leolintang/iStock via Getty Images

Since I announced that I took profits in Value Line, Inc. (NASDAQ:VALU) in an article with the very original title “Taking Profits in Value Line,” the shares have dropped just under 46% in value, against a loss of about .8% for the S&P 500. I know that people don’t like it when you brag, so I’m not going to ask you to indulge me with this call. I’m not going to go on about how the shares did a nose dive almost immediately after I published the above article. I’m not going to write any of that, because it would be rude to do so. Anyway, the company has reported earnings since, so I thought I’d review the name yet again. Additionally, a stock trading at $52 is, by definition, a less risky investment than the same stock when it’s trading at $96. I’m obviously comfortable owning Value Line at the right price, and today I want to determine if $52 is the “right” price or not.

Welcome to the “thesis statement” portion of the article. In case you’re the kind of person who wants more than a title and bullet points, but less than an article, this paragraph is for you. It would also help if you’re the type to skip the first 173 words in an article before you start to read it. I write these thesis statements as a way to help you get the “gist” of my thinking without the need to read through paragraph after paragraph of my tedious self-congratulation. You’re welcome.

Anyway, I continue to think that this is a fine company and that the share capital structure and dividend remain very secure. In spite of the significant drop in price, Value Line shares remain expensive in my view. I think this will be a great investment if we see the shares reach the level they did when I became bullish about the stock “back in the day,” as the young people say.

For the moment, though, I think there are far safer investments that offer far better dividend yields than Value Line, Inc. There you have it. If you read on from here, that’s on you. I don’t want to read any complaining in the comments section about the fact that I’m an inveterate braggart, or the fact that I spell words like “characterise” correctly.

Financial History

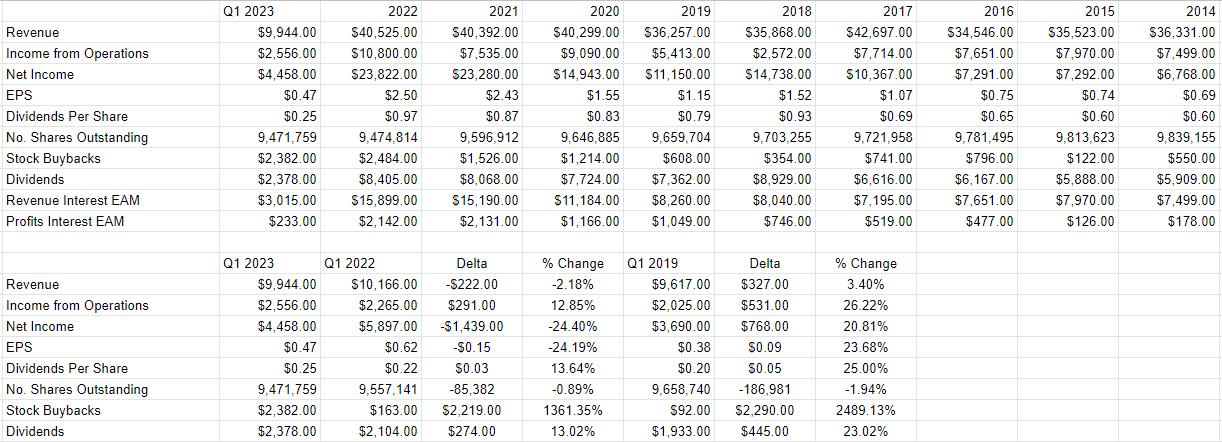

I’d characterize the first quarter of the current fiscal year as “ok, not great.” Revenue was down a slight 2.2% relative to the same period last year, but net income has collapsed by about 24.4%. That written, I think Value Line has generally done a fairly good job at controlling expenses. For example, advertising and promotion expenses and salaries are down about 22% and 13% from last year respectively. The chief culprit that can explain the reduction in net income is the collapse in revenue and profits from the EAM trust. Specifically, it’s down $1.8 million, or 37.25%. Investment gains have also deteriorated by about 25%.

When we broaden our focus a bit, we see that the quarter just ended was far better than 2019. Specifically, revenue and net income were higher by 3.4% and just under 21%, respectively.

At the same time, the capital structure remains fairly strong in my view. For example, cash on the balance sheet of $14.8 million represents about 31% of total liabilities of just over $48 million. For that reason, I’m not worried about the survivability of this business, and I can’t write that about every company I’ve covered recently.

