metamorworks/iStock via Getty Images

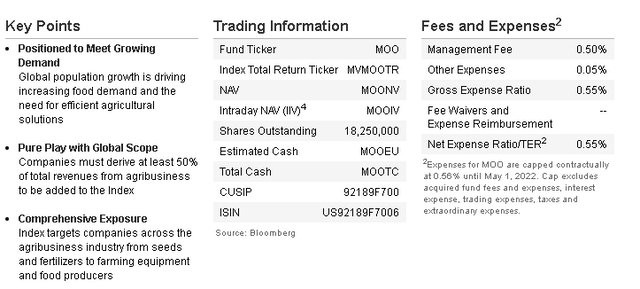

The VanEck Vectors Agribusiness ETF (NYSEARCA:MOO) offers targeted exposure to companies involved in areas like agricultural chemicals, fertilizers, farm equipment manufacturing, livestock and meat production, grains cultivation, along with related trading specialists. This is a segment that has gained importance amid the current macro theme of supply chain disruptions adding to global inflationary trends. Indeed, higher commodity and food prices represent a tailwind for agribusiness which has translated into a 13% gain for the MOO ETF this year. We like the fund for its unique pro-inflation profile and expect more upside with a positive outlook for the underlying companies.

What is the MOO ETF?

MOO technically tracks the “MVIS Global Agribusiness Index” which considers eligible companies that generate at least 50% of their revenue from agribusiness while maintaining a market capitalization greater than $150 million. Notably, the methodology specifically excludes companies that produce the bulk of their revenue from the sale of packaged foods, biodiesel, ethanol, or forestry products. The index and fund feature a modified market-cap weighting with a quarterly rebalancing. The expense ratio for MOO is 0.55% which is in line with industry-specific and thematic ETFs.

From a high level, the attraction of agribusiness is this understanding that a growing global population is driving increasing food demand as a positive long-term growth runway. An expanding middle class, particularly in emerging markets, also represents a major theme for the industry with more consumers eating a variety of foods including larger quantities of proteins.

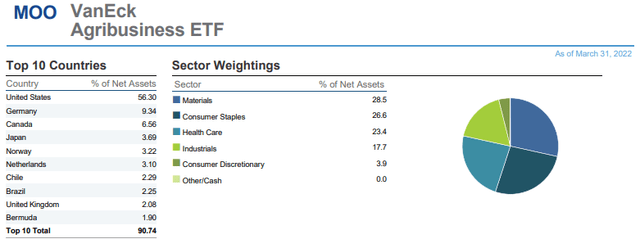

As it relates to the MOO ETF, the portfolio of stocks has a global diversification with approximately 45% of holdings classified as foreign companies. Another key point here is the cross-sector exposure. While agribusiness is seen as a sub-industry, the underlying companies capture trends in the materials sector, consumer staples, healthcare, and industrials with a shared connection to the broader food supply chain.

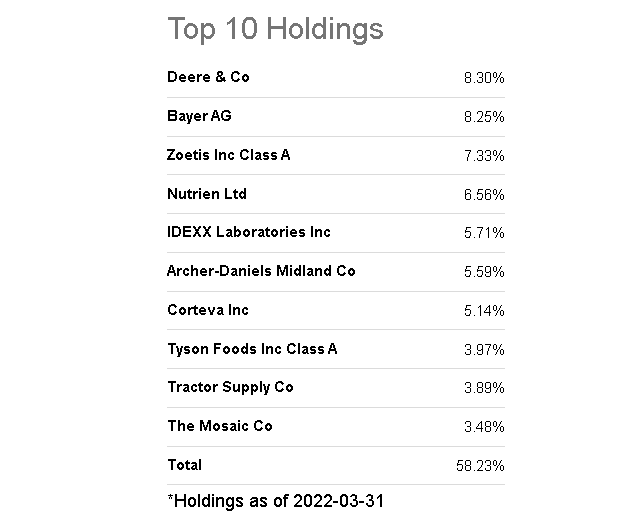

With a portfolio of 54 stocks, the top holding in MOO is Deere & Co. (DE) representing 8.3% of the fund. Deere makes sense considering its position as the world’s largest manufacturer of agricultural machinery and equipment. Shares of DE have outperformed, gaining 28% this year, with a bullish case for the stock that strong agricultural prices support demand by farmers to invest in new equipment and expand production.

Germany-based Bayer AG (OTCPK:BAYZF) with an 8% weighting is a global conglomerate that includes pharmaceuticals but also agriculture biotech, crop protection solutions, and farming analytics solutions. Zoetis Inc (ZTS) at 7% of the fund is recognized as the largest animal-health company, capturing demand for livestock maintenance and veterinary products.

Down the list of holdings, what stands out is the diversity of the group with segment leaders. Nutrien Ltd. (NTR) and The Mosaic Co. (MOS) are major fertilizer producers. Archer-Daniels-Midland Co. (ADM) is a global grains processor, logistics, and trading company. The position in Tyson Foods Inc. (TSN) with a 4% weighting highlights the side of food production with its global beef, pork, and chicken processing operation.

