Chip design, Vaccum Valves, VAT Group, Hidden Monopoly, Sleep Well Investments sefa ozel

In the last seven months, the market’s abrupt shift from ‘growth at all cost’ to ‘where is my value’ has caused my growth stocks to crash between 40-80%, erasing all of the gains in the past two years. Meanwhile, the uncertainties from the war in Ukraine, supply chain disruptions, and rising inflation look likely to persist.

This numbing experience and uncertain outlook led me to refocus my investment checklist to find only top-quality businesses. It places higher importance on a resilient business model, strong profitability, clear moat, and reasonable valuation to ensure ‘business as usual’ even at the worst of times.

“Ultimately, nothing should be more important to investors than the ability to sleep soundly at night,” Seth Klarman.

I believe the VAT Group (OTCPK:VACNY) (OTCPK:VTTGF) can help investors to sleep well at night. Following is a glance at the company and why I believe the business makes a strong case.

Quick facts FY2021:

-

Name: VAT Group

-

Ticker VACN.SW (SIX Swiss Exchange)

-

Currency: 1 Swiss franc CHF = 1.04 USD

-

Trend: Megatrends in AI, Cloud computing, IoT

-

Market cap: CHF 7B ($7B USD)

-

Revenue: CHF 901M

-

Gross profit: CHF 570M

-

EBITDA: CHF 307M

-

FCF: CHF 196M

-

ROIC: 25%

-

Dividend yield: 2.4%

-

Cash: CHF 127M

-

Debt: CHF 204M

-

Insider holding: 10%

-

No. employees: 2540

-

Shares outstanding: 30M shares

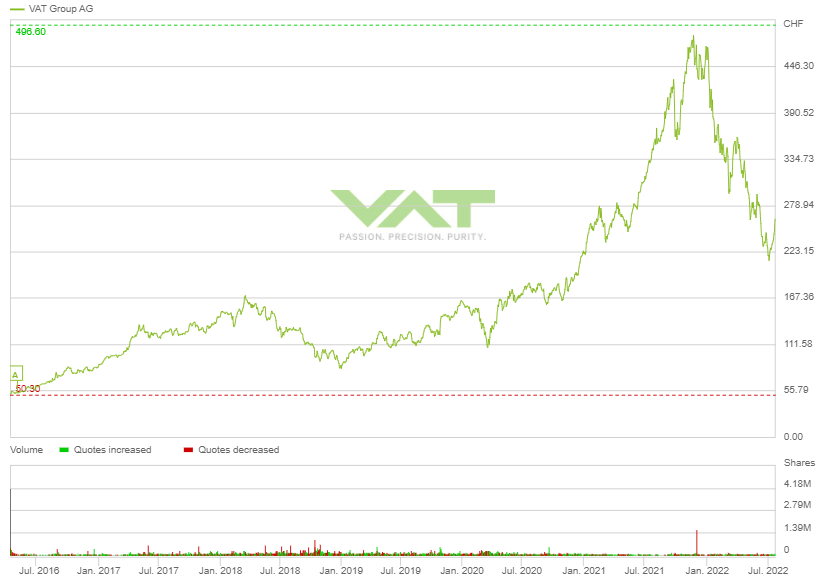

VAT Group AG Investor Relations from IPO in April 2016 (Swiss Franc, CHF)

Investment thesis

VAT boasts impressive numbers:

-

It commands a 58% market share and is the no.1 technology leader. Its annual R&D spending is as high as the next competitor’s revenue.

-

Highly profitable and printing cash with 61% gross margin, 24% net margin, 34% EBITDA margin, and 22% FCF margin.

-

Growing efficiently with 25% ROIC in FY21, strong growth from the 5-year average at 13%.

-

Capital light business at 5% CAPEX/Sales, slightly increasing from the 5-year average level of 3.5%.

-

Financially strong with a net debt position half its FY2021 FCF.

-

Pays an annual dividend yield of 2.4% (4-year average).

And the reasons are:

-

It has been the largest and most technologically advanced producer of vacuum valves, bellows, and modules for ultra-clean and near particle-free manufacturing processes since 1965.

-

The products are mission-critical to the digital revolution and are highly customized, ensuring a long-run way for growth yet challenging for rivals and new entrants to compete.

-

Its customers are long-term and are top OEMs in semiconductors. Significant contract wins with them can ensure revenue visibility for up to 5 years.

-

It has global R&D and manufacturing facilities in Switzerland, Romania, Taiwan, and Malaysia, enabling fast-to-market and adaptability to supply chain deadlocks.

-

It’s a ‘pick and shovel’ and the primary benefactor of the megatrends in cloud computing, smart devices, the Internet of Things, and artificial intelligence.

-

It has multiple revenue sources, from selling valves to semiconductors, advanced industrials, solar panels, and consumer displays.

-

It also has a growing recurring revenue in repairable/upgradeable components.

