Bet_Noire/iStock via Getty Images

Introduction

I first covered the well-known fashion and outdoor equipment company V.F. Corporation (NYSE:VFC) in January, when the stock was trading in the mid-$60 range. In early 2021, VFC traded up to around $90 largely due to market exuberance, and the 25% decline definitely piqued my interest – recency bias is indeed not to be underestimated. However, my sober assessment of the company’s fundamentals led me to conclude that VFC did not merit a premium valuation, and I considered the stock unattractive in the mid-$60 range, which equated to a forward price-to-earnings (P/E) ratio of 21.

Five months later, the stock has fallen another 30% against a backdrop of continuing supply chain problems, continued lockdowns in China, a war in Eastern Europe, and a world most likely headed for recession. I figured everything would eventually get too cheap at some point, so I did a follow-up analysis, which I published on Seeking Alpha. I called VFC a “speculative buy” because I saw little sign of operational improvement and expected the company to continue to underperform – after all, it’s only a manufacturer of discretionary consumer goods in higher price segments.

Clearly, consumer sentiment has continued to deteriorate, and the company also is facing challenges with its key revenue driver – Vans. V.F. Corporation has had to lower its guidance for fiscal 2023 (through March 2023) in the past, but the latest revision at yesterday’s Investor Day event triggered another sell-off. The stock is currently trading at around $33, but the pre-market quote at the time of writing suggests the stock will fall further.

Even after the recent earnings revision, VFC stock is quite cheap with an adjusted P/E ratio of 12.5. In this article, I would like to share my impressions from yesterday’s presentation and give my take on the revised guidance and on whether I think the company could actually become a dividend king in two years, or whether it is a value trap at risk of having its dividend cut.

V.F. Corp. Revised its Fiscal 2023 Guidance – Cause For Concern?

During the Investor Day event, VFC revised its revenue, earnings and cash flow guidance due to continued headwinds in China, a weaker back-to-school season that particularly impacted Vans, and, as I interpret it, higher expected markdowns (expressed in the press release as “increasing inventories leading to a more promotional environment”).

The company now expects sales to increase in the mid-single digits, but on a constant dollar basis. Against the backdrop of a significantly stronger U.S. dollar in recent months, it therefore appears reasonable that unadjusted revenues will be flat in fiscal 2023.

The decline in sales in the Vans segment will be more pronounced than previously expected, even though currency effects already have been taken into account. Conversely, The North Face is expected to perform somewhat better (at least low double-digit growth in constant dollars) than previously anticipated. In fiscal 2022, it was already VFC’s second-largest segment in terms of revenue (28% of total revenue, 32% of revenue for VFC’s top four brands). The segment treaded water between fiscal years 2014 and 2017, but with the exception of the years of the pandemic, it appears that the outdoor brand has really picked up steam.

The company now expects adjusted gross and operating margins to decline by 50 and 120 basis points, respectively. Adjusted earnings per share is now expected to be in the mid-$2.65 range, down from $3.10 previously. I do not mind when a company reports adjusted earnings due in part to one-time charges like impairments (see below), but it really stands out to me when a company reports adjusted gross profits. Even more surprising is that the company also reports adjusted operating cash flows. Admittedly, I have rarely seen a company adjust its operating cash flows for one-time items. Initially, I thought this might be due to unexpected higher additions to working capital (inventory), but the fact that the company now expects adjusted operating cash flow of $1.0 billion vs. $1.2 billion previously suggests otherwise. The increase in working capital is likely already included in the revised guidance. However, since the company appears to already be expecting significant inventory markdowns, this may be the primary reason for adjusting operating cash flow, in addition to adjusting gross and operating margins (which of course are also negatively impacted by markdowns).

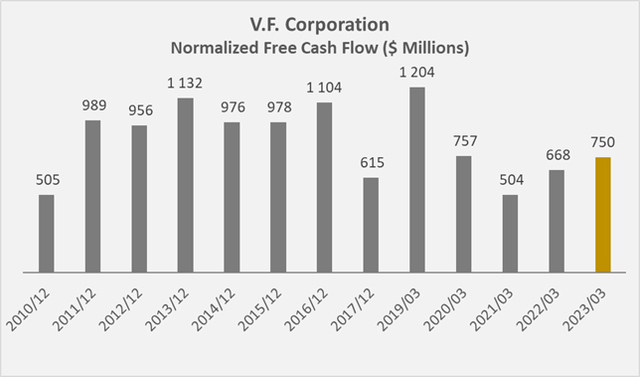

As a result of the revision, VFC now expects adjusted free cash flow of approximately $760 million, reflecting slightly lower capital expenditures. Assuming that stock-based compensation will be around $70 million, and adjusted for working capital movements, free cash flow will be around $750 million – significantly better than in previous years, but still far from the previous figures (Figure 1).

