imagestock/E+ via Getty Images

Thesis

Hindsight is always 20/20, but one of the biggest factors that cloud investors’ judgment when balancing whether to stay in cash is FOMO (fear of missing out). One of the questions we get most often when we advise selling overpriced investments is “What will I do with the funds? What do I buy next?”. FOMO gives a retail investor the feeling that there is always something better out there, where extraordinary returns are being made, and just staying in cash is the most foolish idea possible. What if somebody had told you at the end of 2021 to trim all long duration investments (long bond positions, long duration Tech stocks, etc.) and have 30% or more in cash? You would have called them foolish and unfollowed them. Good long term investing takes discipline and recognizing one’s strengths and weaknesses. Selling overpriced assets and keeping a high cash balance is one of the most difficult things to do from an investor’s standpoint. Today’s market action has taught us that valuation starting points matter, and while long term stock indexes do go up they can be punctuated by vicious bear markets.

Up until a few months ago, the Vanguard Short-Term Treasury Index Fund (NASDAQ:VGSH) was yielding close to nothing due to the Fed zero rate policy. That is 101 Monetary policy – when the Fed sets the Fed Funds rate to zero it encourages market participants to move away from cash like assets and safe assets which yield zero, to more risky investments. When the Fed does not do its job properly, the party they start in risky assets continues for too long and all market participants are severely inebriated at the end rather than just having a nice “buzz”. As most readers know it takes quite a bit of time the next day to get over a blow-out party. This is precisely what we are experiencing now and one of the first things people should ask themselves is whether they would have been comfortable staying in cash like instruments like VGSH for long periods of time in 2021 when stocks were making new highs every day but many people did understand that P/E ratios were unsustainable.

VGSH currently offers a 2.67% 30-day SEC yield and it is set to go higher as assets roll into new higher yielding securities. While we do not believe in selling low and buying high (i.e. now is not a good time to sell your stock portfolio) outside certain clear cut long term investing opportunities investors are best suited to sit on their cash balances in short term bond instruments like VGSH which have no credit risk and a very short duration profile. More importantly for investors we believe this is an ideal time for introspection and understanding how FOMO played a role in their psychology and making the jump to understanding that when selling an overpriced investment, cash can just be kept rather than immediately invested.

Holdings

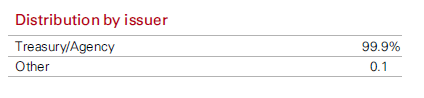

The fund holds exclusively Treasuries securities:

Holdings (Fund Fact Sheet) Given the fund holdings the portfolio is rated AAA, hence the credit risk associated with the holdings is zero. An investor does not have to worry about the underlying securities defaulting.

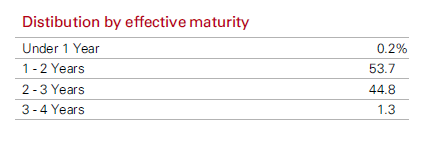

The vehicle is set-up to hold short-dated bonds only:

Effective Maturity Distribution (Fund Fact Sheet) Most of the holdings sit in the 1-2 years bucket, hence there is a good “roll” effect in this fund – i.e. as time passes the holdings come down the maturity curve, hence the discount imposed by higher overall yields is moderating as the pull to par sets in.

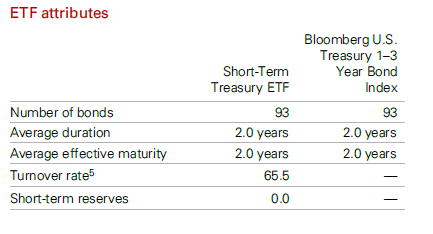

The fund has 93 bonds in its portfolio and a net duration of 2 years:

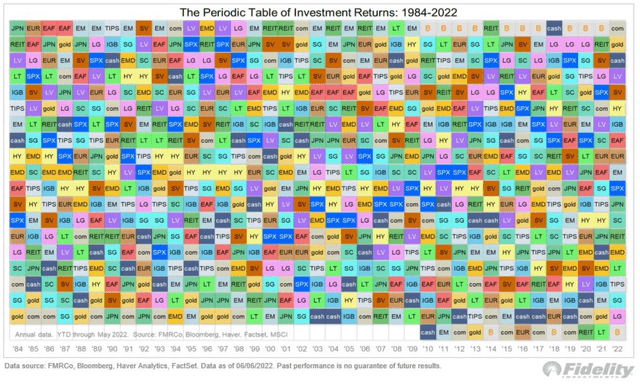

ETF Attributes (fund) A duration of 2 years means the fund has been subject to price losses stemming from higher 2-year yields, but the short dated nature of the collateral gives it a strong “roll” effect. If we take a simple example with a portfolio with a 1-year maturity profile for example, while initially we are going to have price losses due to higher 1-year yields, as the portfolio nears maturity there is a “pull to par” effect, and at the end of the year the underlying collateral will have recouped all its mark-to-market losses due to interest rates. We can see from the below table that cash is the third best performing asset in 2022: Assets (Fidelity) If investors would have been overweight cash and cash like instruments in 2022 their overall portfolio returns would have improved.

Investments Performance

Conclusion

One of the most difficult investment decisions to make after selling overpriced assets is to keep a high cash balance. Zero rates that made instruments like VGSH expose very low 30-day SEC yields and FOMO (fear of missing out) drove many retail investors into other overpriced investments. Valuation points matter and sometimes when no financial instrument looks attractive from a risk/reward perspective, it is worth considering having a very high cash allocation. With no credit risk and a moderate duration profile VGSH is a robust instrument to be kept on investors’ radars.

Be the first to comment