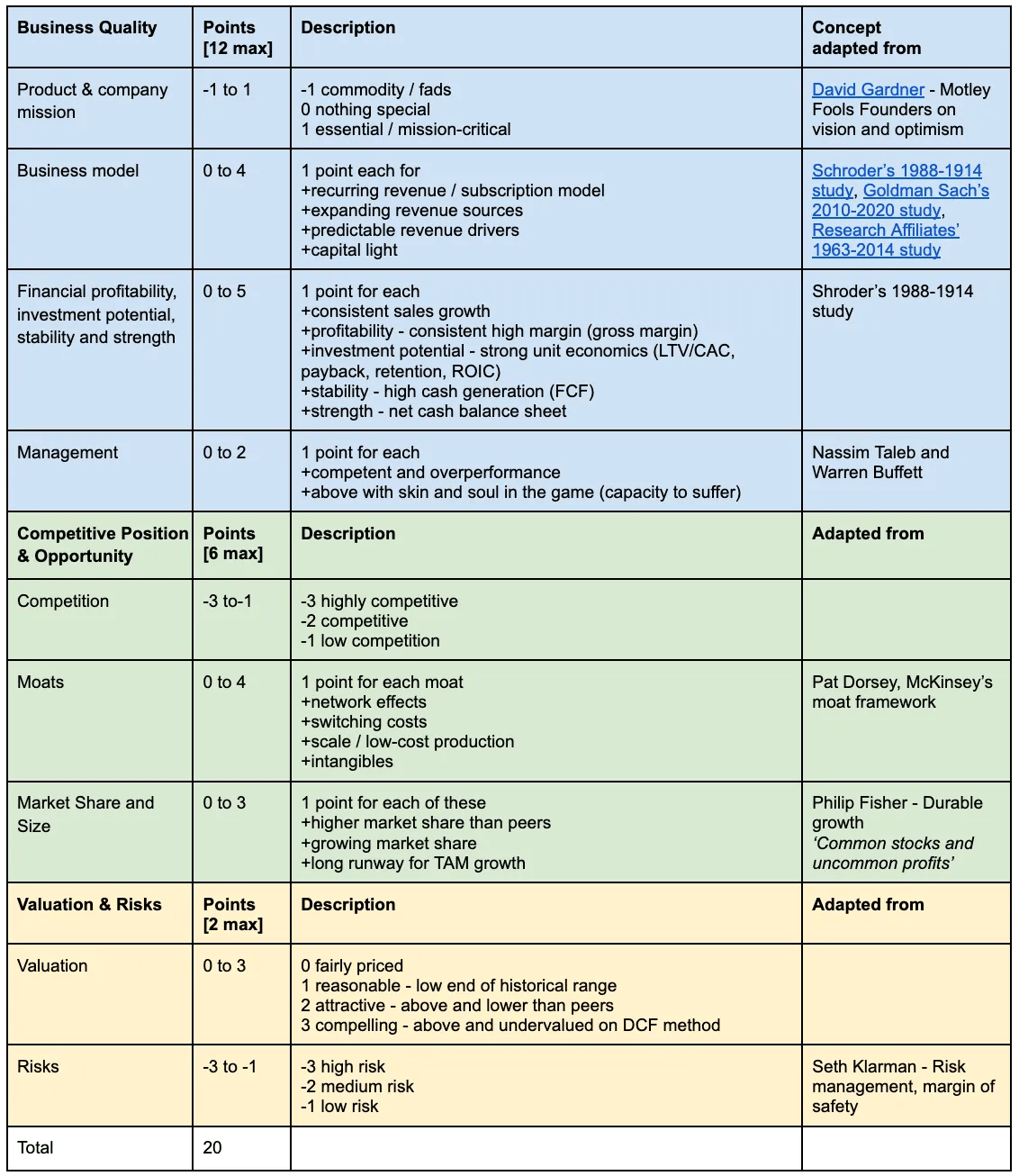

Sleep Well Investment scorecard

VAT can help investors sleep soundly because it has passed a stringent investment checklist. I call it the Sleep Well Investment scorecard. The goal is to find businesses that can perform over multiple economic cycles. Adapted from Nassim Taleb’s anti-fragile concept and studies from various reputable investors, it scores businesses in three areas, in order of importance:

-

Business quality [12 points]

-

Competitive position and opportunity [6 points]

-

Valuation and risks [2 points]

With 20 possible points, business quality is the most important criterion, with 12 points, followed by competitive position & opportunity, 6, and valuation & risks, 2.

Points are deducted for an unconvincing mission statement, commoditized/fads products and services, and clear competition and business risks.

The following table breaks down how I assess these categories.

Sleep Well Investments scorecard (Sleep Well Investments)

Before diving into how VAT made the grade, I will give you a comprehensive overview of the business, the industry, and its history. Skip through this section if you are familiar.

Business overview

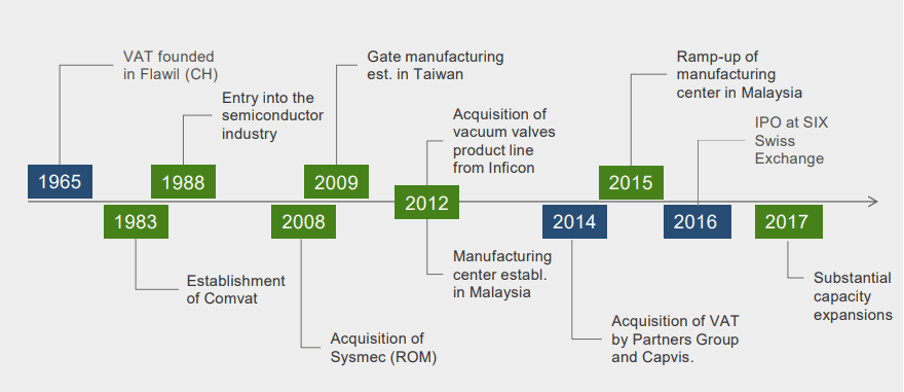

VAT was founded in 1965 by Austrian entrepreneur and mechanical engineer Siegfried Schertler (1926-2010). The business initially focused on vacuum valves for scientific research. A few years later, it diversified into thin-film, and by 1983, VAT was manufacturing edge-welded bellows used as flexible sealing elements.

