SergeyZavalnyuk

Article Thesis

Prices for iron ore and other commodities have pulled back from the highs that were hit not too long ago, but the pricing environment for mining companies such as Vale S.A. (NYSE:VALE) and Rio Tinto Group (NYSE:RIO) remains positive. Both companies will be highly profitable this year, offer hefty shareholder payouts, and operate with clean balance sheets. In this article, we’ll pit them against each other to see what company is the better pick for different kinds of investors.

Are Rio Tinto And Vale Competitors?

Both companies are among the largest mining companies in the world, with BHP (BHP) another important player in this space. Both Rio Tinto and Vale mainly produce and sell iron ore, but they are active in additional areas on top of that.

Rio Tinto owns copper and aluminum assets, for example, while also having some exposure via smaller units that are active in minerals, which includes Titan oxides, Borates, Diamonds, etc. Still, the clear focus is on iron ore.

Likewise, Vale is active in areas in addition to iron ore, via its copper, manganese, nickel, and other business ventures. Like Rio Tinto, Vale generates the vast majority of its revenue and profit with its iron ore assets.

One can thus say that the two companies are direct competitors, although their geographic focus is a different one. Vale is most active in Brazil, whereas Rio Tinto is most active in Australia. But since the metals these companies produce are sold globally, their end markets overlap to some degree.

VALE And RIO Stock Key Metrics

Due to their relatively comparable business models, they are similarly exposed to global commodity price movements. The following chart shows the price of iron ore futures (SCO:COM) over the last five years:

Seeking Alpha

2021 was an extraordinary year where iron ore prices soared well above $200 per tonne, which led to outstanding profits for all iron ore miners, including Rio Tinto and Vale. But those prices were unsustainable in the long run, and on the back of a housing slowdown caused by rising interest rates, and since the economic picture has worsened in the US and Europe, iron ore prices have pulled back considerably. Still, at more than $100 per tonne, they are substantially above the pre-pandemic average, and profitability is still at a compelling level today.

During the first half of the current year, Vale has generated EBITDA of $11.4 billion, with an EBITDA margin in the low 50s. Rio Tinto, by comparison, has generated EBITDA of $15.6 billion during the same period, with a relatively comparable EBITDA margin of 52%. Both companies are thus on a similar level when it comes to turning their sales into profits, which is somewhat surprising as wages are significantly higher in Australia compared to Brazil, for example. But Rio Tinto is able to offset that headwind through efficient operations, which allows both companies to operate with compelling profitability.

When it comes to cash generation, the capital investments of each company naturally play a large role as that directly impacts free cash generation. Vale has invested just $2.4 billion during the first half of the year, whereas Rio Tinto has invested a somewhat higher $3.1 billion over the same time frame. But even that wasn’t overly much, as Rio Tinto is guiding for 2022 capital expenditures of $7.5 billion, which implies spending of more than $4 billion during the current half of the year. Rio Tinto’s plans for 2023 and 2024 see capital expenditures of $9 billion to $10 billion, respectively, which includes regular maintenance capital expenditures and around $3 billion of additional growth spending on top of that. Rio Tinto will only spend those when attractive opportunities materialize, however. Actual spending could thus be lower, if IRR hurdles are not met or if management decides against potential growth projects due to other reasons.