Figure 1: VFC’s historical free cash flow, normalized with respect to working capital movements, stock-based compensation and impairment charges (own work, based on the company’s fiscal 2010 to fiscal 2022 10-Ks, recent cash flow guidance and own estimates)

Three aspects should be noted:

- Since the company expects adjusted free cash flow of $760 million (before my adjustments related to working capital and stock compensation), actual free cash flow will likely be lower, as companies typically do not adjust downward.

- VFC spun off Kontoor Brands (KTB) in 2019, so the long-term comparison is not entirely fair.

- The company’s fiscal year end was changed in 2018, and therefore some of the free cash flow generated in fiscal 2019 (ending March 2019) should be attributed to the previous fiscal year.

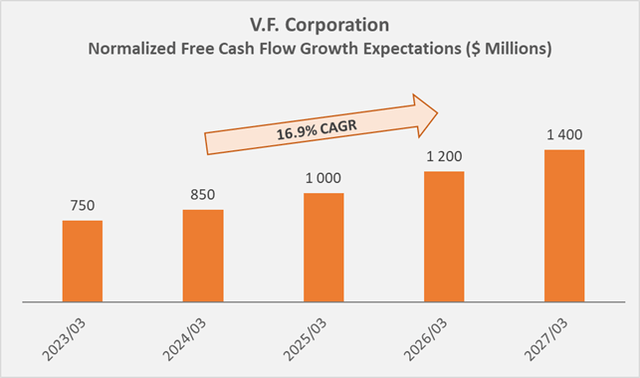

VFC’s cumulative free cash flow target through the end of fiscal 2027 is approximately $5.5 billion, and likely $5.2 billion if stock-based compensation is conservatively accounted for. This represents a compound annual free cash flow growth rate of 17% between 2023 and 2027 (Figure 2). Management has provided a plan to achieve this type of growth, which was presented in a 172-slide presentation at the Sept. 28, 2022, Investor Day.

Figure 2: Normalized free cash flow growth expectations, according to VFC’s five-year cumulative free cash flow forecast (own work, based on slide 161 of the September 28 Investor Day presentation and own estimates)

Key Takeaways From VFC Investor Day Event

During the event, almost the entire C-suite gave a presentation. Management presented their long-term strategic plan to reignite revenue growth and return to strong free cash flow growth, as described in the previous section.

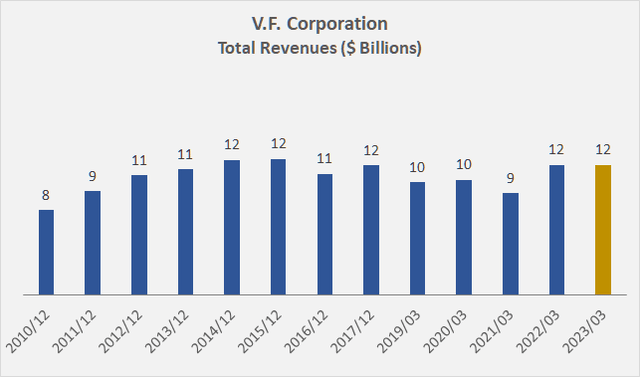

On slide 8 of the presentation, management referenced a revenue growth rate of 16% per year since fiscal 2017, before the pandemic. In my opinion, this only tells part of the story (see below). During the pandemic, revenue growth declined to a 5% CAGR between fiscal 2019 and fiscal 2022, and management expects mid- to high-single-digit revenue growth in constant currency over the long term.

This is an ambitious target, especially since the company has not really been able to grow its revenue for most of the last decade (Figure 3). To be fair, the Kontoor spin-off should not be forgotten – the jeans company had net sales of $2.5 billion in fiscal 2019. At the same time, the acquisition of Supreme also should be considered, as the segment contributed $562 million to VFC’s fiscal 2022 net revenues (p. F-21, fiscal 2022 10-K). Finally, the fiscal year-end change resulted in a transition period of three months through March 2018 ($2.2 billion), which is not reflected in the chart below.

