sankai

While investors may be tempted to ‘buy the dip’ on semiconductor companies, with the VanEck Semiconductor ETF (NASDAQ:SMH) declining 42% YTD, and individual stocks declining even more, new export restriction and poor macroeconomic conditions suggest staying on the sidelines is the best course of action.

Brief Fund Overview

The VanEck Semiconductor ETF provides investors exposure to companies involved in semiconductor production and equipment. It achieves this goal by tracking the MVIS US Listed Semiconductor 25 Index (“MVSMHTR”). The SMH ETF has $5.4 billion in assets and has a 0.86% distribution yield. It charges a fairly standard 0.35% expense ratio.

Semiconductor Is The New Battleground In Escalating Cold War Between U.S. and China

A few months after the U.S. government passed its CHIPS For America Act, which directly subsidizes the development of semiconductor manufacturing in America, On October 10th, the U.S. government announced sweeping new export restrictions on advanced computing and semiconductors to China.

We are seeing the restrictions go into effect immediately, as KLA Corporation (KLAC), a leading semiconductor manufacturing equipment supplier, announced it will stop sales to its Chinese customers. KLA is the 11th largest position within the SMH ETF at a 4.3% weight.

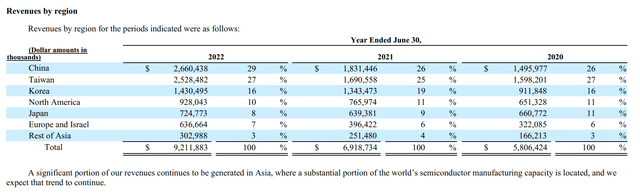

To grasp how monumental this shift in policy is, we must realize that China is one of the most important markets for semiconductors and semi-equipment. For context, it accounts for 29% of KLA’s revenues in the latest fiscal year (Figure 1).

Figure 1 – KLA Sales By Geography (KLA 2022 10K)

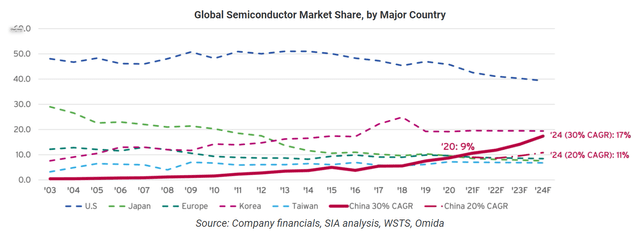

In fact, according to Semiconductor Industry Association (“SIA”), China accounts for ~10% of global semiconductor sales and has been growing at a rapid pace (Figure 2)

Figure 2 – Global Semiconductor Market Share (semiconductor.org)

To suddenly cut off China from the global semiconductor ecosystem will have huge implications for revenues, earnings, and valuations of semiconductor companies.

Export Restrictions Could Backfire In The Long-run

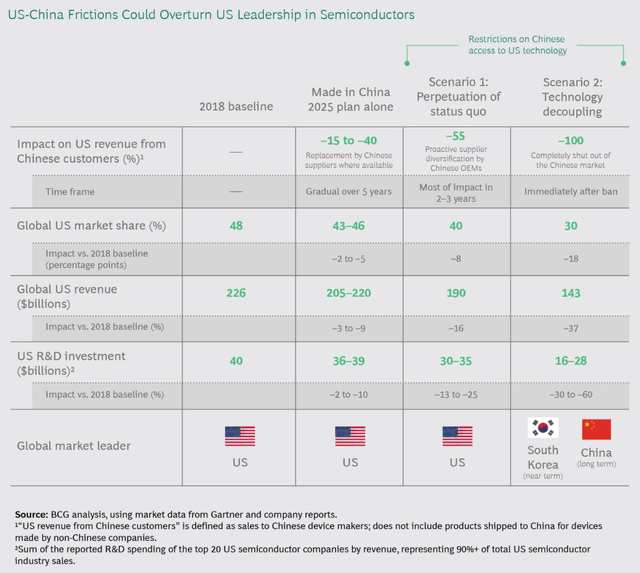

According to a 2020 study by The Boston Consulting Group (“BCG”), if the U.S. ratchets up technology decoupling with China, it could lead to a lose-lose outcome where U.S. semiconductor companies see reduction in market share and revenues by 18% and 37% respectively (Figure 3).

Figure 3 – BCG Study On Impact of Technology Decoupling (bcg.com)

Paradoxically, protectionist policies like the CHIPS Act and Export Restrictions could damage the U.S. technology lead in the long run as semiconductor companies have smaller economies of scale, and face increased competition from global suppliers such as South Korea.

Quoting from the BCG study:

In a scenario in which escalating tensions lead to further restrictions on US semiconductor sales to Chinese customers, South Korea would likely overtake the US as world semiconductor leader in a few years; China could attain leadership in the long term. As experience in communications network equipment and other tech sectors has shown, once the US loses its global leadership position, the industry’s virtuous innovation cycle reverses direction, throwing US companies into a downward spiral of rapidly declining competitiveness and shrinking market share and margins. Lower R&D investment would inhibit the US semiconductor industry’s ability to deliver the breakthroughs that US technology and defense sectors rely on to maintain global leadership; ultimately, it could force them to depend on foreign semiconductor suppliers.