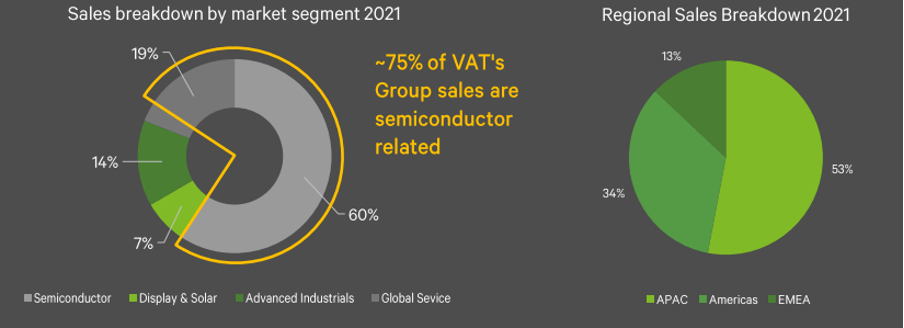

By 1988, it entered the semiconductor sector, which became the most significant segment until today, making up 75% of sales. The remaining business segments include advanced industrial, display, solar, and global services. See below.

VAT Group segments (VAT Group investor deck Spring 2022)

VAT broadens its product scope and expands beyond its traditional European markets. Today only 13% of sales come from Europe, 53% from Asia, and 34% from the Americas.

This was also why VAT launched manufacturing facilities in Romania in 2008, Taiwan in 2009, and Malaysia in 2012, to be closer geographically to its customers. In 2014, private equity, Partners Group & Capvis acquired VAT and listed the company on the public market in 2016. Below are the key developments from its founding year to 2017.

VAT Group history (VAT Group Investor deck 2018)

Ok, what are vacuum valves, you ask?

Like valves you find in your kitchen tap, valves facilitate a transfer of water from one place (water tank) to another (sink). The environment of the water tank and the sink is the same. With vacuum valves, the application is different.

Vacuum valves can isolate environments under two different pressures. It allows a transfer of substrates, like wafers, from the atmosphere to the vacuum and controls the gas flow and pressure.

And why are they so important?

These valves are essential components in the manufacturing processes of semiconductors. First, the transfer of wafers from one process chamber to another requires several steps. Then, it has to be ultra-clean or near particle-free. In addition, it has to be fast, stable, and reliable to optimize production times and yield. There can be no compromise in this process, and VAT is the gold standard in the field.

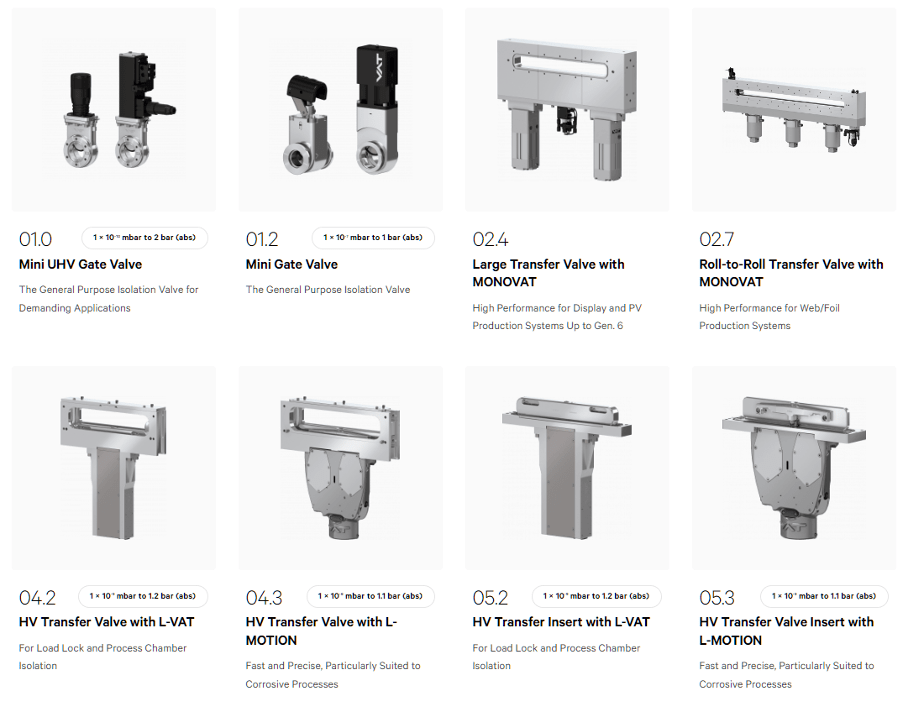

Here is what vacuum valves look like:

VAT’s vacuum valves (VAT Group product catalog)

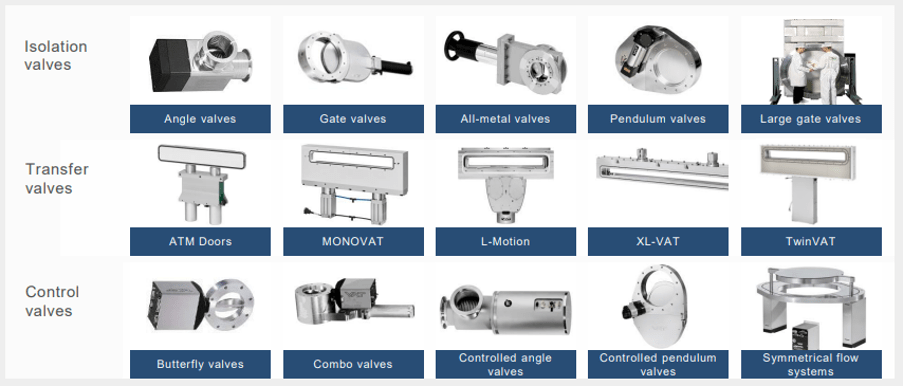

There are three types: isolation valves, transfer valves, and control valves.

VAT Group Investor deck 2018

VAT makes about 140 valve series, with 8000 customized products and over 3000 standardized items.

