Bernard Chantal

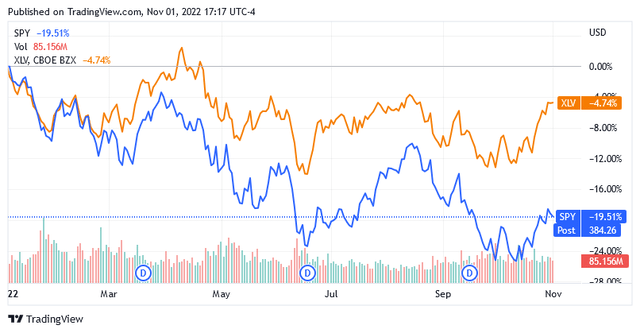

Since the start of the year, bearish sentiment has caused U.S.-traded stocks to fall 19.5% as shown in the chart below. It illustrates the performance of the SPY SPDR S&P 500 Trust ETF (SPY), which serves as the benchmark index for the entire U.S. market.

But fortunately, not everything is negative in this market.

As the modest loss in the Health Care Select Sector SPDR (XLV) Index indicates, the healthcare sector is home to stocks whose bright prospects even this very prolonged bearish sentiment cannot overshadow.

Vaxcyte, Inc. (NASDAQ:PCVX) could be one of these stocks, as the company keeps on laying the foundation for future growth amid market headwinds.

The Role Of Vaxcyte In The Biotech Industry

Based in San Carlos, California, Vaxcyte is a biotech engineer working on vaccines to improve human protection against the effects of serious bacterial infectious diseases.

Vaxcyte’s lead candidate, called VAX-24, is both a broad-spectrum and 24-valent pneumococcal conjugate vaccine the company is developing to prevent invasive pneumococcal disease (IPD) and pneumonia.

VAX-24 can treat a variety of bacterial infections and diseases.

24-valent means that after immunization has been acquired, the pneumococcal disease will be prevented if it is caused by the 24 serotypes contained in the vaccine. Serotypes are a classification within the bacteria that cause IPD based on their surface antigens.

A conjugate vaccine is a substance consisting of a complex protein (conjugated) of polysaccharide antigen bound to a carrier molecule, together contributing to a stable yet effective vaccine.

Invasive Pneumococcal Disease And Pneumonia Disease

Invasive pneumococcal disease (IPD) is an infection caused by the Streptococcus bacteria when the microorganism has spread to sterile parts of the body. These are usually pathogen-free parts of the body, such as the bloodstream, the cerebrospinal fluid (lining of the brain and spinal cord), and pleural fluid (lining of the lungs), as well as the synovial fluid (lining of the joint capsule) or pericardial fluid (heart membrane).

Depending on the site affected by the IPD, patients may have an infection of the blood ranging from mild (bacteremia) to more severe blood poisoning (sepsis) or infection of the bone (osteomyelitis), or of the joints (septic arthritis) or inflammation of the lungs (pneumonia). But also, pericarditis (inflammation of the sac around the heart) or meningitis (inflammation of the cerebrospinal fluid).

Pneumonia can also be caused by a microbial pathogen or virus other than Streptococcus bacteria, which Vaxcyte’s VAX-24 also targets.

The Streptococcus bacterium, more commonly found in the mucous membrane of the nose and throat, is usually transmitted to other people when they come into direct contact with infected respiratory droplets. The ideal environment for the spread of infection is a crowd, so being a carrier of the bacteria is enough to trigger an outbreak. This type of infection is common in winter, but there are also cases at the beginning of each spring.

The bacterium does not cause disease in people with a good immune system, but when the immune system is weak, the microorganism can lead to serious illnesses, requiring hospitalization.

Although in good shape, a healthy immune system for children and the elderly may not be enough to prevent them from developing serious illnesses caused by streptococcal pneumonia.

Not just age, but alcoholism, or the presence of a previous illness, especially if it affects the heart, lungs, kidneys, or liver in a chronic form, represents a significant risk factor for the development of a serious illness.

Pneumococcal disease is a major problem for public health worldwide.

In the U.S. alone, 150,000 people are hospitalized every year because of the invasive form of pneumonia, and 5-7% die. Unfortunately, deaths from other forms of IPD are not uncommon every year either.

The Phase 1/2 Clinical Trial For VAX-24 Yielded Positive Outcomes

On October 24, Vaxcyte announced that the Phase 1/2 clinical trial in which the company is testing its VAX-24 pneumococcal vaccine among 18- 64 old healthy subjects has yielded encouraging results so far.

In terms of antibody response to the same 20 serotypes contained in VAX-24 and Prevnar 20 (PCV20) – the Pfizer (PFE) vaccine used as the benchmark for the evaluation – Vaxcyte’s lead candidate was in the experiment non-inferior, the company said.

In addition, the safety and tolerability results of VAX-24 treatment were consistent with those of Pfizer’s PCV20, demonstrating the potential of VAX-24 as a vaccine against invasive pneumococcal disease (IPD) and pneumonia.

At the conventional dose of 2.2 micro-grams (mcg) against all 24 serotypes, Vaxcyte’s VAX-24 was non-inferior while several times exceeding the immunogenicity (immune response) standards set by the U.S. Food and Drug Administration. This is the dose at which the company plans to advance the drug VAX-24 into Phase 3 of the trial, with regulatory activities that should begin sometime in the second half of 2023.