Figure 3: VFC’s historical revenues and revenue expectation for fiscal 2023; note that the three-month transition period ended March 2018 is not taken into account (own work, based on the company’s fiscal 2012 to fiscal 2022 10-Ks and recent revenue guidance)

Management expects Vans sales to grow at a mid-single-digit CAGR percentage through fiscal 2027. Since the brand was acquired in 2004, segment sales have known only one direction – up and to the right, until most recently. VFC has successfully evolved the brand into an everyday brand (I remember the old days when Vans was mainly a skateboard and snowboard brand). However, Vans is still “only” a $4.2 billion brand, which leaves a lot of room for potential future growth compared to Nike (NKE), which generated $46.7 billion in revenue in fiscal 2022. Management sees big growth opportunities in the EMEA and APAC regions, as they contributed only 22% and 14% of Vans’ fiscal 2022 revenue, respectively (slide 81, Investor Day presentation). The market does not appear to be convinced of these growth opportunities at this time, most likely due to the ongoing conflict in Eastern Europe, continued pandemic-related constraints in Asia, and a suspected trend toward deglobalization.

The North Face – TNF – has performed exceptionally well since its acquisition in 2000, and I think the company is doing an excellent job in terms of TNF’s brand image. TNF is aimed at a very different customer base than Vans, and the brand is present on expeditions all over the world. Therefore, it seems realistic to expect high single-digit to low double-digit sales growth in the future. Who knows, maybe TNF will replace Vans as VFC’s main sales driver? The post-pandemic trend toward hiking, camping and generally spending more time in nature is certainly acting as a tailwind.

Timberland has been a brand of VFC since 2011 and has underperformed since at least fiscal 2018. During the investor day, management indicated that Timberland’s stock keeping units (SKUs) have been streamlined, which seems to confirm that the brand lacked direction. However, the streamlined portfolio, as well as new membership programs that provide better consumer insight, have really helped sales, which have rebounded strongly post-pandemic (slide 121, Investor Day presentation). Looking ahead, VFC expects mid-single-digit sales growth, although the APAC region in particular seems largely untapped. The company also will focus on expanding Timberland’s professional product line, which should lead to synergies in workwear and casual wear sales. The same strategy has been adopted for VFC’s Dickies segment, traditionally known as a workwear brand.

Finally, Dickies continued to perform very well during the pandemic, in part due to a greatly simplified operating model. Longer-term sales growth in the high single digits therefore does not seem unrealistic. Dickies is a comparatively small contributor to VFC’s top-line, with $838 million in revenue in fiscal 2022 (8% of total revenue), and there’s plenty of room for margin expansion, particularly from a direct-to-consumer – DTC – sales perspective: In-store DTC sales accounted for 2% of segment revenue in FY2022, while digital DTC sales accounted for 16% of segment revenue (slide 110, Investor Day presentation). At the corporate level, DTC channels accounted for approximately 35% of revenue in fiscal 2022.

Until a few years ago, VFC’s portfolio lacked brands that define themselves through scarcity and can therefore command premium prices. From this point of view, I think Supreme is a very good addition to the portfolio, even if the valuation seemed a bit high. Supreme’s $2.1 billion price represents a price-to-sales ratio (P/S) of 3.7. Obviously, management’s growth projections have been very optimistic (i.e., very sensitive to interest rates). As a consequence, a $300 million to $450 million impairment charge will have to be taken in the second quarter. Longer term, management expects Supreme to grow sales in the high single digits or low double digits as it continues to preserve the scarcity of the brand, which also is underscored by the small number of flagship stores (slide 138, Investor Day presentation). Given that Supreme remains a U.S. focused brand (>60% of sales), management is increasingly looking for international growth opportunities.

Overall, Vans in particular is underperforming at the moment, but I think offering customization and a strong emphasis on DTC sales is the right direction – also from the perspective that consumers increasingly want to share their experiences via social media.

