Canadian Dollar Talking Points

The recent rally in USD/CAD appears to be unfazed by an unexpected decline in the ISM Manufacturing survey as it trades to a fresh yearly high (1.2914), but the exchange rate may attempt to test the 2021 high (1.2964) as the Federal Reserve is widely expected to normalize monetary policy at a faster pace.

USD/CAD Eyes 2021 High as RSI Approaches Overbought Territory

USD/CAD clears the March high (1.2901) as it initiates a series of higher highs and lows, and swings in investor confidence may sway the exchange rate over the coming days as the recent strength in the US Dollar has been largely accompanied by the weakness in global equity prices.

As a result, looming developments in the Relative Strength Index (RSI) may show the bullish momentum gathering pace if the oscillator manages to push into overbought territory for the first time in 2022, and the Federal Open Market Committee (FOMC) interest rate decision on May 4 may also foster a further advance in the exchange rate as the central bank is anticipated to deliver a 50bp rate hike.

At the same time, the FOMC may reveal plans to wind down its balance sheet as the “Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting,” and a change in the Fed’s exit strategy may lead to a test of the 2021 high (1.2964) as market participants brace for higher US interest rates.

In turn, the US Dollar may continue to outperform against the commodity bloc currencies as the deterioration in risk appetite looks poised to persist, and a further advance in USD/CAD may fuel the recent flip in retail sentiment like the behavior seen during the previous year.

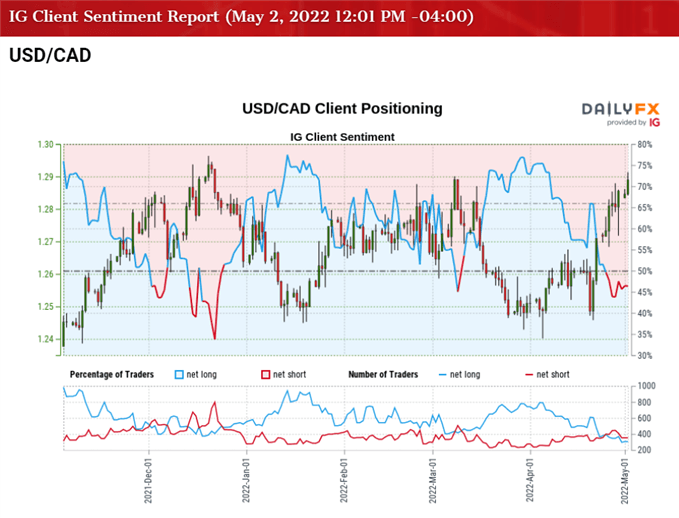

The IG Client Sentiment report shows 49.03% of traders are currently net-long USD/CAD, with the ratio of traders short to long standing at 1.04 to 1.

The number of traders net-long is 22.19% higher than yesterday and 10.80% lower from last week, while the number of traders net-short is 7.92% higher than yesterday and 4.22% higher from last week. The decline in net-long position comes as USD/CAD clears the March high (1.2901), while the rise in net-short interest has fueled the flip in retail sentiment as 52.17% of traders were net-long the pair last week.

With that said, swings in investor confidence may keep USD/CAD afloat ahead of the Fed rate decision as global equity prices come back under pressure, and the exchange rate may attempt to test the 2021 high (1.2964) as Chairman Jerome Powell and Co. are widely expected to normalize monetary policy at a faster pace.

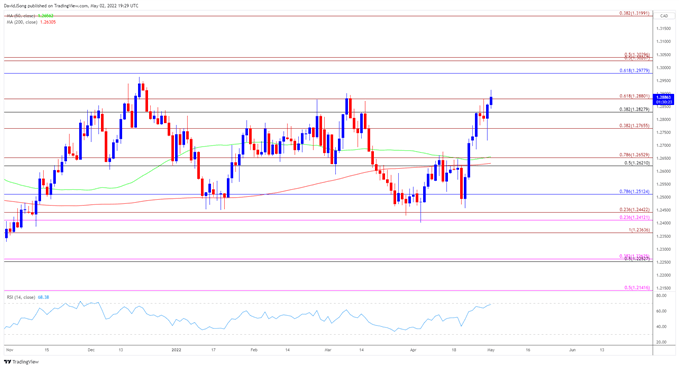

USD/CAD Rate Daily Chart

Source: Trading View

- USD/CAD reversed course ahead of the April low (1.2403) as it failed to push below the Fibonacci overlap around 1.2410 (23.6% expansion) to 1.2440 (23.6% expansion), with the exchange rate clearing the March high (1.2901) as it trades to a fresh yearly high (1.2914).

- Looming developments in the Relative Strength Index (RSI) may show the bullish momentum gathering pace if the oscillator manages to push into overbought territory for the first time in 2022, with a move above 70 in the indicate likely to be accompanied by a further advance in USD/CAD like the price action seen during the previous year.

- A close above the overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion) raises the scope for a test of the 2021 high (1.2964), with a break/close above the 1.2980 (61.8% retracement) region opening up the 1.3030 (50% expansion) to 1.3040 (50% expansion) area.

- However, failure to hold above the overlap around 1.2830 (38.2% retracement) to 1.2880 (61.8% expansion) may push USD/CAD back towards 1.2770 (38.2% expansion), with the next region of interest coming n around 1.2620 (50% retracement) to 1.2650 (78.6% expansion).

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong

Be the first to comment