These results from human studies allow the company to target a market that, according to this June 2020 World Health Organization (WHO) report, should develop in a very interesting way for Vaxcyte’s future ambitions.

So, any further improvement in the development of this drug will potentially have a positive impact on the Vaxcyte stock price.

WHO’s Prospects for Pneumococcal Conjugate Vaccine

According to the WHO, demand for the pneumococcal conjugate vaccine (PCV) is expected to increase by almost 25% over the next decade, compared to 245 million doses sold in 2019.

The increasing demand is being driven by the increasing uptake of routine infant vaccinations in countries around the world, including those with the highest populations such as India, China, and Indonesia.

Supply of PCV is expected to respond to higher demand, with a 60 percent increase in vaccine vial volume just in the first five years of the next decade as more new manufacturers enter the market.

In the medium term, the need for specific vaccines against subtypes and COVID-19 infection could create a supply-demand imbalance that will need to be addressed.

In addition, countries in the poorer regions of the world are expected to strongly boost demand for PCV in the coming years.

The Balance Sheet: New Resources Are On The Way

The company isn’t selling any treatment yet, so its quarterly reports don’t show a positive net result.

For the most recent three-month period that ended June 30, 2022, the net loss was $48.5 million, while in the same quarter last year the net loss was $23.7 million.

In the second quarter of 2022, the company spent $47.5 million on research and development activities (R&D) and general and administrative expenses (G&A), compared to $23.8 million in the same quarter of 2021.

Annualized R&D plus G&A expenses are 1.8 times below net cash of $340.2 million. In addition, the company will shortly mobilize an additional $600 million, which will come from the issuance of shares whose offering had October 28 as the last available day to subscribe for the newly issued shares.

Share Price: A Lower Share Price Is Possible Given The Ongoing Bearish Sentiment

Shares were trading at $44.9 per unit at the time of writing, giving it a market cap of $3.34 billion and a 52-week range of $16.78 to $46.03.

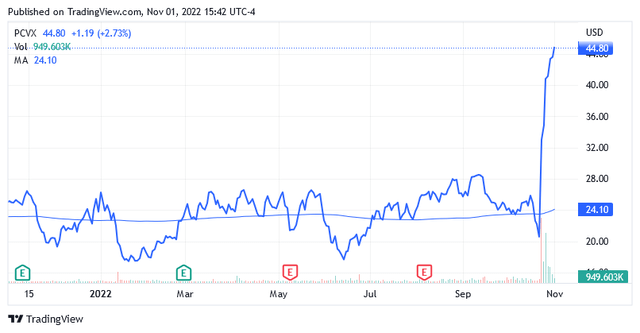

Following the Phase 1/2 study results announced on Oct. 24, the stock rose amazingly, as shown in the chart above, and is now trading 86% above the long-term trend of the 200 moving average of $24.10.

Currently, the stock has a very high share price compared to recent valuations. But a lower share price is possible, as some euphoria over positive Phase 1/2 study results fades amid a market that is likely to remain in a downtrend for a while.

The stock market will most likely continue to be impacted by the U.S. Federal Reserve’s monetary tightening, which may take longer than widely believed. After gross domestic product grew 2.6% in the third quarter, the Federal Reserve did not get the feedback it expected from its plan to slow down fast-rising inflation.

Further rate hikes imply higher discount rates, leading to lower valuations than the market is currently suggesting and, therefore, not welcomed by investors in U.S.-listed equities.

With a market beta of 0.45, Vaxcyte should follow the expected market decline, albeit more slowly.

Analyst Recommendation Rating And Average Target Price

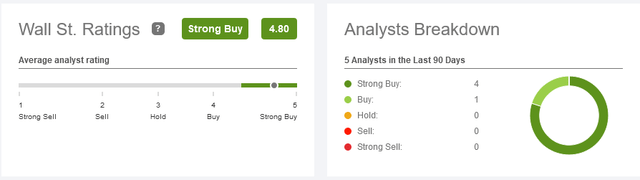

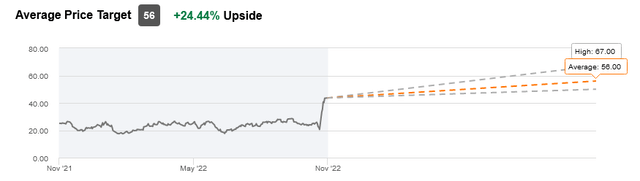

Wall Street issued 4 Strong Buys and one Buy rating, resulting in a medium rating of Strong Buy.

The stock has an average price target of $56 per share, reflecting a 24.44% upside from current levels.

Conclusion – The stock Has Amazing Growth Potential, But Share Prices Could Be Lower

Following encouraging results from the first human Phase 1/2 trial, Vaxcyte’s lead candidate, VAX-24, shows a high probability of being a potential pneumococcal conjugate vaccine.

This has practically paved the way for Vaxcyte into a market that is expected to do very well over the next few years.

Vaxcyte, Inc. shares are trading very high compared to recent valuations, but given the continued bearish sentiment, they could get cheaper going forward.

Be the first to comment