christiannafzger/iStock via Getty Images

Introduction

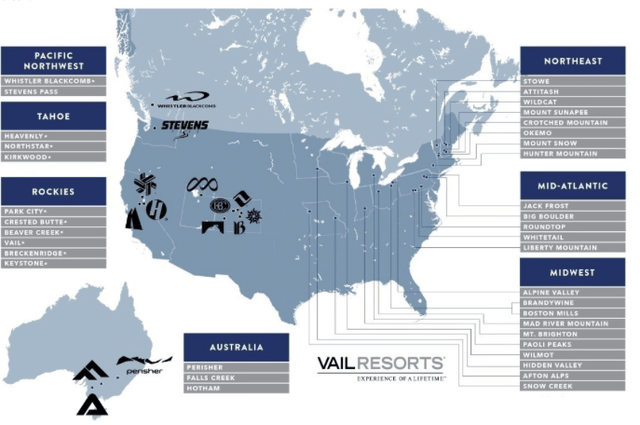

Vail Resorts, Inc. (NYSE:MTN) is the pinnacle of skiing resorts in the nation. The company owns 37 world-class resorts across the country, making money from the lift tickets and rooms to stay in. The business, like many others in hospitality, saw harsh declines during the pandemic but has since rebounded to new highs. There is a headwind of high inflation, but I think the company will perform around the historical norm. At a P/E of 26x, Vail is fairly valued and could make sense for many people’s portfolios.

Financial History

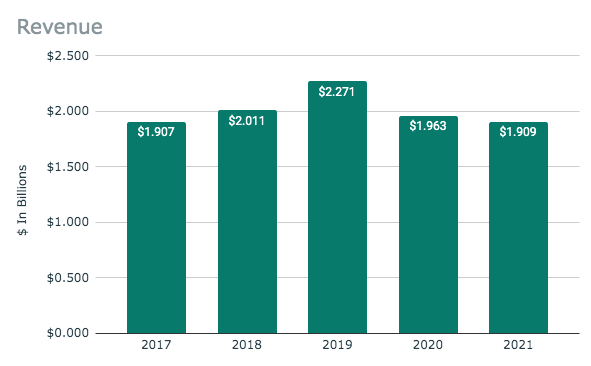

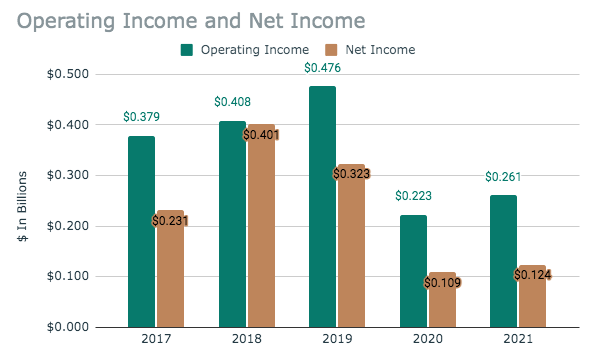

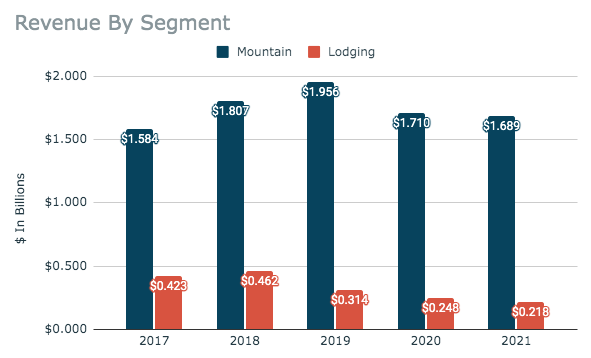

Vail Resorts Revenue (SEC.gov) Vail Resorts Operating & Net Income (SEC.gov) Vail Resorts Revenue By Segment (SEC.gov)

Vail has seen a rather consistent revenue base that was growing at a rate of 27.5% per year until the pandemic. Since COVID, the company has seen revenue 84% below 2019 levels. Vail operates in three segments; Mountain; Lodging; and Real Estate, with the first two making up 99.9% of all revenue. Mountain is the breadwinner and showed growth of 7.3% from 2017 to 2019, but is now down 13.7% since. Lodging has seen a decline since 2019 by 11.5% per year.

Operating income posted the same growth trajectory as revenue, with a CAGR of 7.9% until 2020, when it declined by 45%. Net income, on the other hand, has fluctuated more but is also down 61.6% from 2019 levels.

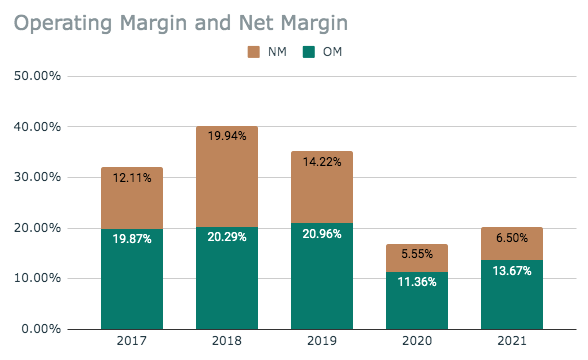

Vail Resorts Margins (SEC.gov)

Looking at the margins shows the business has become way less efficient throughout the pandemic. The operating margin is down 7.29%, and the net margin declined 7.72%.

