirdly, VCSH has a short maturity period (between 1 and 5 years). Bonds with short maturity period are less volatile. When interest rates rise, a short-term bond falls far less than a long-term bond. For instance, VCSH dropped 7.57% YTD, while LQD plummeted almost 20%. Although headline CPI data seems peaked last month, a reversal of bond price may be soon expected. However, should the hawkish Fed raise interest rates more than expected, the downward pressure of long-term bond prices shall surge. At the current moment, Wall Street anticipated the Fed will increase rates until March or May next year.

Conclusion

Investment-grade corporate bonds will be an essential component in everyone’s portfolio. Wall Street is chiefly bullish in this category given the following reasons:-

- Recession risk is high in 2023

- Bond valuation is attractive

- A more significant role in investing strategies

It is a rare opportunity to earn a near 5% yield in an AAA-grade corporate bond, making investment in common stock unattractive. The inclusion of fixed income can improve investors’ psychology in holding common stocks during an economic downturn. VCSH will be an excellent choice to get yourself involved in investment-grade corporate bonds.

Be the first to comment