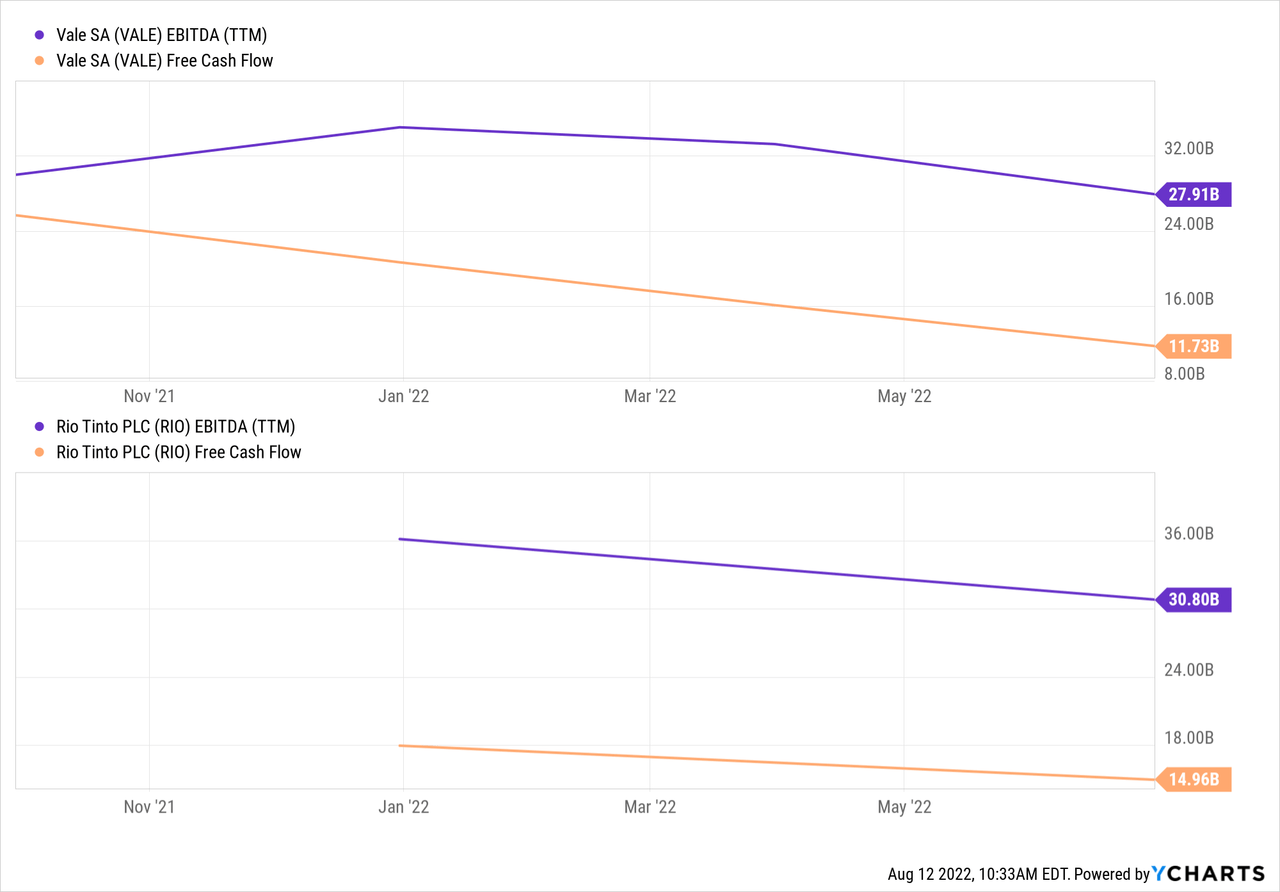

Still, despite these higher investments, Rio Tinto has a superior free cash flow profile:

Its free cash flows over the last year equated to 48% of its EBITDA, whereas Vale generated free cash flows that were equal to 42% of its EBITDA — that’s still not a bad result at all, but Rio Tinto’s performance was just a little better.

Rio Tinto also has the stronger balance sheet, which is, at least partially, the result of its better free cash flow generation in the past. Vale’s Brumadinho dam disaster a couple of years ago, that led to billions of dollars in charges and liabilities, has also impacted its balance sheet. Today, Rio Tinto operates with a small net cash position of $300 million — in other words, Rio Tinto’s cash hoard is larger than all its debt. Vale, by comparison, has a net debt position of $5.4 billion. That’s still not too high at all, as Vale operates with a conservative leverage ratio (net debt to EBITDA) of just 0.2. But again, Rio Tinto is just a little ahead of its peer, as its balance sheet is even stronger than that of Vale.

The strong free cash generation of both companies and their healthy balance sheets, position them well for attractive shareholder returns. Both companies have paid out hefty dividends in the recent past, and it is likely that dividends will remain the main avenue for shareholder returns, as both companies seem to be less interested in massive buybacks. It should be noted that these dividends are quite variable in nature, thus one can’t assume that current dividend levels will be maintained forever.

For the first half of the year, Rio Tinto has paid out $2.67 per share, which equates to around $5.30 annualized. Relative to a current share price of $59, that makes for a 9.2% dividend yield — which is very attractive. Vale has paid out $0.69 for the first half, which equates to an annualized dividend yield of 10.3%. From a yield perspective, Vale is thus slightly stronger than its peer. Looking at the payout ratios, we see that both dividends would be sustainable with commodity prices at the levels seen in recent months. Rio Tinto has paid out $4.3 billion in dividends while generating free cash flows of $7.1 billion over the same time, which means that its surplus free cash flow, after dividends, would be in the $6 billion range on an annual basis. That’s more than enough to cover for higher capital expenditures in the coming years.

Vale has paid out $3.2 billion in dividends for the first half, while generating free cash flows of $3.5 billion. Dividend coverage was thus better at Rio Tinto (1.65x) versus Vale (1.13x), but Vale’s dividend yield is higher. One could thus say that Rio Tinto is the better pick from a risk perspective, while Vale is the company that offers a higher current return rate, at least when it comes to income generation via its dividends.

