Canadian Dollar Talking Points

USD/CAD snaps the series of lower highs and lows from last week as commodity bloc currencies weaken against the Greenback, and the Federal Reserve interest rate decision is likely to sway the near-term outlook for the exchange rate as the central bank is expected to normalize monetary policy.

USD/CAD Rate Outlook Hinges on Federal Reserve Rate Decision

USD/CAD retraces the decline from the yearly high (1.2901) with the Federal Open Market Committee (FOMC) widely anticipated to deliver a 25bp rate hike later this week, and the exchange rate may continue to trade to fresh yearly highs in March if the update to the Summary of Economic Projections (SEP) reflects a shift in the Fed’s forward guidance.

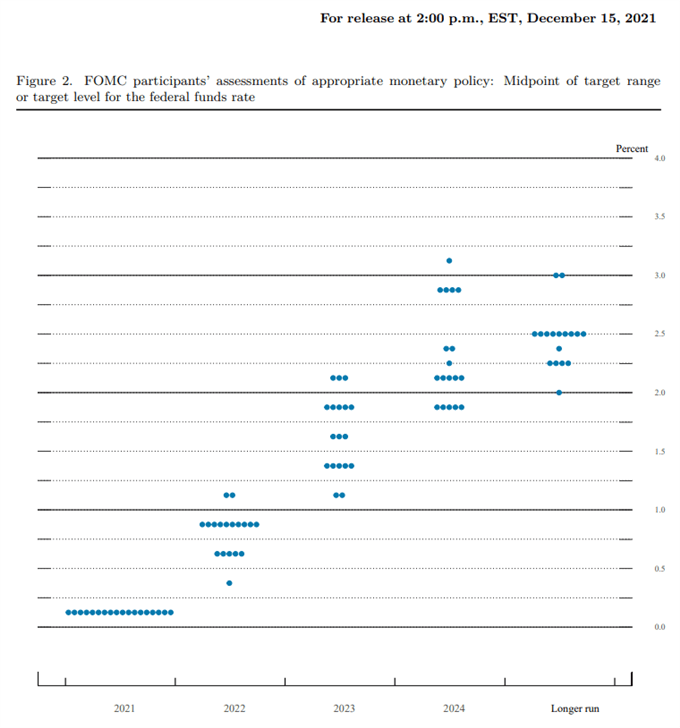

There is likely to be increased attention around the Fed’s SEP as the central bank emphasizes that “the federal funds rate is our primary means of adjusting monetary policy,” and the fresh forecasts may show a steeper path for US interest rates as consumer prices increase for the sixth consecutive month.

Source: FOMC

As a result, USD/CAD may stage another attempt to test the 2021 high (1.2964) if Chairman Jerome Powell and Co. prepare US households and businesses for a series of rate hikes, and it remains to be seen if the FOMC will unveil a more detailed exit strategy as Fed officials discuss unloading the balance sheet later this year.

However, USD/CAD may face a more bearish fate if the FOMC delivers a dovish rate hike, and the exchange rate may continue to give back the advance from the monthly low (1.2587) unless the Fed shows a greater willingness to normalize monetary policy at a faster pace.

In turn, USD/CAD may face headwinds ahead of the next Bank of Canada (BoC) meeting on April 13 as Governor Tiff Macklem and Co. “expects interest rates will need to rise further,” and a further deprecation in the exchange rate may fuel the recent flip in retail sentiment like the behavior seen during the previous year.

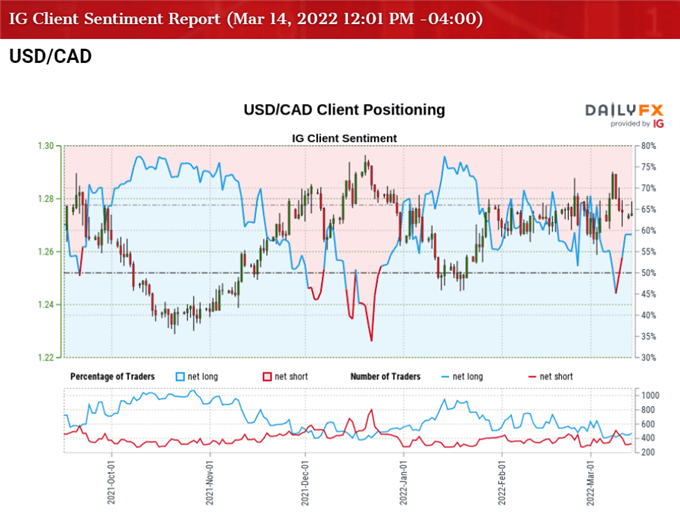

The IG Client Sentiment report shows 57.28% of traders are currently net-long USD/CAD, with the ratio of traders long to short standing at 1.34 to 1.

The number of traders net-long is 22.30% higher than yesterday and 10.59% higher from last week, while the number of traders net-short is 31.07% higher than yesterday and 14.08% higher from last week. The rise in net-long position has materialized as USD/CAD snaps the series of lower highs and lows from last week, while the increase in net-short interest has done little to curb the flip in retail sentiment as 46.28% of traders were net-long the pair last week.

With that said, USD/CAD may continue to trade to fresh yearly highs in March as the FOMC appears to be on track to implement a series of rate hikes over the coming months, and the exchange rate may stage another attempt to clear the 2021 high (1.2964) on the back of US Dollar strength.

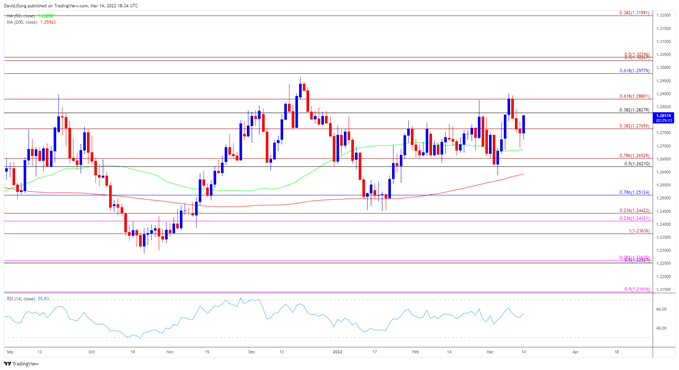

USD/CAD Rate Daily Chart

Source: Trading View

- Keep in mind, USD/CAD traded to a fresh 2021 high (1.2964) in December even as the Relative Strength Index (RSI) diverged with price, with the exchange rate clearing the 2022 opening range in February as it traded to a fresh yearly high (1.2878).

- USD/CAD continued to push to a fresh yearly high (1.2901) in March after reversing ahead of the 200-Day SMA (1.2592), but lack of momentum to hold above the Fibonacci overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion) generated a series of lower highs and lows in the exchange rate.

- Nevertheless, USD/CAD has snapped the bearish price action after failing to test the 1.2620 (50% retracement) to 1.2650 (78.6% expansion) region, with a move back above the overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion) raising the scope for another run at the 2021 high (1.2964).

- A break/close above the 1.2980 (61.8% retracement) area opens up the 1.3030 (50% expansion) to 1.3040 (50% expansion) zone, with the next area of interest coming in around the 1.3200 (38.2% expansion) handle.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment