Lakeview_Images/iStock via Getty Images

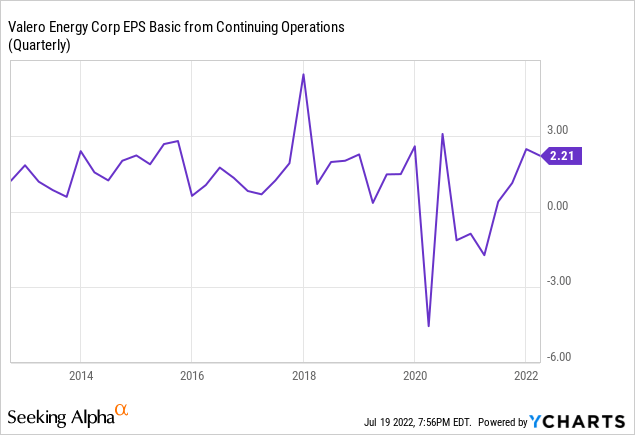

Valero Energy (NYSE:VLO) is expected to report second quarter earnings on July 28, and the consensus estimate is literally off the chart below – $8.75 a share, with analysts providing a wide spread of between $4.29 and $10.04.

The huge quarter is the result of sky-high crack spreads, pushed by a diesel crisis on the East Coast in May that pushed gasoline margins higher when refiners diverted production into refilling thirsty truck stops.

While those margins have peaked, the stock’s recent decline of 30% off its June high means it can hardly be considered overvalued.

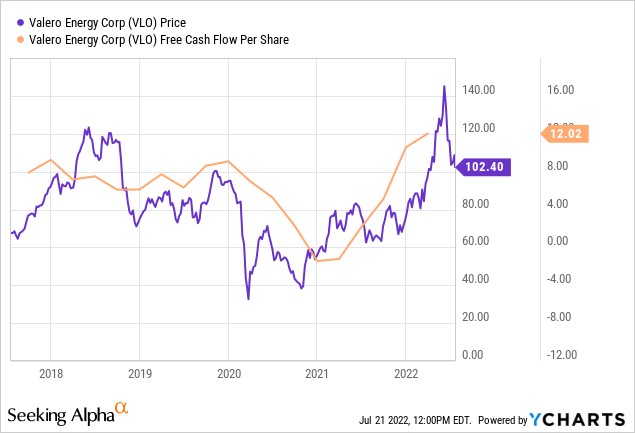

Valero went on a run in the first half and topped its 2018 high before the recent drop. The stock has roughly tracked free cash flow per share and is priced at a reasonable 8.5 times the trailing figure of $12.02.

Bullish Outlook For Refining

Bloomberg energy columnist Javier Blas did a good job of explaining why diesel prices were so high on the East Coast – closures of East Coast refineries, exacerbated by the recent loss of imports of Russian semi-refined products. Diesel crack spreads surged to record levels, and as more barrels were converted, gasoline supplies tightened for the summer driving season.

The futures curve for the RBOB gasoline crack spread is in backwardation but remains elevated. The front-month contract was above $38 (per barrel) as of this week. For 2023-25, the spread bottoms around $16 in winter and peaks around $25 in spring-summer. By contrast, during the 2010s, this spread typically peaked around $18 and bottomed around $6.

The partial Russian oil and gas cutoff benefits the entire U.S. refinery industry, since much higher natural gas prices in Europe raise processing costs for their refiners. The U.S. cost advantage is as much as $9 a barrel because refiners use gas for thermal heating, electricity generation, and hydrogen processes, according to RBN Energy.

Even if events unfurl to relax the refined product supply/demand balance, elevated natural gas prices will continue to cause pain for European refiners, limiting how far refinery gross margins can fall, and allow competitively advantaged U.S. refiners to prosper.”

Capacity Limitations

U.S. oil distillation capacity peaked at 18,796,000 barrels a day in early 2020, and with the COVID-19 crisis causing refinery shutdowns, has dropped to 17,941,000 barrels, a decline of 4.6%, with hardly any rebound, according to the Energy Information Administration. Capacity is at its lowest level in eight years.

Barriers to entry are high. The last new refinery with significant downstream capacity came on line in 1977, according to the Energy Information Administration. Capacity expansions sometimes occur in existing ones, favoring incumbents like Valero, which has expanded its Corpus Christi, Texas, facility.

Even if the Biden administration suddenly shifted its anti-fossil-fuels policies, it would take years to get the permits in a best-case scenario. Inefficient ones like LyondellBasell’s 268,000 barrel-a-day Houston refinery (opened in 1918) are being shuttered after years of losses, despite the high margins available now. The West Coast is something of an energy island, and usually has good margins, which can only benefit as two Bay Area refineries are converted to smaller biofuel processors.

Saudi Arabia’s foreign minister said this week that the shortage is worldwide.

“As of today, we don’t see a lack of oil in the market. There is a lack of refining capacity, which is also an issue, so we need to invest more in refining capacity,” Foreign Minister Prince Faisal Farhan Al Saud told reporters in Tokyo.”

Competitive Advantage

Valero is one of the two largest U.S. independent refiners, along with Marathon Petroleum (MPC), but is more of a pure play since Marathon retains a substantial gathering and processing operation in the MPLX limited partnership. VLO’s main competitive advantage is that it can process cheaper sour crude grades and adjust to changing market conditions, with the highest complexity index in the industry (11.6) compared to Marathon’s 10.8 and Phillips 66’s (PSX) 10.7.

It does especially well when there is a big discount for sour crude, and was hurt in the late 2010s when Venezuelan (sour) production collapsed and the Trump administration issued sanctions against the Maduro regime. The Biden administration has shown signs of easing them. In the meantime, Valero has been buying sour from the Strategic Petroleum Reserve.

Stock Comparison

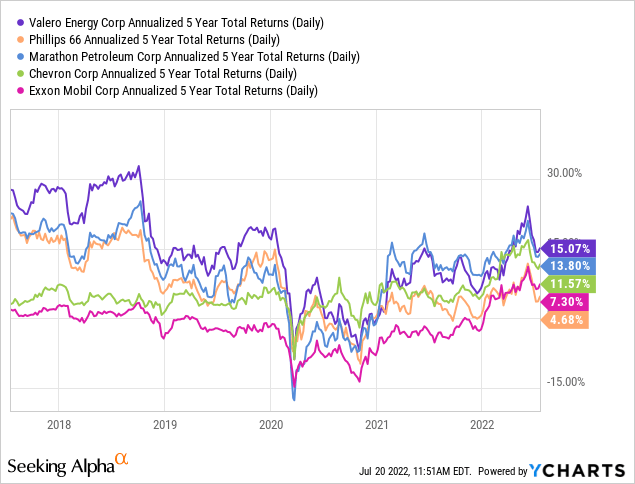

Over a five-year period, VLO’s total return has outperformed both its peers as well as the two U.S.-based integrated majors, Exxon Mobil (XOM) and Chevron (CVX).

The three leading independent refiners resemble each other in market cap and revenue. Valero’s healthy operating margin and low price/earnings growth ratio resemble Marathon more than Phillips, which has the highest yield.

| VLO | MPC | PSX | ||

| Market cap | $43B | $47.8B | $39.2B | |

| Revenue | 125.8B | 135.9B | 125.9B | |

| Trailing P/E | 16.84 | 19.9 | 14.2 | |

| Forward P/E | 8.72 | 10.4 | 8.82 | |

| PEG Ratio (5 yr. expected) | 0.29 | 0.29 | 0.8 | |

| EV/EBITDA | 8.11 | 7.05 | 9.13 | |

| Operating Margin | 3.41% | 3.89% | 1.29% | |

| Yield | 3.69% | 2.64% | 4.69% | |

Source: Yahoo Finance

Valero’s yield of around 3.7% makes it attractive for dividend-oriented investors. It raised its dividend regularly in the 2010s but has not changed it since February 2020, just before Covid. It restarted stock buybacks in the first quarter and aims to return 40% to 50% of cash flow to shareholders.

Bearish Factors

It’s not ideal to buy a stock at the peak of its earnings cycle. Risks include demand destruction from higher gasoline prices, possible long-term loss of demand from conversion to electric vehicles, and a rise in product imports from the Middle East. Gulf Coast hurricanes have unpredictable effects, and oddities like the winter 2021 Texas electricity crisis can ruin quarters.

Conclusion

Valero is a well-run company that has been a profitable part of my portfolio for a decade. Its long-term advantages keep mounting. I’m not selling just because its earnings are reaching a cyclical peak.

Be the first to comment