Kwarkot

Thesis: Commercial Real Estate Is Proving Its Worth

Real estate investment trusts (“REITs”) are a unique asset class in that their stock prices tend to fluctuate quite a bit while their property assets have a certain value on the private market that does not fluctuate very much at all.

REIT stock prices tend to follow stocks more generally and are especially sensitive to changes in interest rates. But while REITs do tend to operate at about 30-40% debt-to-value ratios, they are not as immediately sensitive to interest rate changes as many people think. This is for two reasons:

- REITs tend to opportunistically lock in debt at fixed rates with long maturities when interest rates are low.

- Rising rents offset the negative effect of rising interest expenses.

And yet, despite demonstrating strong fundamental performance over and over again during rising interest rate periods, REITs still tend to underperform during them. That creates significant opportunities for REIT investors.

This year, as we’ll see below, REITs are proving their worth as a strong inflation hedge even in the midst of rising rates. Rent growth has benefited REITs far more than rising rates have hurt them, at least so far.

Let’s look at how U.S. REITs have performed this year and then take a look at five interesting opportunities that have presented themselves because of the selloff.

The REIT Resurgence

NAREIT, the American REIT advocacy organization, tracks a multitude of REIT performance metrics on a quarterly basis and updates them in their T-Tracker reports. The picture we find in NAREIT’s Q2 2022 T-Tracker report is one of almost universal strength in REITdom.

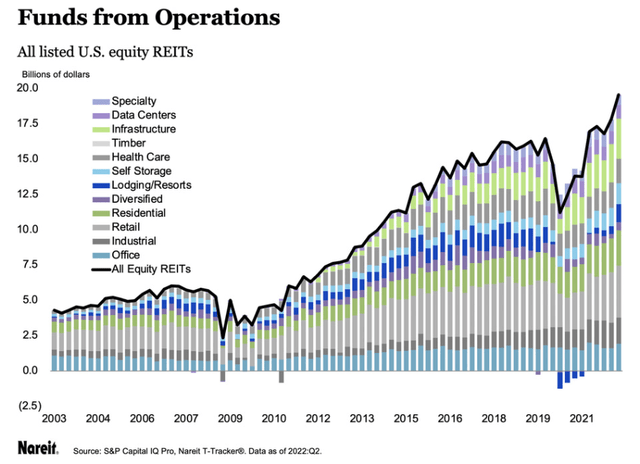

Total funds from operations (“FFO” – the industry standard earnings metric for REITs) reached a new all-time high of nearly $20 billion, as ~84% of REITs reported higher FFO than a year ago while 92% reported higher net operating income (“NOI”).

Nareit T-Tracker

Lodging (hotel & resort) REITs in particular enjoyed a strong showing, reporting ~130% growth in FFO quarter-over-quarter, returning to pre-pandemic levels.

Occupancy for all REITs also returned to pre-pandemic levels of 93.7%, while retail occupancy grew over 100 basis points QoQ to 96.9% and industrial occupancy sits at 97.1%.

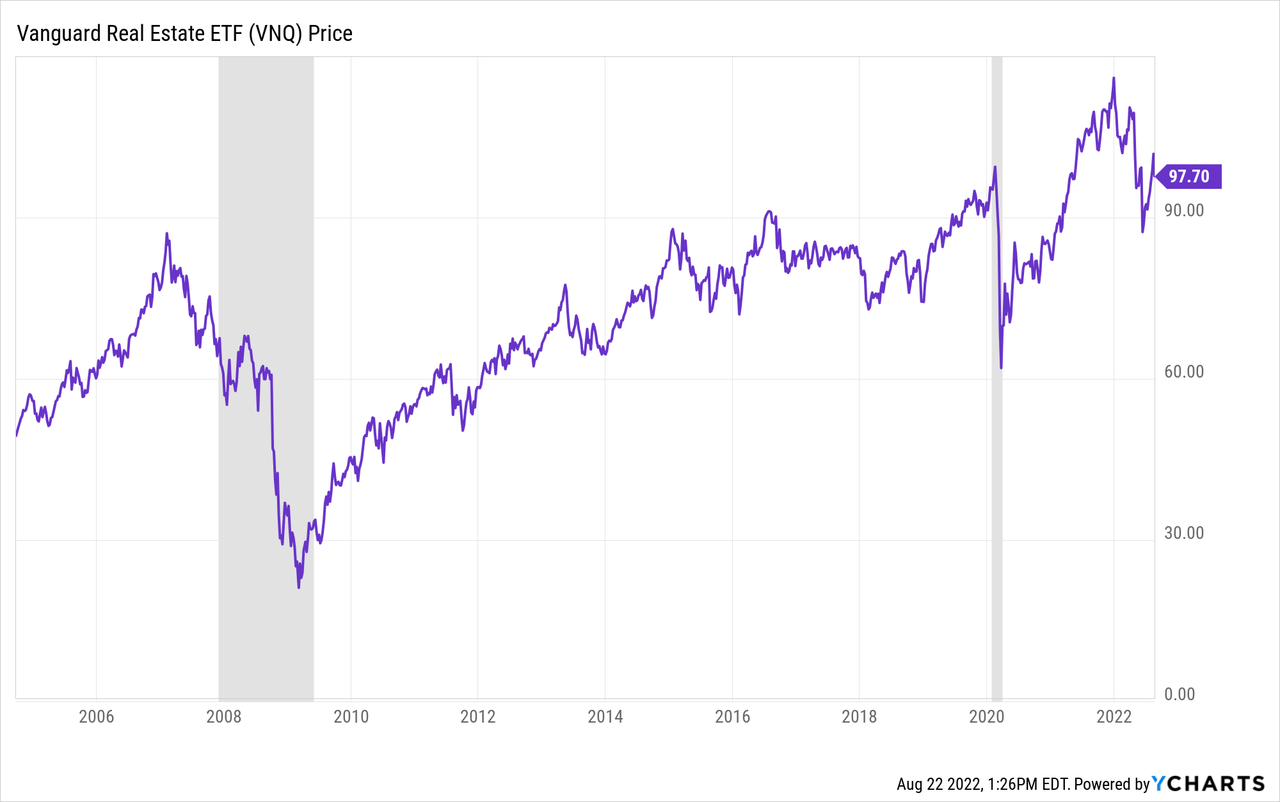

And yet, despite this nearly across-the-board growth from REITs, their stocks are trading on average around the same level they were just prior to the onset of COVID-19.

The market does price in expected future outcomes in advance, so perhaps this weak REIT stock performance signifies weakness yet to manifest. If so, however, none of that weakness has made an appearance so far.

Quite the opposite, actually. In the second quarter, despite rising interest rates, REITs extended the average remaining term to maturity on their debt to a little over 7 years and lowered their interest expense as a percentage of NOI to a record low of 16.8% (down from 17.7% in the first quarter).

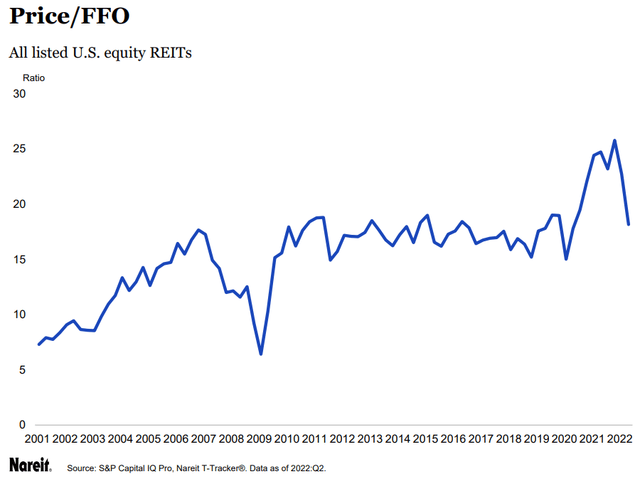

Now, investors may have gotten a little too eager buying REITs in 2021, as REITs’ price-to-FFO multiples got a bit stretched. But after the selloff this year, REIT valuations are roughly back in line with their average post-2010 level.

Nareit T-Tracker

This average FFO multiple was during a time of low inflation, when REIT rent rates grew at a much slower pace than today. Commercial real estate, and thus arguably REITs, should be considered more valuable today than it was then because of its ability to grow NOI along with inflation.