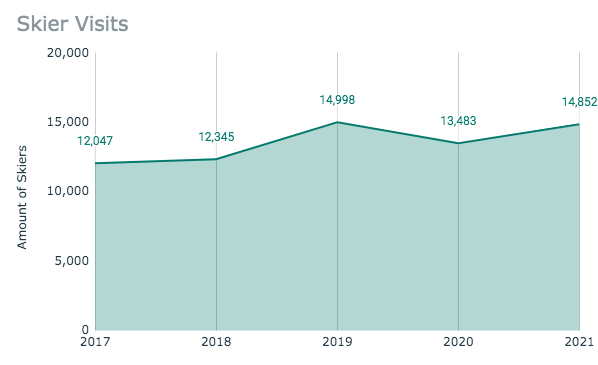

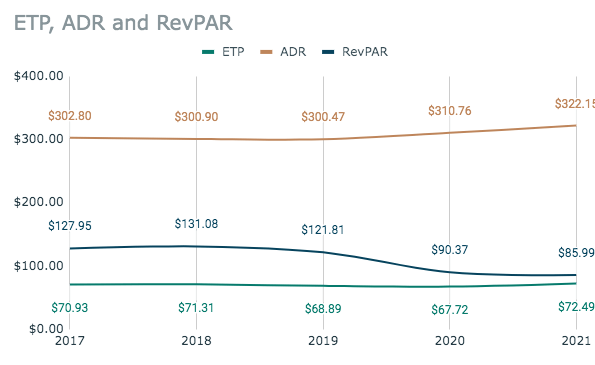

Vail Resorts Skier Visits (SEC.gov) Vail Resorts ETP, ADR, & RevPAR (SEC.gov)

The reason for this revenue and margin decline can be seen in the charts above. In 2020 skier visits were down 10.1% but have since rebounded to 99% of 2019 levels. Entry Ticket Price (ETP) also declined in 2019 but is now above any prior year’s pricing. So while it is reasonable that 2020 Mountain revenue saw a decline, why did 2021 decrease further? While lift revenue increased 18% in 2021, other mountain activities such as ski school, dining, & retail/rental were down considerably. The first two activities were still being restricted by the pandemic.

As for Lodging, the average daily rate (ADR) and revenue per available room (RevPAR) showed opposite trends. ADR has increased since the pandemic, while RevPAR has declined. The company has raised the price of a hotel room since the pandemic but has concurrently seen less occupancy. If you divide RevPAR by ADR, you get the occupancy rate, which has declined from 41% to 27% from 2019 to 2021. This explains the trend in Lodging revenues.

Overall, Vail has not seen the comeback one wished for in 2021. But in 2022, the story is much different and the tides are turning.

Vail’s 2022 So Far

So far in 2022, Vail has seen a real rebound to pre-pandemic levels. Total revenue for the past nine months is up 32.4%, with Mountain and Lodging revenue growing 29% and 74% each. This, in turn, has led to operating and net income growth of 62% and 77%, respectively. Revenue, operating, and net income is now at 111%, 117%, and 115% of 2019 levels, meaning there is now a full bounce back to normal. Skier Visits for the period were 16,279, growing 15%, while ETP also increased 5% to $76.82. This shows very strong demand for the company and is in line with over travel demand in the country. ADR was $403.31, up 17%, and RevPAR was $149.20, for a gain of 72%, showing a great rebound in the lagging Lodging segment.

The occupancy rate is now 37%, showing there is still room to grow on this front. These great results for Vail hopefully will stay. There is a bit of a worry with the inflationary pressures, though. As skiing and travel are luxury services, it will be key to keep an eye on each future quarter while inflation is high.

Balance Sheet

Looking at the company’s balance sheet shows a company with high liquidity and low leverage. Vail has current and quick ratios of 2.22x and 2.11x, meaning the business can pay off all current debts twice over. The business also has just a debt-to-equity ratio of 2.09x, which is very low for the past acquisitions the company has made over the years. Overall, these balance sheet paired with the operations make for a stable company.

Valuation

As of writing, Vail trades around the $215 price level. At this level, the company has a forward P/E of 25.7x and a P/BV of 4.22x. The company also has historically offered a high dividend, and the yield right now is around 2.5%. Overall, the pricing is at a premium for this company which is now rebounded and is very stable. I don’t or love the price point right now, and this may make sense for many people’s portfolios.

Conclusion

Vail has some of the best ski resorts in the world, and this is seen by the constant flow of skier visits. In 2022, the business has fully rebounded since the pandemic and even has room to keep increasing. Inflationary pressures may hold down growth, but I think the company will maintain historical averages. At 26x P/E, the company is fairly valued and may make a good buy.

Be the first to comment