plastic_buddha

In my last article on the VanEck Vectors Gold Miners ETF (NYSEARCA:GDX) on September 6, I noted that a number of factors pointed towards a bottom for the gold mining index (see ‘GDX: The Tide Is Turning Bullish‘). Over the past two months we have seen what appears to be a significant bottoming process take place, with yesterday’s rally providing confirmation. With valuations still depressed from a historical perspective, there is much more upside to come for the gold mining sector.

The GDX ETF

The VanEck Vectors Gold Miners ETF is the oldest, largest, and most liquid gold mining ETF which tracks the performance of the NYSE Arca Gold Mining Index. Newmont (NEM) has the largest weighting on the index at 13%, followed by Barrick Gold (GOLD) which has a 10% weighting. The GDX is more diversified than the iShares MSCI Global Gold Miners ETF (RING) where these two stocks comprise 19% and 14% respectively. This comes at the expense of a slightly higher expense ratio of 0.52% versus RING’s 0.39% and a lower dividend yield of 2.0% vs 2.7%.

The weighting of NEM and GOLD in both indices has declined significantly over the past few months as the two gold majors have seen major selloffs, which have weighed heavily on the ETFs. However, the last few days of price action suggests both stocks are bottoming out after posting false bearish breaks.

Both GDX And Gold Have Broken Resistance

Yesterday’s 6% rally in the GDX has the hallmarks of a bullish breakout that points to significant further gains. A move up to the USD30 area now looks likely, which would mark a further 13% rally.

The rally in GDX has been driven largely by the recovery in gold prices, which have also broken out above down trendline resistance from its March peak. We are still yet to see a higher high in gold prices, with bulls needing to clear the October 4 high at USD1729 to confirm a trend reversal.

A key factor determining the gold price will be expectations of real interest rates. There is a strong correlation between gold prices and inflation-linked bond yields, which reflect future expectations of the spread between interest rates and inflation. Gold’s latest rally has actually occurred despite real bond yields remaining near cycle highs, and we would likely need to see real yields decline for gold’s rally to be sustained. As I have argued in several previous articles (see ‘TIP: Economic Reality Increasingly Supportive‘), such a move should occur sooner rather than later as the Fed is forced to respond to economic weakness by shifting its focus away from fighting inflation.

Valuations Have Risen But Remain Cheap On Most Metrics

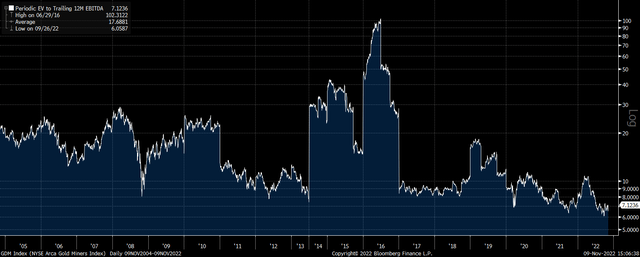

At the GDX’s low on September 26, the underlying NYSE Arca Gold Mining Index traded at a record low EV/EBITDA ratio of 6.0x, and the figure sits at 7.1x now, which is still below previous sustainable market bottoms as the chart below shows.

GDX Trailing EV/EBITDA Ratio (Bloomberg)

The price/book value and price/sales ratios also show the GDX is cheap from a historical perspective, with current ratios on par with previous market lows, with the exception of the crisis level valuations seen in 2015.

GDX Price/Book And Price/Sales (Bloomberg)

Despite strong operating profits and cash flows, earnings and free cash flows have been undermined by rising capex costs, in part driven by the rise in oil prices. The P/E ratio sits at 20x while the price-to-free cash flow ratio is even higher at 33x. The good news is that the ratio of gold prices to oil prices appears to be rolling over, which should provide support to gold miners’ earnings and free cash flows and allow continued growth in dividend payments.

Summary

The GDX has broken to the upside amid a strong recovery in gold prices, with the two leading companies on the index – Newmont and Barrick – showing major reversal patterns. Further gains in the GDX will depend on whether gold can consolidate its recent gains, which will be largely driven by expectations of real bond yields. As it becomes clear that the economy cannot tolerate current high real yields, a dovish pivot by the Fed should allow the precious metals bull market to resume.

Be the first to comment