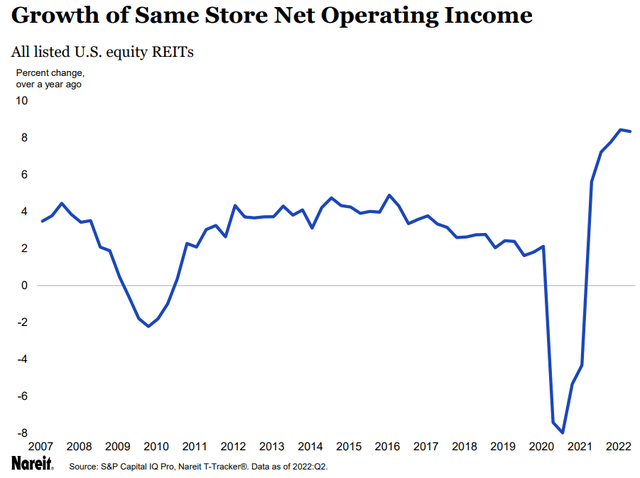

Consider same-store (or same-property) growth numbers. Same-store NOI grew 8.3% over the trailing four quarters. That is roughly in line with the TTM CPI growth of 8.5% as of July 2022.

Nareit T-Tracker

This chart, more than any other, shows that REITs do make a strong inflation hedge. The same properties have generated NOI growth commensurate with inflation over the last year or so.

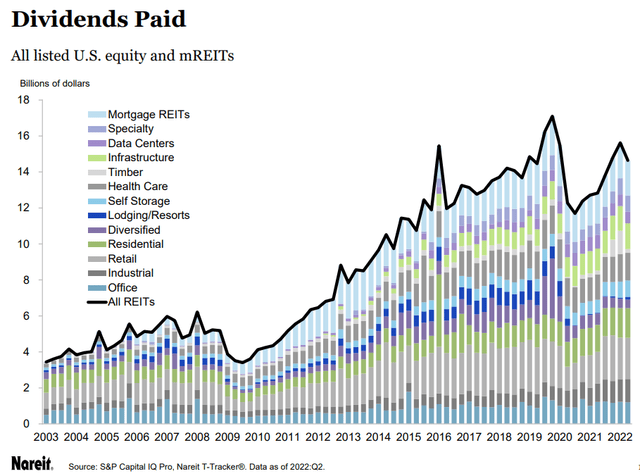

This strong NOI and FFO growth has naturally translated into a resurgence of REIT dividends, many of which had to be cut during the initial COVID-19 outbreak.

Nareit T-Tracker

Nearly all REIT sectors, with the notable exception of lodging, are paying out around the same level of total dividends today as they were before the pandemic.

As you can see, despite market pessimism, REITs’ fundamentals remain strong. There haven’t been any cracks showing up in the numbers yet for REITs broadly. Of course, some individual REITs continue to struggle. But the asset class overall is thriving.

5 REIT Buys Today

One can always just buy the Vanguard Real Estate ETF (VNQ) and be done with it. But Seeking Alpha readers are well aware of the fact that some REITs make better values than others.

Reducing all the value opportunities available in REITdom down to a list of five is perhaps a display of hubris. I do not claim that the following five REITs are the very best buys that will generate the highest total returns in the entire REIT space over such and such time period.

Candidly, I don’t know what the market will do. If your luck is as good as mine, you may buy them and then watch their stock price go down for weeks or months afterward.

I pick the following five REITs because they are each solid performers that I believe will be able to weather the current inflation and a potentially oncoming recession with little to no significant problems.