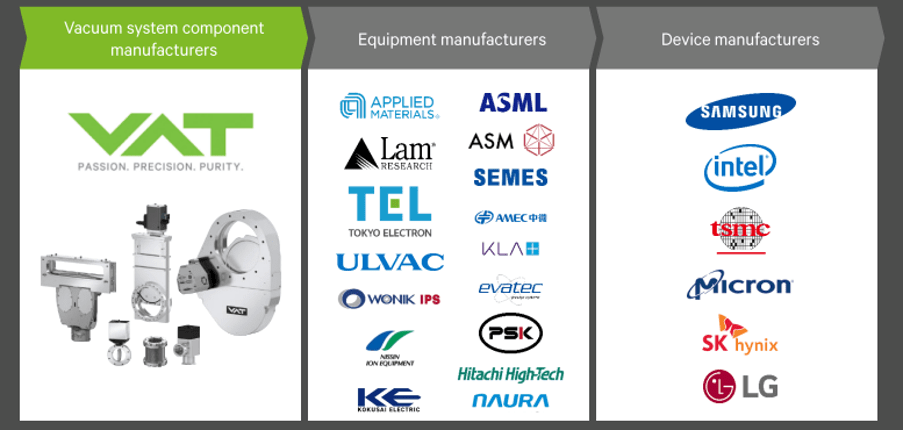

What’s interesting is that VAT’s products are compatible with most OEMs. There are four main types of integrated circuits (IC), and VAT’s valves work with them all:

+Foundry & Logic (which takes 53% of 2022 Wafer Fab Equipment spend)

+DRAM memory (18%)

+NAND flash memory (23%)

+Analogy and others (7%)

This is why you would find VAT products in almost every part of your life, your smartphones, cars, computers, work’s data center servers, and your smart homes.

The broad arrays of IC agnostic products and the gold standard quality are no surprise why all leading wafer fab OEMs, including Applied Materials, ASML, and LAM research, are VAT’s long-standing clients.

VAT Group value chain (VAT Group’s Investor presentation Spring 2022)

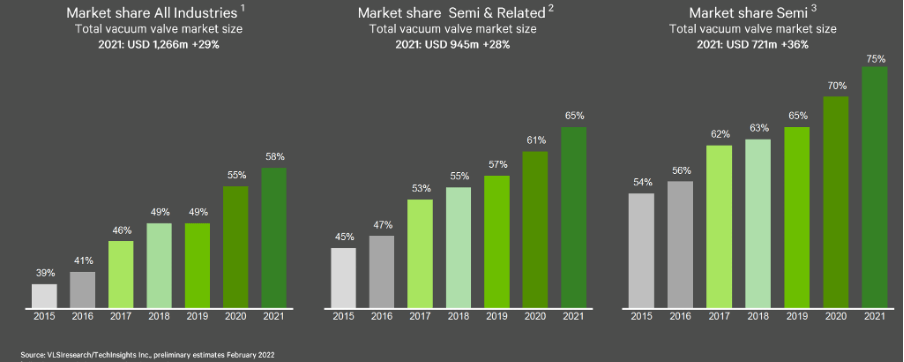

Currently, VAT is the undisputed leader, with 58% of the overall market share and 75% in the semiconductor segment, rising from 39% and 54% in 2015, respectively.

VAT Group market share (VAT Group’s Investor presentation Spring 2022)

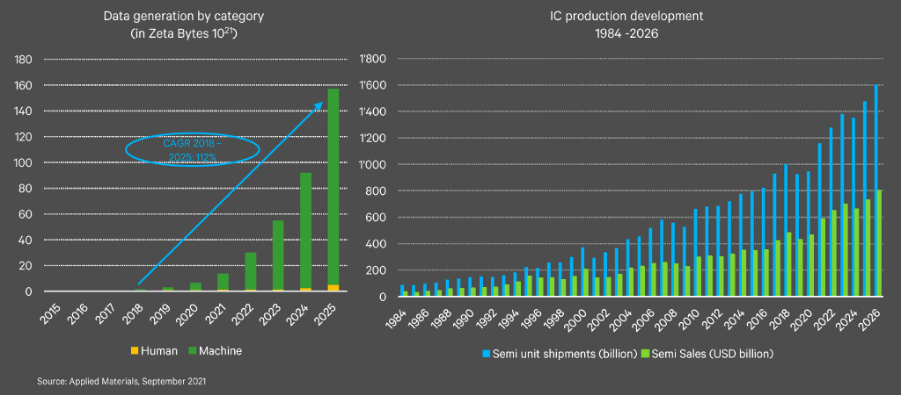

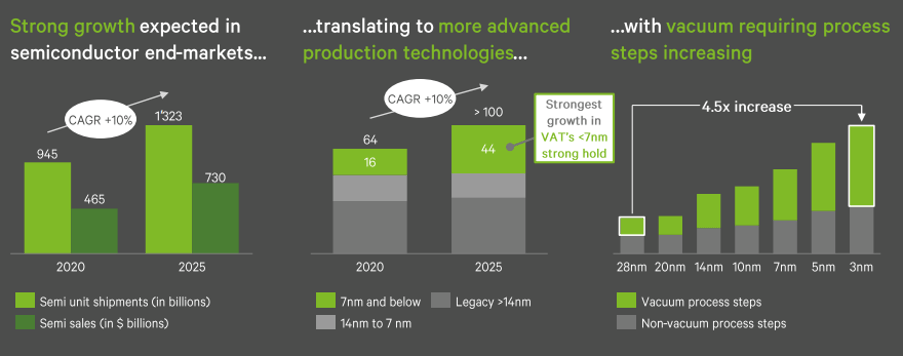

As the undisputed leader, the opportunity for VAT is immense as data generation expects to grow at 112% CAGR until 2025, fueling more IC product development spending and semiconductor end-market sales.