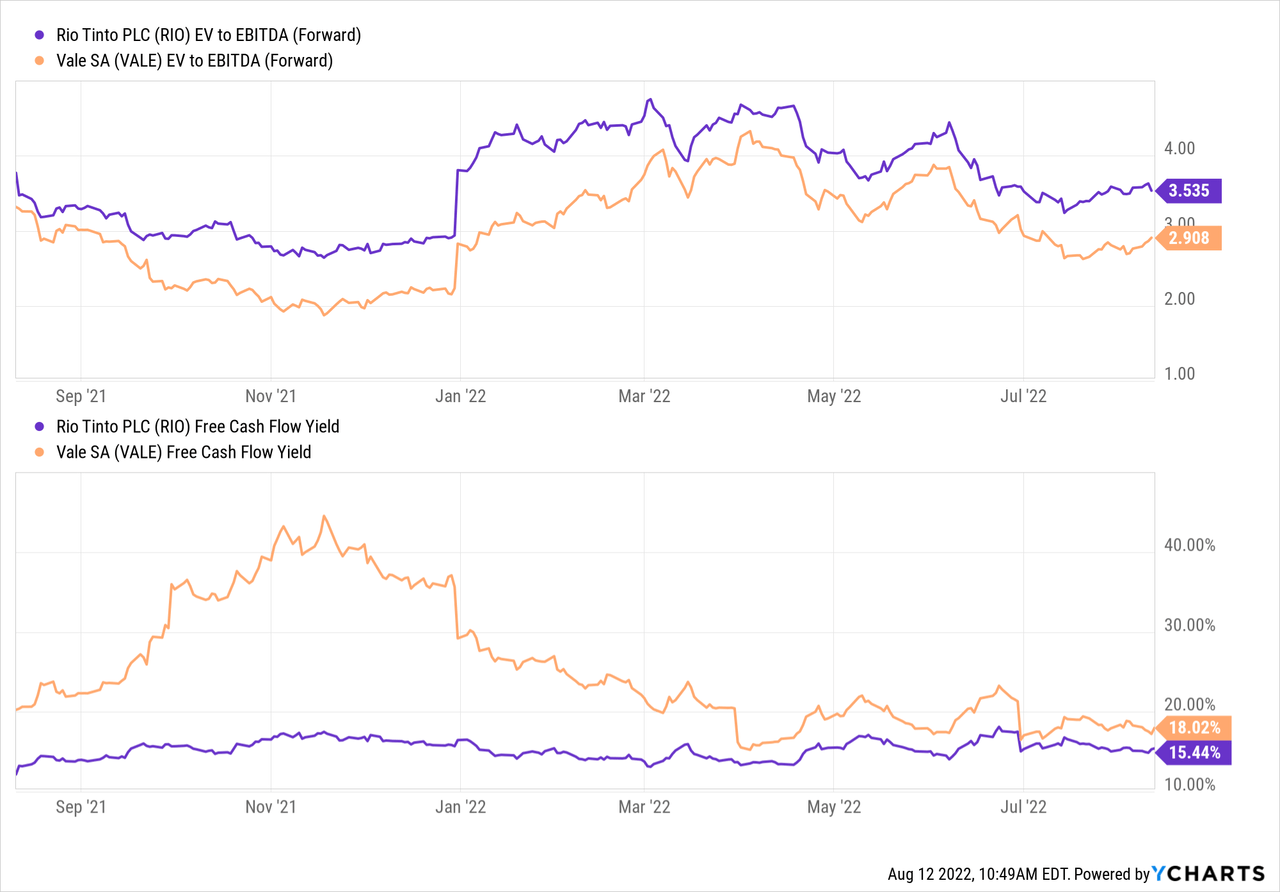

Looking at the valuation of the two companies, we see the following:

Rio Tinto is cheap, but Vale is even cheaper — the EV/EBITDA ratio of RIO is around 20% higher, and the same holds true for the free cash flow yield. I do believe that the discount Vale trades at is not too surprising, as its FCF generation, relative to EBITDA, is slightly worse, and since political risks in Brazil are arguably higher than in Australia. Vale is thus a slightly lower-quality, higher-risk company, which is also underlined by the fact that RIO’s balance sheet is stronger. That being said, Vale looks like a very healthy company as well, which is why it does not look like a bad investment at all.

What Is The Future Outlook For VALE And RIO Stock?

Both companies are heavily exposed to iron ore markets. Demand for iron ore is driven by steel production, which, in turn, depends on a range of end markets. This includes automobiles, shipbuilding, homebuilding, and so on. Supply bottlenecks such as the ones during the pandemic have been passed, which is why I do not believe that the ultra-high iron ore prices from 2021 are coming back. But that’s not needed, and with iron ore in the low $100s, both companies will do fine. With China possibly increasing stimulus in order to drive economic growth, and with infrastructure investments needed in the US and many other countries around the world, steel demand for construction/infrastructure is looking good.

Both companies also are exposed to green themes via their copper, nickel, etc. businesses. These materials are needed for the generation of renewable energy, for electrical grid updates, EVs, and so on. Demand should thus rise, and especially Rio Tinto could benefit from rising copper demand via its gigantic Mongolian Oyu Tolgoi copper project.

I do thus believe that the longer-term business outlook is healthy for both companies, although macro shocks such as a hefty recession will naturally impact profitability, as has been the case in the past as well.

Is RIO Or VALE Stock A Better Buy?

I do believe that both companies are pretty solid investments at current prices. The longer-term outlook is compelling for both, and neither is expensive. RIO seems like the higher-quality pick based on margins, balance sheet strength, etc. VALE is the slightly cheaper and higher-yielding stock among the two, however. Whether one favors better quality at a higher (but still lowish) price, or whether one favors the cheaper, slightly lower-quality stock, is dependent on one’s personal investment approach — neither seems like a bad idea, I believe.

Be the first to comment