1. American Homes 4 Rent (AMH)

- Dividend Yield: 1.95%

- Price to FFO: 23.8x

PR Newswire

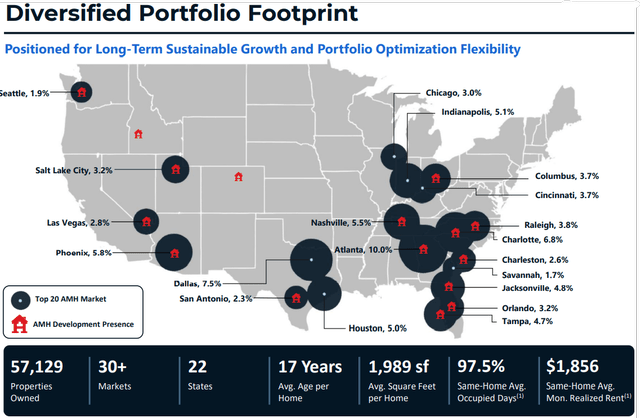

With the national housing shortage continuing to buoy home prices and Millennials aging out of their “apartment phase” of life, single-family rentals such as those owned by AMH should grow in popularity. Now add in highly favorable net migration trends across the Sunbelt and you have the basic case for the continued strong performance of AMH.

The REIT’s SFR portfolio is heavily concentrated in the Sunbelt, especially the fast-growing markets in Florida, Texas, Georgia, North Carolina, and Arizona.

AMH Presentation

What’s more, AMH also boasts the only in-house build-to-rent development platform in its peer group, with a huge land pipeline of over 20,000 lots. The REIT expects to deliver over 2,200 finished homes this year. This is a massive value generator, as AMH is able to develop brand new houses at a lower cost than it would be to simply buy them on the market.

Taking a look at second-quarter results and 2022 guidance, we find that AMH is delivering growth well in excess of inflation.

| American Homes 4 Rent | |

| Q2 2022 AFFO/sh Growth | 16.8% |

| Q2 2022 Same-Home NOI Growth | 10.2% |

| 2022 Core FFO/sh Growth Guidance | 13.2% to 16.2% |

| 2022 Same-Home NOI Growth Guidance | 8.5% to 10.5% |

The REIT also enjoys an investment grade (BBB-) balance sheet with 6.0x net debt to EBITDA, which is actually quite low for an SFR REIT.

One’s home is arguably the most essential expense, which makes it one of the last payments one would stop making during a recession. That is especially true in the midst of a housing shortage wherein housing vacancy is extremely low. As such, AMH looks like a good buy for both inflation protection and recession-resistance.

2. Crown Castle (CCI)

- Dividend Yield: 3.3%

- Price to FFO: 24.0x

Citybiz

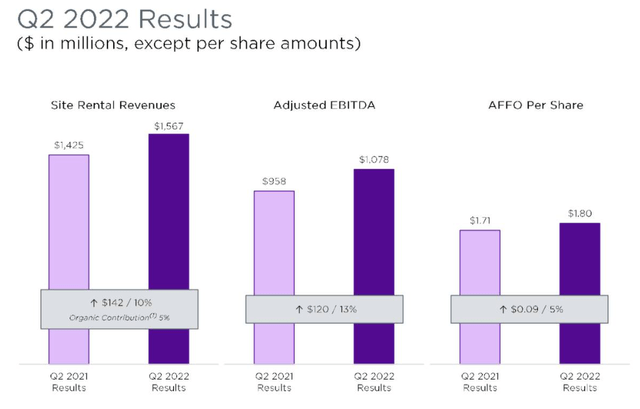

Even with this year being a “transition” year for the telecommunications infrastructure REIT, CCI is still delivering strong results. In Q2, AFFO per share grew 5.3% year-over-year, fueled by 9.8% site rental revenue growth.

CCI Presentation

The REIT is planning to double the deployment of small cell nodes starting next year, which will assist the REIT in making itself the premier infrastructure provider to US wireless mobile communications providers. CCI’s commanding market position in the US in terms of small cells and fiber give it an edge as 5G continues to roll out.

Management believes we are still in the early stages of the decade or longer deployment of 5G technology, which should have ripple effects that continue to make a greater and greater portion of economic activity reliant on telecommunications infrastructure.