VAT Group’s Investor presentation Spring 2022

The overall technology growth trickles down to benefit VAT. It is expected that more OEMs will be knocking on VAT’s door for more advanced production technologies, increasing vacuum process steps to pack more power in their chips and memories.

VAT Group’s Investor presentation Spring 2022

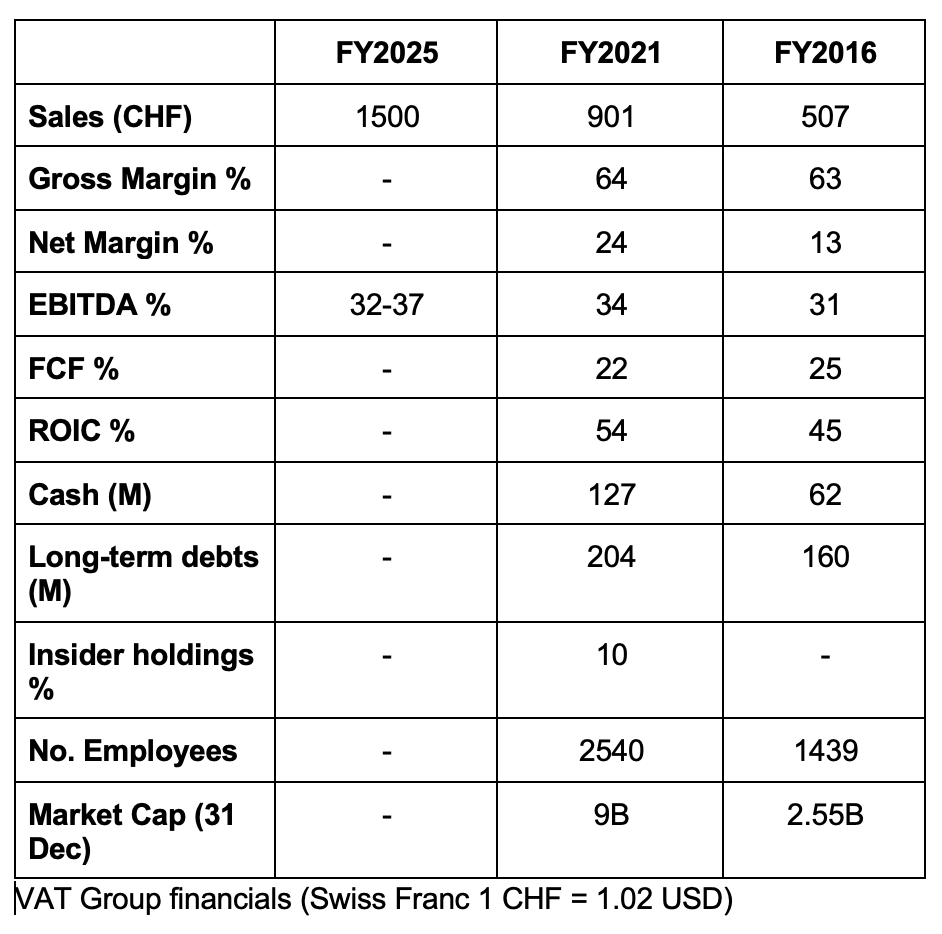

With the strong market backdrop above, I glance at the company’s past, current, and future financial expectations, FY16 at IPO, FY21, and management goals in FY25, respectively.

VAT past and future financials (VAT Group filings)

By now, you would know that VAT is the market leader in vacuum valves, an essential product behind the production process of components for your smartphones, cars, and smart homes.

What’s special about VAT’s valves is its broad array of designs, technology (production process) agnostic, and gold standard quality. On top of that, VAT’s global R&D and manufacturing footprint make it the no.1 choice for leading semiconductors.

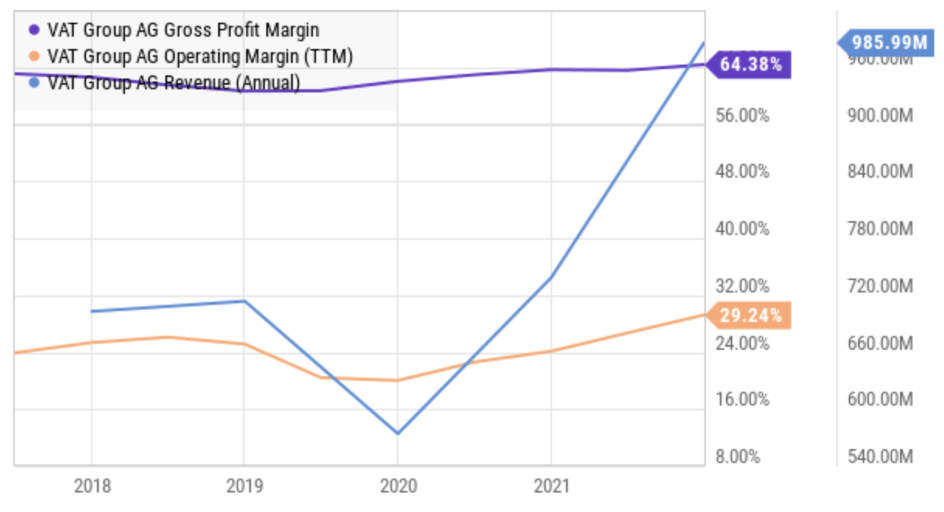

No surprise, VAT has been consistently profitable since IPO with over 60% gross margin and over 30% EBITDA margin.

Ok, time to dive into why VAT is a top-quality business.

Business quality

Business quality is the most important factor in determining a good investment. It takes 60% weighting of the overall sleep well score, 12 points out of 20. To assess it, I look at four aspects:

+Product & company mission: [1 point] I give VAT 1 point here as it manufactures mission-critical products to build machines for semiconductors and digital appliances OEMs.