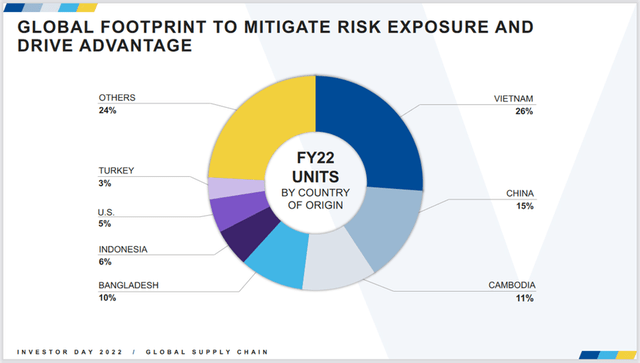

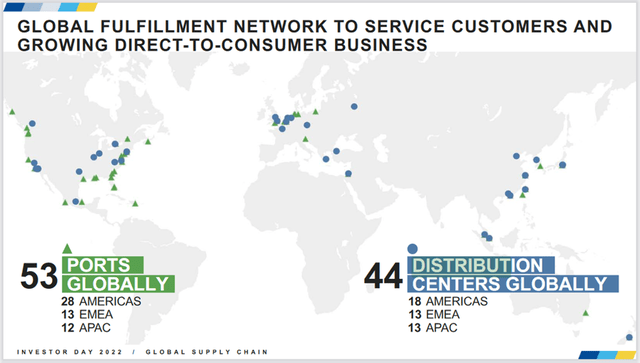

DTC eliminates the costly middleman, but of course requires well-designed logistics to actually lead to margin expansion. In this context, VFC’s efforts in establishing regional product supply (slide 45, Investor Day presentation) and building highly automated distribution centers (slide 46 f.) are worth noting. The company still struggles with supply chain disruptions, but its portfolio of product origin countries (Figure 4) and its global fulfillment network (Figure 5) appear increasingly diversified.

Figure 4: Slide 40 of VFC’s September 28 Investor Day presentation

Figure 5: Slide 41 of VFC’s September 28 Investor Day presentation

It’s clear that the increasing emphasis on DTC will benefit all of VFC’s brands. The trend toward bypassing brick-and-mortar retail – which also provides an opportunity for consumer behavior insights – is probably also the main reason for the high implicit free cash flow expectations, compared to mid- to high-single-digit sales growth through fiscal 2027. Clearly, management sees plenty of room for margin expansion. Thanks in part to increased DTC sales, VFC can increasingly rely on historical data to forecast sales trends, which should lead to fewer markdowns. As a result of initiatives mainly focused on digitization, portfolio optimizations and continued cost discipline, VFC’s adjusted operating margin should increase from the current 12% to 15% by the end of fiscal 2027 (slide 160 of the Investor Day presentation).

Is V.F. Corporation About To Cut Its Dividend?

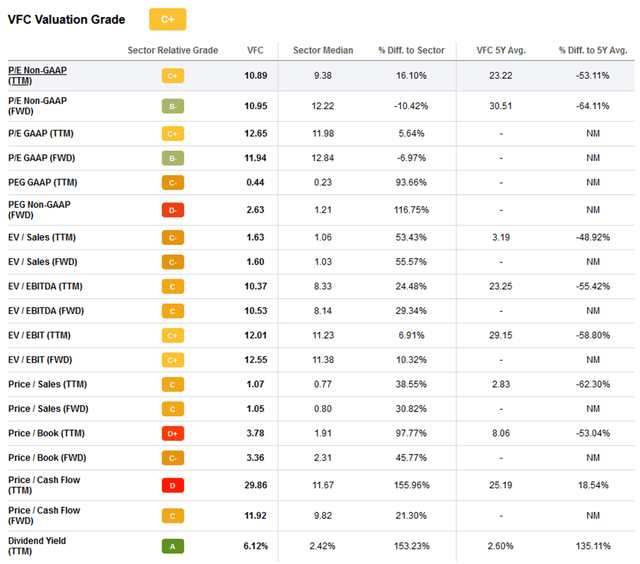

At $33, VFC now offers a yield of over 6% – more than double the average dividend yield over the past five years (Table 1), and at least partly reflecting the – in my opinion – largely unjustified premium valuation VFC has received in recent years. From a dividend perspective, the stock is definitely cheap, and I would even go so far as to say that the market is pricing in a dividend cut.

That would be a shame, of course, because the company would be a dividend king in two years. Of course, the slowdown in dividend growth and the recent increase of only $0.01 suggest that free cash flow is not particularly strong – as I have detailed in my previous articles. However, in its comments during yesterday’s presentation, management remains committed to the dividend. Also, the fact that VFC increased its dividend during the pandemic while most other fashion companies cut their dividends is a testament to management’s commitment to cash-based shareholder returns.