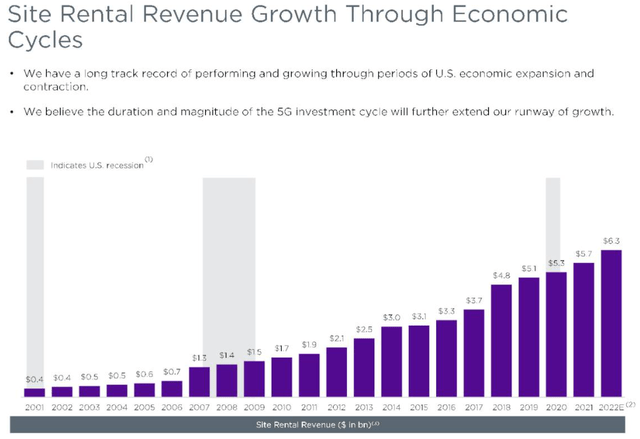

Also consider this: Cell tower rental revenue has grown very steadily over the last two decades, hardly blinking during recessions.

CCI Presentation

This makes CCI one of the most recession-resistant REITs, in my estimation.

The only weakness to CCI that I can see is the $3.3 billion drawn on its floating rate credit facility (15% of total debt). This is the primary reason why management does not believe the REIT will achieve its annual target of 7-8% AFFO per share growth this year (falling just short of it).

The good news for CCI is that the weighted average remaining term to maturity for all debt is 9 years, and there is almost no debt coming due through 2024.

3. NETSTREIT (NTST)

- Dividend Yield: 3.9%

- Price to FFO: 17.9x

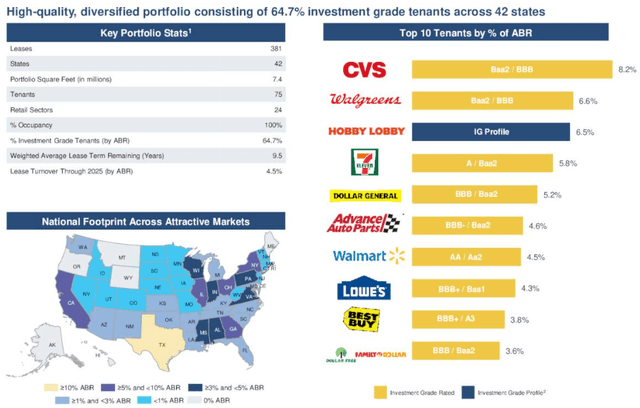

NTST Presentation

NTST is a net lease REIT that focuses on high credit quality national and regional retailers. Nearly 2/3rds of its NOI comes from investment grade tenants (81% if you count private tenants with IG profiles), the portfolio is 100% occupied, and less than 5% of leases expire before 2026.

Judging by tenant credit quality alone, NTST has the second highest quality portfolio in the net lease space, behind only Agree Realty (ADC) with its >67% IG exposure.

NTST Presentation

And with only 381 leases, NTST’s portfolio is still quite small and capable of growing rapidly. That is what makes its nearly 18x FFO multiple actually low compared to the REIT’s relatively short history as well as its growth trajectory. In the second quarter, for instance, NTST’s AFFO per share grew 40% YoY.

While NTST’s leases have only about 1% average annual rent escalations, making each individual lease vulnerable to real value erosion from inflation, NTST is able to grow AFFO per share rapidly. Thus, from the shareholder’s perspective, an investment in NTST beats inflation handily.

Combine that with the ultra-strong credit quality of NTST’s tenant base and you’ve got yourself the formula for a recession-resistant and inflation-beating investment.

4. STAG Industrial (STAG)

- Dividend Yield: 4.4%

- Price to FFO: 15.0x

PR Newswire

Though STAG does specialize in the “value plays” within the industrial real estate space, its valuation discount to peers is stark. Prologis (PLD), the market leader among industrial REITs, trades at a ~25x FFO multiple – 10 turns higher than STAG!

This despite the fact that STAG is currently enjoying record organic rent growth in its portfolio. In the second quarter, STAG achieved core FFO per share growth of 7.7% on the back of same-property NOI growth of 4%. But this relatively low number masks the incredible demand for STAG’s property type right now.

In Q2, STAG signed new leases at nearly 15% higher rates than the previous leases on the same properties. Lease renewals were signed at nearly 14% higher rates. The only reason same-property NOI growth is in the single-digits is because so few leases roll over from quarter to quarter.