Vacuum valves are required regardless of what happens to the front end of the chip innovation or semi-cycle. For example, ASML (ASML) or TSMC (TSM) investors would have to worry about picking the winner and betting on which technology will prevail. For vacuum valves, VAT will likely remain the winner barring extraordinary events.

+Business model: [3 points] I give VAT three points here. VAT gets one point from selling valves as one-off transactions with recurring service revenue. It gets another point for having predictable revenue drivers and long-standing customer relationships who are top OEMs in semiconductors. Finally, the business is capital-light with a consistent capital/sales ratio below 5% since IPO.

+Financial profitability, investment potential, stability, and strength: [4 points] VAT gets four points. The business is incredibly profitable for a ‘manufacturer’ with a 61% gross margin and a consistent operating margin above 20%. It has strong ROIC, high and consistent cash flow even at the cycle’s trough, and manageable debts.

+Management: [1 point] VAT gets half the possible point here because they have a deeply technical CEO who overperformed during tenure and are ahead of 2025 targets. He and the board is fairly incentivized and highly focused on stakeholder returns.

Competitive position and opportunity

The second important area is assessing the business’s competitive position in relation to its competitors and identifying the future opportunity for further growth. I assess this in three areas as follows:

+Competition: [-1 point] Competition is always a risk. Businesses will always get points deducted. VAT benefits from a superior technology and market position. I believe the risk from the competition is low. As a monopoly with a 58%+ market share and still growing, there is little chance competitors can catch up. The barrier to entry is also high due to high start-up costs.

+Moats: [3 points] VAT gets three points for having clear scale and cost advantage whilst providing the highest quality and most innovative products. Its longstanding relationship with top OEMs and growing service line ensure a high switching cost for these customers. Lastly, VAT is the leading brand in the industry, giving it a brand advantage compared to peers.

+Market share & size: [2 points] VAT’s market size is small at roughly $1.5B. However, it has a long runway for growth as a pick and shovel business for the digital revolution. The business commands a 58% market share, and impressively, it continues to grow.

Valuation and risks

+Valuation: [1 point] VAT earns one point for being ‘fairly priced’. It trades at a premium to peers but at the low end of the spectrum, and the DCF model shows undervaluation.

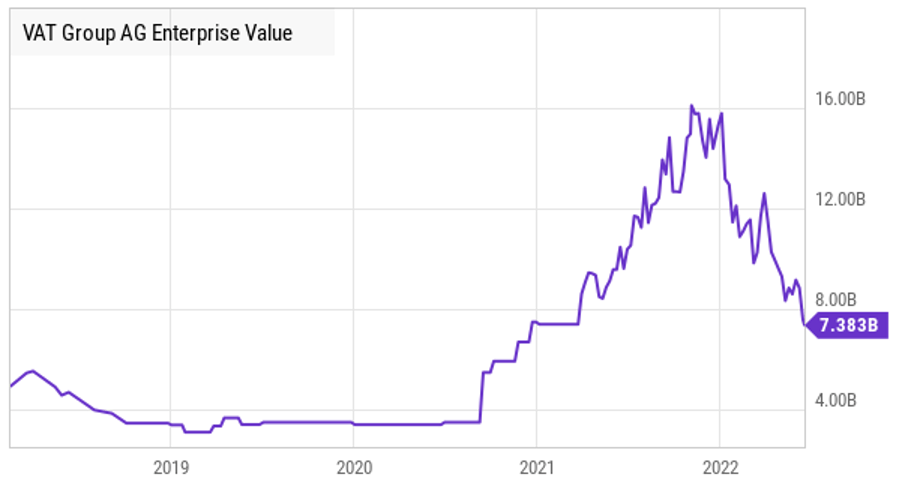

In more detail, VAT has an enterprise value of CHF 7.5B today, more or less the same as at the beginning of 2021 and down 50% from its peak in Nov 2021.

VAT Group (Ycharts)

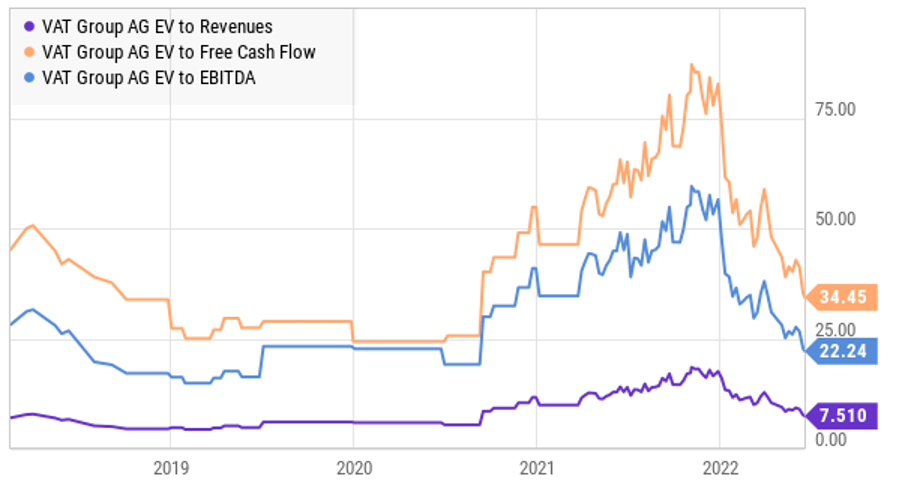

Historically, VAT trades between 18x to 60x (data available from 2018, 2016-2018 was around 25-35x) on the EV/EBITDA spectrum. Today, at 22x, it trades towards the low end of the range.