Table 1: Valuation metrics for VFC (taken from Seeking Alpha’s stock quote page)

The implied double-digit free cash flow growth expectation sounds very ambitious, but is at least somewhat realistic given the plan presented at yesterday’s presentation. The company paid out $773 million in dividends in fiscal 2022, so from a normalized free cash flow perspective, the dividend was not covered. Going forward, it will take a while for the dividend to be sustainable again, so only token increases are to be expected.

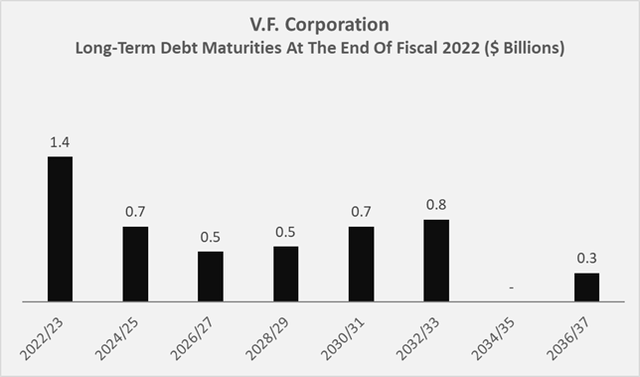

Given the importance management places on the dividend, it seems realistic that VFC is striving to become a dividend king. Looking at the maturity profile (Figure 6), VFC will certainly have to spend a larger portion of its operating income on interest payments in the near future, as $1.4 billion will mature by 2023 and the company cannot repay the debt with cash from operations. However, this sounds worse than it actually is, as the weighted average interest rate on VFC’s long-term debt at the end of fiscal 2022 was only 2.16%. Admittedly, management did a remarkable job of refinancing the 6.0% and 6.45% bonds in early 2020. In addition, VFC has significant liquidity from its revolving $2.25 billion credit facility, which expires in November 2026. As of the end of fiscal 2022, the company was in compliance with all loan covenants (p. 33 f., fiscal 2022 10-K ). However, it appears worth noting that the company also draws liquidity from international lines of credit it maintains with various banks ($55.7 million at the end of fiscal 2022) and that these borrowings had a weighted average interest rate of 26.0% at the end of fiscal 2022 (Note 12, fiscal 2022 10-K ).

Figure 6: VFC’s long-term debt maturities at the end of fiscal 2022 (own work, based on the company’s fiscal 2022 10-K)

Conclusion

In my last article, I concluded that the company lacks tangible evidence of a return to solid free cash flow growth, and this remains somewhat true today. Management’s plan presented at the investor day to deliver double-digit free cash flow growth sounds very ambitious, and the market clearly isn’t buying the growth story right now.

The company’s main revenue driver (Vans) is struggling at the moment, but the other brands are showing promising results and management is pulling the right levers in terms of supply chain optimization and digitalization. There was a lot of superficial language during the presentation, and I also don’t like the fact that management is adjusting cash flow from operations, but all in all they laid out a credible case that at least makes revenue growth seem realistic. Revising guidance again also was a disappointment, but not too unexpected given that inventories have increased significantly in recent quarters, making markdowns to be expected.

Taken together, I can understand both the bears and the bulls. Management’s plan is simply too optimistic to be a mere pipe dream. However, it seems fair to conclude that management got ahead of itself and may not quite achieve free cash flow growth going forward, but I think the valuation reflects this appropriately.

I continue to rate the stock a “hold” for two simple reasons:

- The impairment announced for Supreme suggests that the brand will not grow as strongly as expected. It should nevertheless develop well, but this will take some time and depends largely on developments in Europe and Asia. The same applies to VFC’s main sales driver, Vans.

- The U.S., and most likely the entire world, is heading into a recession, and VFC is starting to feel pressure due to increasingly deteriorating consumer sentiment. Considering how volatile fashion company sales are during a recession, I think it’s reasonable to expect another guidance revision, also in light of potential renewed pandemic-related measures. After all, VFC is still expecting approximately flat sales for fiscal 2023.

I have VFC on my watch list and plan to open a position depending on developments over the next few months. I don’t mind paying a little more if I get more tangible signs of improvement in return. At the end of the day, investor sentiment is really bad, as underscored by another 4% decline at the time of writing.

Thank you very much for taking the time to read my article. In case of any questions or comments, I am very happy to hear from you in the comments section below.

Be the first to comment