syahrir maulana

Vanguard Small Cap Growth ETF (NYSEARCA:NYSEARCA:VBK) is an exchange-traded fund that is designed to track its benchmark index, the CRSP US Small Cap Growth Index, the most recent factsheet for which indicates 713 constituents (as of June 30, 2022) with a median market cap of $1.7 billion. All constituents represented less than 1% of the index, and VBK‘s portfolio closely follows, with 709 holdings most recently (as of July 2022 month-end). The expense ratio of the fund is marginal (cheap), at just 0.07%, while the fund had assets under management of $12.8 billion as of July 31, 2022.

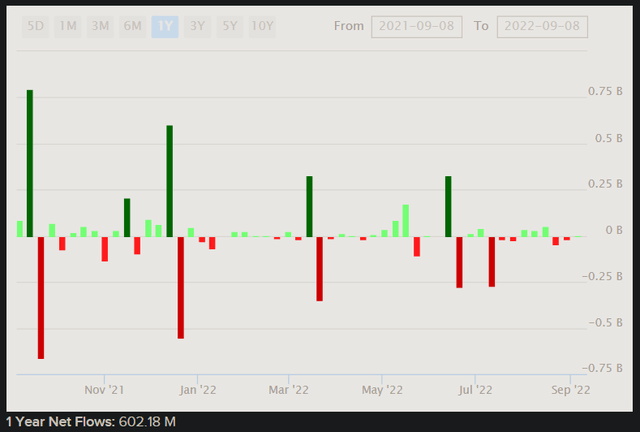

VBK’s assets under management have increased over the past year or so, per the data/chart below, which indicates roughly $600 million of net fund flows over the past year.

However, VBK has underperformed most recently. My last article covering VBK was published on August 19, 2021, in which I was ultimately neutral but described the fund as risky at the time. Since then, per Seeking Alpha data at the time of writing, VBK’s share price has fallen by -18.67% against the S&P 500 U.S. equity index’s comparable change of -7.78%. That is “down beta” of circa 2.4x, against the long-term historical beta to date of about 1.14x. So, clearly VBK has been moving sharply downward in a decidedly “non-random” fashion. My previous opinion on VBK was driven by an elevated valuation, and the possibility of higher risk-free rates (which did materialize), and inflationary pressures that small-cap stocks are less likely to be able to withstand.

Larger companies that dominate U.S. equity indices such as the S&P 500 tend to have more pricing power than smaller companies. Generally speaking, it is a riskier proposition to have exposure to small-caps during inflationary periods. If inflationary concerns abate, and risk-free rates ease off (or even fall), you could see small-cap out-performance. However, this is of course not guaranteed; the valuation at your entry point will still matter, as will the longevity of any renewed risk-on environment.

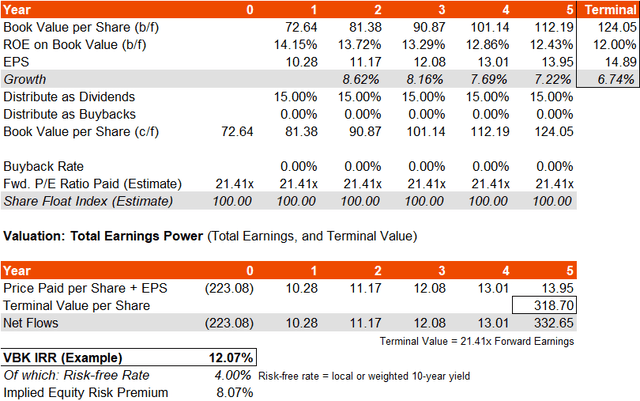

In terms of present valuation: Morningstar tells us that VBK’s forward price/earnings ratio is circa 21.41x, with a price/book ratio of 3.03x, and an indicative dividend yield of 0.65%. Three- to five-year earnings growth is projected at circa 14.70%. These numbers also by implication suggest a forward return on equity of 14.15%. Fidelity offers a trailing price/earnings ratio of circa 23x; although this is probably not perfectly comparable, I can also use that to guess a distribution rate of earnings into dividends of about 15%, which is low but not surprising given that VBK is invested in supposedly higher-growth small-cap stocks (which are more likely to retain and reinvest earnings).

