Swedish Krona, Norwegian Krone, US Dollar, Riksbank – TALKING POINTS

- Swedish Krona could fall on Riksbank rate decision, outlook on the economy

- Coronavirus may push Sweden’s economy into biggest contraction since 1940

- USD/SEK, EUR/SEK continuation patterns suggest a bullish breakout ahead

Swedish Krona Analysis Ahead of Riksbank Rate Decision

The Swedish Krona may fall if the Riksbank lowers the outlook for interest rates that were already expected to remain at 0 percent through 2021. Officials have expressed reluctance to cut rates below zero after monetary authorities had just recently pulled them from out of the sub-zero abyss. Having said that, the central bank has introduced unprecedented measures to counter the impact of the novel coronavirus pandemic.

Recommended by Dimitri Zabelin

Traits of Successful Traders

The central bank may expand its quantitative easing (QE) program beyond its commitment to purchase bonds in “the period March–December 2020 for a total nominal amount of up to SEK 300 billion”. Officials, most notably Riksbank Governor Stefan Ingves, have expressed trepidation in cutting interest rates below zero from the idea that other alternative credit-easing means could be more effective.

“Zero is already a low rate … and 500 billion in free money is, in our opinion, more effective in the current situation than making small changes to the interest rate” – Stefan Ingves.

Officials have also added several new debt classes to what was an originally purely government bond-purchasing program. The Riksbank recently announced that it will purchase bonds from municipalities amounting to a total nominal value of SEK 15 billion. They also will be buying commercial paper in the secondary market from non-financial corporates which will be required to have“a credit rating equivalent to Baa3/ BBB- or higher”.

For more in-depth analysis on central bank policy, be sure to follow me on Twitter @ZabelinDimitri.

The unprecedented measures come as government officials warn of a 7 percent contraction 2020, making it the worst economic downturn since the 1940’s, surpassing the turmoil the Great Recession in 2008. The already-gloomy outlook is further muddied by expectations that the Eurozone economy – a magnet for Nordic exports – is anticipated to contract between 7-10 percent.

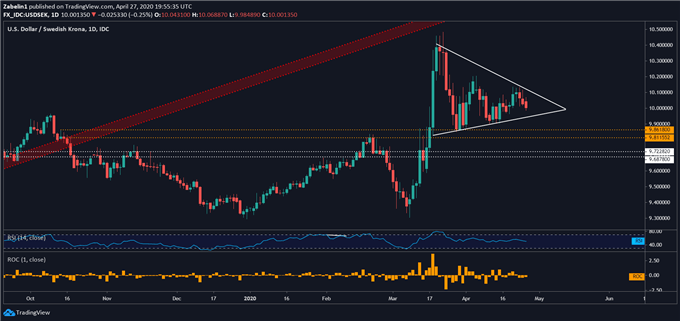

USD/SEK Forecast

USD/SEK recently cooled down from 19-year highs after the pair rose over 10 percent from the January swing-low at 9.3786. The pair – like other US Dollar crosses – appears to be a forming a bullish continuation pattern known as a Pennant. USD/SEK’s consolidation period may result in an upside breakout with the same magnitude as the spike leading up to the digestive interim.

USD/SEK – Daily Chart

USD/SEK chart created using TradingView

Recommended by Dimitri Zabelin

Forex for Beginners

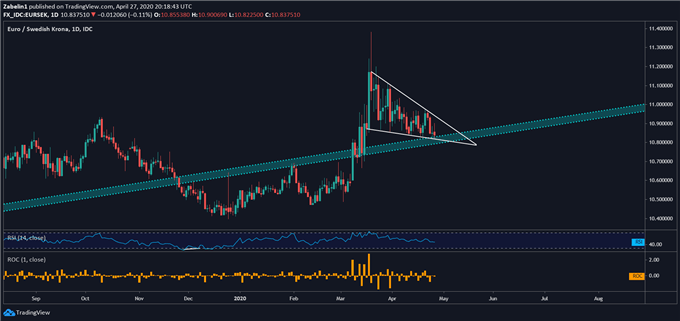

EUR/SEK Price Chart

Much like USD/SEK, EUR/SEK also appears to be in the formation of a bullish continuation pattern known as a Falling Wedge. This pattern – unlike the Pennant which has no clear directional bias in the congestive interim – has downward-sloping converging lines that compress the pair until it bursts above resistance. If this breach is met with follow-through, it could reinvigorate bullish sentiment and push EUR/SEK higher.

EUR/SEK – Daily Chart

EUR/SEK chart created using TradingView

SWEDISH KRONA TRADING RESOURCES:

— Written by Dimitri Zabelin, Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitriTwitter

Be the first to comment