Ycharts

Similarly, VAT trades at the low ends on the EV/FCF and EV/Revenue spectrums, despite its revenue and margins being close to the high watermark, see below.

Ycharts

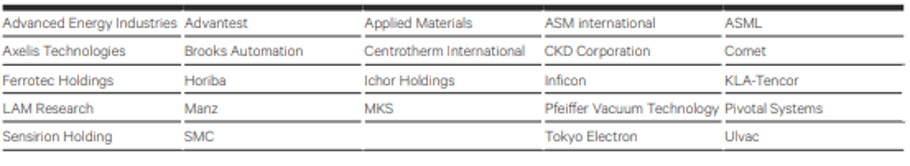

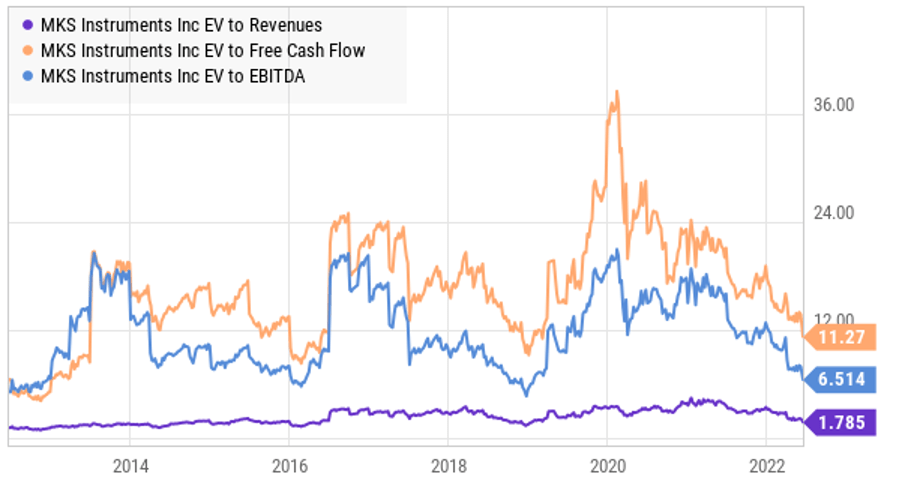

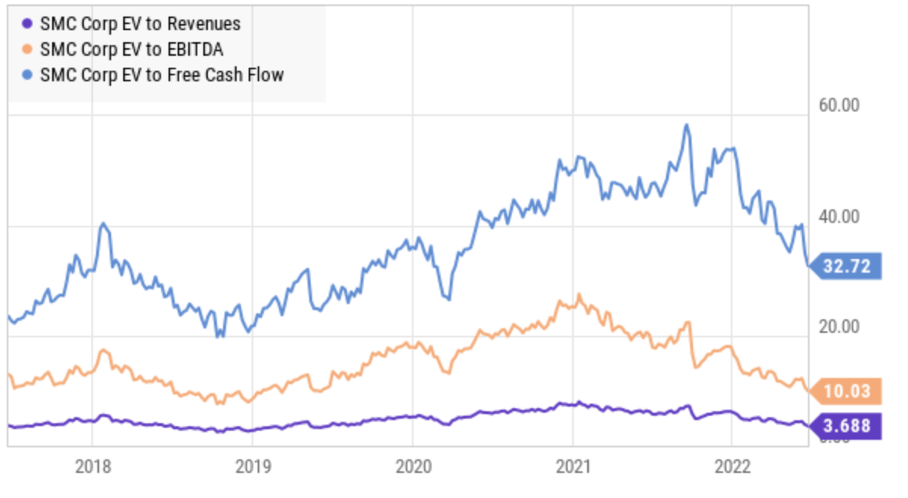

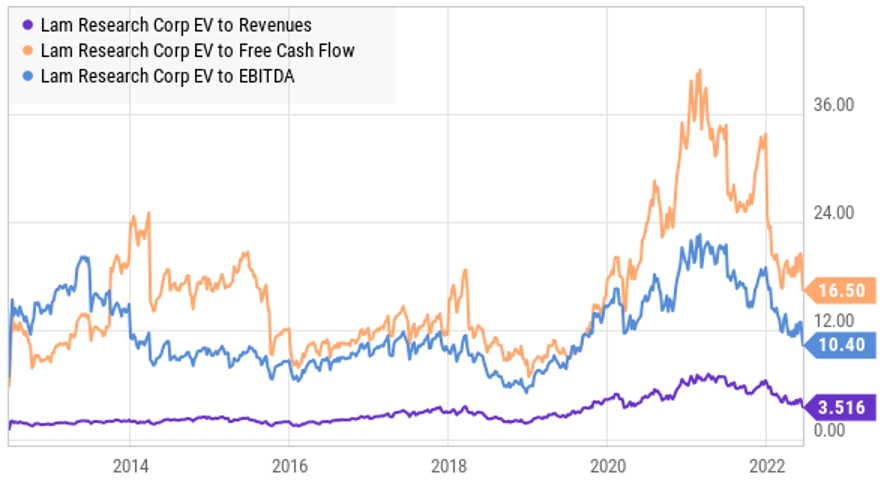

Compared to peers, VAT trades at a premium. I picked MKS, SMC Corp, Lam Research, and ASML as a sample out of the 24 peers management identified.

VAT Group FY2021 annual statement

MKS and SMC Corp are direct competitors, the second and sixth largest players in the vacuum valve market, respectively. The key difference is that they have other businesses besides vacuum valves, lower margin profiles, and are more capital-intensive businesses. That partly explains why their multiples are lower. MKS, in particular, is more cyclical as well.