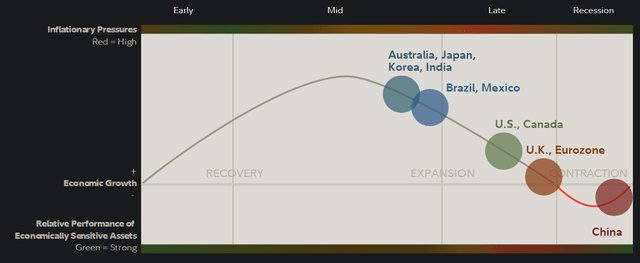

I would also caution against Morningstar’s numbers, which characteristically adjust for certain non-operating items, and can often adjust for company losses across portfolios. However, we will proceed first with these inputs. A forward return on equity of over 14% is good, but I will assume a tailing off to 10% over the next few years, which takes my three- to five-year earnings growth rate to 7-8% (lower than Morningstar’s circa 14-15% consensus). I would prefer to be conservative given the possibility of recession, especially given that recession is the most likely next phase in the present U.S. business cycle (see below for a chart from Fidelity research for Q3 2022).

Based on my assumptions, and a notional risk-free rate of 4% (to help gauge any underlying equity risk premium), I arrive at an implied IRR for VBK of about 12%. The implied ERP is 8%, which is strong, even if we adjust for historical beta of 1.14x (making the adjusted ERP safely above 7%, especially since I have used a generous risk-free rate assumption).

This does use likely adjusted earnings, but I have at least provided a forecast earnings growth trajectory that is about half the consensus growth rate. One aspect, I would however revisit at this point, is the forward price/earnings multiple, which is currently about 21.41x (as provided for above). Assuming a 5.5% ERP scaled up by VBK’s historical beta of 1.14x, and a 4% notional risk-free rate, and a 2-3.5% earnings growth rate to perpetuity, the forward price/earnings multiple over the long haul should probably fall into the region of 12.09x to 14.77x.

The interesting part of ETFs is that they rebalance, so it is difficult to value ETF as a constant portfolio; my gauges of IRR are based on long-term holding, but even so-called passive ETFs are in a sense actively managed due to rebalancings. Nevertheless, it is not likely a good idea to try to account for favorable rebalancings; on the contrary, VBK may well rebalance out of companies that are particularly successful over the long haul, once they no longer fall within VBK’s small-cap growth remit. Therefore, I think this approach is fair, and so it makes sense to assume some long-term “earnings multiple drag”.

While small caps might not “mature” rapidly, if we assumed a ten-year linear maturity in earnings growth potential, the forward price/earnings multiple might fall from the present 21.41x to something like 18x by the terminal year. This would reduce my implied IRR from 12.07% (above) to a much lower 8.73%. The implied ERP would drop to 4.73%. An adjusted ERP of 4.15% would lead me to believe that VBK is probably on the outskirts of fair value, though potentially slightly overvalued (I generally believe an ERP of 4.2-5.5% is fair for the S&P 500/the broader U.S. stock market).

On balance, I think VBK is trading at close to fair value, only in the short term it would seem as though all the same inflationary pressures and profit concerns are likely to hit VBK’s portfolio harder than the broader indices. Therefore, I would generally expect further “down beta” from VBK in the near term, especially as we could see a recession in the next 12-24 months which tends to result in risk-off events that harm small-caps more than large-caps.

In other words, VBK is at best probably trading within the realms of fair value, while it is cyclically poorly positioned. On the other hand, the underlying IRR might be in the range of 8-12%, so it does not make sense to take a bearish view on a longer-term time horizon. I would just not expect any material or sustained out-performance in the medium term.

Be the first to comment