Seeking Alpha

MOO ETF Performance

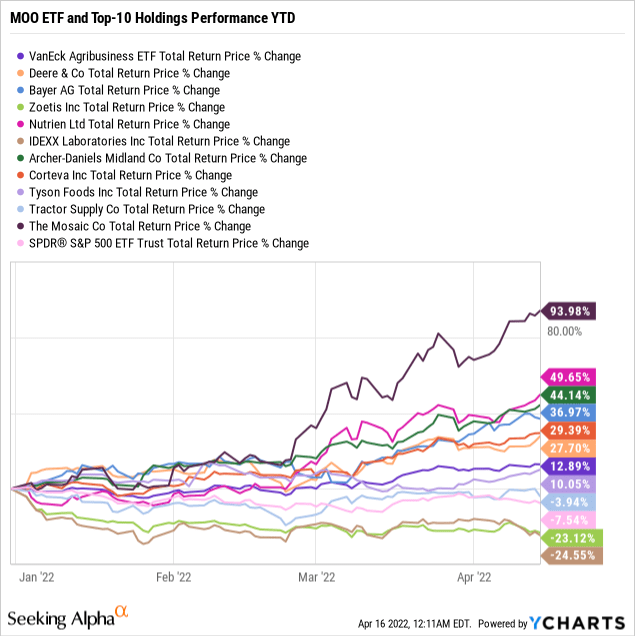

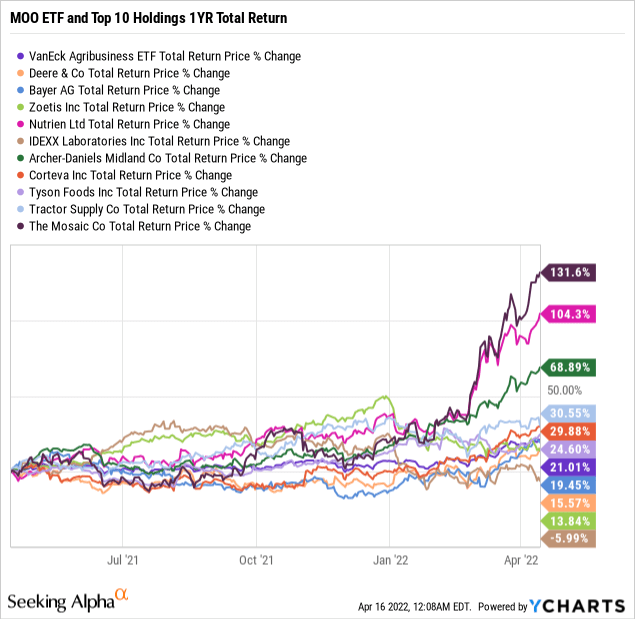

We mentioned the fund has been a winner, with MOO returning 13% thus far in 2022 which represents an outperformance to the broader market considering the S&P 500 (SPY) is down 8%. From the chart below, several of the top holdings in MOO have boosted the fund’s return with Mosaic Co standing out, up 94% YTD.

Companies with exposure to fertilizer including phosphates and potash have benefited from tight global supply conditions that have been further pressured by the ongoing Russia-Ukraine conflict. Agri-traders like ADM, up 44% YTD, and Bunge Limited (BG), up 33% in 2022, have also been winners with higher prices in grains like wheat and soybeans as positive to their earnings outlook.

The exception in MOO is the animal health players like Zoetis Inc. and IDEXX Laboratories Inc. (IDXX) which have notably underperformed, each down by 23% and 24% this year, respectively. Part of this dynamic considers a more recent impact of rising Avian flu (“bird flu”) cases seen potentially limiting poultry flock sizes in the year ahead as a headwind for veterinary consumables. Nevertheless, the strength in MOO is widespread with the core exposures to agri-businesses gaining momentum this year.

MOO ETF Price Forecast

Breaking down the portfolio, materials sector holdings that represent nearly one-third of the fund include companies that are directly benefiting from higher commodity prices like fertilizers and agricultural products. There is also a component of the fund in consumer staples which includes companies that are able to pass along inflationary cost pressures through pricing power.

Beyond inflation, the ongoing Russia-Ukraine conflict remains a major market development. While the situation has added to supply chain disruptions and is in part responsible for higher agricultural prices, the other side is the potential impact on global economic activity. When looking at the MOO ETF, a risk to consider is a deteriorating macro outlook that would pressure demand and reverse commodity prices lower.

That said, there is a thought that an eventual resolution to the geopolitical crisis could jumpstart economic growth which would further add momentum to commodity and agricultural prices. In this regard, we see different scenarios where MOO can continue rallying either because of ongoing supply-side challenges or because demand re-accelerates down the line. In the near term, we can say that the environment will be very positive for the underlying agribusiness company’s cash flows and earnings.

Final Thoughts

We are bullish on the MOO ETF which is well-positioned to continue rallying into persistent inflationary trends. The fund brings together an interesting group of high-quality companies that can outperform in the current macro environment.

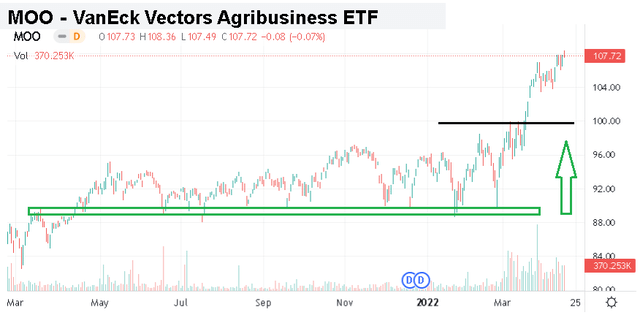

Looking at the ETF price chart, MOO was trading in a relatively tight range for most of 2021 before the more recent breakout through the $100 price level. The upcoming Q1 earnings season with the key underlying holdings of the MOO ETF reporting can be a catalyst for the fund to take the next leg higher.

Be the first to comment