Ycharts Ycharts

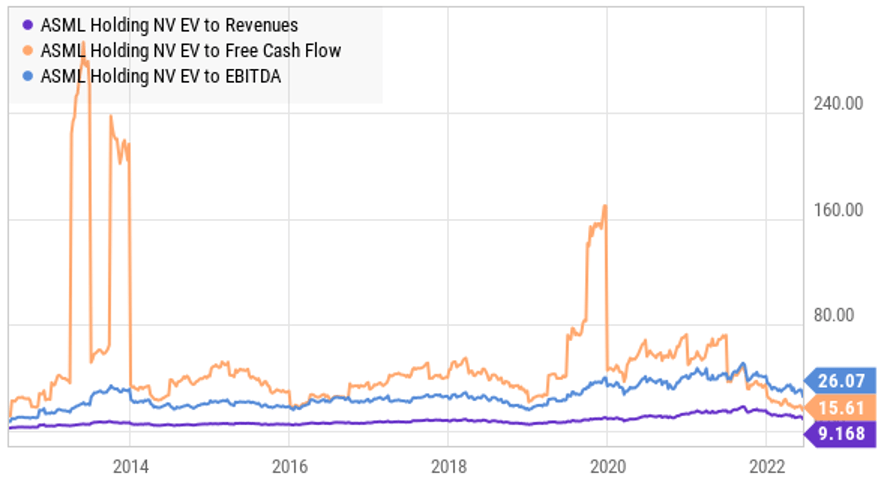

Lam Research and ASML are VAT’s key customers, and their valuation metrics correlate highly to VAT.

Ycharts Ycharts Ycharts

On working out the value of the business using a simple DCF method, I assume

● CHF 1.5B in 2025 as management guided, then 10% topline growth for 2026-27, and incremental slow down to 5% at 2030,

● 31% EBITDA margin (mid-point ave in all cycles),

● 70% FCF conversion (mid-point 5-year average),

● 10% WACC, and

● 30x FCF terminal multiple.

VAT’s value works out to be around CHF 8.1B ($8.4B).

It doesn’t look like VAT is cheap compared to the current EV of CHF 7.5B. With DCF, a slight change in any variable can make a big difference. For example, if we were to put more value on VAT’s ROIC and assume VAT’s service segment expands by 2030, the EBITDA margin would likely be higher. As a result, VAT’s value would be closer to CHF 9B. On the other hand, if we were to increase WACC by 2% to 12%, the value would move south to CHF 7B.

In summary, VAT trades at a premium to peers thanks to its monopolistic position in the market, high business quality, and high margin profile. Nevertheless, it has traded at the lower end of the range since 2018, implying investors are not overpaying at this level.

Borrowing from Warren Buffett, we would rather buy a great business at a reasonable price than a mediocre business at a great price. As such, we find VAT fits the mold. However, in this highly uncertain market, we plan to buy very slowly, perhaps dollar-cost-average (DCA), to a full position within a few quarters and keep the position small. If VAT stock falls further, we get to buy more at lower prices, and if VAT stock rallies, we would be glad to have captured some of the gains. The following analysis of risks tempers our bullishness of the business.

+Risks: [-1 point] VAT is exposed to multiple risks. However, I believe most are short-term and should resolve themselves or immaterial over the long term.

For example, the risks that the business is highly correlated to the cyclical nature of the semiconductor’s CAPEX cycle or that it is impacted by the current supply chain issues and higher input costs in aluminum, plastics, and other rare metals. I consider these risks short-term; some will resolve themselves as the economic environment normalizes.

The CEO of Texas Instruments (TXN), Rich Templeton, has something to say about this at Bernstein 38th Annual Strategic Decisions Conference:

“It’s going to go up until it stops going up, and then it will go down. And then after it goes down, it will go up again. And I just don’t care that much because we know where we’re going and what matters is the longer term.”

The other risks that investors should be aware of are the high customer concentration risk, the likelihood that customers bring production of valves in-house, and Moor’s law ending.

The high customer concentration can be scary at first glance. 40% of VAT’s FY2021 revenue came from the top two customers. The level of concentration is high and increased from its IPO in FY2016, where 41% of revenue came from the top three customers. Nevertheless, the top three customers are Applied Materials, Lam Research, and Tokyo Electron. These customers are OEM leaders with minimal counterparty risk, and their relationship with VAT is long-standing. VAT is critical to their existence.

With regards to the risk of customers bringing production in-house, I also believe this shouldn’t worry investors much. As mentioned, vacuum valves are incredibly technical that require high-performance demands. Importantly, they are mission-critical. Moreover, as mentioned, at about 2% to 4% of the cost of the equipment, Applied Material or VAT’s other customers wouldn’t be too keen to bring it in-house or do anything to compromise quality. VAT’s position as the key supplier is safe.

Lastly, Moore’s law predicted a doubling of computer power every three years. However, the pace of change is becoming longer and longer as the space on microchips shrinks, making it harder to increase the output of chips (faster computers) without increasing the power input (more energy to run it). Eventually, adding more transistors become counter-productive. That’s when Moore’s law ends. Most forecasters believe this will happen around the end of this decade.

It is difficult to predict what that means for VAT. On the one hand, as innovation of microchips slows, there could be lower demand for new valve designs. On the other hand, the process steps for the production of the current node and the next one are already so complex. Moreover, with further adoption of EUV (extreme ultraviolet) lithography, a new production method, VAT should not have demand problems in the near term.

Conclusion

In summary, VAT’s position in the industry is rock solid as the leader in a high barrier to entry industry. I believe there is little existential threat to the business.

VAT scores highly on my Sleep Well Investment scorecard, and I intend to add to my position as prices continue to stay at the lower end of the valuation spectrum.

However, investors need to be aware of the cyclical nature of this business, the potential higher input costs, production delays caused by the global supply chain blockages, high customer concentration risk, and the possibility of a slower innovation cycle in the future.

Be the first to comment