Given all of the above, the relative softness during the most recent quarter is not ideal, but it doesn’t disqualify the company from consideration. At a payout ratio of only about 53%, I think the dividend is reasonably well covered. For that reason, I’d be very happy to buy back in at the right price.

Value Line Financials (Value Line investor relations)

The Stock

I can picture some of my regulars rolling their eyes at this point, because they know that I’ve talked myself out of some great trades with the phrase “at the right price.” That’s certainly true, but I’d rather miss out on potential upside than risk capital on a trade that goes sideways after I buy something expensive in the hopes that it becomes more expensive.

It’s also the case that I’m firmly of the view that the Value Line business with its strong balance sheet and sustainable dividend is a different thing from the “stock.” This is because the business generates revenue and profits, and the stock is a speculative instrument that gets traded around based on long-term expectations about the business. Given that the financial statement valuation of the business is “backward-looking” and the stock is a forecast about the distant future, there’s an inevitable tension between the two. The tension is highlighted by the fact that the business is about selling investment periodicals, while the stock is buffeted by a host of factors having nothing to do with that. The stock may be impacted by the musings of a member of the Federal Reserve, for instance, because we live in a world where they apparently matter to stock performance.

This is why I consider the stock as a thing distinct from the business, and I think it’s often a poor proxy for what’s going on at the company. Additionally, I think it’s possible to profitably exploit this disconnect. In my view, the only way to successfully trade stocks is to spot the discrepancies between what the crowd is assuming about a given company and subsequent results. What I want to see in this regard is a stock that the crowd is somewhat pessimistic about that goes on to exceed expectations. When the crowd is pessimistic, the shares are cheap, which is why I try to buy only cheap stocks.

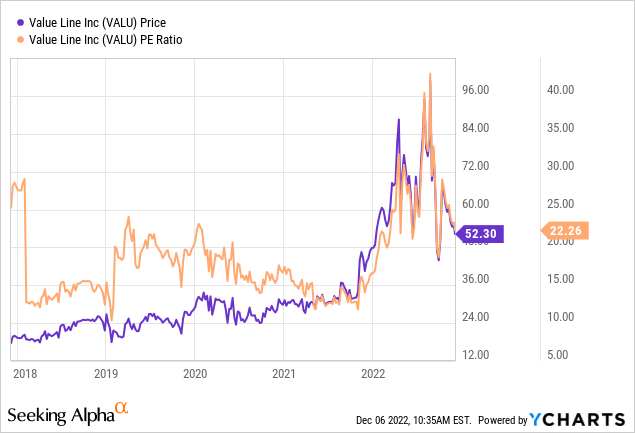

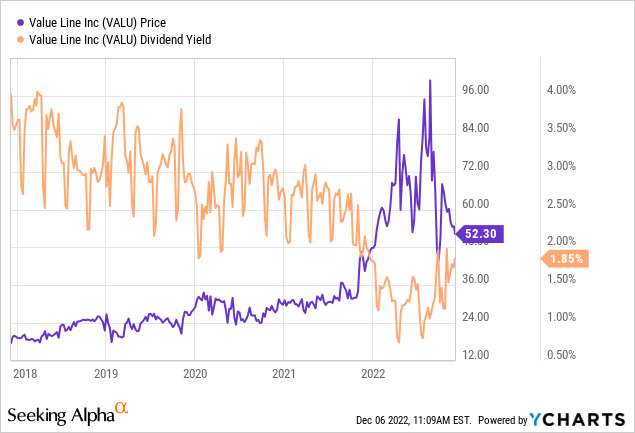

In my previous piece, in case you’ve forgotten, I decided to walk away from Value Line after the P/E went parabolic and went above 40. I highlighted the extreme nature of this valuation by putting it in the context of a graph that went back to the mid-1980s. Additionally, the dividend yield had collapsed. I reasoned that paying all-time highs and getting near-low payments was not a recipe for success. Fast-forward to the present, and here’s the current lay of the land. In spite of the fact that Value Line shares are down quite a bit, they’re still quite expensive by historical standards. At the same time, the dividend yield is still near record lows.

In addition to looking at ratios, I want to try to work out what the market is “thinking” about a given investment. If you read my stuff regularly, you know that the way I do this is by turning to the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply some pretty basic math to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in this formula. In case you find Penman’s writing a bit opaque, you might want to try “Expectations Investing” by Mauboussin and Rappaport. These two have also introduced the idea of using the stock price itself as a source of information, and we can infer what the market is currently “expecting” about the future.

Be the first to comment