luza studios/E+ via Getty Images

“Know the enemy, know yourself and victory is never in doubt, not in a hundred battles.” – Sun Tzu, The Art of War

Today, we take a deep dive into Vaxart (NASDAQ:VXRT) for the first time here on Seeking Alpha. The company is a unique vaccine concern in that is developing oral vaccines that offer an easier route of administration as well as room temperature stability and other advantages.

January Company Presentation

The company has several candidates in development targeting large potential markets. Like more vaccine plays, the market has not been kind to the stock so far in 2022. A full analysis follows below.

Company Overview:

January Company Presentation

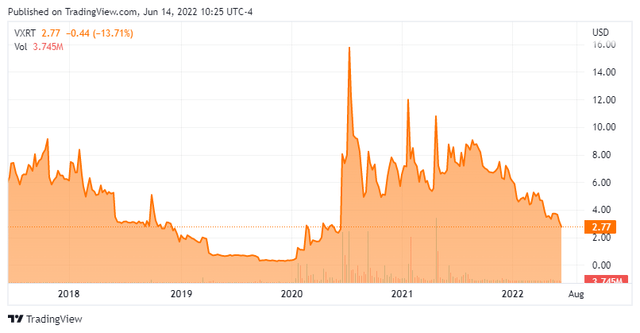

Vaxart is based in San Francisco. This clinical staged biotech concern is focused on the discovery and development of oral recombinant protein vaccines based on its proprietary oral vaccine platform. The stock currently trades just under three bucks a share and sports an approximate market capitalization of $400 million.

January Company Presentation

The company has multiple ‘shots on goal’ including two efforts targeting Covid-19.

January Company Presentation

The most advance of these is in Phase II development. Earlier this month, the company disclosed positive results from both of these candidates in studies. The company believes its candidates could be effective as new Covid variants emerge and also help increase the percentage of individuals vaccinated against Covid because of its delivery approach.

January Company Presentation

The company has two more major focus areas in its pipeline. The first of which is around developing a vaccine for influenza.

January Company Presentation

Obviously, this is a potential large market. Vaxart has completed Phase 1 trials for an H1N1 influenza A strain and for an influenza B strain. These demonstrated safety and immune responses that correlate with protection from influenza. A quadrivalent influenza program is on hold until a development partner can be found.

January Company Presentation

The other key effort underway is around norovirus. This is a large market as this affliction triggers approximately 20 million cases of acute gastroenteritis each year and as many as 800 deaths in the United States. The company has conducted three Phase 1 studies of its norovirus tablet vaccine. These showed that this candidate was well tolerated and generated systemic and local immune responses that are both robust and persistent. The latest results came out early this month and showed positive preliminary data from a phase 1b trial in adults aged 55-80 years.

Analyst Commentary & Balance Sheet:

Last month, B. Riley Financial reiterated a Hold rating and $6 price target on VXRT while Brookline Capital reissued its Buy rating and $10 price target. Let in February, Piper Sandler maintained its Buy rating as its analyst

Continues to be “impressed” by Vaxart’s progress in its COVID and norovirus programs, and views the Q4 to be rich in catalysts for the next 12 months. Most notable is the Phase 2 COVID naive and booster data expected in the first half of 2022 and three norovirus studies with data between Q1 2022 – Q1 2023. Vaxart also provided new NHP data from its COVID study that showed pan variant coverage and up to 1000X greater IgA responses compared to control.”

Finally, at the end of December, Jefferies reissued its Buy rating and $12 price target. Approximately 18% of the outstanding float is currently held short. There has been no insider buying or selling in the stock so far in 2022. The company ended the first quarter with $157 million in cash and marketable securities on the balance sheet after burning through $25.1 million in cash for operations in the first quarter.

Verdict:

Vaxart is definitely working on an intriguing pipeline. I would be more enthusiastic if its Covid-19 program was 12-18 months further along given the abundance of currently approved vaccines, and the pandemic has ebbed significantly over the past year (as far as being in the headlines).

January Company Presentation

The hard part of putting together an investment case around Vaxart is trying to figure out major milestone timelines for its vaccine candidates. There are no quarterly conference call transcripts to go through. This information is not forthcoming on its website either. Finally, most of the milestones listed on its last investor presentation from January have been achieved.

Without this information, it is hard to forecast when the company could hit the commercialization stage and also when/how much more of a capital raise it will need to do to achieve this. Vaxart is also currently searching for a permanent CFO. Therefore, as intriguing as Vaxart’s pipeline might be, the investment case has to get an ‘incomplete‘ at this point. This is likely a story we circle back on when more information is forthcoming.

“It is a fact that one man can be deliriously happy in the exact situation that causes another man to wither from depression.” – Richelle E. Goodrich

Be the first to comment