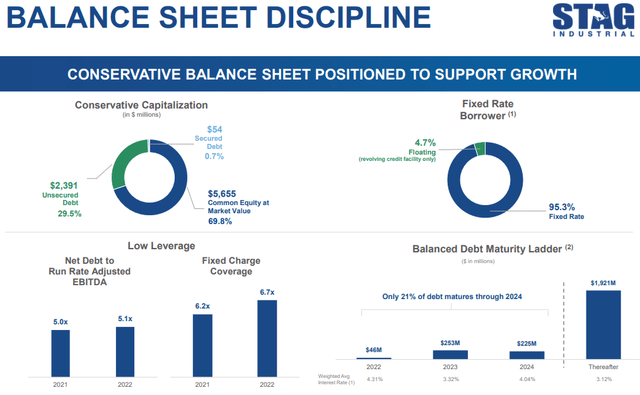

Plus, with an investment grade-rated balance sheet levered at only 5.1x net debt to EBITDA and less than 5% floating rate debt, STAG appears well-positioned to weather any economic storms ahead. Notice below that STAG’s fixed charge coverage ratio is a sky-high 6.7x!

STAG Presentation

And though STAG’s dividend growth has been slow in the past, now that leverage is where management wants it and organic rent growth has picked up, the dividend growth rate may pick up soon.

5. Urstadt Biddle Properties (UBA)

- Dividend Yield: 5.4%

- Price to FFO: 11.8x

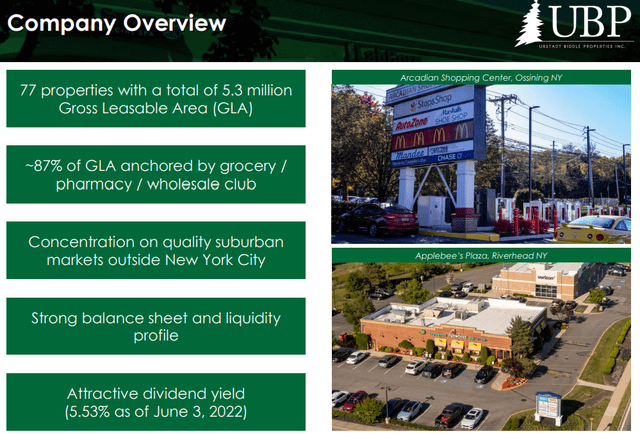

UBA Presentation

Since ending its 26-year streak by reducing the dividend in 2020, the market has not fully come around again to this New York tri-state area shopping center REIT. Part of that, surely, is due to investor soreness over the dividend cut. But more likely, the market’s cold shoulder pertains to UBA’s mixed results on rent growth, with slight lease-over-lease declines in rent rates for new leases in some quarters.

In the most recent quarter, however, both new and renewal rents rose – new at 2.5% and renewal at 3.5%. Meanwhile, same-property NOI increased 4.7% YoY, and FFO per share rebounded 19.4%. Since UBA already enjoys some of the highest rents per square foot in its peer group, pushing rents up further is harder for it than the average retail REIT.

Note that UBA’s retail portfolio is more conservative than the average shopping center REIT’s because of its emphasis on grocery-anchored centers (grocers make up 29% of rent), which tend to draw steady traffic in good economies and bad.

UBA Presentation

With debt to assets of about 32% and a fixed charge coverage ratio of 3.6x, UBA boasts a fortress balance sheet that should be able to withstand any normal recession the economy can throw at it. What’s more, the dividend is well-covered with a payout ratio of only 60-65% (although a lot of that cash flow is currently being used for tenant improvements in order to raise occupancy).

Though growth will likely continue to be slow for UBA, the nearly 5.5% yield and valuation upside of 15-20% makes it an attractive pick for conservative investors.

Bottom Line

It looks increasingly likely that a recession is coming soon. How severe it will prove to be is up for debate, but the idea that a recession is on its way is less and less controversial. That means that now is the time to think about capital preservation – not just seizing opportunities but defending one’s portfolio against long-term capital losses.

For dividend growth investors, I believe these five REITs are a great bundle that should weather a recession nicely and be able to continue compounding shareholders’ invested dollars for many years to come.

Be the first to comment