Semiconductor Sales Already Slowing; Expect Nuclear Winter Next

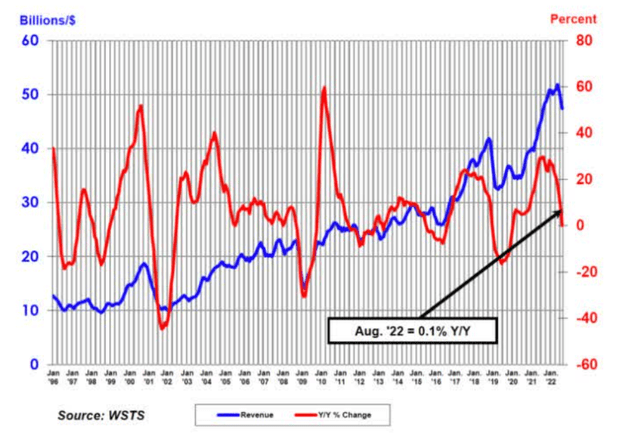

Already, we are seeing semiconductor sales slowing, with global sales of semiconductors stalling YoY and declining MoM in August (Figure 4). Just last week, we had AMD (AMD) delivering a shocking preliminary sales report for Q3/2022.

Figure 4 – Global Semiconductor Sales Slowing (WSTS via Seeking Alpha)

With global growth slowing, PC demand sinking, and crypto demand imploding (especially due to the recent switch of Ethereum from Proof-of-Work to Proof-of-Stake), semiconductor companies and investors may be looking at a ‘nuclear’ winter in the coming months.

Semiconductor Valuations Normalizing

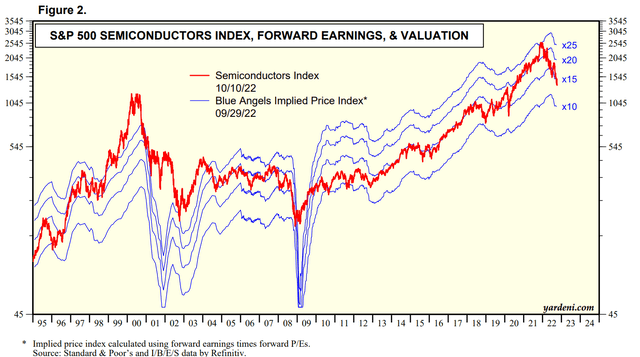

Historically, semiconductors were a cyclical industry, with ebbs and flows corresponding to macroeconomic cycles. However, since 2009, we have essentially seen a 1-way bet on semiconductors as chips and processing capabilities were added to everything, including toasters and ovens. This has pushed semiconductor industry valuations far above norms, with the industry recently trading at 25x Forward Earnings (Figure 5). Many recent investors do not even know what a semiconductor cycle is, as their investing experiences have only seen semiconductor companies trade ever higher.

Figure 5 – Semiconductor Industry valuations (yardeni.com)

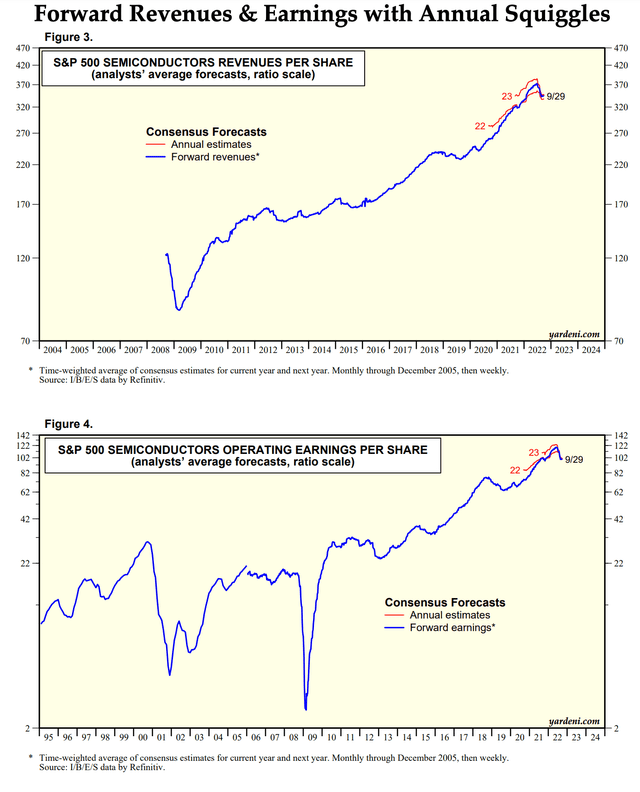

Although industry valuations have since normalized to 15x Forward P/E, we should note that is based on rosy forward revenues and earnings. Once analysts start modeling in the impact of these new export restrictions, we could see drastic reductions in their revenue and earnings estimates (Figure 6).

Figure 6 – Semiconductor Industry Forward Revenues & Earnings (yardeni.com)

Conclusion

In conclusion, while investors may be tempted to ‘buy the dip’ on semiconductor companies, with the SMH ETF declining 42% YTD, and individual stocks like Advanced Micro Devices Inc. and NVIDIA Corporation (NVDA) declining 62% and 61% YTD respectively, I suggest investors stay on the sidelines until we see signs of stabilization in guidance and estimate cuts.

Be the first to comment